The standard Medicare Part B premium (currently $104.90 per month) is automatically reimbursed by NYSHIP to eligible New York State retirees through their monthly pension checks.

Who is eligible for Medicare Part B reimbursement?

· Employers participating in NYSHIP are required to reimburse the cost of Medicare Part B for enrollees and dependents in accordance with Section 167-a of Civil Service Law. Occasionally, EBD owes retroactive Medicare Part B reimbursements to individuals because EBD was not informed that they were Medicare-primary.

Does Medicare refund Part B premiums?

When Medicare is primary to NYSHIP, under NYSHIP rules, your former employer must reimburse you for the standard Medicare Part B premium (excluding any penalty for late enrollment) and any IRMAA you must pay for Part B, unless you receive reimbursement from another source or if your Medicare premium is being paid by another entity on your behalf.

How does Medicare Part B reimbursement work?

Medicare Part B Premium Reimbursement When Medicare is primary to NYSHIP, NYSHIP reimburses you for the standard Medicare Part B premium (excluding any penalty for late enrollment) and any IRMAA you must pay for Part B, unless you receive reimbursement from another source or if your Medicare premium is being paid by another entity on your behalf.

Is nyship Medicaid?

NYSHIP Will Reimburse Additional Medicare Part B Premium. The standard Medicare Part B premium (currently $104.90 per month) is automatically reimbursed by NYSHIP to eligible New York State retirees through their monthly pension checks. For high earners (those with Modified Adjusted Gross Incomes exceeding $85,000 per person, $170,000 per couple) who pay …

How do I get reimbursed for Medicare Part B?

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Does Nyship cover Medicare Part B deductible?

Your NYSHIP plan covers much of the Medicare Part A and Part B deductible and coinsurance amounts if you use the NYSHIP plan provider network and may cover some other medical expenses Medicare does not cover.

How do I get reimbursed for Part B premium?

2. What document do I need to submit to receive my correct Part B reimbursement amount? You must submit a copy of your Social Security benefits verification statement (your “New Benefit Amount”) or a copy of a 2022 Centers for Medicare and Medicaid Services (CMS) billing statement.

How do I get reimbursed for Medicare payments?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

Does NYS reimburse Medicare premiums?

Medicare Part B Premium Reimbursement When Medicare is primary to NYSHIP coverage, NYSHIP reimburses you for the standard Medicare Part B premium you pay to SSA, excluding any penalty you may pay for late enrollment.

Is Empire Nyship Medicare?

Effective January 1, 2013, NYSHIP replaced the Empire Plan Prescription Drug Program coverage for Medicare-primary enrollees and dependents with Empire Plan Medicare Rx (PDP), a Medicare Part D prescription drug program with expanded coverage designed especially for NYSHIP.

How does Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is retroactive reimbursement of Medicare premium?

If you are enrolled in the QI program, you may receive up to three months of retroactive reimbursement for Part B premiums deducted from your Social Security check. Note that you can only be reimbursed for premiums paid up to three months before your MSP effective date, and within the same year of that effective date.

How long does it take to get Medicare reimbursement?

Claims processing by Medicare is quick and can be as little as 14 days if the claim is submitted electronically and it's clean. In general, you can expect to have your claim processed within 30 calendar days.

Can a patient get reimbursed by Medicare?

Since Medicare Advantage is a private plan, you never file for reimbursement from Medicare for any outstanding amount. You will file a claim with the private insurance company to reimburse you if you have been billed directly for covered expenses. There are several options for Part C plans including HMO and PPO.

How much is Medicare reimbursement?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill. Not all types of health care providers are reimbursed at the same rate.

What is the med prmy indicator on NYBEAS?

The “Med Prmy” indicator on the NYBEAS record will reflect the date the enrollee became Medicare primary and should have enrolled in Medicare Part B. The “Med Reimb” indicator will reflect the date NYSHIP will allow retroactive Medicare Part B reimbursement to begin.

What is EBD in New York?

Determine the process that takes place when the Employee Benefits Division (EBD) discovers a New York State or Participating Employer’s enrollee or dependent who has not received Medicare Part B reimbursements that he or she is entitled to.

Does EBD pay Medicare Part B?

