Medicare Supplement plans work together with Original Medicare. First, Medicare pays for a percentage, usually 80 percent, of the Medicare-approved cost of your health care service. After this is paid, your supplement policy pays your portion of the remaining cost.

What is a Medicare inpatient PPS system?

Except for acute care hospital settings, Medicare inpatient PPS systems are in their infancy and will be experiencing gradual revisions. Prepayment amounts cover defined periods (per diem, per stay, or 60-day episodes). The payment amount is based on a unique assessment classification of each patient.

When did Medicare change from fee for service to PPS?

Faced with sharply escalating Medicare costs in the early 1980s, the federal government completely revised the way Medicare pays hospitals for treating elderly patients. The governing agency, the Health Care Financing Administration, switched from a retrospective fee-for-service system to a prospective payment system (PPS).

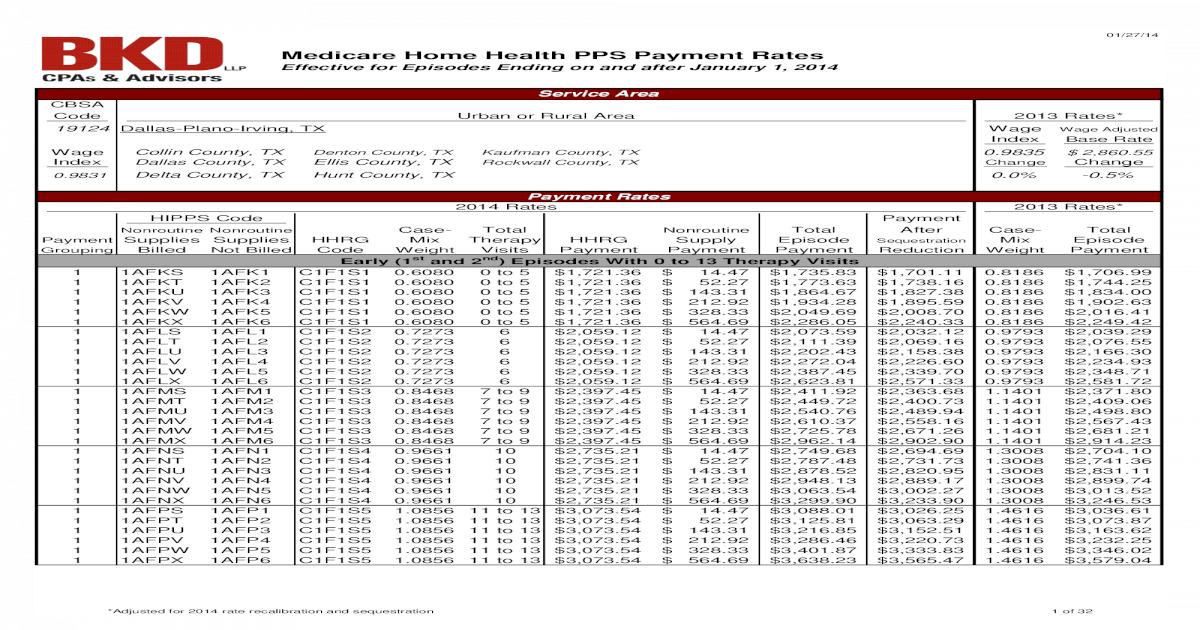

What does PPS stand for in home health?

Home Health PPS The Balanced Budget Act (BBA) of 1997, as amended by the Omnibus Consolidated and Emergency Supplemental Appropriations Act (OCESAA) of 1999, called for the development and implementation of a prospective payment system (PPS) for Medicare home health services.

What are the Medicare Part A prospective payment systems?

Following are summaries of Medicare Part A prospective payment systems for six provider settings. The DRG payment rate is adjusted based on age, sex, secondary diagnosis and major procedures performed. DRG payment is per stay.

