The way that Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

How does a Medicare Part D plan work?

How does a Medicare Part D plan work? Medicare Part D plans are like any insurance that provides lower-costing coverage for your prescription drugs.

What does Medicare Part D cost in 2018?

In 2018, Part D costs include: If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions.

What is a Medicare Part D formulary?

A "formulary" is a list of drugs that your Medicare Part D plan will cover. And it is important to understand that no Medicare Part D plan covers all prescription drugs. Part D plans are only required to cover a certain number of drugs in specific drug classes.

Where can I find information about Medicare Part D drug coverage?

Official Medicare site. Learn about the types of costs you’ll pay in a Medicare drug plan. Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How does the Medicare Part D work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

How does Medicare Part D reimbursement work?

The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

Does Medicare Part D roll over?

Do I have to reenroll in my Medicare Part D prescription drug plan every year? En español | No. If you like your current Part D drug plan, you can keep it without doing anything additional.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

How do I claim Medicare reimbursement?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

How do I get out of the donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

Can you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Will my Part D plan automatically renew?

Like Medicare Advantage, your Medicare Part D (prescription drug) plan should automatically renew. Exceptions would be if Medicare does not renew the contract with your insurance company or the company no longer offers the plan.

What is the problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Can Medicare Part D be changed anytime?

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want. Your final choice will take effect on January 1.

How Much Does Medicare Part D Cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency th...

What Does Medicare Part D Cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers. Often, you...

Don't Miss Out on The Prescription Drugs That You Need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their hea...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Types of Medicare Part D Plans

Before you sign up for a plan on Medicare Part D, you should know the different types of plans that are available in the first place. You can get standalone Medicare Part D coverage that will be an accent to a different type of plan that you already have.

What Does Medicare Part D Cover

It’s unfortunate, but Medicare Part D does not cover all the types of prescription drugs. They are only required to cover a certain number of drugs in each category, but that doesn’t mean it will cover the one you have been taking for a while. There are different type of drugs that have different preferences as far as Medicare Part D goes.

What is Late-Enrollment with Medicare Part D Plans?

You are eligible to enroll in Medicare Part D as soon as you are 65 years old. However, if you do not enroll at that time, either due to an employer plan that provides prescription coverage, or coverage from Veterans Affairs, you will not incur a penalty.

How Does it Cover You?

The way that Medicare Part D works is that you do have to pay a deductible in the beginning of the year of only $405. So you will cover the first $405 of your prescription drugs. Then, after that you just pay a 25% coinsurance up to a certain point.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What happens if you don't enroll in Part B?

If you don’t enroll in Part B when you first become eligible – the 7-month window that starts three months before the month you turn 65 and ends three months after that month – then you may have to pay a penalty fee if you decide to en roll later. For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

Find out more about your Medicare prescription drug benefits

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

How much does Medicare Part D cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency that oversees Medicare doesn't set fixed amounts for most of those costs.

What does Medicare Part D cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers.

Don't miss out on the prescription drugs that you need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their healthcare expenses. By finding out what a Part D plan will cover and how much it will cost, you'll be in a better position to choose the right plan to meet your specific medical needs.

What is Medicare Part D?

Medicare Part D plans are like any insurance that provides lower-costing coverage for your prescription drugs. And like any other insurance coverage, you usually pay the plan a monthly premium, you may have an initial deductible that you must pay first before your insurance coverage begins to pay a portion of your drug costs, ...

How many parts of Medicare Part D 2022?

The following information describes how the basic or model 2022 Medicare Part D prescription drug plan is separated into four main parts. Depending on your prescription drug needs, you may only go into one or two parts of your Part D coverage (and if you spend over $7,050 in prescription drugs you might go into all four parts of your Part D coverage):

What happens when you meet your initial coverage limit?

Once you meet your plan's Initial Coverage Limit, you will exit the Initial Coverage Phase and enter the Coverage Gap. (As a note, most people never leave their Medicare drug plan's Initial Coverage Phase). Part 3 - The Coverage Gap or Donut Hole - In this phase of coverage, you will receive a 75% discount on all formulary drugs ...

How much is a Part 1 deductible?

Part 1 - The Initial $480 Deductible - Some Medicare Part D prescription drug plans (PDP) and Medicare Advantage plans that provide drug coverage (MAPD) have an initial deductible that you must pay out-of-pocket before the start of your plan coverage (or before the start of your plan's cost-sharing). Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deductible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area). You may notice that some Medicare Part D plans have a "standard" Initial deductible, but the plans exempt low-costing drugs from the deductible, meaning your inexpensive generic drugs may be covered before you pay any of your deductible.

What is Part 2 of Medicare?

Part 2 - The Initial Coverage Phase - Once you meet your plans Initial Deductible (if any), your drug plan then provides cost-sharing coverage for formulary drugs. Cost-sharing is where you and your Medicare Part D plan share in the retail cost of covered drugs with co-insurance (a percentage of retail, such as 25%) or co-payment ...

What is the catastrophic coverage phase?

Part 4 - The Catastrophic Coverage Phase - When a person has spent more than $7,050 for prescription medications, they will be protected by Catastrophic Coverage - here the cost of medications is substantially reduced to about 5% of the retail drug price. When a person reaches Catastrophic Coverage, they will remain in this coverage area through the end of the year (December 31st).

Does Medicare Part D have a deductible?

Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deduct ible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area).

How Does Medicare Part D Work?

Part D adds prescription drug coverage to your existing Medicare health coverage. You must have either Medicare Part A or Part B to get it. When you become eligible for Medicare (usually when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How Do I Choose a Part D Plan?

