Medicare is one of the largest health insurance programs in the world, accounting for 20% of healthcare expenditures, one-eighth of the Federal Budget, and more than 3% of the Nation’s Gross Domestic Product (GDP). Its impact upon healthcare, the economy, and American life generally has been significant:

Full Answer

What is Medicare and how does it work?

A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. programs offered by each state. In 2017, Medicare covered over 58 million people.

How much does the government spend on Medicare each year?

Now let’s break down the cost structure of Medicare. Medicare Part A, as mentioned above is premium free, so that means $0 a month. Medicare Part B is where the costs come into play. Every year there is a standard Medicare Part B premium that is based on income. The standard Medicare Part B monthly premium in 2021 is $148.50.

Where does the money for Medicare come from?

Dec 03, 2021 · Medicare is a federal health insurance program that provides affordable healthcare and subsidizes the cost of treatments, medicine, and medical services for people living in the U.S. Medicare is not the same as Medicaid, which is the federal healthcare plan for lower-income individuals.

Why is Medicare spending growing so slowly?

Jul 16, 2021 · It is funded in part by Social Security and Medicare taxes which you pay on your income throughout your career, in part by premiums paid by those using Medicare, and in part by the federal budget. Medicare originated in 1965 as a part of the Social Security Act. It was designed as a social safety net to protect citizens over the age of 65 or those younger than that …

Is Medicare in financial trouble?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.Dec 20, 2021

Is Medicare well funded?

Money in the Medicare Trust Funds comes from tax revenue and the insurance premiums that Medicare beneficiaries pay. All workers pay at least 1.45% of their incomes in Medicare taxes....The Additional Medicare Tax.Filing status2022 Additional Medicare Tax ThresholdHead of household (with qualifying person)$200,0004 more rows

How long until Medicare runs out of money?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.Dec 30, 2021

What is the problem we are facing with Medicare?

Financing care for future generations is perhaps the greatest challenge facing Medicare, due to sustained increases in health care costs, the aging of the U.S. population, and the declining ratio of workers to beneficiaries.Oct 1, 2008

Is Medicare funded by taxpayers?

Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis.

How does Medicare funding work?

How is Medicare financed? Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.Mar 16, 2021

How Long Will Social Security and Medicare last?

The combined OASI and DI Trust Fund reserves have a projected depletion date of 2034, a year earlier than in last year's report. After the depletion of reserves, continuing tax income would be sufficient to pay 78 percent of scheduled benefits in 2034, and 74 percent by 2095.

What will happen to Medicare in the future?

At its current pace, Medicare will go bankrupt in 2026 (the same as last year's projection) and the Social Security Trust Funds for old-aged benefits and disability benefits will become exhausted by 2034. A quick look at the data proves just how broken our current entitlement programs are.Sep 1, 2021

What happens when Medicare runs out in 2026?

Under current law, if the trust fund runs out, Medicare payments would be reduced to levels that would be able to be covered by incoming tax and premium revenues. That could threaten coverage for tens of millions of Americans, the trustees said.Sep 1, 2021

What is the most important source of funding for Medicare?

Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

What are the disadvantages of Medicare?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Is Medicare still around today?

Medicare spending projections fluctuate with time, but as of 2021, the Medicare Part A trust fund was expected to be depleted by 2026. (Medicare will continue to exist, but claims will have to be covered by payroll taxes, which won't be sufficient to fully cover all Part A claims.)

How much is Medicare spending?

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection. In 2018, Medicare benefit payments totaled ...

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

When will Medicare be depleted?

In the 2019 Medicare Trustees report, the actuaries projected that the Part A trust fund will be depleted in 2026, the same year as their 2018 projection and three years earlier than their 2017 projection (Figure 8).

Will Medicare spending increase in the future?

While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicare’s actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care prices.

Does Medicare Advantage cover Part A?

Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan; about half of Medicare Advantage enrollees pay no additional premium.

