Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

What is Medicare Part D, and do I need It?

What Is Medicare Part D and Do I Need It? CA Medicare January 19, 2015 Announcement. Medicare Part D is a federal-government program introduced in 2003 to help eligible Medicare recipients get subsidized prescription drug coverage. The plans are sold through private insurance companies (approved by Medicare) and often have an additional premium.

How do I know if I have Medicare Part D?

The Part D Standard Benefit

- Standard Part D Benefit 2020-2021

- Alternatives to the Standard Benefit

- Income-Related Monthly Adjustment Amount Part D

- Income-Related Adjustments 2021

- Drug Tiers

- The Donut Hole

- TrOOP. ...

- EOBs

- The Donut Hole Discount

- Recommended Reading: Where To Send Medicare Payments. ...

How much does Part D of Medicare cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount. You can add Part D coverage to Medicare Parts A and/or B.

What are the benefits of Medicare Part D?

- Monthly premiums

- Annual deductible (maximum of $445 in 2021)

- Copayments (flat fee you pay for each prescription)

- Coinsurance (percentage of the actual cost of the medication)

Do you automatically get Part D with Medicare?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

What is the advantage of having Medicare Part D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What does Medicare Part D include?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

Why is Medicare Part D so complicated?

Part D plans have a certain quirk, often called the donut hole or coverage gap, which is important to understand before you purchase one of these plans. In essence, this is a gap in coverage that begins after your plan has spent a certain amount that year, but before you've reached your annual out-of-pocket limit.

Is Medicare Plan D worth it?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

How does Part D work?

You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug's cost. The insurance company will pay the rest.

How much does Medicare Part D cost in 2021?

Premiums vary by plan but the base monthly premium for a Part D plan in 2022 is $33.37, up from $33.06 in 2021. If you make more than a certain amount, you will have to pay a higher premium. The extra amount you pay is based on what's known as an income-related monthly adjustment amount (IRMAA).

What is the average cost of Medicare Part D?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan.

What is the maximum out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

Can you add Medicare Part D anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is Medicare Part D coverage?

Medicare Part D prescription coverage has something called the coverage gap , or donut hole. The coverage gap is a stage in which you pay much more out of pocket for your prescription drugs. It's not based on a time period.

What is Medicare Advantage?

You buy Medicare Advantage plans from private health insurance companies that contract with the government. They work with Original Medicare coverage. Part D covers prescription drugs. Many Medicare Advantage plans combine Parts A, B and D in one plan. And each Medicare plan only covers one person.

How much does Medicare pay for coinsurance?

When you have Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for most medical services covered under Part B. Medicare Advantage plans use copays more than coinsurance. Which means you pay a fixed cost. You might have a $15 copay for doctor office visits, for example.

What is the difference between Medicare Supplement and Medicare Advantage?

Medicare supplement, or Medigap, plans are another option. In a way, Medicare Advantage replaces Original Medicare and connects all the pieces together on one plan. Supplement plans don't replace Original Medicare. It's more like an extra you can add on top of Original Medicare.

Why are Medicare Advantage plans so popular?

Medicare Advantage plans are popular because of their convenience. Most plans combine medical and prescription coverage on one card. Some offer dental and vision coverage, too. And you're able to predict your out-of-pocket costs better than you can with Original Medicare.

Does Medicare have a cap on out-of-pocket expenses?

That means once you spend a certain amount of money on health care each year, your plan pays 100 percent of the cost of services it covers. Original Medicare doesn't have this cap. So if you get really sick, you'll end up paying a lot.

Do Medicare supplement plans come with dental?

And supplement plans don't come with the extra benefits you often get with Medicare Advantage, like dental and vision coverage. The triangles to the right show how supplement plans sit on top of Medicare Parts A, B and D. You can get complete coverage, but you still have to coordinate all those pieces on your own.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Select your county. Get Started. Summary: Medicare Part D is prescription drug coverage for Medicare beneficiaries. You get it as a stand-alone plan with Original Medicare or included in a Medicare Advantage plan. Medicare Part D may have formularies, or lists of covered prescription drugs, and tiers, which is a price structure ...

How long does Medicare Part D last?

You’re first eligible to sign up for Medicare Part D during your Initial Enrollment Period, which lasts for seven months. This is the time frame three months before your 65th birthday, includes your birthday month, and lasts for three months after your 65th birthday.

What is a formulary in Medicare?

A formulary is the list of prescription drugs that your Part D plan covers. Formularies may vary from plan to plan but Medicare dictates that all or “substantially” all prescription drugs in certain protected classes are covered.

When is the open enrollment period for Medicare Part D?

This takes place from October 15 to December 7.

When is Medicare Part D late enrollment?

This takes place from October 15 to December 7. You may pay a late-enrollment penalty if you sign up for Medicare Part D after having gone 63 days or more without “creditable” prescription drug coverage after your Initial Enrollment Period is over.

Do you have to pay a penalty for Medicare Part D?

Creditable prescription drug coverage must pay on average at least as much as standard Medicare prescription drug coverage. You may have to pay this penalty as long as you’re enrolled in the Medicare Part D Prescription Drug Plan.

Does Medicare Advantage cover prescription drugs?

Most but not all Medicare Advantage plans cover prescription drugs. A Medicare Advantage plan may charge a premium in addition to the Medicare Part B premium you still have to pay. Some Medicare Advantage plans also charge a separate deductible for prescription drugs.

What is deductible in Medicare?

