The Medicare levy is collected from you in the same way as income tax. Generally, the pay as you go amount your employer withholds from your salary or wages includes an amount to cover the Medicare levy. Your actual Medicare levy is calculated by us when you lodge your income tax return.

Full Answer

What is the Medicare levy?

Who Pays the Medicare Levy? If you earn more than $29,033 in the most recent tax year, you will pay the Medicare Levy at a simple 2% of your taxable income. Using some very simple numbers: A part-time or casual employee who earned $20,000 pays zero Medicare Levy. An employee earning $50,000 in the last tax year pays $1,000.

Do I have to pay Medicare levy if my income is low?

Mar 26, 2022 · The Medicare Levy is charged at 2% of your annual income and goes towards funding Medicare. You usually need to pay the full percentage if you earn over $29,033. However, you may get an exemption if you are a low-income earner, or a reduction if you are a senior citizen .

How do I work out my Medicare levy?

Mar 31, 2022 · A tax levy is served by the Internal Revenue Service (IRS). The IRS may send a paper Notice of Levy directly to the Medicare contractor. The Medicare contractor implements the tax levy to recoup funds against current Medicare claims processing on behalf of the IRS.

Do I have to pay the Medicare levy in Australia?

May 08, 2018 · If you earn more than $27,068 per year (or $42,805 for seniors and pensioners), then you’ll need to pay a Medicare levy equal to 2% of your annual taxable income. If your income is lower than this – between $21,655 and $27,068 (or $34,244 and $42,085 for seniors and pensioners) – then you’ll only pay part of the Medicare levy.

How do you get around the Medicare levy?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

What is the threshold for the Medicare levy?

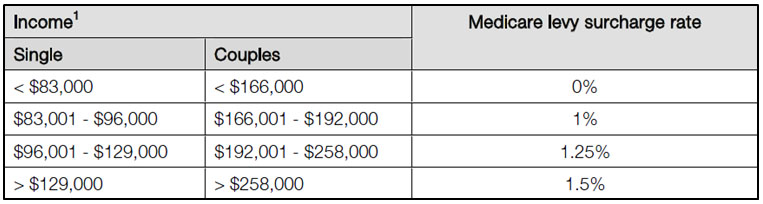

Income threshold and rates from 2014–15 to 2022–23ThresholdBase tierTier 2Single threshold$90,000 or less$105,001 – $140,000Family threshold$180,000 or less$210,001 – $280,000Medicare levy surcharge0%1.25%Jul 5, 2021

How do I avoid Medicare surcharges?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).Dec 21, 2021

Does everyone pay the 2% Medicare levy?

Not everyone is required to pay the Medicare levy surcharge, but if you're single and earning more than $90,000 or part of a family earning $180,000, you may be charged.

Who are exempt from Medicare levy?

You may qualify for an exemption from paying the Medicare levy if you meet certain medical requirements, are a foreign resident, or you are not entitled to Medicare benefits.Jun 29, 2021

Why Medicare surcharges can shock retirees?

Why the surprise? Because many retirees aren't aware these surcharges even exist, or don't understand how they're triggered. Again, your income (specifically, your “modified adjusted gross income”) is the key. As such, large—and, frequently, one-time—financial events can push you into surcharge territory.Feb 3, 2022

How are Medicare surcharges calculated?

How Medicare Surcharges Are Determined. According to the Social Security Administration (SSA), your modified adjusted gross income (MAGI) from two years ago is what counts. This means that benefits for the current period are based on calculations from income you earned two years earlier.

How is the Medicare premium calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is Medicare levied on?

The Medicare Levy Surcharge is different to the Medicare Levy. It is a charge levied on medium and high income earners who do not have private hospital cover. It ranges from 1-1.5% of your annual income. Please click here to read more about the Medicare Levy Surcharge. Popular Articles.

Do low income people have to pay taxes?

Some low income earners (depends on your annual income) do not have to pay the levy or receive a reduction on the levy rate. Do not pay: Income equal to or less than $22,801 (or $36,056 if entitled to the seniors and pensioners tax offset). Had sole care of one or more dependent children.

What is Medicare tax?

Medicare Levy vs the Medicare Levy Surcharge? The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year. The Medicare Levy Surcharge, on the other hand, ...

