Medicare does cover nursing home care—up to a point. If you are sent to a skilled nursing facility for care after a three-day inpatient hospital stay, Medicare will pay the full cost for the first 20 days.

What happens if Medicare doesn’t cover nursing home care?

stays in a nursing home. Even if Medicare doesn’t cover your nursing home care, you’ll still need Medicare for hospital care, doctor services, and medical supplies while you’re in the nursing home.

Does Medicare pay for skilled nursing care after a hospital stay?

If you are sent to a skilled nursing facility for care after a three-day inpatient hospital stay, Medicare will pay the full cost for the first 20 days.

How long can you stay in a nursing home with Medicare?

Usually, Medicare Part A may pay for up to 100 days in a skilled nursing facility. A skilled nursing facility must admit the person within 30 days after they left the hospital, and they must admit them for the illness or injury the person was receiving hospital care for. Which parts of Medicare cover nursing home care?

What services does Medicare cover in a nursing home environment?

Some services Medicare Part A may cover in a nursing home environment include: Medicare may also cover something called “swing bed services.” This is when a person receives skilled nursing facility care in an acute-care hospital.

How many days will Medicare pay 100% of the covered costs of care in a skilled nursing care facility?

20 daysSkilled Nursing Facility (SNF) Care Medicare pays 100% of the first 20 days of a covered SNF stay. A copayment of $194.50 per day (in 2022) is required for days 21-100 if Medicare approves your stay.

What happens when Medicare hospital days run out?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

Which of the three types of care in the nursing home will Medicare pay for?

Original Medicare and Medicare Advantage will pay for the cost of skilled nursing, including the custodial care provided in the skilled nursing home for a limited time, provided 1) the care is for recovery from illness or injury – not for a chronic condition and 2) it is preceded by a hospital stay of at least three ...

What is the 21 day rule for Medicare?

For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing. You pay the full cost for covered services.

How many days will Medicare pay for hospital stay?

90 daysDoes the length of a stay affect coverage? Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

What is the 100 day rule for Medicare?

Medicare pays for post care for 100 days per hospital case (stay). You must be ADMITTED into the hospital and stay for three midnights to qualify for the 100 days of paid insurance. Medicare pays 100% of the bill for the first 20 days.

Does Medicare cover any portion of long term care?

Medicare doesn't cover long-term care (also called custodial care) if that's the only care you need. Most nursing home care is custodial care, which is care that helps you with daily living activities (like bathing, dressing, and using the bathroom).

What are the two levels of care in nursing homes?

Federal regulation for Medicaid providers specifies two levels of care, SNF and ICF, with standards for each level set by States within Federal guidelines.

Can Medicare benefits be exhausted?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How are hospital days counted?

Length of stay (LOS) is the duration of a single episode of hospitalization. Inpatient days are calculated by subtracting day of admission from day of discharge.

Does Medicare have an out of pocket max?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

How long does Medicare pay for skilled nursing?

Usually, Medicare Part A may pay for up to 100 days in a skilled nursing facility. A skilled nursing facility must admit the person within 30 days after they left the hospital, and they must admit them for the illness or injury the person was receiving hospital care for.

How early can you enroll in Medicare?

If you have a loved one who is reaching age 65, here are some tips on how you can help them enroll: You can start the process 3 months before your loved one turns age 65. Starting early can help you get needed questions answered and take some stress out of the process.

What is swing bed in Medicare?

Medicare may also cover something called “swing bed services.”. This is when a person receives skilled nursing facility care in an acute-care hospital.

What is Medicare Part D?

Medicare Part D is prescription drug coverage that helps pay for all or a portion of a person’s medications. If a person lives in a nursing home, they’ll typically receive their prescriptions from a long-term care pharmacy that provides medications to those in long-term care facilities like a nursing home.

How much does a nursing home cost in 2019?

They found the average 2019 cost of a private room in a nursing home is $102,200 per year, which is a 56.78 percent increase from 2004.

What age do you buy nursing home insurance?

Many people will purchase these policies at a younger age, such as in their 50s, as the premiums usually increase in cost as a person ages. Medicaid. Medicaid, the insurance program that helps cover costs for those in low-income households, has state and national programs that help pay for nursing home care.

