Medicare Advantage medical savings account (MSAs) combine a high-deductible health plan with a dedicated savings account. Each year, the plan deposits into the account a sum of money that partially covers the deductible amount. MSAs are not widely used but may be suitable for people who want more control over their healthcare dollars.

What are the benefits of Medicare savings program?

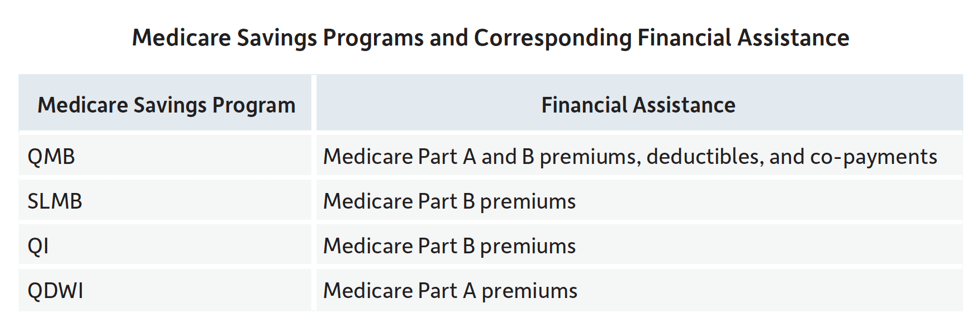

Types of Medicare Savings Programs

- Qualified Medicare Beneficiary (QMB) Programs pay most out-of-pocket costs for Medicare, protecting beneficiaries from cost-sharing. ...

- Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium. ...

- Qualifying Individual (QI) Programs are also known as Additional Low-Income Medicare Beneficiary (ALMB) programs. ...

How do I apply for Medicare savings program?

To qualify for the QI program, you must meet the following:

- Individual monthly income limit of $1,469 (limits may be higher in Alaska or Hawaii)

- Married couple monthly income limit of $1,890 (limits may be higher in Alaska or Hawaii)

- Individual resource limit of $7,970

- Married couple resource limit of $11,960

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

Does Medicaid replace Medicare?

More than 8 million people have both Medicare and Medicaid. In this situation, Medicare becomes your primary insurance and settles your medical bills first; and Medicaid become secondary, paying for services that Medicare doesn’t cover and also paying most of your out-of-pocket expenses in Medicare (premiums, deductibles and copays).

What happens to money left in a MSA at the end of the year?

Any money left in your account at the end of the year will remain in your account. If you stay with the Medicare MSA Plan the following year, the new deposit will be added to any leftover amount.

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple. These programs include all the ones listed below except Supplemental Security Income (SSI).

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How does medical savings account work?

A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. By using untaxed dollars in a Health Savings Account (HSA) to pay for deductibles, copayments, coinsurance, and some other expenses, you may be able to lower your overall health care costs.

Does Medicare look into your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What are the pros and cons of a Health Savings Account?

You pay less out-of-pocket due to the lower deductible and copay, but pay more each month in premium. HSA plans generally have lower monthly premiums and a higher deductible. You may pay more out-of-pocket for medical expenses, but you can use your HSA to cover those costs, and you pay less each month for your premium.

What is an advantage of a medical savings account?

The main benefits of a high deductible medical plan with a health savings account (HSA) are tax savings, the ability to cover some expenses your insurance doesn't, the ability to have others contribute to your account, and the convenience of using the account to pay for healthcare expenses.

What is the difference between a Health Savings Account and a medical savings account?

MSAs are for people enrolled in a high-deductible Medicare plan, while HSAs are designed for those enrolled in a typical high-deductible health plan (HDHP). While MSAs and HSAs tout a number of similar characteristics, determining which account is right for you can be difficult.

What is Medicare Part A?

Original Medicare is comprised of Medicare Part A (hospital insurance) and Medicare Part B (outpatient insurance). MSPs are run at the state level by each individual state’s Medicaid program. That means you need to contact your state’s Medicaid office to apply for an MSP. Even if you already take part in a Medicare Savings Program, ...

How long does Medicare Part B pay out?

The premium payments normally come out of your Social Security check. Service for these two MSPs may be retroactive for up to three months.

What is SLMB in Medicare?

The Specified Low-Income Medicare Beneficiary (SLMB) Program helps pay for Medicare Part B premiums only. You must already have Medicare Part A to qualify. You can take part in the SLMB program and other Medicaid programs at the same time. Some states may refer to this as the SLIMB program.

How old do you have to be to qualify for Medicare?

There are four types of Medicare Savings Programs. Three of them are available only if you have Medicare and are at least 65 years old: The Qualified Medicare Beneficiary (QMB) Program helps pay for Medicare Part A premiums and Medicare Part B premiums, deductibles, coinsurance, and copays.

What is medicaid?

Medicaid is a federal assistance program that provides health insurance for low-income and vulnerable Americans. The program is partially funded by the states and each state can set its own eligibility requirements. Qualifying for Medicaid benefits depends largely on your income, but also on your age, disability status, pregnancy, household size, and your household role.

Does MSP cover prescriptions?

MSPs can help pay the out-of-pocket expenses associated with Medicare Part A and Medicare Part B. They do not cover prescription drug costs. However, Medicare recipients who qualify for an MSP are also automatically eligible for Medicare Extra Help, which helps pay for a Medicare Part D prescription drug plan.

Is Medicaid a separate program from Medicare?

See if you qualify with our state-by-state guide to Medicaid. Medicaid is a separate program from Medicare. Both programs provide health insurance, but Medicare coverage is primarily for seniors while Medicaid eligibility depends largely on your income. It’s possible to take part in both programs at the same time.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

Is Medicare cost prohibitive?

