Medicare Supplement Plan N works with Original Medicare to cover the cost gaps. Also known as Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Is Medicare plan N a cost-effective choice?

"If you are pretty healthy and don't go to the doctor often, Plan N may be a more cost-effective option than Plan G," says Medicare expert Danielle Roberts. "If you go to the doctor once a month, Plan G would likely be more cost-effective than Plan N."

What are the benefits of plan N?

With Aetna Medicare Plan N, you will enjoy:

- Medicare Part A coinsurance and coverage for clinical benefits

- Medicare Part B coinsurance or copayments – with a proviso

- Coinsurance or copayments for hospice care

- The first three pints of blood in a medical procedure

- Medicare Part A deductible

- Coinsurance for skilled nursing facility care

- You can choose a doctor as long as they accept Medicare

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What does Medigap plan N cover?

What Does the Medigap Plan N Cover?

- Medical Expenses – The policy pays Part B coinsurance, except for a small copay for office visits and ER. ...

- Hospitalization – It pays Part A deductible and coinsurance and will provide coverage for around 365 additional days after the Medicare benefits end.

- Hospice Care – It mainly pays Part A coinsurance

What is Medicare Plan N coverage?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

What is the copay for plan N?

What does Medicare Part N cover? Plan N covers 100% of your Medicare Part B coinsurance costs, with the exception of a $20 copay for office visits and a $50 copay for emergency room (ER) visits.

Does Medicare Plan N have copays?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.

Does plan N cover hospital deductible?

Plan N Coverage This standardized Medicare Supplement covers the 20% that Medicare Part B doesn't. It also pays for your hospital deductible and all your hospital costs. You will pay your own excess charges, Part B deductible, and some small copays at the doctor's office and the emergency room.

Is plan n Better Than G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is deductible for plan N?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).

Is plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Does plan N cover prescription drugs?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

Are all Medicare Supplement plan N the same?

Medicare Part N, Medigap Plan N, and Medicare Plan N are the same. Still, the correct term is Medicare Supplement or Medigap Plan N. Remember that Parts refer to Original Medicare, and Plans refer to Medigap.

What is Aetna plan N?

Aetna Medigap Plan N is Aetna's exclusive Medicare Supplement plan for Medicare that offers a low-cost alternative to more comprehensive policies like G or F. Plan N is a relatively novel provision that debuted in 2010. Since then, enrollment in Plan N has been growing progressively each year.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the Medicare deductible for 2022?

$233The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Is Medicare Plan N a good plan?

Medigap Plan N combines fairly extensive coverage with relatively modest premiums, making Plan N a good policy. It is important to remember that Pl...

How popular is Medicare Plan N?

Amount 10% of all Medigap enrollees have Plan N, making it the third most popular plan overall and the second most popular plan for new enrollees.

Does Plan N have a deductible?

Most Plan N policies do not have a deductible. However, beneficiaries enrolled in Plan N are required to meet the Medicare Part B deductible, which...

Does Plan N have a maximum out-of-pocket limit?

Plan N does not have an out-of-pocket limit. Only two Supplement plans have an out-of-pocket limit: Plans K and L.

Can I have Medigap Plan N while enrolled in a Medicare Advantage plan?

No. Medigap policies are only available to people enrolled in the Original Medicare program. They cannot be used by beneficiaries who have Medicare...

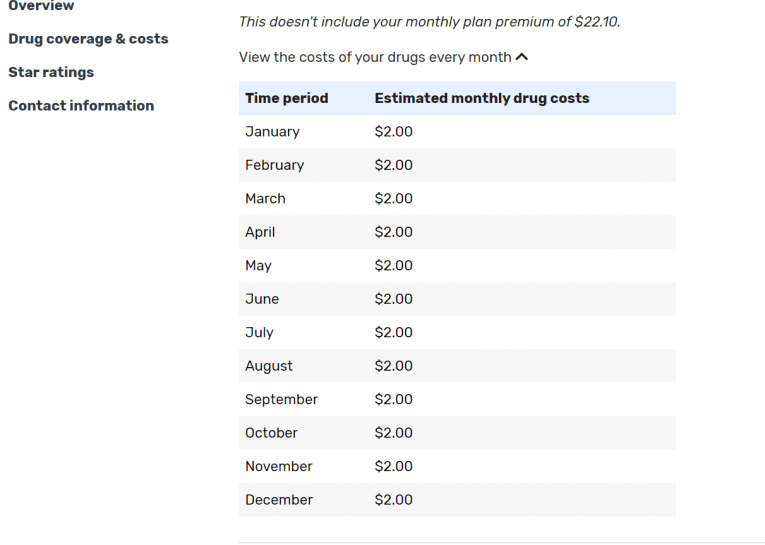

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

How much does Medicare pay for a medical bill?

Medicare pays 80% and then sends the bill to your Medigap plan. If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

When is the best time to enroll in Medicare Plan N?

You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. It’s your one chance to enroll in any Medigap plan without health underwriting.

Does Plan N cover hospital deductible?

For inpatient care, Medicare Supplement Plan N fully covers her hospital deductible.

What is Medicare Supplement Plan N?

