The short answer is that PPACA does not directly impact Medicare Supplement insurance in any way. The bill does not apply to supplemental, or secondary, policies in the same way that it applies to primary insurance or “under-65” insurance.

Full Answer

What are the effects of PPACA on the healthcare system?

· Although Medigap plans are not directly affected, the PPACA does affect Medicare in some ways, primarily in the areas of Medicare Advantage (the private plans that replace Medicare) and Medicare Part D (Rx coverage for people on Medicare). For Medicare Advantage plans, the bill took some money away from the plans in the form of reimbursement rates.

How does the Affordable Care Act affect Medicare?

Starting in 2013, the Medicare payroll tax increased by 0.9% (from 1.45 to 2.35%) for individuals earning more than $200,000 and for married couples with income above $250,000 who file jointly. The extra tax only impacts the wealthiest fraction of the country – less than three% of couples earn $250,000 or more.

Is the PPACA a tax?

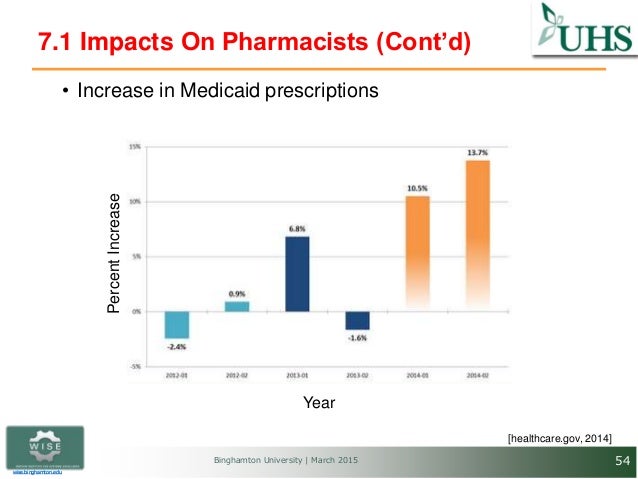

· The Affordable Care Act has made Medicare prescription drug coverage (Part D) more affordable during the coverage gap by gradually closing the prescription drug donut hole over time. In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years.

What is the impact of ACA on health care?

· The Affordable Care Act Strengthens Medicare & Health Care. January 10, 2020. Since the landmark Affordable Care Act (ACA) was signed into law on March 23, 2010, [1] it …

How did the Ppaca affect Medicare?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

How the ACA will affect Medicare spending?

Lower Medicare Premiums, Deductibles and Cost Sharing The ACA reduced the rate of increase in Medicare payments to providers and, over a six-year period, reduced payments to Medicare Advantage plans to bring them closer to the costs of care for a beneficiary in traditional Medicare.

What has been the impact of the Affordable Care Act ACA on healthcare access cost and quality?

The ACA enabled people to gain coverage by 1) expanding the publicly funded Medicaid program to cover adults with annual incomes up to 138% of the federal poverty level; 2) establishing the Health Insurance Marketplace for individuals and small businesses, allowing them to purchase private health insurance (PHI); and 3 ...

What is the impact of the Patient Protection and Affordable Care Act on health care facilities?

The law provides numerous rights and protections that make health coverage more fair and easy to understand, along with subsidies (through “premium tax credits” and “cost-sharing reductions”) to make it more affordable. The law also expands the Medicaid program to cover more people with low incomes.

How will ACA repeal affect Medicare?

