The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

Full Answer

What is prescription drug plan?

House Bill 4348 aims to save patients money by regulating pharmacy benefit managers (PBMs) who serve as facilitators between health plans, drug manufacturers and pharmacists. The plan aims to require individuals seeking PBM licensure to apply to the Director of the Department of Insurance and Financial Services (DIFS).

What is the best Medicare Prescription Plan?

What are the Top 5 Rated Medicare Prescription Drug Plans for 2022

- SilverScript

- Humana

- Cigna

- Mutual of Omaha

- UnitedHealthcare

What is drug plan deductible?

Drug plan deductible facts. The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay.; The full cost of the drug determines how much a beneficiary must ...

What is Medicare Plan D deductible?

What is the Medicare Part D coverage gap (“donut hole”)?

- Brand-name drugs. Once you hit the coverage gap, you will owe no more than 25 percent of the cost of the brand-name prescription drugs covered by your plan.

- Generic drugs. Once you hit the coverage gap, you will owe 25 percent of the cost of the generic drugs covered by your plan.

- Catastrophic coverage. ...

How do deductibles work on drug plans?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

What is the Medicare Part D deductible?

The Medicare Part D deductible is the amount you most pay for your prescription drugs before your plan begins to pay. The amount of the Medicare Part D deductible can vary from plan, but Medicare dictates that it can be no greater than $480 a year in 2022. Some plans don't have a deductible.

What is a deductible for prescription drugs?

A prescription drug deductible is the amount you pay for drugs before we begin to pay our share. Several of our HMO plans have a prescription drug deductible. A prescription drug deductible is the amount you pay for drugs before we begin to pay our share.

What is the deductible stage for Part D?

There are four different phases—or periods—of Part D coverage: Deductible period: Until you meet your Part D deductible, you will pay the full negotiated price for your covered prescription drugs. Once you have met the deductible, the plan will begin to cover the cost of your drugs.

Do prescriptions go towards your deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount.

What is the 2021 Medicare Part D deductible?

Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is the Medicare drug deductible for 2022?

$480This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What happens when you meet your Medicare deductible?

After meeting the deductible, you'll usually have to pay 20 percent of the Medicare-approved costs for most doctor services, outpatient care and durable medical equipment — things such as wheelchairs or walkers your doctor may order for you.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