Employers participating in NYSHIP are required to reimburse the cost of Medicare Part B for enrollees and dependents in accordance with Section 167-a of Civil Service Law. Occasionally, EBD owes retroactive Medicare Part B reimbursements to individuals because EBD was not informed that they were Medicare-primary.

Who will reimburse Medicare Part B?

When a Medicare eligible enrollee or dependent is residing outside the United States, the Employee Benefits Division (EBD) or employer (if the individual is enrolled through a Participating Agency [PA]) will reimburse Medicare Part B for individuals who are enrolled in Medicare.

Does NYSHIP pay for Medicare?

However, Medicare does not provide benefits out of the country. If an enrollee incurs medical expenses outside the United States, NYSHIP pays as primary insurer whether or not the individual is enrolled in Medicare.

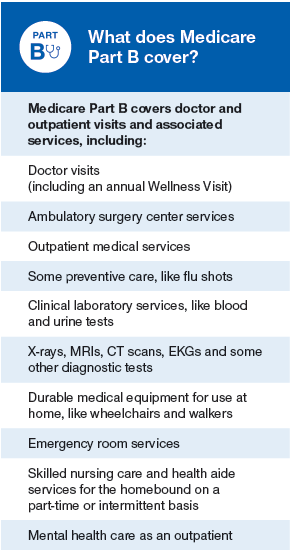

What is Medicare Part A and B?

Medicare Part A covers inpatient care in a hospital or skilled nursing facility, hospice care and home health care.

When does Medicare become primary for spouse?

Since you are no longer actively employed, Medicare becomes primary to NYSHIP for your spouse at age 65. Medicare does not become primary for you until you reach age 65 or otherwise become eligible for Medicare.

Is Empire Plan covered by Medicare?

If you receive services from a provider who does not participate in The Empire Plan, and these services are covered under The Empire Plan but not under Medicare, it is your responsibility to file a claim or have the provider file a claim with the appropriate Empire Plan administrator for Basic Medical or non-network benefits.

Does Medicare send an EOMB?

Medicare will send you an Explanation of Medicare Benefits (EOMB) that will note whether your claim was sent to The Empire Plan. This process, known as Medicare Crossover, is automatic for the medical program, hospital program and outpatient mental health and substance abuse program; however, inpatient mental health and substance abuse services are not crossed over directly from Medicare to Beacon Health Options. For these services, you will need to submit your EOMB to Beacon Health Options if you receive a bill.

Is NYSHIP a dependent?

If you return to work for New York State (or if you worked for a Participating Employer and you return to work for the same employer) in a benefits-eligible position after retiring, NYSHIP is primary for you as an active employee and, in most cases, for your Medicare-eligible dependents .

Do you have to file a claim for NYShip?

For medical/surgical or mental health/substance abuse expenses, you and your enrolled dependents age 65 and over generally have no claims to file because you are automatically enrolled in NYSHIP’s Medicare Crossover Program in the state where you reside.

Who is required to submit Medicare claims?

Providers (such as hospitals, doctors and laboratories) who accept Medicare are required by federal law to submit claims to Medicare for Medicare-primary patients. After Medicare processes the claim, The Empire Plan considers the balance for secondary (supplemental) coverage.

When do retirees get Medicare?

Retirees are automatically granted a Medicare reimbursement upon reaching their 65th birthdays , the current Medicare eligibility date. It is NYSHIP policy to request the Medicare card of a retiree's dependent before granting the enrollee a Medicare credit for the dependent.

When does Medicare credit automatically apply to dependents?

When a dependent of an enrollee who is eligible for Medicare primary payments becomes age 65, grant the Medicare credit automatically for that dependent as is done for enrollees. All enrollees and their dependents eligible for Medicare primary coverage will receive a letter at least three months before their 65th birthdays advising them of the need to join Medicare, that they will be receiving Medicare reimbursement, and instructing them to contact EBD if they are not eligible for Medicare or are already receiving a Medicare reimbursement from another source. Under 65 enrollees and dependents who become Medicare eligible will still have to submit a copy of the Medicare card since that may be the only way we learn of their eligibility.

Does NYSHIP pay for Medicare?

