How is Medicare DRG payment calculated?

The MS-DRG payment for a Medicare patient is determined by multiplying the relative weight for the MS-DRG by the hospital's blended rate: MS-DRG PAYMENT = RELATIVE WEIGHT × HOSPITAL RATE.

How much does Medicare reimburse per RVU?

On the downside, CMS set the 2022 conversion factor (i.e., the amount it pays per RVU) at $33.59, which is $1.30 less than the 2021 conversion factor. There was also mixed news on telehealth.

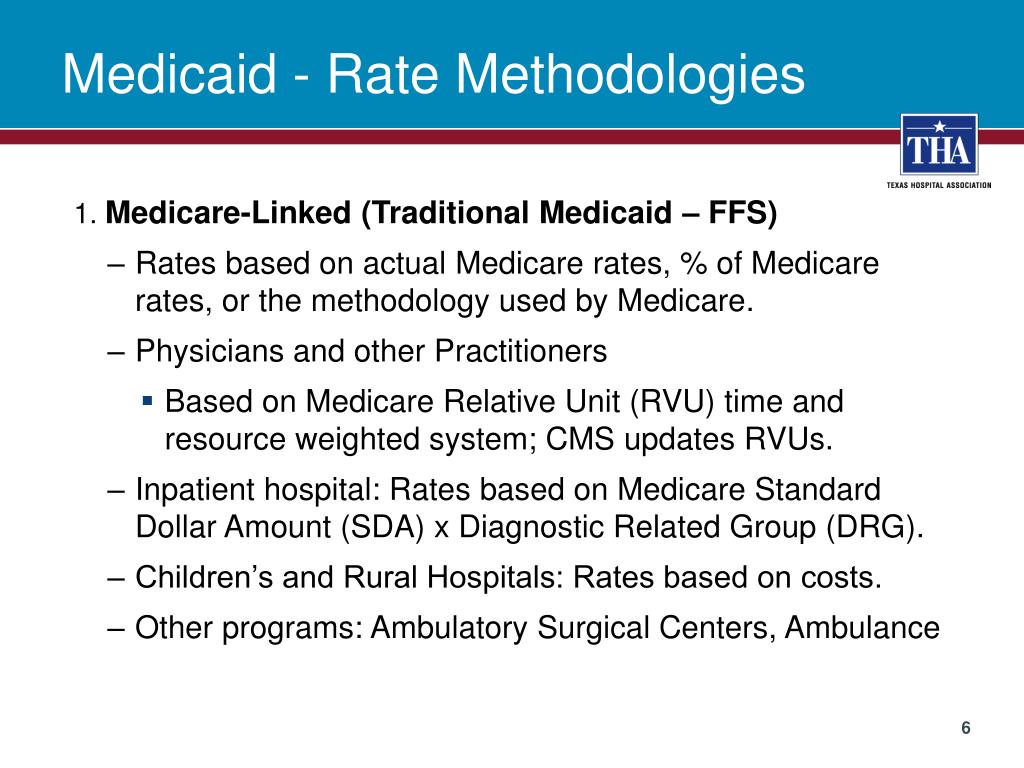

Does Medicare pay based on DRG?

Under the IPPS, each case is categorized into a diagnosis-related group (DRG). Each DRG has a payment weight assigned to it, based on the average resources used to treat Medicare patients in that DRG. The base payment rate is divided into a labor-related and nonlabor share.

How does Medicare calculate RVU?

Basically, the relative value of a procedure multiplied by the number of dollars per Relative Value Unit (RVU) is the fee paid by Medicare for the procedure (RVUW = physician work, RVUPE = practice expense, RVUMP = malpractice)....ABBREVIATIONS:RVURelative Value UnitSGRSustainable Growth Rate6 more rows

How are RVU payments calculated?

Calculation of RVUs RVUs combine components related to the physician's work, the practice's expenses, and when desired, the liability protection. The calculations are aligned by geographic index adjustments and a health system wide conversion factor to ensure alignment within the reimbursement system.

What is RVU compensation?

RVUs, or relative value units, do not directly define physician compensation in dollar amounts. Rather, RVUs define the value of a service or procedure relative to all services and procedures.

How do hospitals get reimbursed from Medicare?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).

How does DRG affect payment for healthcare?

The introduction of DRGs shifted payment from a “cost plus profit” structure to a fixed case rate structure. Under a case rate reimbursement, the hospital is not paid more for a patient with a longer length of stay, or with days in higher intensity units, or receiving more services.

How are DRGs assigned?

DRGs are defined based on the principal diagnosis, secondary diagnoses, surgical procedures, age, sex and discharge status of the patients treated. Through DRGs, hospitals can gain an understanding of the patients being treated, the costs incurred and within reasonable limits, the services expected to be required.

What are the 3 components of RVUs?

CMS calculates an individual GPCI for each of the RVU components -- physician work, practice expense and malpractice.

How does the RVU system work?

How RVUs Work. RVUs do not represent monetary value. Instead, they signify the relative amount of physician work, resources, and expertise required to service patients. The actual dollar amount of payment for those services only comes when a conversion factor (CF) — dollar per RVU — is applied to the total RVUs accrued ...

Who decides RVU?

Specialty Society Relative Value Scale Update CommitteeThe Specialty Society Relative Value Scale Update Committee (also known as the RUC) determines the RVUs for each new code and revalues existing codes on a five-year schedule to reflect changes in costs and technology.

What is an RVU worth in 2021?

For each year, work RVUs and conversion factors of that specific year were applied to the formula, $36.04 for 2019 and $32.41 for 2021.

What is Medicare reimbursement fee schedule?

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

How much is a wRVU worth?

The current conversion factor for 2020 is $36.0896. This is standard, regardless of the CPT code. You can learn the wRVU associated with each CPT code by downloading the 2020 Physician Fee Schedule from CMS.gov.

How are Medicare reimbursements calculated?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.