Medicare establishes the reimbursement rates based on recommendations from a select committee of 52 specialists. The committee is composed of 29 medical professionals and 23 others nominated by professional societies.

Where can I find the Medicare physician fee schedule?

The searchable Medicare Physician Fee Schedule can also be accessed on the federal Medicare website. Enter the HCPCS code in the box provided and click “Submit” to see the rate at which Medicare reimburses for the given service or item. Learn more in the CMS guide, How to Use the Searchable Medicare Physician Fee Schedule.

How does Medicare Set physician prices?

Since the program began, physician prices have been set through a series of administrative calculations. Since 1992, Medicare has set prices using the Resource-Based Relative Value Scale (RBRVS), which calculates the estimated amount of work and practice expense involved in delivering specific services.

How does Medicare pay providers?

For most payment systems in traditional Medicare, Medicare determines a base rate for a specified unit of service, and then makes adjustments based on patients’ clinical severity, selected policies, and geographic market area differences. Medicare uses prospective payment systems for most of its providers in traditional Medicare.

What is the Medicare physician fee schedule proposed rule?

This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021. This proposed rule proposes potentially misvalued codes and other policies affecting the calculation of payment rates.

How are Medicare physician payments calculated?

Calculating 95 percent of 115 percent of an amount is equivalent to multiplying the amount by a factor of 1.0925 (or 109.25 percent). Therefore, to calculate the Medicare limiting charge for a physician service for a locality, multiply the fee schedule amount by a factor of 1.0925.

What method does Medicare use to establish physician reimbursement rates?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).

What determines physician's reimbursement?

Physician reimbursement from Medicare is a three-step process: 1) appropriate coding of the service provided by utilizing current procedural terminology (CPT®); 2) appropriate coding of the diagnosis using ICD-9 code; and 3) the Centers for Medicare and Medicaid Services (CMS) determination of the appropriate fee based ...

How does Medicare pricing work?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

How is allowed amount determined?

If you used a provider that's in-network with your health plan, the allowed amount is the discounted price your managed care health plan negotiated in advance for that service. Usually, an in-network provider will bill more than the allowed amount, but he or she will only get paid the allowed amount.

How are fee schedules determined?

Most payers determine fee schedules first by establishing relative weights (also referred to as relative value units) for the list of service codes and then by using a dollar conversion factor to establish the fee schedule.

Does Medicare pay doctors less?

Fee reductions by specialty Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

What are the four main methods of reimbursement?

Here are the five most common methods in which hospitals are reimbursed:Discount from Billed Charges. ... Fee-for-Service. ... Value-Based Reimbursement. ... Bundled Payments. ... Shared Savings.

What affects Medicare reimbursement?

Average reimbursements per beneficiary enrolled in the program depend upon the percentage of enrolled persons who exceed the deductible and receive reimbursements, the average allowed charge per service, and the number of services used.

What percent of the allowable fee does Medicare pay the healthcare provider?

80 percentUnder Part B, after the annual deductible has been met, Medicare pays 80 percent of the allowed amount for covered services and supplies; the remaining 20 percent is the coinsurance payable by the enrollee.

How are prices determined in the US healthcare system?

These prices are set based on CMS' analysis of labor and resource input costs for different medical services based on recommendations by the American Medical Association. As part of Medicare's pricing system, relative value units (RVUs) are assigned to every medical procedure.

What components make up the Medicare physician fee schedule?

The Medicare Physician Payment Schedule's impact on a physician's Medicare payments is primarily a function of 3 key factors: The resource-based relative value scale (RBRVS) The geographic practice cost indexes (GPCI)...2022 Medicare physician payment schedulesPhysician work.Practice expense (PE)Malpractice (MP) expense.

What is the methodology of the resource based relative value scale?

The way Medicare determines how much it will pay physicians, based on the resource costs needed to provide a Medicare-covered service. The RBRVS is calculated using three components: physician work, practice expense and professional insurance.

Who sets RVU?

The Specialty Society Relative Value Scale Update CommitteeThe Specialty Society Relative Value Scale Update Committee (also known as the RUC) determines the RVUs for each new code and revalues existing codes on a five-year schedule to reflect changes in costs and technology.