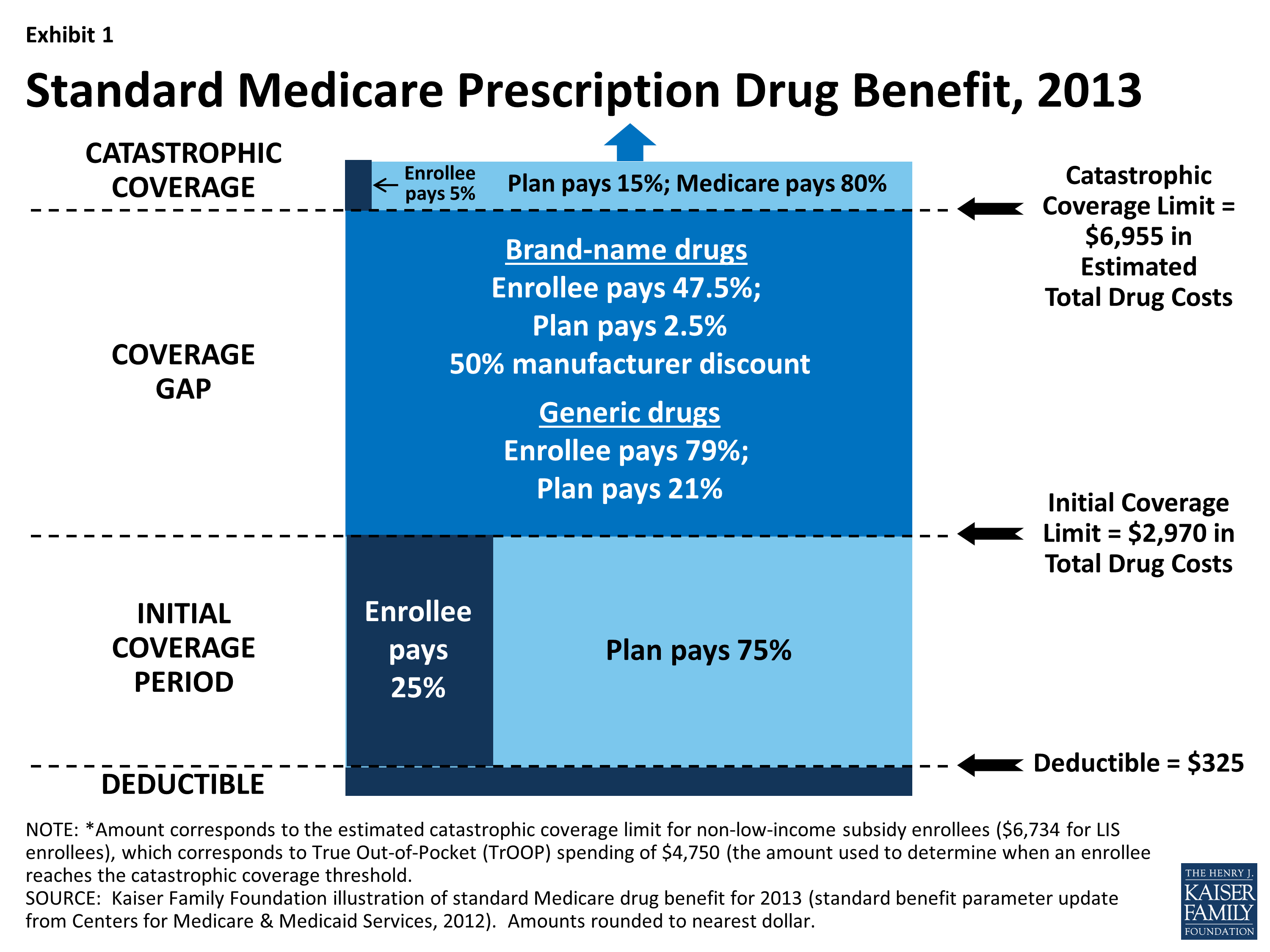

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Is there still a donut hole in Medicare Part D?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people with Medicare won't pay anything once they pass the Initial Coverage Period spending threshold.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

What is a drug plan deductible?

Drug plan deductible facts. The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

How much is the Medicare deductible for 2021?

Medicare sets the standard deductible every year. In 2021, that’s $445. Plans can have no deductible or any amount up to the standard amount. A plan determines which medications are subject to its deductible. In many plans, that’s Tiers 3, 4 and 5 drugs. The deductible applies to drugs the plan covers.

What is EOB in Medicare?

In each month you get prescriptions, the plan sponsor will send a monthly prescription summary, which is an explanation of benefits (EOB).

How much does Dorothy's tier 4 medication cost?

Dorothy’s one medication, a Tier 4 muscle relaxant with a full cost of $2.26, is subject to the deductible. She will pay that amount, $2.26, every month and won’t meet the plan’s deductible this year. Don’s regimen of seven drugs includes two of Tier 3 in the mix. The full cost for those two is $70.96.

How much does a cardiac med cost?

For a certain cardiac medication, the cost ranges from $23 to $231. Compare the costs at different pharmacies. Chances are, preferred pharmacies can save you money. Don’t choose a plan just because it has the lowest deductible. Determine how much you’ll pay for all your drugs over the course of the year.

Does a deductible apply to a drug plan?

The deductible applies to drugs the plan covers. If the plan does not cover a given medication, the beneficiary pays the full cost, and those payments will not apply to the deductible. It’s possible to meet the deductible all at once, over time or maybe never.

Is Medicare Part B deductible complicated?

Medicare Part B Drug Plan Deductibles Can Be Complicated. getty. Medicare Part D prescription drug coverage can cause confusion, and much of that starts with the deductible, which is the first of the Part D drug coverage payment stages. Confusing yes, but the inherent hazards of the deductible, those with financial implications, ...

What is a prescription drug deductible?

A prescription drug deductible is the amount you pay for drugs before we begin to pay our share. Several of our HMO plans have a prescription drug deductible.

How to know if you are close to a deductible?

The best way to keep track of how close you are to meeting your deductible is to check your Caremark Explanation Of Benefits, or EOB, which is mailed to members with prescription drug coverage. If you have any questions, you can always give us a call.

What is an example of a HMO value RX plan?

What is an example? For example, if you are in the HMO Value Rx plan and have a prescription for a drug on tier 3, 4, or 5 you would pay the first $200 of your prescriptions before your coverage begins. Once you pay your deductible in full, you would just have a copay for any prescriptions. $200 is the total amount of the deductible for Tiers 3, 4, ...

How much is the deductible for tier 3?

Once you pay your deductible in full, you would just have a copay for any prescriptions. $200 is the total amount of the deductible for Tiers 3, 4, and 5. You will not pay $200 per tier. (The deductible does not apply to drugs on tier 1 or 2.

Does HMO Prime RX have a deductible?

Yes, our HMO Prime Rx and HMO Prime Rx Plus plans don’t have a prescription drug deductible. And, of course, our plans that do not include prescription drug coverage also do not have a prescription drug deductible. Compare our HMO Plans.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Medicare Part D plans are like any insurance that provides lower-costing coverage for your prescription drugs. And like any other insurance coverage, you usually pay the plan a monthly premium, you may have an initial deductible that you must pay first before your insurance coverage begins to pay a portion of your drug costs, ...

What is Part 2 of Medicare?

Part 2 - The Initial Coverage Phase - Once you meet your plans Initial Deductible (if any), your drug plan then provides cost-sharing coverage for formulary drugs. Cost-sharing is where you and your Medicare Part D plan share in the retail cost of covered drugs with co-insurance (a percentage of retail, such as 25%) or co-payment ...