Does Medicare cover nursing home care?

Medicare doesn’t cover care in a nursing home when a person needs custodial care only. Custodial care includes the following services: bathing. dressing. eating. going to the bathroom. As a general rule, if a person needs care that doesn’t require a degree to provide, Medicare doesn’t cover the service.

How much does Medicare pay for skilled nursing?

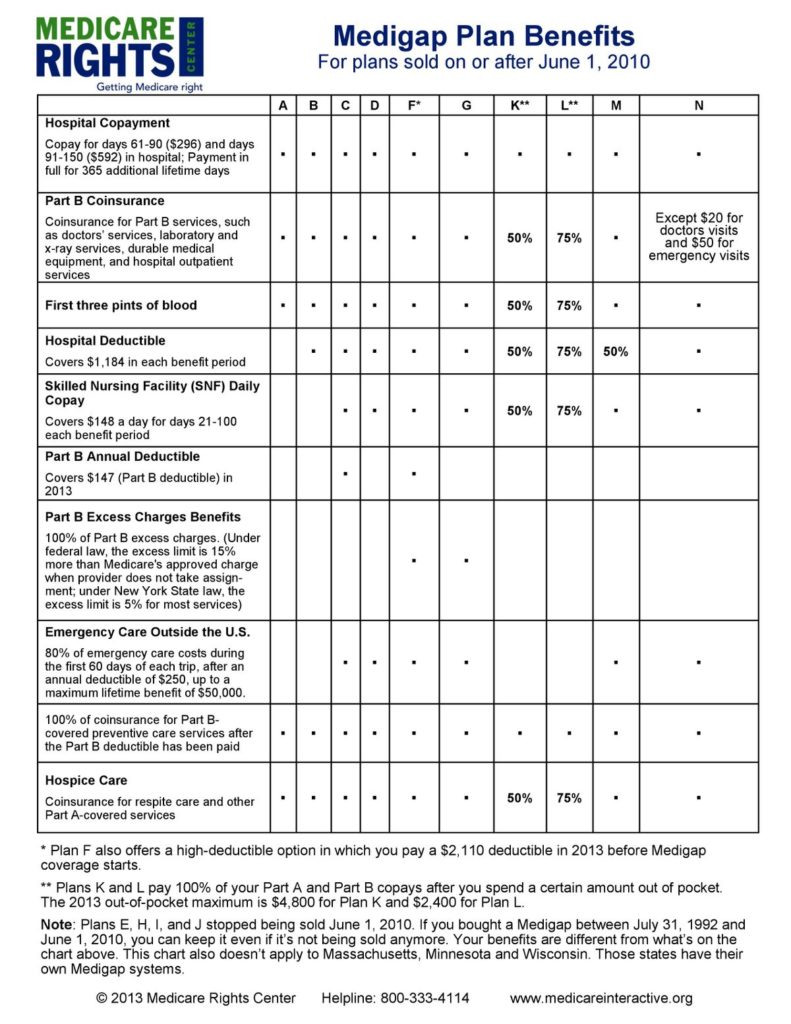

For the next 100 days, Medicare covers most of the charges, but patients must pay $176.00 per day (in 2020) unless they have a supplemental insurance policy. 3 .

How long do you have to transfer assets to qualify for medicaid?

The transfer of assets must have occurred at least five years before applying to Medicaid in order to avoid ...

How does Medicaid calculate the penalty?

Medicaid calculates the penalty by dividing the amount transferred by what Medicaid determines is the average price of nursing home care in your state. 12 . For example, suppose Medicaid determines your state's average nursing home costs $6,000 per month, and you had transferred assets worth $120,000.

When was medicaid created?

Medicaid was created in 1965 as a social healthcare program to help people with low incomes receive medical attention. 1 Many seniors rely on Medicaid to pay for long-term nursing home care. “Most people pay out of their own pockets for long-term care until they become eligible for Medicaid.

What age can you transfer Medicaid?

Arrangements that are allowed include transfers to: 13 . Spouse of the applicant. A child under the age of 21. A child who is permanently disabled or blind. An adult child who has been living in the home and provided care to the patient for at least two years prior to the application for Medicaid.

Can you get Medicaid if you have a large estate?