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

The Cost of Medicare with Premium Free Medicare Part A

Now let’s break down the cost structure of Medicare. Medicare Part A, as mentioned above is premium free, so that means $0 a month. Medicare Part B is where the costs come into play. Every year there is a standard Medicare Part B premium that is based on income. The standard Medicare Part B monthly premium in 2021 is $148.50.

Original Medicare with a Supplement Plan or Medicare Advantage (AKA Medicare Part C)

Here is where there is a fork in the road for people as there are two ways to obtain complete Medicare coverage: Original Medicare with a Supplement plan or Medicare Advantage (also called Medicare Part C).

What's the Difference?

I talk at length on the difference in coverage and costs between Original Medicare and a Supplement and Medicare Advantage plans in other videos and blogs. For all the details of what each version entails, check out our video.

Medicare Part D Prescription Drug Plans: The Final Element

The last cost to consider for a full Medicare package is Medicare Part D Prescription Drug Plans. Many Medicare Advantage Plans combine Medicare Part D to bundle services, those are called Medicare Advantage Prescription Drug Plans, MAPD.

How Much Does Medicare Cost? It Depends!

After examining all the different elements of Medicare and the corresponding plan options, you can see that there are no one-size-fits-all solutions when it comes to Medicare costs. There are so many factors to consider including your wages, overall health, prescriptions, and what your state’s individual offerings are.

What is Medicare Advantage?

Established in 1965, Medicare is a federal health insurance program that provides benefits to seniors and those with disabilities and certain illnesses. Medicare has several parts. Part A covers hospitals, nursing facilities, and home health services. Part B covers preventative services like doctor visits, diagnostic tests, and medical equipment. Part D covers prescription drugs, and Part C, also known as Medicare Advantage, offers its own additional benefits. While Part A is typically free, Parts B, C, and D come with premiums.

What are the requirements for Medicare?

Certain individuals under 65 are eligible for Medicare as well -- namely: 1 Anyone who's permanently disabled and has received disability benefits for at least two years. 2 Those with end-stage renal disease (ESRD). 3 Those with ALS (Lou Gehrig's disease).

How old do you have to be to qualify for Medicare?

Medicare eligibility. If you're a U.S. citizen or have been a permanent legal resident for at least five years, your Medicare eligibility starts at age 65 provided you meet these requirements: You or your spouse worked enough years to be eligible for Social Security or Railroad Retirement benefits.

Who is eligible for Medicare?

Certain individuals under 65 are eligible for Medicare as well -- namely: Anyone who's permanently disabled and has received disability benefits for at least two years. Those with end-stage renal disease (ESRD). Those with ALS (Lou Gehrig's disease).

What happens if you miss your enrollment period?

If you fall into the latter category and fail to sign up during your initial enrollment period, you may be hit with a penalty. If you miss your initial enrollment period, you'll be able to sign up during the general enrollment period, which runs from Jan. 1 to March 31 each year.

Who is Maurie Backman?

Maurie Backman is a personal finance writer who's passionate about educating others. Her goal is to make financial topics interesting (because they often aren't) and she believes that a healthy dose of sarcasm never hurt anyone. In her somewhat limited spare time, she enjoys playing in nature, watching hockey, and curling up with a good book.

What age group is most likely to be on Medicare?

According to research by the Kaiser Family Foundation, the typical Medicare enrollee is likely to be white (78% of the covered population), female (56% due to longevity), and between the ages of 75 and 84 .

How much did Medicare cost in 2012?

According to the budget estimates issued by the Congressional Budget Office on March 13, 2012, Medicare outlays in excess of receipts could total nearly $486 billion in 2012, and will more than double by 2022 under existing law and trends.

When did Medicare start a DRG?

In 1980 , Medicare developed the diagnosis-related group (DRG), the bundling of multiple services typically required to treat a common diagnosis into a single pre-negotiated payment, which was quickly adopted and applied by private health plans in their hospital payment arrangements.

