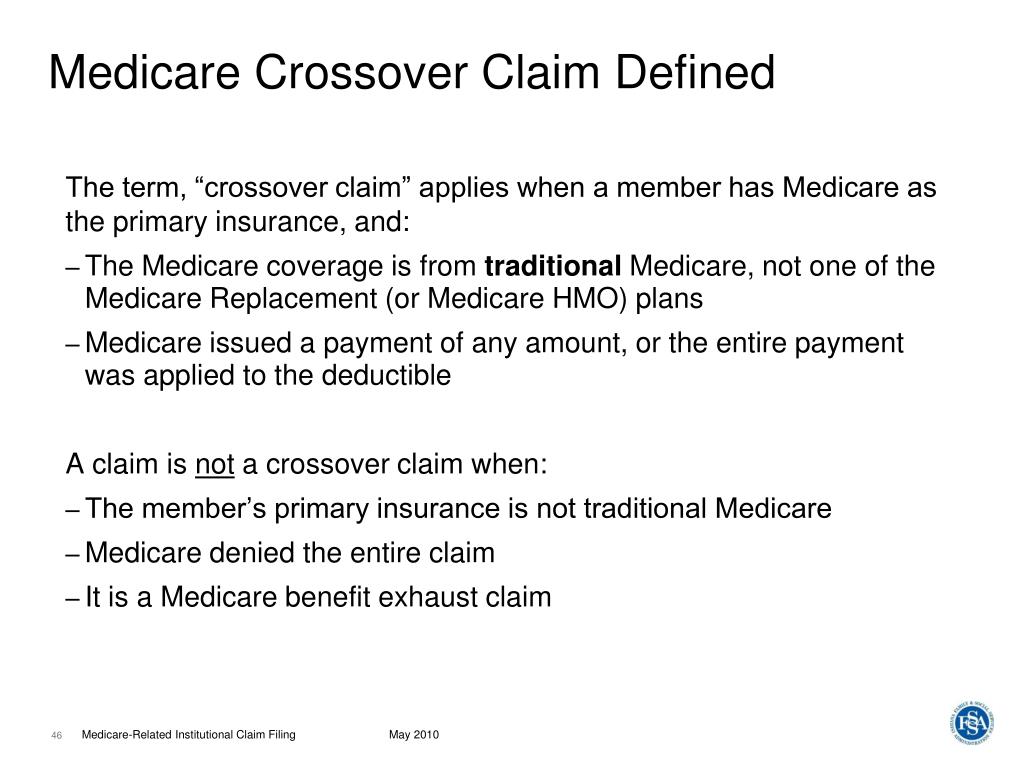

How does the Medicare crossover claim system work?

Apr 08, 2016 · CROSSOVER CLAIMS The crossover process allows providers to submit a single claim for individuals dually eligible for Medicare and Medicaid, or qualified Medicare beneficiaries eligible for Medicaid payment of coinsurance and deductible to a Medicare fiscal intermediary, and also have it processed for Medicaid reimbursement.

How to set up Medicare crossover?

Part 1 – Medicare/Medi-Cal Crossover Claims Overview Page updated: August 2020 Automatic Crossover Claims Medicare uses a consolidated Coordination of Benefits Contractor (COBC) to automatically cross over to Medi-Cal claims billed to any Medicare contractor for Medicare/Medi-Cal eligible recipients.

How to fill in Medicare claims?

2. How will the crossover process work? New York State Medicaid will receive Medicare . crossover claims from the Coordination of Benefits . Contractor (COBC), Group Health Inc. (GHI). The various Medicare payers across the State will all transmit paid claims for Medicare/Medicaid beneficiaries to GHI. GHI will transmit the claims to eMedNY. 3.

Where do I send claims for Medicare?

A Medicare cross-over is a claim that Medicare sends to another insurer for secondary payment. When a Medicare beneficiary is a dual eligible – meaning they have Medicare and Medicaid – their Medicare claims should cross-over to Medicaid, which would cover Medicare cost sharing (i.e., deductibles, co-pays and coinsurance). Claims can also cross-over from Medicare to …

How does Medicare crossover claims?

1. What is meant by the crossover payment? When Medicaid providers submit claims to Medicare for Medicare/Medicaid beneficiaries, Medicare will pay the claim, apply a deductible/coinsurance or co-pay amount and then automatically forward the claim to Medicaid.Feb 1, 2010

When would you work a crossover claim?

In health insurance, a "crossover claim" occurs when a person eligible for Medicare and Medicaid receives health care services covered by both programs. The crossover claims process is designed to ensure the bill gets paid properly, and doesn't get paid twice.

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

How long does Medicare crossover take?

A: Once payment is received from Medicare and Remark Code MA07 (“The claim information has also been forwarded to Medicaid for review”) appears on the Medicare RA, providers should expect to see the claim appear on the Medicaid RA within 30 days.

What is the Medicare crossover code?

CODE INDICATING THAT THE ELIGIBLE IS COVERED BY MEDICARE (KNOWN AS DUAL OR MEDICARE ELIGIBILITY), ACCORDING TO MEDICAID (MSIS), MEDICARE (EDB) OR BOTH IN THE CALENDAR YEAR.

Does Medicare crossover to AARP?

Things to remember: When Medicare does not crossover your claims to the AARP Medicare Supplement Plans, you will need to make sure this CO253 adjustment is applied before you electronically submit to AARP as a secondary payer.Mar 2, 2022

How do I file Medicare secondary claims electronically?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.Sep 9, 2021

What happens when Medicare is secondary?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

What is a crossover only application?