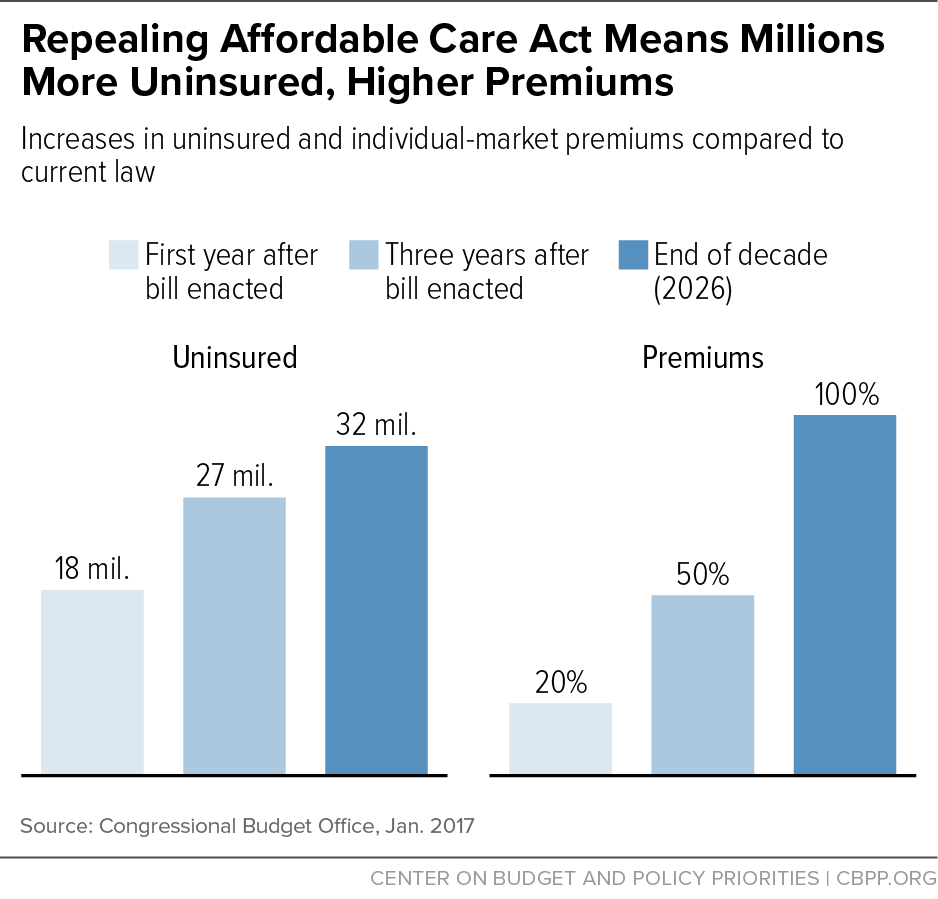

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

Is Medicare Part of the Affordable Care Act?

The 2010 Affordable Care Act (ACA) included many provisions affecting the Medicare program and the 57 million seniors and people with disabilities who rely on Medicare for their health insurance coverage.

What impact do you think the Ppaca will have on the US economy?

When fully implemented, the Act will cut the number of uninsured Americans by more than half. The law will result in health insurance coverage for about 94% of the American population, reducing the uninsured by 31 million people, and increasing Medicaid enrollment by 15 million beneficiaries.

What is the impact of the Affordable Care Act on vulnerable populations?

The Affordable Care Act (ACA) has the potential to dramatically improve rates of health insurance coverage for low-income Americans, including many vulnerable populations. In states that are opting to expand Medicaid, people with incomes up to 138 percent of poverty may enroll with little or no cost sharing.

How did the ACA fail to provide access to healthcare for all individuals?

It largely failed. Health insurance markets are only afloat because of massive federal subsidies and premiums and out-of-pocket obligations significantly increased for families. While the ACA has led to about 13 million more people with Medicaid, many more have been harmed.

What is the individual mandate component of the Patient Protection and Affordable Care Act?

Individual mandate. The most legally and politically controversial aspect of the ACA, the individual mandate requires Americans to purchase health insurance or face a government penalty, with some exceptions—particularly for low-income individuals who cannot afford to buy insurance [3].

How does the ACA improve access to healthcare?

The ACA uses two primary approaches to increase access to health insurance: It expands access to Medicaid, based solely on income, for those with incomes up to 138% of the federal poverty level (FPL), and creates eligibility for those with incomes from 139% to 400% FPL to apply for subsidies [in the form of advance ...

What are the cons of the Affordable Care Act?

Cons:The cost has not decreased for everyone. Those who do not qualify for subsidies may find marketplace health insurance plans unaffordable. ... Loss of company-sponsored health plans. ... Tax penalties. ... Shrinking networks. ... Shopping for coverage can be complicated.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

Is Medicare Part B covered by the law?

However, if you only have Medicare Part B (medical insurance), you aren’t considered covered under the health care law. This might mean that you’ll have to pay the fee that people without coverage must pay when filing a federal income tax return (or purchase additional coverage to avoid the payment).

Does Medicare require health insurance?

In many instances, Medicare coverage meets the Affordable Care Act ’s requirement that all Americans have health insurance. For example, those who have Medicare Part A (hospital insurance) are considered covered under the law and don’t need to purchase a Marketplace plan or other additional coverage.

When does Medicare Part B start?