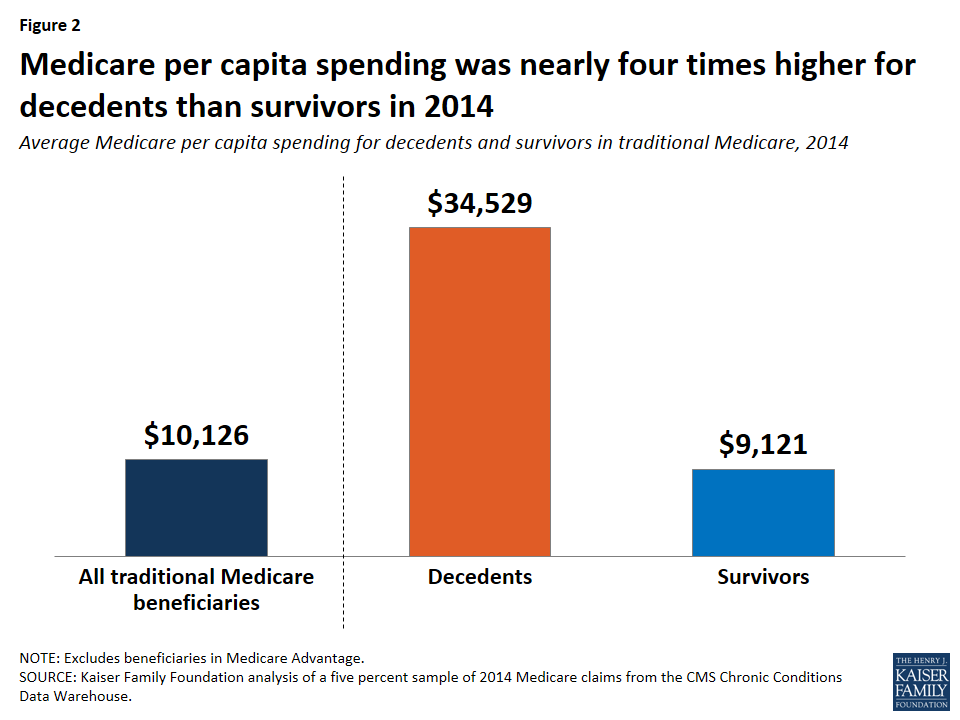

What is rationing care?

Rationing Care. Specifically, care can be rationed in the last months of life to palliative treatment. Currently, 12% of Medicare patients account for 69% of all Medicare expenses, usually in the last six months of life.

Is Medicare a right?

While many believe that access to quality healthcare is a fundamental right and a characteristic of civilized society, others feel that taking care of one’s self is an individual responsibility. Medicare suffers from the perception that it serves a limited section of society, rather than the populace as a whole. But we should remember that the program is a sentry for the future that all of us will face someday.

Why does home insurance increase?

Every year, premiums would increase due to the rising costs of replacement materials and labor. In such an environment, no one could afford the costs of home insurance. Casualty insurance companies reduce the risk and the cost of premiums for home owners by expanding the population of the insured properties.

What is defensive medicine?

The practice of “defensive” medicine due to an irrational fear of medical malpractice suits and punitive, often excessive jury awards. The presence of multiple interest groups influencing federal and state legislators and regulators to protect or extend financial interests. 7. Generational, Racial, and Gender Conflict.

How many people are covered by Medicare?

Signed into law 55 years ago, the Medicare program today covers more than 62 million Americans, many of whom are senior citizens aged 65 and older. The traditional Medicare program consists of Part A (hospital insurance), Part B (outpatient services), and Part D (prescription drug coverage). Meanwhile, Part C refers to Medicare Advantage, an alternative program run by for-profit insurance companies that provides some perks that aren't available with traditional Medicare, like vision, dental, and hearing care.

Will Biden change Medicare?