Medicare Plan N is one of several Medigap plans (also known as Supplemental plans) available from private insurance companies that will pay additional healthcare costs not covered by Medicare Part A and Part B (original Medicare).

Medigap Plan N Costs

In exchange for paying a lower premium, you’ll have to pay for a few things that are covered by other plans. For example, you’ll pay the Part B deductible of $198 in 2020. You may also have copayments of up to $20 for doctor appointments and $50 copayments for emergency room visits if you’re not admitted.

Medicare Plan N Eligibility

To be eligible for enrollment in any Medicare supplement plan, you must be enrolled in Medicare Part A and Part B. You must also live in a plan’s service area.

Enrollment in Medigap Plan N

You can enroll in Plan N at any time, but your best bet is to enroll during your Initial Enrollment Period. This is a six-month window that starts with the effective date of your Part B coverage. That is because you enjoy the added benefits of enrolling in any plan in your area without being denied or charged more due to pre-existing conditions.

Medicare Supplement Plan N Reviews

With standardized benefits, networks, and payment processing, insurance companies that sell policies are highly rated primarily due to price, stability, and customer service responsiveness.

How does Medigap Plan N compare to other plans?

To help you decide if Medigap Plan N is right for you, here’s a side-by-side comparison of all supplemental plan benefits.

Medigap Plan N insurance companies

Companies use one of three methods to price Plan N policies. It’s helpful to know which price rating system is used so that you can better understand the quote you receive and the reasoning used to arrive at the premium cost.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N. Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021. It’s the plan for those who prefer lower monthly premiums without forfeiting benefits. Yet, when you enroll in this plan, you’re responsible for deductibles and a few copays.

What is the difference between Plan G and Plan N?

Plan G covers Part B excess charges , which are not a concern in most cases but especially not if they aren’t allowed in your state to begin with. Plan N also involves cost-sharing via copayments and coinsurance, which Plan G covers. However, premiums for Plan G are usually higher than those for Plan N.

Why is Plan N so popular?

This popularity is not surprising, because the policy offers a decent amount of coverage at a reasonable price. Plan N offers extra coverage to supplement your Medicare benefits without breaking the bank. The small copays this plan involves keeping the monthly premium lower.

How much does Medigap cost in 2021?

How Much Does Medigap Plan N Cost in 2021. The average cost of Plan N is around $120-$180 per month. However, in some states, it can be as much as $200 and in others, it can be as low as $80. Your premium rates depend on your personal information as well as the plan letter you choose. Factors such as your state of residence, gender, age, ...

What are the factors that affect your monthly premium rates?

Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In the last five years, premium rates for Plan N have increased between 2% and 4%. These increases are lower when compared to Plan F and comparable when compared to Plan G.

Does Medigap cover out of pocket costs?

It covers 100% of your out-of-pocket costs. Outside of the monthly premium, you never need to pay out-of-pocket . Plan N is two steps down from Plan F in terms of coverage. Yet, the premiums for Plan F are higher because the more benefits a plan offers, the higher the premiums will be. Also, Medigap Plan F is not available to all beneficiaries, ...

Does Plan N cover travel?

Plan N also includes foreign travel emergency benefits. If you travel outside the United States, Plan N will cover emergency services up to plan limits.

How does Medigap Plan N work?

On Medigap Plan N, you would meet the deductible first. The way this typically works is that you go to the doctor and the doctor files the claim to Medicare. Once Medicare responds that you have not met the deductible, the doctor’s office will bill you for up to $198 in a calendar year. If you have met the deductible, ...

What is a Medigap Plan N?

Medigap Plan N is a relatively newer Medigap plan. It originated when the plans were re-standardized in 2010. That said, it has definitely picked up traction as one of the increasingly popular options among the Medigap plans. Plan N is a plan that offers a lower premium in exchange for some cost-sharing (i.e. out of pocket costs for the insured).

What is the only variable in Medicare?

The only variable is the Part B Excess charges. You can usually call your primary physician or other physicians you see regularly to find out if they accept Medicare “assignment”. If they do not, that means that they can charge these excess charges. So that’s a good idea if you are considering Plan N.

How long after Medicare benefits are used is Medicare Part A coinsurance?

Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used) So, with Plan N, there is more uncertainty as far as your total out of pocket costs than there would on other plans, such as Plan G or Plan F.

Can you add a plan N to a Medigap plan?

Just like with any of the Medigap plans, it is important to remember the basics with Medigap insurance. First and foremost, the plans are Federally-standardized. So, a Plan N with one company will be identical to a Plan N with another company. They are not allowed to add/take away benefits from the benefits set forth on the Medigap coverage chart.

Does Medicare Part B cover coinsurance?

It does not cover the Medicare Part B deductible (currently $198/year for 2020). Also, it does not cover the Part B coinsurance in full – if you have Plan N, you are responsible for co-pays of up to $20 per doctor visit and $50 at the emergency room. Lastly, it does not cover the Medicare Part B Excess charges.

Does Plan N cover Medicare Part B?

It is probably easier to talk about it from a standpoint of what does Plan N NOT cover. It does not cover the Medicare Part B deductible (currently $198/year for 2020).