Perhaps the most important consideration when choosing a Part D plan is whether that plan covers the specific prescriptions you take. You can input the drugs you take and compare plan options using Medicare’s comparison tool. Otherwise, consider your priorities. Do you want:

How much will Medicare pay for donut hole in 2021?

In 2021, it starts when you and the drug plan have spent $4,130 total on covered prescriptions, and ends once you’ve spent $6,550 out of pocket. In 2022, the Medicare donut hole starts when you and the plan have spent $4,430 total on covered prescriptions, and ends once you’ve spent $7,050 out of pocket (the amounts typically change each year). 7 During this time, you’ll generally pay no more than 25% toward the cost of prescription drugs. 8

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

What is Part D insurance?

For Part D coverage, you’ll pay a premium, a deductible, and copays that differ between types of drugs. Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What happens if you don't enroll in Medicare?

If you don’t enroll when you’re first eligible for Medicare and decide to enroll later, you may face a lifetime late enrollment penalty.

What is the Medicare coverage gap?

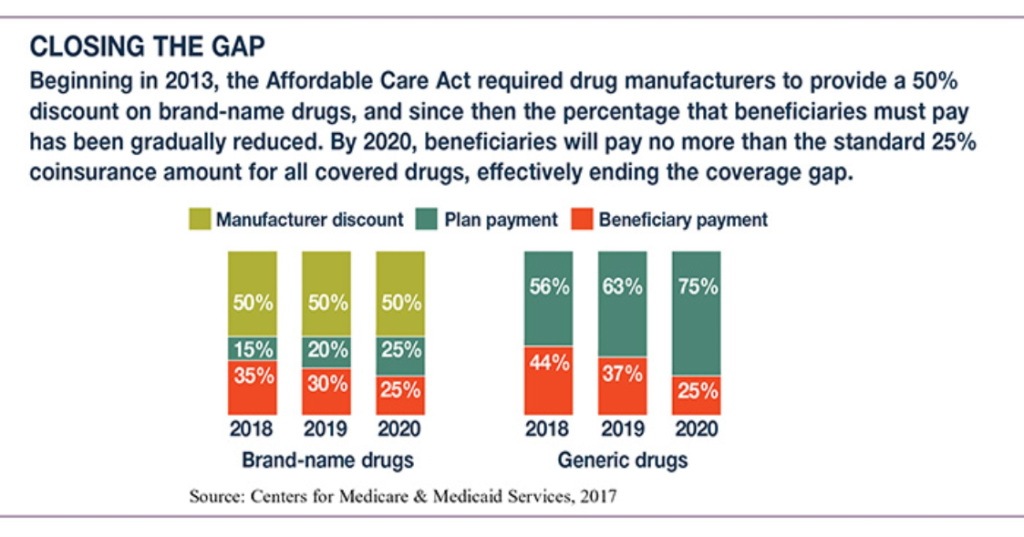

Medicare thinks that by introducing this coverage gap, seniors will look for cheaper, generic drugs over expensive, brand-name drugs. The coverage gap, or the donut hole, requires seniors to pay a share of their drug spending above a certain threshold to make sure they have “skin in the game” – and to discourage them from wasteful spending.

How much does Medicare pay for generic drugs?

In 2018, Medicare will pay 56% of the price for generic drugs during the coverage gap. You'll pay the remaining 44% of the price.

How much out of pocket do you have to spend to get out of the coverage gap?

Once you've spent $5,000 out-of-pocket in 2018, you're out of the coverage gap.

Is having a drug plan a lifesaver?

As you can see, having a drug plan can be a lifesaver when it comes to drug costs!

Does Medicare spend money on healthcare?

Medicare spends a huge amount of money on healthcare costs, which means they’re always looking for ways to cut costs and incentivize seniors to save where possible.

How Is Epic Used With Medicare Part D

EPIC supplements Medicare Part D drug coverage for greater annual benefits and savings. When purchasing prescription drugs, the member shows both their EPIC and Medicare Part D drug plan cards at the pharmacy. After any Medicare Part D deductible is met, if the member has one, drug costs not covered by Part D can be submitted to EPIC for payment.

What Medicare Part D Plans Cover

Medicare drug plans cover both generic and brand-name drugs. All plans must meet a standard level of coverage set by Medicare. This means they must all cover the same categories of drugs, such as asthma or diabetes medicines, but plans can choose which specific drugs are covered in each drug category.

Federal Employee Health Benefits Program

This is health coverage for current and retired federal employees and covered family members. These plans usually include creditable prescription drug coverage, so you dont need to get Medicare drug coverage . However, if you decide to get Medicare drug coverage, you can keep your FEHB plan, and in most cases, the Medicare plan will pay first.

How Much Will You Pay For Drugs Once You Enter The Donut Hole

Once you enter the donut hole, hereâs what youâll pay for your prescription drugs in 2018:

How Copays Coinsurance And Deductible Work Together

With a Medicare Advantage plan, well track all the costs you pay deductible, copays and coinsurance. When you reach a certain amount, we pay for most covered services. This is called the out-of-pocket maximum.

Medicare Prescription Drug Plan Availability In 2022

In 2022, 766 PDPs will be offered across the 34 PDP regions nationwide , a substantial reduction of 230 PDPs from 2021 and the first drop in PDP availability since 2017 .

How Does The Medicare Part D Drug Plan Requirement Work

EPIC members are required to be enrolled in a Medicare Part D drug plan or a Medicare Advantage health plan with Part D . Enrolling in EPIC will give a member a Special Enrollment Period to join a Medicare Part D drug plan. Medicare Part D provides primary drug coverage for EPIC members.