At this point, it's unclear if Biden would have enough support in the House and Senate to pass his two-pronged plan to change Medicare. Much depends on the political makeup of Congress after the election.

Does Biden have Medicare?

Biden, who's been leading in virtually all polling over Trump, has big plans for Medicare. In particular, he's highlighted two changes he's eager to make if he wins the election. Interestingly, though, neither of these changes appear to tackle Medicare's most pressing concern: the HI Trust funding shortfall.

What is Medicare Advantage 2021?

Updated on March 19, 2021. Medicare managed care plans are an alternative to Original Medicare. Otherwise known as Medicare Advantage plans with many plan types, most are either HMOs or PPOs. Managed-care plans provide benefits for gaps in Parts A and B coverage. These alternative health-care plans make up Part C of Medicare.

What is managed care plan?

Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan. MA plans decide on rate amounts, making prices different from plan to plan. Processing payments are done through the private plan, not Medicare.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

Can seniors travel internationally?

Coverage is not available when traveling internationally. Seniors often live in northern states for the summer and come winter, they head south. The better known as snow-birds may find they’re out-of-network for half of the year. Enrolling in a Medicare Supplement plan may be a better option for these individuals.

Is Medicare Supplement the same as Managed Care?

Managed-care plans and Medicare Supplement plans are not the same. This misconception is common. Both provide additional benefits to Original Medicare. However, they serve two totally different purposes. Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan.

What is indemnity health insurance?

Before HMOs, PPOs, and others, Indemnity plans were the main plans to choose from. Indemnity plans pre-determine the percentage of what they consider a reasonable and customary charge for certain services. Carriers pay a percentage of charges for a service and the member pays the remainder.

Is Medicare managed care affordable?

Medicare managed care plans can provide some relief . Enrolling in the right plan for you is key to making health-care more affordable. The number of Medicare beneficiaries enrolling in managed care plans is on the rise. Instead of working alongside Medicare-like Medigap insurance, Advantage plans replace Original Medicare.

What is a hospice aide?

Hospice aides. Homemakers. Volunteers. A hospice doctor is part of your medical team. You can also choose to include your regular doctor or a nurse practitioner on your medical team as the attending medical professional who supervises your care.

How long can you live in hospice?

Hospice care is for people with a life expectancy of 6 months or less (if the illness runs its normal course). If you live longer than 6 months , you can still get hospice care, as long as the hospice medical director or other hospice doctor recertifies that you’re terminally ill.

Can hospice be provided in the home?

Care generally is provided in the home. Family caregivers can get support. if the hospice provider is Medicare-approved. To find out if a hospice provider is Medicare-approved, ask one of these: If you're in a Medicare Advantage Plan (like an HMO or PPO) and want to start hospice care, ask your plan to help find a hospice provider in your area.

Does hospice cover terminal illness?

Once you start getting hospice care, your hospice benefit should cover everything you need related to your terminal illness. Your hospice benefit will cover these services even if you remain in a Medicare Advantage Plan or other Medicare health plan.

Is hospice only for cancer patients?

Hospice isn’t only for people with cancer. The focus is on comfort, not on curing an illness. A specially trained team of professionals and caregivers provide care for the “whole person,” including physical, emotional, social, and spiritual needs.

How many hours a day do hospice nurses work?

In addition, a hospice nurse and doctor are on-call 24 hours a day, 7 days a week, to give you and your family support and care when you need it.

Does hospice cover inpatient care?

The cost of your inpatient hospital care is covered by your hospice benefit , but paid to your hospice provider.

