Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare MSA Plan. These plans are similar to Health Savings Account Plans available outside of Medicare.

Full Answer

How do I decide on which Medicare plan to use?

You join a plan offered by Medicare-approved private companies that follow rules set by Medicare. Each plan can have different rules for how you get services, like needing referrals to see a specialist. Costs for monthly premiums and services you get vary depending on which plan you join. Plans must cover all emergency and urgent care, and almost all medically necessary …

What are the best Medicare plans?

Rules for Medicare Advantage Plans. Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. Each Medicare Advantage Plan can charge different out-of-pocket costs. They can also have different rules for how you get services, like:

What do you need to know about Medicare plans?

What else do I need to know about Original Medicare? You generally pay a set amount for your health care ( deductible [glossary] ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share ( coinsurance / copayment ) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket.

What are the advantages of Medicare plans?

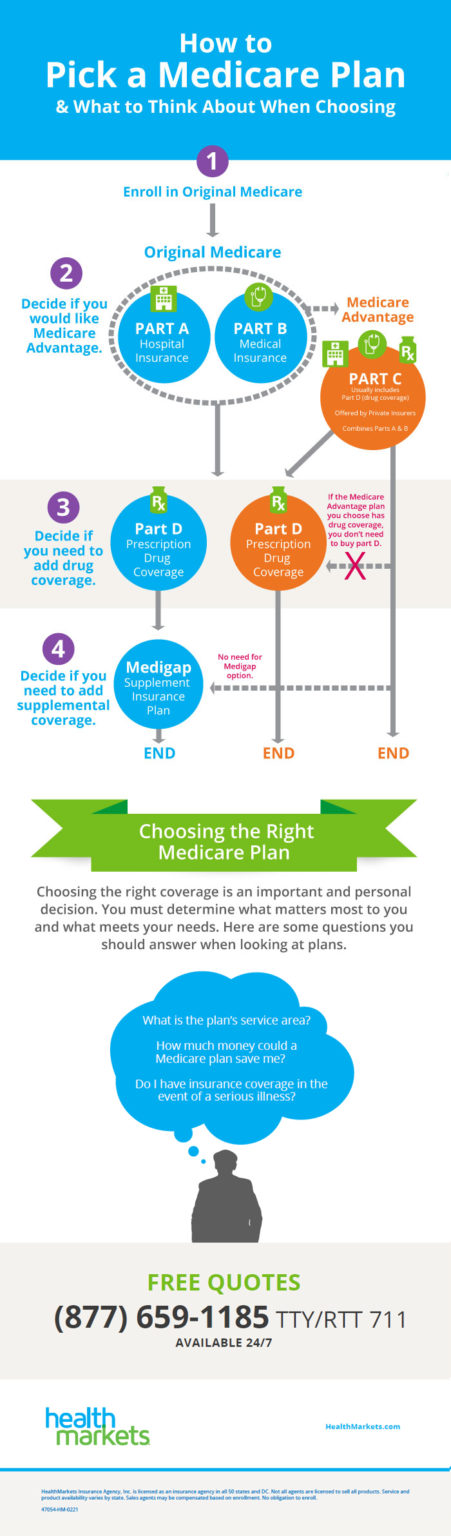

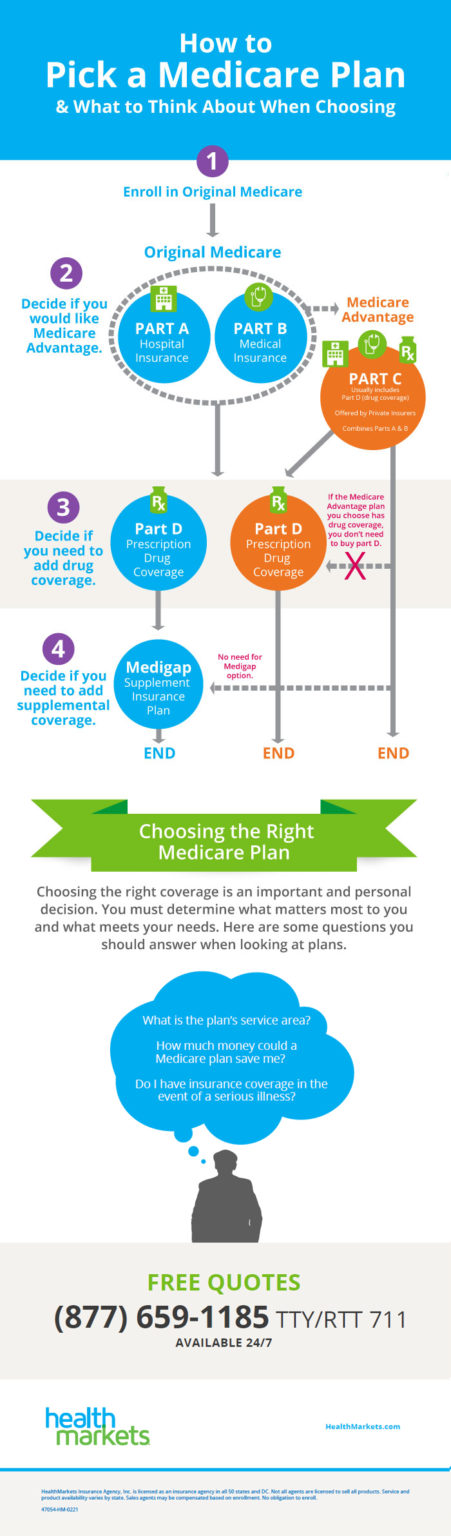

How does Medicare work? With Medicare, you have options in how you get your coverage. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage. There are 2 main ways: Original Medicare. Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). You pay for services as you get them.

What does Medicare plan a do?

Does Medicare Part A cover 100 percent?

How does Medicare A and B work?

Who pays for Medicare Part A?

Does Medicare Part A cover MRI?

Is Medicare Part A free at age 65?

Is Medicare Part A and B free?

How long before you turn 65 do you apply for Medicare?

It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Are you automatically enrolled in Medicare Part B?

Does Medicare cover dental?

Is there a deductible for Medicare?

How much does Medicare cost at age 83?

| Age in years | Average monthly premium for Plan F |

|---|---|

| 82 | $236.53 |

| 83 | $220.81 |

| 84 | $225.56 |

| 85 | $234.20 |

What is Medicare Advantage Plan?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

What happens if you join Medicare Advantage?

If you join a Medicare Advantage Plan, you still have. Medicare. Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD) .

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

Does Medicare Advantage cover vision?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits.

