How does insurance work with Medicare and other health plans?

- Payer: Your health insurance coverage – for example, Medicare or an employer plan

- Primary payer: The health insurance that pays first, up to its limits

- Secondary payer: The secondary health insurance pays then pays what the primary payer doesn’t cover, up to the secondary payer’s limits. ...

Full Answer

What is the best insurance to go with Medicare?

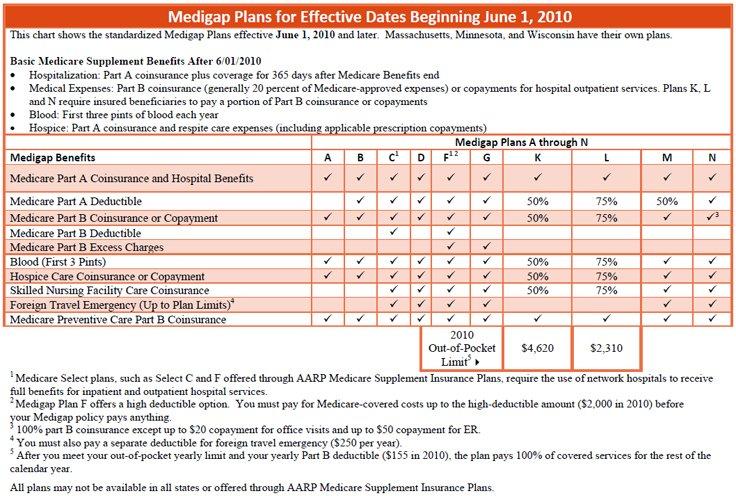

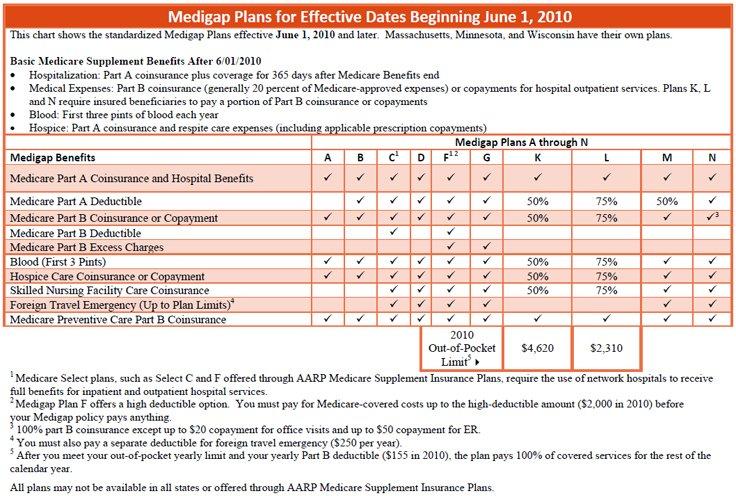

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

Can I use private insurance instead of Medicare?

You can also have both Medicare and private insurance to help cover your health care expenses. In situations where there are two insurances, one is deemed the “primary payer” and pays the claims first. The other becomes known as the “secondary payer” and only applies if there are expenses not covered by the primary policy.

How does Medicare work and what it covers?

Medicare also may cover:

- A medical social worker

- Dietary counseling if indicated

- Medical equipment and devices you use during your hospital stay

- Ambulance transportation to and from the facility

How does Medicare coordinate with employer health coverage?

- Who pays first for a car accident victim’s medical expenses? With coordinated benefits, health insurance is the primary payer. With uncoordinated benefits, No-Fault is the primary payer.

- Is coordinated coverage optional? Coordinated coverage of No-Fault and health insurance benefits is optional for drivers. ...

- Is one cheaper than the other? Yes. ...

Can I have Medicare and private insurance at the same time?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

When Can Medicare be a secondary payer?

If you're under 65, eligible for Medicare due to a disability, and have group employer coverage through an employer with more than 100 employees, Medicare will be your secondary payer.

How do you determine which health insurance is primary?

If you have Medicare and other health insurance or coverage, each type of coverage is called a "payer." When there is more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay.

Can you be covered by 2 insurances at the same time?

While it sounds confusing, having dual insurance like this is perfectly legal—you just need to make sure you're coordinating your two benefits correctly to make sure your medical expenses are being covered compliantly.

What is Medicare Secondary Payer Rule?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare.

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.

What happens when you have 2 health insurance plans?

If you have multiple health insurance policies, you'll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance won't pay toward your primary's deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

Is it good to have two health insurance plans?

Having access to two health plans can be good when making health care claims. Having two health plans can increase how much coverage you get. You can save money on your health care costs through what's known as the "coordination of benefits" provision.

How does primary and secondary insurance work?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs.

How does secondary insurance work with copays?

Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid (e.g., deductibles, copayments, coinsurances). For example, if Original Medicare is your primary insurance, your secondary insurance may pay for some or all of the 20% coinsurance for Part B-covered services.

Does secondary insurance cover primary deductible?

Does Secondary Insurance Pay the Primary Deductible? This will depend on the plan you are enrolled in. However, many secondary plans can help you pay off deductibles that your primary plan isn't paid.