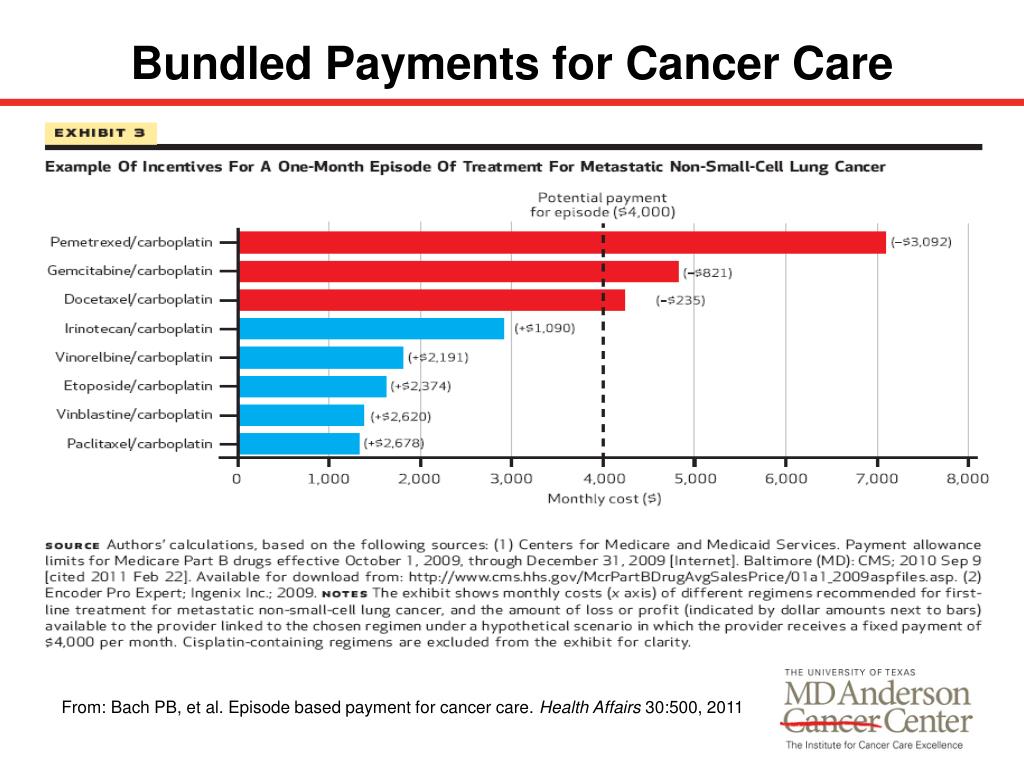

What are the main advantages of a prospective payment system?

One important advantage of Prospective Payment is the fact that code-based reimbursement creates incentives for more accurate coding and billing. PPS results in better information about what payers are purchasing and this information can be used, in turn, for network development, medical management, and contracting.

Why did Medicare move to a prospective payment system?

The idea was to encourage hospitals to lower their prices for expensive hospital care. In 2000, CMS changed the reimbursement system for outpatient care at Federally Qualified Health Centers (FQHCs) to include a prospective payment system for Medicaid and Medicare.

What is the difference between fee-for-service and prospective payment system?

Fee-for-service has traditionally focused on reactive care and the result is that the USA is not a leader in chronic care management for diseases like diabetes and asthma. The prospective payment system stresses team-based care and may pay for coordination of care.

How does Medicare IPPS work?

Under the IPPS, each case is categorized into a diagnosis-related group (DRG). Each DRG has a payment weight assigned to it, based on the average resources used to treat Medicare patients in that DRG. The base payment rate is divided into a labor-related and nonlabor share.

When did Medicare switch to PPS?

1984The Medicare Case-Mix Index, which increased sharply with the implementation of PPS in fiscal year 1984, has continued to increase, at an annual rate of 3 percent for fiscal years 1984-86.

How does Medicare reimburse physician services?

Traditional Medicare reimbursements Instead, the law states that providers must send the claim directly to Medicare. Medicare then reimburses the medical costs directly to the service provider. Usually, the insured person will not have to pay the bill for medical services upfront and then file for reimbursement.

What are the main disadvantages of a prospective payment system?

Prospective payment plans also come with drawbacks. Because providers only receive fixed rates, some might seek to employ cost-cutting measures to maximize profits while not necessarily keeping their patients' best interests in mind.

How is PPS rate calculated?