What happens if you don't get a referral?

If you don't get a referral first, the plan may not pay for the services. to see a specialist. If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care. These rules can change each year.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

Does Medicare cover health care?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it. Whether you have other health insurance that works with Medicare.

What are the factors that affect Medicare?

Factors that affect Original Medicare out-of-pocket costs 1 Whether you have Part A and/or Part B. Most people have both. 2 Whether your doctor, other health care provider, or supplier accepts assignment. 3 The type of health care you need and how often you need it. 4 Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it. 5 Whether you have other health insurance that works with Medicare. 6 Whether you have Medicaid or get state help paying your Medicare costs. 7 Whether you have a Medicare Supplement Insurance (Medigap) policy. 8 Whether you and your doctor or other health care provider sign a private contract.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a copayment?

copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is Medicare for?

Medicare is the federal health insurance program for: 1 People who are 65 or older 2 Certain younger people with disabilities 3 People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare Advantage?

You buy Medicare Advantage plans from private health insurance companies that contract with the government. They work with Original Medicare coverage. Part D covers prescription drugs. Many Medicare Advantage plans combine Parts A, B and D in one plan. And each Medicare plan only covers one person.

Why are Medicare Advantage plans so popular?

Medicare Advantage plans are popular because of their convenience. Most plans combine medical and prescription coverage on one card. Some offer dental and vision coverage, too. And you're able to predict your out-of-pocket costs better than you can with Original Medicare.

How much does Medicare pay for coinsurance?

When you have Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for most medical services covered under Part B. Medicare Advantage plans use copays more than coinsurance. Which means you pay a fixed cost. You might have a $15 copay for doctor office visits, for example.

Does Medicare have a cap?

That means once you spend a certain amount of money on health care each year, your plan pays 100 percent of the cost of services it covers. Original Medicare doesn't have this cap. So if you get really sick, you'll end up paying a lot.