Crossover Only providers are those providers who are enrolled in Medicare, not enrolled in Medi-Cal, and provide services to dual-eligible beneficiaries. Dual-eligible beneficiaries are those beneficiaries who are eligible for coverage by Medicare (either Medicare Part A, Part B or both) and Medi-Cal.

What is it commonly called when Medicare electronically forwards secondary claim information?

A. The Electronic Remittance Advice (ERA), or 835, is the electronic transaction which provides claims payment information in the HIPAA mandated ACSX12 005010X221A1 format.

What is the purpose of the AOB form?

An AOB is an agreement that, once signed, transfers the insurance claims rights or benefits of your insurance policy to a third party. An AOB gives the third party authority to file a claim, make repair decisions and collect insurance payments without your involvement.

What is Medicare Part A?

Medicare divides its services into Part A and Part B. Part A covers institutional services and Part B covers non-institutional services. Recipients may be covered for Part A only, Part B only or both.

When will Medicare replace HIC?

Beginning April 1, 2018 , the Health Insurance Claim (HIC) number traditionally appearing on Medicare cards is being replaced by a non-Social Security Number based Medicare Beneficiary Identifier (MBI) number. Updated Medicare cards with MBIs will be phased into use through December 31, 2019. Therefore, the term HIC will be phased out of the Medi-Cal provider manuals, as appropriate. Removal of references to HIC does not preclude providers from processing transactions using HIC numbers. Providers can continue to process both HIC and MBI numbers, as appropriate, from April 1, 2018 through December 31, 2019. Providers should refer to the CMS website for detailed information.

What is Medi-Cal eligibility verification?

The Medi-Cal eligibility verification system indicates a recipient’s Medicare coverage when a provider submits a Medi-Cal eligibility inquiry. One of the following messages will be returned if a recipient is eligible for Medicare:

Is Medicare covered by Medicare?

Most medical supplies are not covered by Medicare and can be billed directly to Medi-Cal. However, the medical supplies listed in the Medical Supplies: Medicare-Covered Services section of the appropriate Part 2 manual are covered by Medicare and must be billed to Medicare prior to billing Medi-Cal.

Do you have to bill Medicare before you use Medi-Cal?

If a recipient has Medicare Part A coverage only, and a provider is billing for Part A covered services, the provider must bill Medicare prior to billing Medi- Cal. However, if billing for Part

Can you bill Medicare for coinsurance?

Providers who accept persons eligible for both Medicare and Medi-Cal as recipients cannot bill them for the Medicare deductible and coinsurance amounts. These amounts can be billed only to Medi-Cal. (Refer to Welfare and Institutions Code [W&I Code], Section 14019.4.) However, providers should bill recipients for any Medi-Cal Share of Cost (SOC). Note: Providers are strongly advised to wait until they receive the Medicare payment before collecting SOC to avoid collecting amounts greater than the Medicare deductible and/or coinsurance.

Does California pay Medicare Part B?

California has a buy-in agreement with the federal government whereby the Department of Health Care Services (DHCS) pays the Medicare Part B premiums on behalf of all individuals eligible for Medi-Cal. These individuals are therefore protected by federal Medicaid rules that preclude providers from charging recipients any sums in addition to payments made to the provider.

How does the Medicare crossover work?

The way that the “crossover” system works is that Medicare sends claims information to the secondary payer (the Medigap company) and, essentially, coordinates the payment on behalf of the provider.

What is Medicare and Medigap?

Medicare and Medigap insurance comprise a sound financial plan for someone over age 65. Medicare works as the primary coverage, with the Medigap plan (sometimes called a Medicare Supplement) filling in the gaps in Medicare. But, how exactly do Medicare and Medigap work together?

What happens if you go to a doctor who doesn't accept Medicare?

In other words, if you go to a doctor who does not accept Medicare, or file to Medicare, your Medigap plan (regardless of what company it is with) will be useless. The key, as a Medicare beneficiary, is seeing if your doctor/hospital, or any doctor/hospital you wish to use, accepts Medicare.

What is the Medicare Part B deductible for 2020?

Plan G which is the next step down, and usually is the best deal, pays all but the Medicare Part B deductible, which is $198/year (for 2020). NOTE: For people who were first eligible for Medicare after 1/1/2020, Plan F is no longer available.

Does Medicare have a network?

FACT 3: Medicare and Medigap Do Not Have Specific Networks. Neither Medicare nor Medigap plans have any specific networks that you must use. Medicare is a fee-for-service plan – in other words, it is not a PPO or an HMO which requires adherence to a certain, predetermined network of doctors/hospitals.

Do Medicare and Medigap work together?

Medicare and Medigap plans work together seamlessly. One the major concerns that we address in people turning 65 is how the Federal government health program could possibly work well together with a private insurance company’s individual health insurance policy. Although we certainly recognize the root of this concern, ...

Does Medicare accept medicaid?

Most doctors and medical facilities do, of course, accept Medicare. Most importantly, anywhere that Medicare is accepted, your Medigap plan will also be accepted. As the primary coverage, Medicare determines where you can use your plans.

Monday, April 4, 2016

Medicare/MO HealthNet (crossover) claims that do not automatically cross from Medicare to MO HealthNet must be filed through the MO HealthNet billing Web site, www.emomed.com or through the 837 electronic claims transaction.

Why Medicare cross over not happening automatically - some basic reason to check

Medicare/MO HealthNet (crossover) claims that do not automatically cross from Medicare to MO HealthNet must be filed through the MO HealthNet billing Web site, www.emomed.com or through the 837 electronic claims transaction.