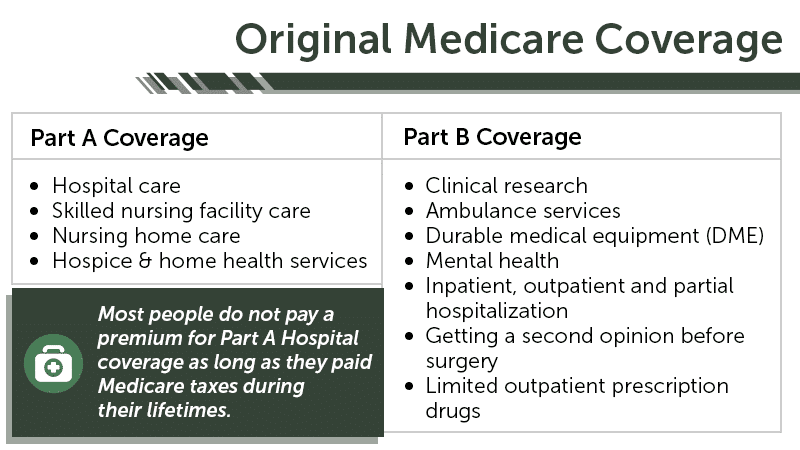

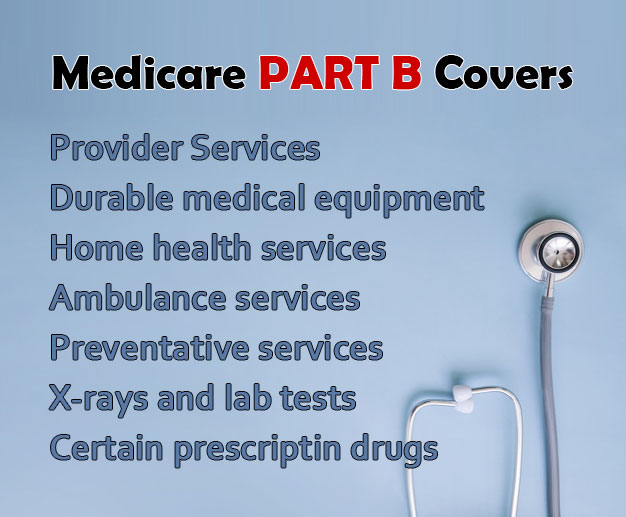

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much will Medicare cost in 2021?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $259.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

D Appeals And Grievances

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

What Is Donut Hole Prescription Assistance

Ask your doctor if any other medicine on your plans formulary would be as effective for your condition as the ones youre currently using. Using lower-cost drugs, like generics or similar drugs, will substantially lower your costs.

Is There Financial Help For Part D

Medicare provides assistance, known as Extra Help, in paying for prescription drug costs for those with limited income and resources.

How Do I Compare Medicare Part D Prescription Drug Plans

You should look at all three out-of-pocket expenses when you compare plans: Your Medicare Part D premiums, deductible, and copayment or coinsurance amounts. A plan with a higher deductible may have lower monthly premiums. If you dont use a lot of prescription medications, that may be the most cost-effective option for you.

Enroll In Medicare In Phoenix Today

Learn more about which Medicare programs may be right for you and get enrolled by calling Phoenix Health and Life Insurance. We serve thousands of clients across the valley and are ready to help you, too! to schedule an appointment with one of our experienced agents.

Faqs About Medicare And Open Enrollment

Medicare is the largest health insurance program in the United States, covering more than 60 million Americans.

What If Youre Already Taking Prescription Medications

If the medications you are taking are all generic then you might be better off purchasing them without using insurance. By using the website GoodRx.com, you might find that the cash price of your medication is less than the insurance copay for many of the medications youre taking.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What factors affect Medicare out of pocket costs?

Whether you have Part A and/or Part B. Most people have both. Whether your doctor, other health care provider, or supplier accepts assignment. The type of health care you need and how often you need it.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

Does Medicare cover health care?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it. Whether you have other health insurance that works with Medicare.

Does Medicare cover prescriptions?

With a few exceptions, most prescriptions aren' t covered in Original Medicare. You can add drug coverage by joining a

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

Which pays first, Medicare or group health insurance?

If you have group health plan coverage through an employer who has 20 or more employees, the group health plan pays first, and Medicare pays second.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How much will Medicare pay for donut hole in 2021?

In 2021, it starts when you and the drug plan have spent $4,130 total on covered prescriptions, and ends once you’ve spent $6,550 out of pocket. In 2022, the Medicare donut hole starts when you and the plan have spent $4,430 total on covered prescriptions, and ends once you’ve spent $7,050 out of pocket (the amounts typically change each year). 7 During this time, you’ll generally pay no more than 25% toward the cost of prescription drugs. 8

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

What is Part D insurance?

For Part D coverage, you’ll pay a premium, a deductible, and copays that differ between types of drugs. Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

Why switch to a different Medicare Part D plan?

Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way. Part D drug plans also have changes from year to year.

When did Medicare Part D start?

Prior to 2006, when the Medicare Part D began, tens of thousands of Medicare beneficiaries in America had little help with retail drug costs. They would often spend thousands of dollars each year paying for their medications out of pocket. Updated for 2021.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

What is the Medicare Part D deductible for 2021?

In 2021, the allowable Medicare Part D deductible is $445. Plans may charge the full Part D deductible, a partial deductible, or waive the deductible entirely. You will pay the network discounted price for your medications until your plan tallies that you have satisfied the deductible. After that, you enter initial coverage.

How does each drug plan work?

Each drug plan will separate its medications into tiers. Each tiers has a copy amount that you will pay. For example, a plan might assign a $7 copay for a Tier 1 generic medication. Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on.

What is Part D?

What is Part D? It is an optional prescription drug program for people on Medicare.

Does Medicare have a D plan?

Beneficiaries can enroll in a standalone Part D drug plan that goes alongside their Original Medicare benefits, or they can choose a Part D drug plan that is built-in to a Part C Medicare Advantage plan.