What happens if you don't have a Medicare Advantage plan?

That means that if you don't have a Part D plan through an employer or union, you may face a penalty if you don't buy one on your own. And supplement plans don' t come with the extra benefits you often get with Medicare Advantage, like dental and vision coverage.

Does Medicare cover prescription drugs?

Medicare Part D covers prescription drugs. You get it through a Part D prescription drug plan or through a Medicare Advantage plan. But it works differently from prescription coverage that comes with other health insurance plans. Medicare Part D prescription coverage has something called the coverage gap, or donut hole.

Can Medicare Supplement replace Original Medicare?

In a way, Medicare Advantage replaces Original Medicare and connects all the pieces together on one plan. Supplement plans don't replace Original Medicare. It's more like an extra you can add on top of Original Medicare.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a multi-employer plan have?

At least one or more of the other employers has 20 or more employees.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

Does Medicare Supplement pay for coinsurance?

Most supplement plans pay for Medicare copayments, coinsurance, and deductibles. But the coverage may vary according to the plan you choose. Medicare Supplement plans work together with Original Medicare. First, Medicare pays for a percentage, usually 80 percent, of the Medicare-approved cost of your health care service.

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

Does Medicare Supplement cover prescriptions?

They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan. These plans also do not include prescription drug coverage.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover prescriptions?

Original Medicare benefits do not cover prescription drug costs unless the drugs are part of inpatient hospital care or are certain drugs that your health care provider administers in a medical facility. Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions ...

How much does Medicare Advantage cost in 2020?

In the case of a standalone plan, you also pay a set annual deductible. As of 2020, the amount can be no more than $435.00 per year.

What is the difference between tier one and tier two?

The amount you pay depends on the formulary of your plan and the tier on which your drug is categorized. Tier one includes generic brands of permitted drugs and they have the lowest copay ment. Tier two includes brand-name, preferred drugs and carry a higher copayment than tier one.

What is Medicare Plan G?

Plan G offers full coverage of the Part A deductible and the Part A coinsurance charges. Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed ...

How long does Medicare plan G cover?

Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed those 90 days. Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare ...

How long is a hospital stay covered by Medicare?

Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed those 90 days.

How long does Medicare cover inpatient hospital stays?

Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed those 90 days. Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare benefits are exhausted.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans can offer similar coverage options combined with prescription drug coverage, but recipients cannot enroll in both a Medicare Supplement ...

Does Medigap cover Part B?

Although it does not cover the Part B deductible, Plan G does cover costs related to Part B coinsurance or copayment charges.

What is Medicare Part A?

Medicare Part A covers some costs associated with inpatient hospital treatment, a skilled nursing facility, or hospice. Medicare Part B covers some costs associated with medically necessary outpatient services ...

Does Medigap work with Medicare?

However, Medigap works as a supplement to Original Medicare Part A and Part B only.

What are the benefits of Medicare Supplement?

These are the benefits that may be available with a Medicare Supplement plan: 1 Coverage for Part A hospital coinsurance costs for up to 365 days once Part A’s coverage is used up. 2 Part B copayments and coinsurance amounts. 3 Coverage for the first three pints of blood if required during treatment. 4 Hospice care share-of-cost obligations with Part A. 5 Coinsurance related to a stay in a skilled nursing facility. 6 Coverage for the deductibles for Part A or Part B. 7 Excess charges not covered by Part B. 8 Medical emergencies while traveling in a foreign country.

Does Medicare Part A cover coinsurance?

Although Medicare Part A and Part B can help cover many expenses, recipients are still obligated to pay deductibles, copayments and coinsurance amounts. A Medigap plan can help alleviate the burden of some of the costs of deductibles, coinsurance, copayment, and medical care outside of the United States. There are a variety of policies that offer ...

How long does it take to enroll in Medigap?

The initial enrollment period for a Medigap plan begins the month a recipient turns 65 and is enrolled in Part B. Recipients have a 6-month period to purchase any Medigap plan available in their state.

How long does a special enrollment period last?

A special enrollment period begins 60 days before a loss of coverage is expected to occur and can last up to 63 days after it happens.