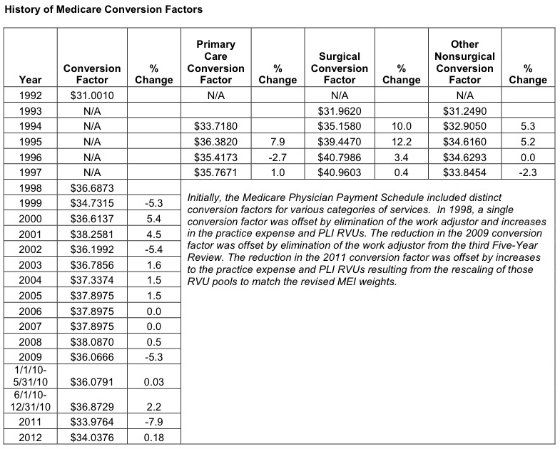

What is the CMS conversion factor?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931.

What is mod Gy?

The GY modifier is used to obtain a denial on a Medicare non-covered service. This modifier is used to notify Medicare that you know this service is excluded. The explanation of benefits the patient get will be clear that the service was not covered and that the patient is responsible.

How much does Medicare pay for medical services?

The Medicare reimbursement rates for traditional medical procedures and services are mostly established at 80 percent of the cost for services provided. Some medical providers are reimbursed at different rates. Clinical nurse specialists are paid 85 percent for most of their billed services and clinical social workers are paid 75 percent ...

How much can Medicare increase from current budget?

By Federal statute, the Medicare annual budget request cannot increase more than $20 million from the current budget.

How many specialists are on the Medicare committee?

Medicare establishes the reimbursement rates based on recommendations from a select committee of 52 specialists. The committee is composed of 29 medical professionals and 23 others nominated by professional societies.

Why use established rates for health care reimbursements?

Using established rates for health care reimbursements enables the Medicare insurance program to plan and project for their annual budget. The intent is to inform health care providers what payments they will receive for their Medicare patients.

What is the original objective of Medicare?

The original objective was to establish a uniform payment system to minimize disparities between varying usual, customary, and reasonable costs. Today, Medicare enrollees who use the services of participating health care professionals will be responsible for the portion of a billing claim not paid by Medicare.

Who needs to be a participant in Medicare?

To receive reimbursement payments at the current rates established by Medicare, health care professionals and service companies need to be participants in the Medicare program.

Does Medicare accept all recommendations?

While Medicare is not obligated to accept all of the recommendations, it has routinely approved more than 90 percent of the recommendations. The process is composed of a number of variables and has been known for lack of transparency by the medical community that must comply with the rates.

What is the SGR for Medicare?

Under current law, Medicare’s physician fee-schedule payments are subject to a formula, called the Sustainable Growth Rate (SGR) system, enacted in 1987 as a tool to control spending. For more than a decade this formula has called for cuts in physician payments, reaching as high as 24 percent.

Does Medicare have a fee for service?

Current payment systems in traditional Medicare have evolved over the last several decades, but have maintained a fee-for-service payment structure for most types of providers. In many cases, private insurers have modeled their payment systems on traditional Medicare, including those used for hospitals and physicians.

Does Medicare use prospective payment systems?

Medicare uses prospective payment systems for most of its providers in traditional Medicare. In general, these systems require that Medicare pre-determine a base payment rate for a given unit of service (e.g., a hospital stay, an episode of care, a particular service).

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

When will CMS accept comments on the proposed rule?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: ...

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

Is it a good idea to use HCPCS codes?

Using HCPCS codes. It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

What is the Medicare Physician Fee Schedule?

The Medicare Physician Fee Schedule (MPFS) uses a resource-based relative value system (RBRVS) that assigns a relative value to current procedural terminology (CPT) codes that are developed and copyrighted by the American Medical Association (AMA) with input from representatives of health care professional associations and societies, including ASHA. The relative weighting factor (relative value unit or RVU) is derived from a resource-based relative value scale. The components of the RBRVS for each procedure are the (a) professional component (i.e., work as expressed in the amount of time, technical skill, physical effort, stress, and judgment for the procedure required of physicians and certain other practitioners); (b) technical component (i.e., the practice expense expressed in overhead costs such as assistant's time, equipment, supplies); and (c) professional liability component.

Why is Medicare fee higher than non-facility rate?