The PPS rate is computed by dividing the total reimbursable costs computed in PART A by total reimbursable visits from Worksheet 6 per the provider's records.

Why is PPS important?

PPS is intended to motivate healthcare providers to structure cost-effective, efficient patient care that avoids unnecessary services. The goal is to provide quality patient care that engages patients, and strives for faster diagnosis and treatment, shorter hospital stays, and lower costs.

How is IPPS calculated?

The IPPS pays a flat rate based on the average charges across all hospitals for a specific diagnosis, regardless of whether that particular patient costs more or less. Everything from an aspirin to an artificial hip is included in the package price to the hospital.

What steps are involved in determining the payment rate for IPPS?

Under the IPPS, DRG per-discharge payment rates are based on patients' clinical conditions (diagnoses) and the procedures furnished by the hospital during the stay. The beneficiary's principal diagnosis and up to eight secondary diagnoses that indicate comorbidities and complications will determine the DRG assignment.

How is Medicare DRG payment calculated?

The MS-DRG payment for a Medicare patient is determined by multiplying the relative weight for the MS-DRG by the hospital's blended rate: MS-DRG PAYMENT = RELATIVE WEIGHT × HOSPITAL RATE.

Zipcode to Carrier Locality File

This file is primarily intended to map Zip Codes to CMS carriers and localities. This file will also map Zip Codes to their State. In addition, this file contains an urban, rural or a low density (qualified) area Zip Code indicator.

Provider Center

For a one-stop resource web page focused on the informational needs and interests of Medicare Fee-for-Service (FFS) providers, including physicians, other practitioners and suppliers, go to the Provider Center (see under "Related Links" below).

Overview

Section 10501 of the Patient Protection and Affordable Care Act of 2010 modified how payment is made for Medicare services furnished at Federally qualified health centers (FQHCs).

FQHC Center

For a one-stop resource web page focused on the informational needs and interests of Medicare Fee-for-Service (FFS) federally qualified health centers, go to FQHC Center.

What is PPS in home health?

The Balanced Budget Act (BBA) of 1997, as amended by the Omnibus Consolidated and Emergency Supplemental Appropriations Act (OCESAA) of 1999, called for the development and implementation of a prospective payment system (PPS) for Medicare home health services.

When did the Home Health PPS rule become effective?

Effective October 1, 2000, the home health PPS (HH PPS) replaced the IPS for all home health agencies (HHAs). The PPS proposed rule was published on October 28, 1999, with a 60-day public comment period, and the final rule was published on July 3, 2000. Beginning in October 2000, HHAs were paid under the HH PPS for 60-day episodes ...

When will HHAs get paid?

30-Day Periods of Care under the PDGM. Beginning on January 1 2020, HHAs are paid a national, standardized 30-day period payment rate if a period of care meets a certain threshold of home health visits. This payment rate is adjusted for case-mix and geographic differences in wages. 30-day periods of care that do not meet ...

Is telecommunications technology included in a home health plan?

In response CMS amended § 409.43 (a), allowing the use of telecommunications technology to be included as part of the home health plan of care, as long as the use of such technology does not substitute for an in-person visit ordered on the plan of care.

How Does The Snf Pps System Determine Payment?

WhenPPS payments are adjusted for the geographic variation of wages, any costs associated with covering these costs, such as routine, ancillary, and capital-related, are covered.

How Does Medicare Pps Work?

Medicare payment is made based on fixed amounts with preferential payment systems (PPS) – the basis for paying patients by predetermined amounts through the use of this system. For a particular service, the billing level is calculated from the different groups that receive services (such as inpatient mental health services).

What Services Are Included In The Consolidated Billing Of The Snf Pps?

patients in a SNF may receive consolidated billing, which includes physical therapy, occupational therapy, speech therapy, and specialized services. Working with suppliers, physicians, and other professionals is a must for the SNF.

Is Inpatient Prospective Payment System Cost Based Or Price Based?

According to the IPPS, hospitals pay a flat rate for diagnoses regardless of whether the patient actually pays more or less than the average for any given condition. Our hospitals charge anywhere from $75 to $150 for the treatment of aspirin, for artificial hips, etc.

Does Medicare Cover Snf Costs?

