What are the proposed changes to Medicare?

Mar 23, 2020 · Reimbursement is based on the DRGs and procedures that were assigned and performed during the patient’s hospital stay. Each DRG is assigned a cost based on the average cost based on previous visits. This assigned cost provides a simple method for Medicare to reimburse hospitals as it is only a simple flat rate based on the services provided.

When do the Medicare premiums and coinsurance rates change?

Jul 27, 2021 · Finding the Medicare Reimbursement Form. The Medicare reimbursement form, also known as the “Patient’s Request for Medical Payment,” is available in both English and Spanish on the Medicare website. How to Get Reimbursed From Medicare. To get reimbursement, you must send in a completed claim form and an itemized bill that supports …

What are the changes in Medicare?

May 21, 2020 · Typically, an individual does not have to submit a claim to Medicare for reimbursement of their healthcare costs. This article will explain how payments and reimbursement processes work within the ...

How does Medicare determine reimbursement?

1-800-810-1437. Proposed changes to Medicare Part B drug payments could provide beneficiaries with better drug options and lower costs in the future – but not everyone is happy with the changes. As prescription drug costs continue to soar from year to year, the government is looking at ways to cut expenses, particularly for Medicare enrollees.

How does Medicare influence reimbursement?

A: Medicare reimbursement refers to the payments that hospitals and physicians receive in return for services rendered to Medicare beneficiaries. The reimbursement rates for these services are set by Medicare, and are typically less than the amount billed or the amount that a private insurance company would pay.

How does Medicare reimburse health care providers?

Traditional Medicare reimbursements When an individual has traditional Medicare, they will generally never see a bill from a healthcare provider. Instead, the law states that providers must send the claim directly to Medicare. Medicare then reimburses the medical costs directly to the service provider.May 21, 2020

What reimbursement method does Medicare use?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).Dec 1, 2021

How does Medicare affect medical billing?

For providers that do not accept assignment for the specific procedure, Medicare will pay the patient directly for the reimbursement amount. Then, the patient will be responsible for providing the full payment to the provider. Medicare Part C is also known as Medicare Advantage.

How does Medicare Part B reimbursement work?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.Dec 3, 2021

How do I claim medical reimbursement?

How to claim Medical reimbursement? One can claim reimbursement of medical expenses by submitting the original bills to the employer. The employer would accordingly reimburse such expenses incurred subject to the overall limit of Rs 15,000 without tax deduction.Jan 13, 2022

How does Medicare determine its fee for service reimbursement schedules?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

How has Medicare influenced the entire US healthcare system?

They removed the racial segregation practiced by hospitals and other health care facilities, and in many ways they helped deliver better health care. By ensuring access to care, Medicare has contributed to a life expectancy that is five years higher than it was when the law went into effect.Jul 30, 2015

What happens after Medicare processes a claim?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered. s for covered services and supplies you get.

What is Medicare reimbursement based on?

Reimbursement is based on the DRGs and procedures that were assigned and performed during the patient’s hospital stay. Each DRG is assigned a cost based on the average cost based on previous visits. This assigned cost provides a simple method for Medicare to reimburse hospitals as it is only a simple flat rate based on the services provided.

How much does Medicare reimburse?

In addition, Medicare will only reimburse patients for 95 percent of the Medicare approved amount. This means that the patient may be required to pay up to 20 percent extra in addition to their standard deductible, copayments, coinsurance payments, and premium payments.

What is Medicare Part A?

What Medicare Benefits Cover Hospital Expenses? Medicare Part A is responsible for covering hospital expenses when a Medicare recipient is formally admitted. Part A may include coverage for inpatient surgeries, recovery from surgery, multi-day hospital stays due to illness or injury, or other inpatient procedures.

Does Medicare cover hospital care?

Medicare recipients can receive care at a variety of facilities, and hospitals are commonly used for emergency care , inpatient procedures, and longer hospital stays. Medicare benefits often cover care at these facilities through Medicare Part A, and Medicare reimbursement for these services varies. Billing is based on the provider’s relationship ...

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Medicare reimburse doctors?

Medicare Reimbursement for Physicians. Doctor visits fall under Part B. You may have to seek reimbursement if your doctor does not bill Medicare. When making doctors’ appointments, always ask if the doctor accepts Medicare assignment; this helps you avoid having to seek reimbursement.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Does Medicare cover nursing home care?

Your doctors will usually bill Medicare, which covers most Part A services at 100% after you’ve met your deductible.

What is Medicare certified provider?

A Medicare-certified provider: Providers can accept assignments from Medicare and submit claims to the government for payment of their services. If an individual chooses a participating provider, they must pay a 20% coinsurance.

What is the limiting charge for Medicare?

Medicare calls this the limiting charge. Some states set a lower limiting charge. For example, in the state of New York, the limiting charge is 5%. An individual may be responsible for a 20% coinsurance and expenses over the agreed amount.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Do you have to pay for medical bills upfront?

Usually, the insured person will not have to pay the bill for medical services upfront and then file for reimbursement. Providers have an agreement with Medicare to accept the Medicare-approved payment amount for their services. However, out-of-pocket costs may still apply.

Does Medicare Advantage cover medical expenses?

These insurers have a contract with Medicare to provide benefits from parts A and B. As with traditional Medicare , an individual generally does not need to file a claim for medical expenses.

Does Medicare cover Part B deductible?