Depending on Medicaid as your long-term care insurance can be risky if you have a sizeable estate. And even if you don't, it may not meet all your needs. But if you anticipate wanting to qualify, review your financial situation as soon as possible, and have an elder- or senior-care attorney set up your affairs in a way that will give you the money you need for now, while rendering your assets ineligible to count against you in the future.

Can you put a lien on a house after death?

14 . In most states, the government can place a lien on the home after the death of both spouses, unless a dependent child resides on the property. 14 .

How much does it cost to go to a nursing home after Medicare ends?

Nursing home care can easily cost over $450 a day. If rehabilitation is involved, it can be even more expensive.

How long does Medicare pay for nursing home care?

If a patient has been in the hospital for three days, then enters a nursing home, Medicare will pay for this care. During the first 20 days a person is in a nursing home, care is paid 100%. The following 80 days will be partially paid, but there is a $ 157.50 co-pay each day.

What to do if you don't have a medicap policy?

Make sure to have a supplemental insurance policy, also known as a “Medigap” policy, in place and to encourage any loved one who is in rehab to continue as much as possible. If you don’t have one of these policies, make sure to see an elder law attorney as soon as possible to find out what you can do to sign up for one.

Does Medicare cover supplemental insurance?

However, there is a catch. Medicare only pays if the patient meets certain guidelines in regard to rehabilitation.

When did Medicaid lien on homes become common?

The Federal Government Has Pressed People to Rely on Private Funds. Medicaid liens on homes have become common since the federal Omnibus Budget Reconciliation Act (OBRA) of 1993, which forces estate recovery if the homeowner: Relied on Medicaid at age 55+. Left the home, at any age, for a permanent care setting.

What does it mean to accept medical assistance?

When Accepting Medical Assistance Means a Lien on the Home. A lien provides the right to take property to resolve an unpaid debt. Most people are familiar with liens on homes, especially the mortgage lien. After a lien is recorded by a county’s registry of deeds, title may not be transferred without the creditor’s knowledge. ...

What are the two types of liens for Medicaid?

Medicaid uses two lien types: TEFRA, and estate recovery liens. Under the Tax Equity and Fiscal Responsibility Act (TEFRA) of 1982, states may prevent Medicaid recipients from giving away the home that they leave when they go into a long-term care setting.

Can a spouse sell a house with a Medicaid lien?

And the spouse may sell the home, overriding the Medicaid lien.

Can you recover Medicaid if your spouse has an equity interest in your home?

Your home is also shielded from recovery if a spouse or sibling has an equity interest in it, and has lived in it for the legally specified time, or if it’s the home of a child who is under 21 or lives with a disability. But Medicaid may try to recover funds at a future date, before your home is conveyed to a new owner.

Does Medicare cover long term care?

Medicare, as a rule, does not cover long-term care settings. So, Medicare in general presents no challenge to your clear home title. Most people in care settings pay for care themselves. After a while, some deplete their liquid assets and qualify for Medicaid assistance. Check your state website to learn about qualifications for Medicaid.

Can you take Medicaid home?

If you are likely to return home after a period of care, or your spouse or dependents live in the home, the state generally cannot take your home in order to recover payments.

How long does Medicare pay for rehab?

When your Loved One is first admitted to rehab, you learn Medi care pays for up to 100 days of care. The staff tells you that during days 1 – 20, Medicare will pay for 100%. For days 21 – 100, Medicare will only pay 80% and the remaining 20% will have to be paid by Mom. However, luckily Mom has a good Medicare supplement policy that pays this 20% co-pay amount. Consequently, the family decides to let Medicare plus the supplement pay. At the end of the 100 days, they will see where they are.

What happens after completing rehab?

After completing rehab, many residents are discharged to their home. This is the goal and the hope of everyone involved with Mom’s care. But what if Mom has to remain in the Nursing Home as a private pay resident? Private pay means that she writes a check out of pocket each month for her care until she qualifies to receive Medicaid assistance. Here are a couple of steps to take while Mom is in rehab to determine your best course of action.

How long did Mom stay in the hospital?

After a 10 day hospital stay, Mom’s doctor told the family that she would need rehabilitative therapy (rehab) to see if she could improve enough to go back home. Mom then started her therapy in the seperate rehab unit of the hospital where she received her initial care.