What happens when you meet your initial coverage limit?

Once you meet your plan's Initial Coverage Limit, you will exit the Initial Coverage Phase and enter the Coverage Gap. (As a note, most people never leave their Medicare drug plan's Initial Coverage Phase). Part 3 - The Coverage Gap or Donut Hole - In this phase of coverage, you will receive a 75% discount on all formulary drugs ...

How many parts are there in Medicare Part D 2021?

The following information describes how the basic or model 2021 Medicare Part D prescription drug plan is separated into four main parts. Depending on your prescription drug needs, you may only go into one or two parts of your Part D coverage (and if you spend over $6,550 in prescription drugs you might go into all four parts ...

What percentage of Donut Hole Discount is applied to brand name formulary?

In such as plan, a member who purchases a brand-name medication that also has coverage in the Donut Hole will actually receive the brand-name drug manufacturer's portion of the Donut Hole Discount (70% ) is also applied to the brand-name formulary drug purchase.

Does Medicare Part D have a deductible?

Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deduct ible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area).

Does Medicare cover all prescription drugs?

And it is important to understand that no Medicare Part D plan covers all prescription drugs. Part D plans are only required to cover a certain number of drugs in specific drug classes. However, Medicare Part D plans can decide to cover a particular generic and exclude the corresponding brand-name drug from coverage.

What is a prescription deductible?

A prescription deductible is a form of cost-sharing. If your plan has a deductible, you must first pay a predetermined amount out of pocket before your health insurance plan will begin to pay for covered services and products. The total amount of your deductible (and whether it is combined for medical and prescription) will vary by plan.

How many gold and platinum tier plans have separate deductibles?

If you are shopping on the Marketplace, many gold- and platinum-tier plans will offer separate deductibles. In 2019, 48% of gold plans and 54% of platinum plans offered separate deductibles.

How much is Joe's deductible?

Joe’s health plan has a combined deductible of $3,000. He has purchased $250 in prescriptions and spent $2,750 on a minor surgery covered by his plan, which he paid for out of pocket. Joe’s deductible has been met for any medical or prescription purchase he makes in this plan year. He will only have to pay $10 for each refill of the regular, generic prescription he takes.

Is Medicare deductible complicated?

Health Insurance Medicare Topics: Prescriptions. Print October 8, 2019. Prescription deductibles aren’t too complicated. In fact, deductibles can be one of the easiest parts of a plan to compare. They can be seen at a glance, and there aren’t many factors to consider. But you should know the differences between plans before you decide in order ...

Do prescriptions have to be covered by a deductible?

Usually, once this single deductible is met, your prescriptions will be covered at your plan’s designated amount. This doesn’t mean your prescriptions will be free, though. You may still have to pay some form of cost-sharing, even after a deductible is met.

Can I use HSA to buy prescriptions?

Because prescription medications are “qualified medical expenses,” health savings accounts (HSAs ) can be used to purchase prescriptions before and after a prescription deductible has been met. Remember, HSAs have exclusions, and they do not cover everything available at the pharmacy. From the Pharmacy.

Does visiting the doctor count as a deductible?

No other covered medical costs (such as visiting the doctor’s office) will count toward your prescription deductible. While this may seem like a negative aspect, separate prescription deductibles are much lower than combined deductibles that cover both medical care and prescriptions, so they are easier to meet.

How much is the 2021 drug deductable?

You would first pay $445 of the $450 retail drug cost to satisfy your 2021 Initial Deductible, the remaining $5 portion of the retail cost ($450 - $445) would carry over to your Initial Coverage phase where you have a $40 co-pay. But, since you never pay more than the drug plan’s retail cost, you are not charged the full $40 co-pay, but instead, ...

What is the Medicare Part D deductible for 2021?

For example, the standard 2021 Medicare Part D deductible is $445 and people must satisfy this deductible before their Medicare plan coverage begins - unless they are enrolled in a Medicare plan that excludes certain drugs from the plan's deductible (see Example 4, below).

What is the deductible for Tier 1 and Tier 2?

So, if you have a $445 standard deductible with Tier 1 and Tier 2 drugs excluded from the deductible, and you purchase a Tier 2 generic drug that has a retail price of $15 (with a co-pay of $3) – you pay only the $3 co-pay and your $445 deductible is not affected by your purchase.

What is a Tier 1 and Tier 2 drug?

Example 4: Tier 1 and Tier 2 drugs are excluded from the Initial Deductible. Some Medicare Part D plans exclude Tier 1 and Tier 2 drugs from the plan's Initial Deductible and these low-costing drugs are not impacted by your Initial Deductible and have immediate coverage as if you were in your plan's Initial Coverage Phase.

Do you have to pay Medicare deductible before you get Medicare?

Next >. In most cases, you must pay your Medicare Part D plan's Initial Deductible before you receive Medicare Part D coverage - just as you would with other types of insurance, such as automobile insurance. For example, the standard 2021 Medicare Part D deductible is $445 and people must satisfy this deductible before their Medicare plan coverage ...