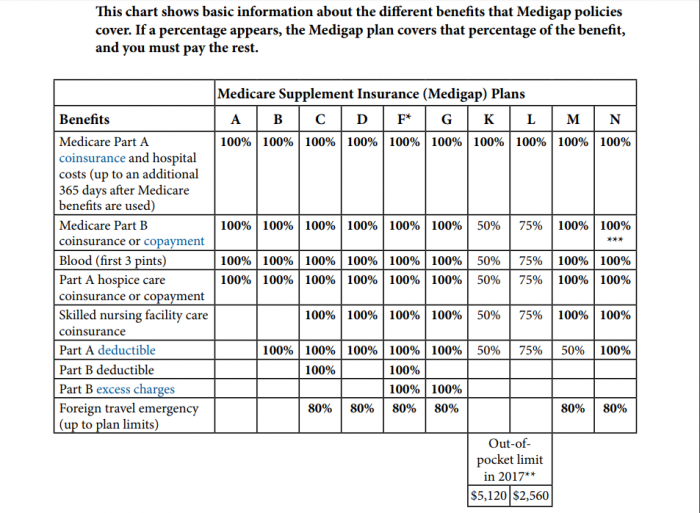

However, new Medigap plans do not cover the Part B deductible.

How much does Medicare Part B cost?

As it stands, Part B spends about $20 billion a year on prescription drugs. This figure represents nearly 5 percent of the total amount that the U.S. spends on all drugs each year. Medicare Part B covers preventive treatments and medically necessary services, like screenings for the flu and wheelchairs.

What is the number to call for Medicare Part B?

1-800-810-1437. Proposed changes to Medicare Part B drug payments could provide beneficiaries with better drug options and lower costs in the future – but not everyone is happy with the changes. As prescription drug costs continue to soar from year to year, the government is looking at ways to cut expenses, particularly for Medicare enrollees.

What is Medicare reimbursement?

A: Medicare reimbursement refers to the payments that hospitals and physicians receive in return for services rendered to Medicare beneficiaries. The reimbursement rates for these services are set by Medicare, and are typically less than the amount billed or the amount that a private insurance company would pay.

What is an opt out provider?

What is a Medicare opt-out provider? A small number of doctors (less than 1 percent of eligible physicians) opt out of Medicare entirely, meaning that they do not accept Medicare reimbursement as payment-in-full for any services, for any Medicare patients.

Who is Louise Norris?

CMS maintains a webpage that lists providers who are currently opted out of Medicare. Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

How long does it take to appeal a debt?

The appeal must be filed no later than 120 days from the date the demand letter is received. To file an appeal, send a letter explaining why the amount or existence of the debt is incorrect with applicable supporting documentation.

How do payers communicate reimbursement rejections?

Payers communicate healthcare reimbursement rejections to providers using remittance advice codes that include brief explanations. Providers must review these codes to determine whether and how they can correct and resubmit the claim or bill the patient. For example, sometimes payers reject services that shouldn’t be billed together during a single visit. Other times, they reject services due to a lack of medical necessity or because those services take place during a specified timeframe after a related procedure. Rejections could also be due to non-coverage or a whole host of other reasons.

How are hospitals paid?

Hospitals are paid based on diagnosis-related groups (DRG) that represent fixed amounts for each hospital stay. When a hospital treats a patient and spends less than the DRG payment, it makes a profit. When the hospital spends more than the DRG payment treating the patient, it loses money.

What is EHR document?

Document the details necessary for payment. Providers log into the electronic health record (EHR) and document important details regarding a patient’s history and presenting problem. They also document information about the exam and their thought process in terms of establishing a diagnosis and treatment plan.

Do providers have to pay back a reimbursement if they don't have documentation?

Although providers can take steps to identify and prevent errors on the front end, they still need to contend with post-payment audits during which payers request documentation to ensure they’ve paid claims correctly. If documentation doesn’t support the services billed, providers may need to repay the healthcare reimbursement they received .

Can a provider submit a claim to a payer?

Providers may submit claims directly to payers, or they may choose to submit electronically and use a clearinghouse that serves as an intermediary, reviewing claims to identify potential errors. In many instances, when errors occur, the clearinghouse rejects the claim allowing providers to make corrections and submit a ‘clean claim’ to the payer. These clearinghouses also translate claims into a standard format so they’re compatible with a payer’s software to enable healthcare reimbursement.

What are the three forms of reimbursement?

Traditionally, there have been three main forms of reimbursement in the healthcare marketplace: Fee for Service (FFS), Capitation, and Bundled Payments / Episode-Based Payments . The structure of these reimbursement approaches, along with potential unintended consequences, are described below.

What is bundled payment?

Bundled payments, also known as episode-based payments, are the reimbursement of health care providers on the basis of expected costs for clinically-defined episodes of care. These episodes cover a wide range of conditions from maternity care, to hip replacements, to cancer, to organ transplants.

What is capitation payment?

There are many different forms of capitation. Some capitation payments only cover professional fees ( i.e., costs of going to a primary care doctor or specialist), while others cover all costs patients incur (hospital inpatient, outpatient, and pharmacy costs).

Is Medicaid the lowest?

Medicaid prices are the lowest, then Medicare, then Commercial. And so, a physician might get paid three times as much to provide the exact same care to a privately insured patient than they would for a patient covered under Medicaid.

What is VBR in healthcare?

Ultimately, VBR approaches are attempting to change the way provider groups do business to both lower cost of care and improve patient care management.

Does AHP accept liability for the content of this article?

AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.