Also, you are only permitted to enroll in Medicare Part B (and Part A in some cases) during the Medicare general enrollment period that runs from January 1 to March 31 each year. However, coverage will not begin until July of that year. This could create a gap in your insurance coverage.

How does ACA help the health care system?

ACA promotes health and wellness for beneficiaries by emphasizing prevention, quality, and care coordination. It also benefits the families of Medicare beneficiaries by extending access to health insurance coverage to millions of uninsured individuals, and by protecting everyone against insurance company practices that deny health insurance coverage to people when they need it.

When did the Affordable Care Act become law?

Since the landmark Affordable Care Act (ACA) was signed into law on March 23, 2010, [1] it has increased access to needed health services, reduced costs and improved care for millions. Yet, as this progress continues and the law’s most impactful provisions near implementation, threats to the law continue, through repeal efforts, budget cuts and legal challenges.

Is the ACA good for Medicare?

As the Center has said since it was signed into law, ACA is good for Medicare and good for families that depend on it. It is saving older and disabled Americans thousands of dollars a year and strengthening the solvency of Medicare.

How does PPACA affect businesses?

Regardless of the way the new tax is implemented, it will affect every company (except those exempted obviously) that does business in the United States. There seems little doubt that a 2700-page regulation, affecting literally every employed American, will generate enormous amounts of paperwork. Paperwork is rarely anticipated with joy by any company. Laws or regulations that include particularly egregious penalties are liked even less. The PPACA promises both as the reporting requirements and penalties are one of the few features of the law that are exactly delineated. In addition, paperwork entails more than crossing the T’s and dotting the I’s when complying with the PPACA. There are very real costs associated with this law. Proper record keeping will ensure the most accurate and lowest employer contributions and will diminish or eliminate penalties and interest.

What are the ramifications of PPACA?

the program. The ramifications of the PPACA can be broadly characterized as the good, the bad, and the ugly.

Is PPACA a tax?

In any event, the Supreme Court, in making its decision, ruled that the PPACA is indeed a tax and, thus, there will be some very real and negative economic ramifications for all taxpaying individuals.

Is PPACA good or bad?

The Bad. While good healthcare is beneficial to every American as an individual, the effects of PPACA on the healthcare system, the economy, and on the population as a whole are still undecided as to whether they will be beneficial or not. Only time will tell if the program succeeds or not.

Is the Patient Protection and Affordable Care Act constitutional?

The recent Supreme Court ruling that the Patient Protection and Affordable Care Act ( PPACA) is constitutional will have an extraordinary effect on the human resource functions of every U.S. company. Regardless of how a small business owner feels about the new healthcare initiative,

Is PEO a good solution to PPACA?

Certainly, a PEO solution to the new PPACA will exact financial benefits. In addition, it will provide some very real, albeit intangible benefits. On the employee side, morale will improve as all employees will be assured that an adequate level of healthcare will be available when necessary (a situation that was not always the case in the past). A more productive workplace will result. On the employer side, HR administrators, senior company executives and business owners will be relieved of much of the strain and aggravation of implementing and monitoring this new law. A renewed concentration on the core of the business should reap rewards that are not directly assignable but that will show up on the bottom line.

How does PPACA affect Medicare?

While some of the Medicare provisions would have a largely one-time impact on the level of expenditures (for example, the reduction in MA benchmarks), others would have an effect on expenditure growth rates. Examples of the latter include the productivity adjustments to Medicare payment updates for most categories of providers, which would reduce overall Medicare cost growth by roughly 0.6 to 0.7 percent per year, and the Independent Payment Advisory Board process, which would further reduce Medicare growth rates during 2015-2019 by about 0.3 percent per year. As discussed previously, however, the growth rate reductions from productivity adjustments are unlikely to be sustainable on a permanent annual basis, and meeting the CPI-based target growth rates prior to 2020 will be very challenging as well.

How will the PPACA affect health insurance?

By calendar year 2019, the individual mandate, Medicaid expansion, and other provisions are estimated to reduce the number of uninsured from 57 million under prior law to 23 million after the PPACA. The percentage of the U.S. population with health insurance coverage is estimated to increase from 83 percent under the prior-law baseline to 93 percent after the changes have become fully effective.

What are the provisions of PPACA?