SNF treatment may not be covered by Medicare after a hospitalization for a specified period of time. You’ll be asked when and how long in what condition Medicare covers ia care may be needed for a much longer period of time.

How Do Snfs Get Paid By Medicare?

Under the current Medicare Part A system, skilled nursing facilities (SNFs) with audiology and speech-language pathology services can be paid according to a prospective payment system (PPS).

How Are Snfs Paid?

Assisted living facilities already receive base rate and extra reimbursement from the per diem they receive based on the number of therapy minutes and/or nursing services they provide. Some providers and agencies may be incentivized to provide medically unnecessary care through this payment system.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

Does Medicare Supplement pay for coinsurance?

Most supplement plans pay for Medicare copayments, coinsurance, and deductibles. But the coverage may vary according to the plan you choose. Medicare Supplement plans work together with Original Medicare. First, Medicare pays for a percentage, usually 80 percent, of the Medicare-approved cost of your health care service.

What is IPF PPS?

What’s the IPF PPS? In 1999, section 124 of the Balanced Budget Refinement Act or BBRA required that a per diem (daily) PPS be developed for payment to be made for inpatient psychiatric services furnished in psychiatric hospitals and psychiatric units of acute care hospitals and critical access hospitals. Section 124 of the BBRA required the IPF ...

When was the IPF PPS implemented?

Section 124 of the BBRA required the IPF PPS be implemented for cost reporting periods beginning on or after October 1, 2002. The law also required: An "adequate patient classification system that reflects the differences in patient resource use and costs among such hospitals".

What is PPS in healthcare?

The governing agency, the Health Care Financing Administration, switched from a retrospective fee-for-service system to a prospective payment system (PPS). Under PPS, hospitals receive a fixed amount for treating patients diagnosed with a given illness, regardless of the length of stay or type of care received.

How effective is PPS?

PPS proved effective at curbing cost growth. However, because it contained incentives for hospitals to shorten stays and to choose the least expensive methods of care, PPS raised concerns about possible declines in the quality of care for hospitalized Medicare patients. A study conducted jointly by RAND and the University of California, ...

What are the recommendations of the PPS study?

First, to eliminate possible problems with patients discharged in unstable condition, a more systematic assessment should be made of patients’ readiness to leave the hospital and receive care in another setting. Second, to provide current information about the effects of Medicare’s payment methods on quality of care, clinically detailed data should be collected to monitor sickness at admission, processes of care, discharge status, and outcomes on a regular basis as long as PPS is in place .

Does mortality increase after PPS?

Mortality rates for patients with the given conditions did not increase after PPS. Across all of these measures, mortality declined for all five patient groups. Similarly, the other outcome measures evidenced no post-PPS declines in quality of care.

Can you bill for medical supplies during a POC?

The agency that establishes the episode is the only entity (other than a physician) that can bill and receive payment for medical supplies during an episode for a patient under a home health POC. Reimbursement for routine and non-routine medical supplies is included in the payment rates for every Medicare home health patient.

Is DME included in PPS?

With the exception of certain covered osteoporosis drugs where the patient meets specific criteria, durable medical equipment (DME), and furnishing negative pressure wound therapy (NPWT) using a disposable device, payment for all services and supplies is included in the HH PPS episodic rate for individuals under a home health POC. You must provide the covered home health services (except DME) either directly or under arrangement (an outside supplier furnishes services under arrangement and looks to the HHA for payment). You must bill for such covered home health services, and payment must be made to you.

Explore Inpatient PPS Topics

At a Glance At Issue The Centers for Medicare & Medicaid Services (CMS) April 27 issued its hospital inpatient prospective payment system (PPS) and long-term care hospital (LTCH) PPS proposed rule for fiscal year (FY) 2022. The rule affects inpatient PPS hospitals, critical acc...

Regulatory Advisory: Hospital Inpatient PPS Proposed Rule for FY 2022

At a Glance At Issue The Centers for Medicare & Medicaid Services (CMS) April 27 issued its hospital inpatient prospective payment system (PPS) and long-term care hospital (LTCH) PPS proposed rule for fiscal year (FY) 2022. The rule affects inpatient PPS hospitals, critical acc...