How much is Medicare tax?

The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year.

Who is Alex Holderness?

As Finder's insurance group publisher, Alex Holderness aims to make confusing topics easy to understand. She's been published in Money Mag, Yahoo Finance, Hospital Health, and is a contributing author for Google's Startup Grind. She has a keen passion for running and is currently studying for her General Insurance certification.

What is the Medicare tax rate for 2019?

The Medicare Levy is a flat 2% income tax for any earning above the threshold. The 2019-20 upper threshold is $28,501 per year. For example, if you earned $75,000 your Medicare Levy would be $1,500. You will only have to pay part of the Medicare Levy if your taxable income is between $22,801 and $28,501 ...

Does Medicare cover everything?

Unfortunately, Medicare doesn't cover everything – but private health insurance can help fill in the gaps. It can cover you for things like ambulance transportation, dental and optical, and often gives you access to treatment quicker than the public system.

What is Medicare levy surcharge?

365. A Medicare levy surcharge may apply if you, your spouse and all your dependants did not maintain an appropriate level of private patient hospital cover for the full income year. Use the number of days listed at A to help you complete the Medicare levy surcharge question on your tax return. See also:

What is the income threshold for MLS?

The base income threshold (under which you are not liable to pay the MLS) is: $90,000 for singles. $180,000 (plus $1,500 for each dependent child after the first one) for families. However, if you had a spouse for the full year, you do not have to pay the MLS if: your family income exceeds the $180,000 ...

Is a super contribution deductible?

if you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

Do you have to pay MLS for Medicare?

If you have to pay Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income.

What is Medicare levy surcharge?

The Medicare levy surcharge is calculated at between 1% and 1.5% of your income, and is payable in addition to the Medicare levy 7.

How is Medicare funded?

Medicare is partly funded by the Medicare levy, which is 2% of your taxable income 2. Certain individuals earning over the threshold and not holding Private Hospital cover will also be required to pay a Medicare levy surcharge towards the cost of the Medicare system 3. Compare Health Insurance.

What is Medicare tax?

The Medicare Levy Explained. Medicare is the scheme that gives Australian residents access to health care 1. It provides access to free or subsidised treatment by health professionals including doctors, specialists, optometrists and dentists, and free treatment and accommodation for public patients in public hospitals 1.

Does Medicare cover a doctor's bill?

When you visit a doctor outside a hospital, Medicare will cover 100% of the scheduled fee for a general practitioner and 85% of the scheduled fee for a specialist. If your doctor bulk bills, you won’t have to pay for anything 4.

Can you be a public patient under Medicare?

Under Medicare, you can be treated as a public patient in a public hospital, at no charge, by a doctor appointed by the hospital . You can choose to be treated as a public patient even if you’re privately insured.

What is the Medicare Levy?

The Medicare Levy is how Australians contribute toward the cost of Medicare, which is 2% of your taxable income if your taxable income is above a certain threshold and you are not exempt from paying.

Am I eligible for the Medicare Levy exemption?

According to the Australia Taxation Office (ATO), some foreign residents and low-income earners generally do not have to pay the whole or part of the Medicare Levy. If you meet specific medical requirements or live in Australia but do not qualify for Medicare benefits, you might also be exempt from paying this levy.

What is the Medicare Levy Surcharge (MLS)?

The MLS is an extra health insurance tax you pay in addition to your Medicare Levy and depending on your income, your MLS rate might be 1%, 1.25% or 1.5%. Your taxable income includes:

Who should pay the Medicare Levy Surcharge?

All Australian taxpayers without private hospital insurance earning over a certain amount of income typically need to pay the MLS. The levy surcharge is calculated on your family status and individual or combined income.

How to avoid paying the Medicare Levy Surcharge

You can avoid paying the MLS if you purchase a hospital policy from a registered private health insurance company in Australia. For a plan to be sufficient, the hospital policy excess, also known as co-payment, must be equal to or less than $500 for single policies and $1000 for a couple/family policy.

Frequently asked questions and answers

To avoid paying the Medicare levy surcharge, you’ll generally need to apply for an eligible Hospital policy before the first of July. To find the right Hospital plan for your requirements, call us at 1300 795 560 to speak with a specialist or fill in the quote form below.