A number of provisions in the PPACA have an immediate effect on insurance coverage. Most of these provisions, however, do not have a direct impact on Federal expenditures. (A discussion of their impact on national health expenditures is included in the following section of this memorandum.) Section 1101 of the PPACA authorizes the expenditure of up to $5 billion in support of a temporary national insurance pool for high-risk individuals without other health insurance. Section 1102 requires the Secretary of HHS to establish a Federal reinsurance program in 2010-2013 for early retirees and their families in employer-sponsored health plans. Participation by employers is optional, and the law authorizes up to $5 billion in Federal financing for the reinsurance costs. No other financing is provided, and reinsurance claims would be paid only as long as the authorized amount lasts. We estimate that the full amount of the authorizations for sections 1101 and 1102 would be expended during the first 1 to 3 calendar years of operation.

What are the changes to the health care system?

The national health care reform provisions in the Patient Protection and Affordable Care Act, as amended, make far-reaching changes to the health sector, including mandated coverage for most people, required payments by most employers not offering insurance, expanded eligibility for Medicaid, Federal premium and cost-sharing subsidies for many individuals and families, a new system of health benefits Exchanges for facilitating coverage, and a new Federal insurance program in support of long-term care. Additional provisions will reduce Medicare outlays, make other Medicaid modifications, provide more funding for the CHIP program, add certain benefit enhancements for these programs, and combat fraud and abuse. Federal revenues will be increased through an excise tax on high-cost insurance plans; fees or excise taxes on drugs, devices, and health plans; higher Hospital Insurance payroll taxes for high-income taxpayers; a new tax on investment revenues and other unearned income; and other provisions.

Why were people over 64 excluded from the ACA?

Individuals older than 64 years were excluded because the ACA was not intended to affect their health care coverage. Our sample starts in 2011 because this is the first year in which the BRFSS included cell phones in its sampling frame. A 2011-2016 sample period gives us 3 years of pretreatment data and 3 years of posttreatment data.

What effect did the third year of the health insurance policy have on the health insurance coverage?

We find that gains in health insurance coverage and access to care from the policy continued to increase, while an improvement in the probability of reporting excellent health emerged in the third year, with the effect being largely driven by the non-Medicaid expansions components of the policy .

How long did the Affordable Care Act last?

While the Affordable Care Act (ACA) increased insurance coverage and access to care after 1 (2014) or 2 (2014-2015) postreform years, the existing causally interpretable evidence suggests that effects on self-assessed health outcomes were not as clear after 2 years.

Does the ACA affect mental health?

With respect to self-assessed health, we find that the ACA increased the probability of reporting excellent health and reduced days in poor mental health. In contrast, a recent article with only 2 posttreatment years found no evidence of gains in these outcomes despite also using BRFSS data and the same identification strategy.18The emergence of an impact on the probability of having excellent self-assessed health appears particularly gradual, as the effect of the full ACA was small and insignificant in 2014, 1.9 percentage points in 2015, and 2.7 percentage points in 2016. Improvements in self-assessed health at lower points of the distribution also emerge in 2016. Most of these gains appear to come from the non-Medicaid-expansion components of the law.

What are the effects of pre-ACA coverage?

Pre-ACA insurance expansions have largely demonstrated improved access to care for low-income populations. For example, the Massachusetts health reform was associated with significant reductions in forgone or delayed care and improvements in access to a personal doctor and usual source of care among adults overall (46, 54, 56, 58, 72, 88) and, in particular, for subgroups targeted by the ACA, such as low-income and childless adults (54, 56, 58). With regard to affordability, the Medicaid expansion in Oregon diminished financial hardship from medical costs, markedly reducing catastrophic OOP expenditures (5, 35, 98). In addition, other states that expanded public insurance prior to the ACA demonstrated improvements in access and affordability among low-income adults (62, 82) and children (33, 44) across comparable measures. More recently, the California LIHP waiver project found large reductions in the likelihood of any family OOP health care spending but did not detect significant differences in access to care, which may be explained by a well-established safety net in the state prior to program implementation (38). One ongoing concern about expanding coverage is that increased demand for services by newly insured individuals may limit access to care, but evidence from prior expansions does not appear to sufficiently support this hypothesis (67).

How does the ACA affect health care?