What is the birthday rule?

Birthday Rule: This is a method used to determine when a plan is primary or secondary for a dependent child when covered by both parents' benefit plan. The parent whose birthday (month and day only) falls first in a calendar year is the parent with the primary coverage for the dependent.

How does Medicare work if you work for a company?

Here's how Medicare payments work if your employer covers you: If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. If you work for a larger company, your employer is primary and Medicare is secondary.

How does Medicare work?

Here's how Medicare payments work if your employer covers you: 1 If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. 2 If you work for a larger company, your employer is primary and Medicare is secondary. 3 If Medicare is the secondary payer, it will reimburse based on what the employer paid, what is allowed in Medicare and what the doctor or provider charged. You will then have to pay what's left over.

What happens if you don't sign up for Part B?

If you don't sign up for Part B, you will lose TRICARE coverage. TRICARE FOR LIFE (TFL) is what TRICARE-eligible individuals have if they carry Medicare Part A and B. TFL benefits include covering Medicare's deductible and coinsurance. The exception is if you need medical attention while overseas, then TFL is primary.

What is Cobra insurance?

COBRA. COBRA lets you keep your employer group health insurance plan for a limited time after your employment ends. This continuation coverage is meant to protect you from losing your health insurance immediately after you lose a job. If you're on Medicare, Medicare pays first and COBRA is secondary.

How to decide if you have dual health insurance?

When deciding whether to have dual health insurance plans, you should run the numbers to see whether paying for two plans would be more than offset by having two insurance plans paying for medical care. If you have further questions about Medicare and COB, call Medicare at 855-798-2627.

Does Medicare cover VA?

Medicare doesn't cover services within the VA. Unlike the other scenarios on this page, there is no primary or secondary payer when it comes to VA vs. Medicare. Having both coverage gives veterans the option to get care from either VA or civilian doctors depending on the situation.

Does Medicare pay a doctor if they are owed money?

The rest is on you if the doctor is still owed money. If Medicare is the secondary payer and the primary insurer doesn't pay swiftly enough, Medicare will make conditional payments to a provider when "there is evidence that the primary plan does not pay promptly.".

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

Medicare Pays First When It Serves As Your Primary Payer

If you have Medicare as well as another type of insurance, your coverage is provided through a coordination of benefits. In some situations, Medicare will serve as your primary payer, which means Medicare pays first. Your other insurance coverage will then serve as your secondary payer.

Medicare Secondary Claim Development Questionnaire

The Medicare Secondary Claim Development Questionnaire is sent to obtain information about other insurers that may pay before Medicare. When you return the questionnaire in a timely manner, you help ensure correct payment of your Medicare claims.

Does Medicare Work Together With Medicaid

Yes, but Medicaid will always pay as the payer of last resort. This means if you have Medicare and Medicaid, Medicare will pay as primary and Medicaid as secondary. If you have Medicare, another insurance, and Medicaid, Medicaid will only pay after Medicare and the other insurance company have processed the claim.

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

How Does Medicare Work With My Other Health Insurance Coverage

Medicare works in tandem with your other health insurance coverage. The two tag team. One insurance plan becomes the primary payer or the one that pays costs first. The other insurance becomes the secondary payer and pays the remaining costs.

Is Medicare A Primary Or Secondary Payer

Medicare can be either a primary or secondary payer, depending on what other insurance you have and the situation involved in the claim. For those who have Medicare, here are some of the situations when Medicare might be the secondary payer:

Which Is Better For Those With Dependents

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

Medicare and Group Health Insurance

Many of those who qualify for Medicare are retired, but some may still work or have spouses who still work. If this applies to you, you may still be covered under an employer’s group health insurance plan. In general, a group health insurance policy should provide payment before Medicare.

Medicare and Retiree Health Plans

Some employers offer retirement group health plans for previous employees who retire. If you have both a retiree group health plan and Medicare, Medicare will generally pay first while your group health insurance provides supplement. To qualify for this, you must not be currently employed.

Medicare and Family Group Health Insurance

In the case where you are covered under a family member’s group health insurance who is not a spouse, the requirements for payment between Medicare and the group health insurance are different. In cases where the employer employs more than 100 workers, their group health insurance plans will pay first.

Medicare and Liability Accidents

Many of your other insurance policies, such as home insurance and auto insurance, come with medical payments coverage. If you are in a car accident, for example, your vehicle’s medical payments coverage should help with medical bills you and your passengers may face.

Can You Have More Than One Medicare Plan?

In general, you cannot have more than one Medicare plan at a time, including Medicare Advantage plans. Even though Medicare Advantage plans are primarily available through private insurers, individuals are still only able to enroll in a single plan at a time.

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

Does Medicare pay second to employer?

Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance ...

Can an employer refuse to pay Medicare?

The first problem is that your employer can legally refuse to make any health-related medical payments until Medicare pays first. If you delay coverage and your employer’s health insurance pays primary when it was supposed to be secondary and pick up any leftover costs, it could recoup payments.