Pursuant to Sec. 167-a of the CSL, upon the exclusion of Medicare's payment from the amount NYSHIP is required to pay for claims , the enrollee is granted a reimbursement of Medicare premium. Enrollees eligible for primary Medicare coverage such as retirees, vestees, certain COBRA enrollees and their dependents are required to join Medicare. Retirees are automatically granted a Medicare reimbursement upon reaching their 65th birthdays, the current Medicare eligibility date. It is NYSHIP policy to request the Medicare card of a retiree's dependent before granting the enrollee a Medicare credit for the dependent.

Who administers Medicare Part D?

The New York State Department of Civil Service shall administer the Medicare Part D Drug Subsidy on behalf of each Participating Agency in the New York State Health Insurance Program (NYSHIP). The Department shall provide to each employer its RDS based upon the actual utilization of each employer’s qualified enrollees using the enrollment information provided by the employer. In order to effect this distribution, the Department and the employer must have executed the Medicare Part D Drug Subsidy Agreement Form.

What is Medicare for ALS?

Medicare is a federal health insurance program for people age 65 or older, certain disabled people, and for people with end stage renal disease (kidney failure) or ALS (amyotrophic lateral sclerosis). It is administered by the U.S. Department of Health and Human Services through the Centers for Medicare and Medicaid Services (CMS). Local Social Security Administration offices provide information about the program and take applications for Medicare coverage. Various health insurance companies provide Medicare insurance. These companies contract with CMS to pay Medicare claims.

Does Medicare require a duplicate?

If a Participating Agency has documentation that an employee or dependent who is eligible for Medicare coverage is receiving Medicare reimbursement from another source (e.g., a public agency or private employer), the Participating Agency is not required to provide a duplicate Medicare reimbursement.

Can you get Medicare if you are 65?

If a NYSHIP enrollee or dependent under age 65 is eligible for Medicare primary coverage due to disability, this status must be entered into NYBEAS or for agencies without access, contact the Employee Benefits Division. NYBEAS will automatically update Medicare status for non-active employees and their dependents who turn age 65.

Does Medicare pay for inpatient care?

NYSHIP requires enrollees and their dependents to have Medicare Part A in effect as soon as they become eligible. There is usually no cost for Part A.

Does Empire Plan offer no drugs?

Participating Agency may elect to offer a no-drug Empire Plan option to enrollees who have been approved for the LIS at a reduced premium. If the Participating Agency elects to offer this option, it will be the agency’s responsibility to obtain a copy of the LIS approval from their enrollees and a letter from the enrollee requesting the no -drug Empire Plan option. The Participating Agency must provide this documentation to the Employee Benefits Division which will verify eligibility for the lower cost, no-drug Empire Plan option.

Medicare: A Federal Program

Medicare is a federal health insurance program for people who are age 65 or older, or have been entitled to Social Security disability benefits for 24 months, or have end stage renal disease (permanent kidney failure). Medicare is directed by the federal Centers for Medicare and Medicaid services (formerly Health Care Financing Administration).

NYSHIP is primary for most active employees

NYSHIP (Empire Plan or HMO) provides primary coverage for you, your enrolled spouse and other covered dependents while you are an active employee, regardless of age or disability.

You and your dependents must have Medicare in effect

As soon as you or your covered dependent becomes eligible for Medicare coverage that pays primary to NYSHIP (because of end stage renal disease or domestic partner status), you or your covered dependent must be enrolled in Medicare Parts A and B.

When you are no longer an "active employee"

When you are no longer an active employee of the State or a Participating Employer, NYSHIP or Medicare will be primary as follows:

If you are also covered by another employer's group plan

If you are no longer an active employee of the State or a Participating Employer and you have coverage under another employer's group plan, the order of claims payment is 1) current employer plan; 2) Medicare; and 3) NYSHIP.

When to enroll in Medicare

As an active employee, contact Medicare immediately if you, your spouse or enrolled dependent is eligible for primary Medicare coverage due to end stage renal disease. Also, the domestic partner of an active employee must have Medicare Part A and Part B in effect by the first of the month in which the domestic partner reaches age 65.

Planning to retire: Avoid a gap in coverage

If you are planning to retire or otherwise leave service with your employer and are under 65, Medicare becomes primary to NYSHIP on the first day of the month in which you reach age 65. Contact Social Security three months before you reach age 65 to be sure of having Medicare in effect at that time.