The Patient Protection and Affordable Care Act (ACA) expands access to health insurance in the United States , and, to date, an estimated 20 million previously uninsured individuals have gained coverage. Understanding the law’s impact on coverage, access, utilization, and health outcomes, especially among low-income populations, is critical to informing ongoing debates about its effectiveness and implementation. Early findings indicate that there have been significant reductions in the rate of uninsurance among the poor and among those who live in Medicaid expansion states. In addition, the law has been associated with increased health care access, affordability, and use of preventive and outpatient services among low-income populations, though impacts on inpatient utilization and health outcomes have been less conclusive. Although these early findings are generally consistent with past coverage expansions, continued monitoring of these domains is essential to understand the long-term impact of the law for underserved populations.

What is the goal of increased coverage eligibility and affordability?

An important goal of increased coverage eligibility and affordability is to increase access to adequate health care services for the poor. As a result, the ACA’s impact on access to high-quality health care has been evaluated across multiple dimensions, including access to a doctor, having a usual source of care, timeliness of care, affordability, and access to medications and preventive, primary, and specialty care.

What is the coverage gap?

Approximately 9% of the remaining uninsured (almost 3 million Americans) fall into what is known as the “coverage gap.” This group represents poor, uninsured adults who reside in the 19 non–Medicaid expansion states whose income is above the state’s threshold for Medicaid eligibility but less than the 100% threshold for Marketplace subsidy eligibility. Also included are childless adults who were not previously eligible for Medicaid. Almost 90% of all adults in the coverage gap live in the South, half in either Texas or Florida, which aligns with this region’s high uninsurance rates, limited Medicaid eligibility, and low uptake of Medicaid expansion (37). Consistent with demographic characteristics and policies excluding nondisabled adults in states that did not expand Medicaid, African Americans and childless adults also account for a disproportionate share of individuals in the coverage gap (37). If all current nonexpansion states opted to expand Medicaid, 5.2 million currently uninsured adults would gain coverage: 2.9 million who are in the coverage gap, 0.5 million who are already eligible for Medicaid though alternate pathways, and an additional 1.8 million who are presently eligible for Marketplace subsidies with incomes from 100% FPL to 138% FPL yet did not enroll (37). Because a substantial portion of the remaining uninsured are either eligible for coverage or fall in the coverage gap, the law’s potential impact on the poor has not yet been fully realized.

How effective is Medicaid expansion?

The expansion of Medicaid has been particularly effective in states that took advantage of the opportunity for early Medicaid expansion allowed under the ACA. Between 2010 and 2014, six states (California, Colorado, Connecticut, Minnesota, New Jersey, Washington) and the District of Columbia extended Medicaid eligibility for low-income adults through the early Medicaid expansion option or the Section 1115 waiver process (18). In California, the LIHP significantly increased coverage by 7.3 percentage points for poor adults (up to 138% FPL) within the first two years (38). Similarly, one year after early expansion, Medicaid coverage increased significantly in Connecticut (4.9 percentage points) and modestly in Washington, DC (3.7 percentage points) among low-income childless adults—a key subpopulation targeted by Medicaid expansion (86). Trends in coverage gains in these early expansions echoed those of the Massachusetts health reform, which was associated with an estimated 18.4-percentage-point increase in coverage among low-income adults and even larger gains among low-income childless adults (54). Though these expansions were implemented prior to the ACA, their positive findings inform potential coverage gains for the poor under the ACA.

How does the reliance on the ACA affect health insurance?

Despite the availability of subsidies and cost-sharing reductions, the reliance of the ACA on health insurance exchanges may both increase access to health insurance and simultaneously pose unintended barriers to access, particularly for low-income populations. These barriers can arise in two ways. The most publicized method is through the creation of narrow networks, where insurers offer plans and policies with fewer doctors and hospitals in an effort to keep premiums as competitive as possible. Whether narrow networks create actual, rather than perceived, barriers to care has not been well established yet through research. Nevertheless, the existence of narrow networks has created the perception that exchange-based QHPs are limiting access to a greater extent than did pre-ACA policies, despite the absence of adequate baseline data from pre-ACA years.

Does the ACA expand Medicaid?

In summary, early evidence following ACA implementation has demonstrated significant progress toward its goal of expanding coverage for millions of low-income individuals who would have otherwise remained uninsured. Not all individuals equally experience the potential benefits of the law, however, and disparities have developed on the basis of state decisions regarding whether to expand Medicaid.

How did the ACA affect Medicare?