The cost of Medicare benefits in the form of premiums, coinsurance, copayments and deductibles can raise concerns about affordability, especially when you are on a limited income. For Medicare recipients under a certain income and asset level, Medicare benefits can be cost prohibitive.

How much did Medicare spend in 2016?

People on Medicare are more likely to have fixed incomes, but spent as much as $5,460 in healthcare out-of-pocket costs in 2016. 1 Picking a plan that will save the most money could have a major impact on your ability to afford life’s essentials.

What is MSA in Medicare?

An MSA is a special type of Medicare Advantage plan with two components: A high-deductible health plan: This type of health plan requires you to pay an expensive annual deductible before your coverage benefits kick in. Specifically, you will pay full cost for any Part A or Part B Medicare-covered services until you spend a dollar amount equal ...

How does MSA work?

How an MSA Works. You can use your MSA to pay for services right away. You do not have to wait until you spend the full deductible amount out of your own pocket. In fact, any money you spend for Medicare-covered services from this account will help pay down your deductible.

Does Medicare pay 100% of your deductible?

A bank account set up by your health plan: Medicare funds this bank account with a fixed dollar amount every year. The amount varies based on the specific plan you choose, but will be less than your annual deductible.

Is $300 a medical expense?

Although this is not a qualifying medical expense, you decide to use $300 from your bank account to pay for it: $300 is taken from your bank account but cannot be applied to your deductible. You now have $1,200 in your bank account ($1,500 - $300) and $5,000 left to pay on your deductible.

Is acupuncture deductible on Medicare?

Your visit costs $100: $100 is taken from your bank account but cannot be applied to your deductible.

What is Medicare savings?

Medicare savings programs help people with lower income pay their Medicare Part A and Part B premiums, deductibles, copays, and coinsurance. To qualify, your monthly income must be at or below a certain limit for each program, and your household resources cannot exceed certain limits.

Why are Medicare benefits created?

These programs were created because not everyone reaches retirement age with the same ability to handle expenses like Medicare premiums, copays, coinsurance, deductibles, and the cost of prescription drugs. In 2018, the U.S. Census Bureau predicted that by 2034, 77 million Americans will be 65 years or older.

How to cut Medicare costs?

You can also cut your Medicare costs by applying for Medicaid, enrolling in PACE, or purchasing a Medigap policy.

What is a Medigap plan?

Medigap plans are private insurance policies that help you pay your Medicare costs , including copays, coinsurance, and deductibles. You can choose from among 10 plans, and each plan offers the same coverage nationwide.

What documents are needed to apply for Medicare?

Before you begin applying, gather supporting documents such as your Social Security and Medicare cards, proof of your address and citizenship, bank statements, IRA or 401k statements, tax returns, Social Security awards statements, and Medicare notices.

How to apply for medicaid?

To apply for the a program, you’ll need to contact your state Medicaid office. You can check online to find your state’s office locations, or call Medicare at 800-MEDICARE. Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal.

Do you have to pay extra help copay?

If you have Extra Help, you’ll always pay either your Extra Help copay or your Part D cost for your prescriptions, whichever is less. It’s possible to get partial support from Extra Help. People with partial Extra Help pay lower premiums, deductibles, and copays.

How many types of Medicare savings programs are there?

There are four types of Medicare Savings Programs and each one comes with its own benefits. Learn about how you could save on some of your Medicare Part D costs.

Does SLMB pay for Part B?

This savings program pays for the Part B premium but unlike the QMB, it does not pay for Part A premiums or for any cost-sharing expenses. The SLMB program uses the same income and asset qualifying criteria as the QMB, with qualifying numbers that may change from year to year.

What assets are considered eligible for Medicare?

things that can be sold for cash, may make it harder to qualify. This may include cash, bank accounts, stocks, bonds, real estate, and motor vehicles.

What is the FPL for Medicare?

Each of the four Medicare Savings Programs has different financial eligibility requirements. When it comes to income, the federal poverty limit (FPL) is used to determine eligibility in a number of government programs.

How much does a person pay for Part B insurance?

That means that an individual without other assets or financial resources would pay 18 percent of their annual income towards Part B premiums, and a couple, paying $1,608 in annual premiums per person, would pay as much as 24 percent.

Does Medicare pay for health care?

Types of Medicare Savings Programs. Thank goodness there are Medicare Savings Programs available to soften the blow. These programs do not pay directly for your health care. What they do is pay down the costs that Medicare leaves on the table, costs like premiums, deductibles, coinsurance, and copayments.

Is Medicare the most affordable insurance?

Income Limits to Qualify. Asset Limits to Qualify. How to Apply. Medicare may be the most affordable insurance option for American seniors, but that does not mean it's cheap. It still may be hard for some people to make ends meet. A senior who has worked 40 quarters ...

Is Medicare a countable asset?

The federal guidelines, however, exclude the following from consideration: These are not considered to be countable assets. Although Medicare is a federal program, the Medicare Savings Programs are run by the Medicaid programs in each state. This allows the states to set the final terms of eligibility.

How does Medicare work?

Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare Medical Savings Account (MSA) Plan. This type of plan combines a high-deductible health insurance plan with a medical savings account that you can use to pay for your health care costs. Medicare MSA Plans give you freedom to control your health care dollars and provide you with important coverage against high health care costs.

What rights do you have with Medicare?

As a person with Medicare, you have certain rights. One of these is the right to a fair process to appeal decisions about your health care payment of services.

What is Medicare MSA?

Medicare MSA Plans (offered by private companies) are Medicare Advantage Plan options . Medicare MSA Plans are similar to Health Savings Account plans available outside of Medicare. If you choose a Medicare MSA Plan, you’re still in Medicare and you will still have Medicare rights and protections.

What is assignment in Medicare?

Assignment—An agreement by your doctor or other supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.