How long does nursing home rehab last?

In either case, the course of therapy last for only a short period of time (usually 100 days or less).

How long does it take for a mom to see her therapist?

At the end of the 100 days, they will see where they are. The “wait and see” approach has at least one advantage – no one knows whether or not Mom will progress with her therapy. After the 100 days , she may have progressed with her rehabilitative therapy well with the ability to return home.

Can a beneficiary receive Medicare if they are making progress?

A beneficiary can receive Medicare if they simply maintain their current condition or further deterioration is slowed. However, some facilities interpret this policy as reading that “As long as Mom is making progress, we will keep her.”. When she stops making progress, she will be discharged.

Can you receive Medicaid if you gift money 5 years prior?

Financial gifts or transfers from 5 years prior may resulted in a penalty period. This is a period of time during which, even though your Loved One is qualified to receive Medicaid benefits, actual receipt of Medicaid benefits may be delayed to offset any prior gifts (or to use Medicaid’s wording, “uncompensated transfer”).

Advantages Of A Nursing Home

Even if you live with loved ones, they might not be able to provide the level of care you need. Whether you need medical help or custodial help , it can be demanding for loved ones to give this constant care and to do it right.

Contributing Factors To Ratings

Experts recommend that you dig deeply into the reasons behind the rating. Each report contains a great deal of useful information. It may be difficult to find a nursing home with a flawless rating that is in your preferred area and within your budget. Therefore, you may need to prioritize your concerns.

Does Medicare Pay For Long

Long-term care is a range of services and support for your personal-care needs. Most long-term care isn’t medical care, but rather help with basic personal tasks of everyday life , such as dressing and bathing.

Does Medicare Cover Care In A Skilled Nursing Facility Or Nursing Home

Medicare Part A covers up to 100 days in a skilled nursing facility after a qualifying hospital stay. The Part A deductible covers the first 20 days per benefit period. After that, you pay a share of the cost for each additional day of your stay. You would start paying the full cost after 100 days.

How Do I Apply For Va Long

An application for VA long-term care is separate from the application to enroll in VA medical care coverage. To apply for nursing home or other long-term care, a veteran or veterans caregiver must fill out a special application for extended care services.

What Kind Of Care Do Nursing Homes Provide

How Does the Medicare Elder Care Process Work? Medicare Home Health Care

How Your Assets Impact Eligibility

Besides income, your assets will be counted toward meeting eligibility requirements. Countable assets include checking and savings account balances, CDs, stocks, and bonds.

How long does it take to get Medicare to cover rehab?

The 3-day rule for Medicare requires that you are admitted to the hospital as an inpatient for at least 3 days for rehab in a skilled nursing facility to be covered. You must be officially admitted to the hospital by a doctor’s order to even be considered an inpatient, so watch out for this rule. In cases where the 3-day rule is not met, Medicare ...

How many days do you pay for Medicare?

You usually pay nothing for days 1–60 in one benefit period, after the Part A deductible is met. You pay a per-day charge set by Medicare for days 61–90 in a benefit period. You may use up to 60 lifetime reserve days at a per-day charge set by Medicare for days 91–150 in a benefit period.

How long does Medicare cover inpatient rehab?

Medicare covers inpatient rehab in a skilled nursing facility – also known as an SNF – for up to 100 days. Rehab in an SNF may be needed after an injury or procedure, like a hip or knee replacement.

What is Medicare Part A?

Published by: Medicare Made Clear. Medicare Part A covers medically necessary inpatient rehab (rehabilitation) care , which can help when you’re recovering from serious injuries, surgery or an illness. Inpatient rehab care may be provided in of the following facilities: A skilled nursing facility.

What is an inpatient rehab facility?

An inpatient rehabilitation facility (inpatient “rehab” facility or IRF) Acute care rehabilitation center. Rehabilitation hospital. For inpatient rehab care to be covered, your doctor needs to affirm the following are true for your medical condition: 1. It requires intensive rehab.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much does Medicare pay for day 150?

You pay 100 percent of the cost for day 150 and beyond in a benefit period. Your inpatient rehab coverage and costs may be different with a Medicare Advantage plan, and some costs may be covered if you have a Medicare supplement plan. Check with your plan provider for details.