Summary

Health

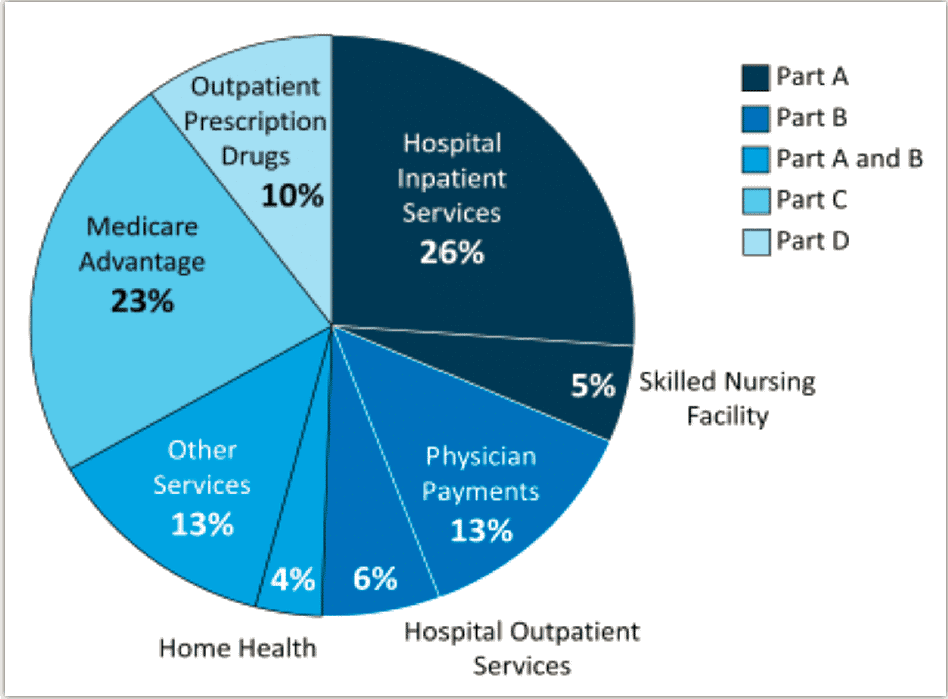

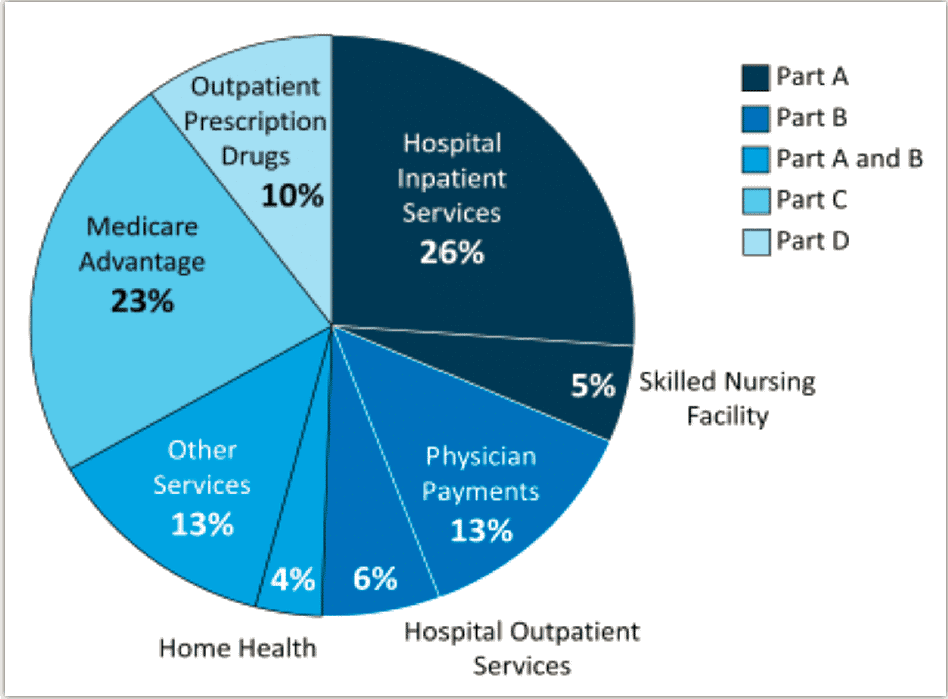

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physici...

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…