The Medicare provisions of the ACA have played an important role in strengthening Medicare’s financial status for the future, while offsetting some of the cost of the coverage expansions of the ACA and also providing some additional benefits to people with Medicare. Savings were achieved in part by reducing payments to providers, such as hospitals and skilled nursing facilities. Medicare provider payment changes in the ACA were adopted in conjunction with the ACA’s insurance coverage expansions, with the expectation that additional revenue from newly-insured Americans would offset lower revenue from Medicare payments. In addition, Medicare savings were achieved through lower payments to Medicare Advantage plans.

What are the benefits of the ACA?

Medicare Benefit Improvements. The ACA included provisions to improve Medicare benefits by providing free coverage for some preventive benefits , such as screenings for breast and colorectal cancer, cardiovascular disease, and diabetes, and closing the coverage gap (or “doughnut hole”) in the Part D drug benefit by 2020.

What would happen if the 0.9 percent payroll tax on high earners was repealed?

This would result from higher spending for Part A services due to higher payments to Part A service providers (such as hospitals) and Medicare Advantage plans for services provided under Part A, along with reduced revenues, if the additional 0.9 percent payroll tax on high earners is repealed.

How much will Medicare save in 2026?

Increase Medicare spending over time, in the absence of the Board’s cost-reducing actions. CBO projects Medicare savings of $8 billion as a result of the IPAB process between 2019 and 2026. 12

What is the ACA program?

The ACA also created incentives for hospitals to reduce preventable readmissions and hospital-acquired conditions, and established new accountable care organizations (ACO) programs. Research has shown declines in Medicare patient readmissions since the Hospital Readmission Penalty Program provisions were introduced.

How much did CMMI receive in 2010?

CMMI received an initial appropriation of $10 billion in 2010 for payment and delivery system reform model development and evaluation, and the ACA called for additional appropriations of $10 billion in each decade beginning in 2020.

What is CMS in Medicare?

Through a new Center for Medicare & Medicaid Innovation (CMMI, or Innovation Center) within the Centers for Medicare & Medicaid Services (CMS), the ACA directed CMS to test and implement new approaches for Medicare to pay doctors, hospitals, and other providers to bring about changes in how providers organize and deliver care. The ACA authorized the Secretary of Health and Human Services to expand CMMI models into Medicare if evaluation results showed that they either reduced spending without harming the quality of care or improved the quality of care without increasing spending. CMMI received an initial appropriation of $10 billion in 2010 for payment and delivery system reform model development and evaluation, and the ACA called for additional appropriations of $10 billion in each decade beginning in 2020.

What is Medicare Advantage?

Medicare Advantage, also called Part C, is another way to get your Original Medicare (Part A and Part B) benefits through a private insurance company approved by Medicare. Medicare Advantage plans got their name in 2003 with the passage of the Medicare Modernization Act (MMA).

How many people will be enrolled in Medicare Advantage in 2020?

Since 2014, Medicare Advantage enrollments have increased, while premiums have decreased. In 2020, about 39% of Medicare beneficiaries (24.4 million) were enrolled in Medicare Advantage plans, according to the Centers for Medicare & Medicaid Services (CMS). This is a marked increase since 2009, pre-Obamacare, when Medicare Advantage enrollment was about 23% of Medicare beneficiaries (10.5 million) according to the Kaiser Family Foundation.

How much is the average health insurance premium in 2020?

The average premium overall (all ages) for a health insurance plan under the Affordable Care Act was $484 in 2020, eHealth reported. The average Medicare Advantage premium in an eHealth survey was $5 per month.

Is Medicare Advantage still affordable?

Medicare Advantage plans may still be affordable despite Obamacare cuts. According to the Centers for Medicare & Medicaid Services (CMS), the estimated average premium for a Medicare Advantage plan is $21 a month in 2021. In fact, Medicare Advantage premiums have been going down year by year, CMS reports.

When does Medicare disability end?

Includes the 25th month of getting disability benefits. Ends three months after your 25th month of getting disability benefits. Learn about the other time periods when you may be able to sign up for a Medicare Advantage plan.

How long does Medicare last after 65?

Includes the month of your 65th birthday. Lasts for three months after your turn 65. If you qualify for Medicare because of a disability, this Initial Enrollment Period usually: Begins the first three months before your 25th month of getting Social Security or Railroad Retirement Board disability benefits.

How to contact Medicare by phone?

You can enter your zip code on this page to get started. Call Medicare at 1-800-MEDICARE (1-800-633-4227) . TTY users should call 1-877-486-2048. Medicare representatives are available 24 hours a day, seven days a week.