In general, if services are rendered in one's own office, the Medicare fee is higher (i.e., the non-facility rate) because the pratitioner is paying for overhead and equipment costs. Audiologists receive lower rates when services are rendered in a facility because the facility incurs ...

Why do audiologists get lower rates?

Audiologists receive lower rates when services are rendered in a facility because the facility incurs overhead/equipment costs. Skilled nursing facilities are the most common applicable setting where facility rates for audiology services would apply because hospital outpatient departments are not paid under the MPFS.

What are the two categories of Medicare?

There are two categories of participation within Medicare. Participating provider (who must accept assignment) and non-participating provider (who does not accept assignment). You may agree to be a participating provider (who does not accept assignment). Both categories require that providers enroll in the Medicare program.

Can speech therapy be provided at non-facility rates?

Therapy services, such as speech-language pathology services, are allowed at non-facil ity rates in all settings (including facilities) because of a section in the Medicare statute permitting these services to receive non-facility rates regardless of the setting.

Does Medicare pay 20% co-payment?

All Part B services require the patient to pay a 20% co-payment. The MPFS does not deduct the co-payment amount. Therefore, the actual payment by Medicare is 20% less than shown in the fee schedule. You must make "reasonable" efforts to collect the 20% co-payment from the beneficiary.

How does Medicare pay hospitals?

Medicare pays hospitals using the Inpatient Prospective Payment System (IPPS). The base rate for each discharge corresponds to one of over 700 different categories of diagnoses—called Diagnosis Related Groups (DRGs)—that are further adjusted for patient severity. Medicare’s payments to hospitals also account for a portion of hospitals’ capital and operating expenses. Moreover, some hospitals receive additional payments, for example, academic medical centers receive higher payments because they provide graduate medical education and safety-net hospitals receive higher payments for treating a high proportion of indigent patients, in addition to DRG payments. 6 Recent Medicare policies can also reduce payments to some hospitals, such as hospitals that have relatively high readmission rates following hospitalizations for certain conditions. 7,8

What is the ratio of payment to cost in hospitals?

We note, however, that a hospital’s ratio of payment-to-costs reflect a combination of external factors such as the local costs for wages or utilities and the hospital’s own behavior, including how efficiently it manages its resources . 13 A 2019 MedPAC analysis found that hospitals that face greater price pressure operate more efficiently and have lower costs. Relatively efficient hospitals, which MedPAC identified by cost, quality and performance criteria, had higher Medicare margins (-2 percent) than less efficient hospitals. 14

What is upcoding in Medicare?

Hospitals and physician practices may be upcoding, a practice whereby providers use billing codes that reflect a more severe illness or expensive treatment in order to seek a larger reimbursement from Medicare. A study of 364,000 physicians found that a small number billed Medicare for the most expensive type of office visit for established patients at least 90 percent of the time. 50 One such example is a Michigan orthopedic surgeon who billed at the highest level for all of his office visits in 2015. The probability that these physician practices are only treating the sickest patients is quite low. In the past, CMS has justified reductions in payments to hospitals and physician groups to compensate for the costs of this upcoding—a vicious cycle we would not want to perpetuate.

Why are hospitals in concentrated or heavily consolidated markets using high revenues from private payers?

MedPAC analyses have asserted that hospitals in concentrated or heavily consolidated markets use high revenues from private payers to invest in cost-increasing activities like expanding facilities and clinical technologies —thereby leading to negative margins from Medicare because of an increased cost denominator. 16.

How much will Medicare save in 2020?

The move would save Medicare an estimated $810 million in 2020, while saving beneficiaries an average of $14 per visit. The agency also proposed a wage index increase for struggling rural hospitals, while decreasing the index for high-wage facilities.

What is ASP reimbursement?

Drugs administered by infusion or injection in physician offices and hospital outpatient departments are reimbursed based on the average sales price (ASP), which takes volume discounts and price concessions into account.

What is the primary driver of healthcare spending in the United States?

There is a strong consensus that the primary driver of high and rising healthcare spending in the United States is high unit prices—the individual prices associated with any product or service, like a medication or a medical procedure. 1 Moreover, research shows that these prices are highly variable and may not reflect the actual underlying cost to provide healthcare services, particularly the prices paid by commercial health insurance, which covers almost 60 percent of the U.S. population. 2