Indeed, reasonable funeral and burial expenses are charged against the probate and trust estate. However, you can be reimbursed by filing a creditor claim. A creditor claim is a claim that is required to be filed in writing, and in proper form by someone who is owed money by a person who has passed away.

Full Answer

How are funeral expenses paid in a probate case?

Unlike other expenses incurred after death, in order for the funeral expenses of the decedent to be paid by the estate through a probate case, the person who paid the funeral expenses must file a creditor claim with the probate court. (Probate Code § 9000 (a) (3).)

How much does a funeral cost with Medicare and Social Security?

The simple fact is that Medicare coverage ends, well, when your life does. And Social Security’s death benefit is a mere $255. According to the National Funeral Directors Association, the national median cost of a funeral with viewing and burial in 2019 was $7,640. 1

Can a probate judge deny reimbursement for funeral expenses?

Without a properly filed creditor claim, reimbursement from the estate for funeral expenses may be disallowed by the probate judge, even without an objection. What costs are included in funeral expenses?

Can I use estate assets to reimburse myself for funeral costs?

If you’ve paid some of those costs or are planning to, you’re probably wondering whether you can use the estate assets to reimburse yourself for funeral expenses or other out-of-pocket expenses. The answer is: absolutely, yes!

Does Medicare pay after death?

Medicare pays a surviving relative of the deceased beneficiary in accordance with the priorities in paragraph (c)(3) of this section. If none of those relatives survive. Medicare pays the legal representative of the deceased beneficiary's estate. If there is no legal representative of the estate, no payment is made.

What happens when someone dies with debt?

Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid. Generally, no one else is required to pay the debts of someone who died.

Is life insurance considered part of an estate?

Unless payable to your own estate, death benefits payable under your life insurance policies are NOT estate assets, which means they do not go according to your Will and which sometimes means they go to the “wrong people.” Money paid out on your life insurance policy when you die is not “your” money.

Can creditors go after joint bank accounts after death?

Can a creditor go after joint tenancy assets? Joint tenancy (with rights of survivorship) is extremely common between spouses and in nearly all cases creditors very little to no rights against property held in joint tenancy between the deceased person and the joint tenant.

What loans are forgiven at death?

Federal student loans are forgiven upon death. This also includes Parent PLUS Loans, which are forgiven if either the parent or the student dies. Private student loans, on the other hand, are not forgiven and have to be covered by the deceased's estate.

Who is responsible for medical bills of deceased parent?

estateIn most cases, the deceased person's estate is responsible for paying any debt left behind, including medical bills. If there's not enough money in the estate, family members still generally aren't responsible for covering a loved one's medical debt after death — although there are some exceptions.

Who gets life insurance if beneficiary is deceased?

If the beneficiary dies first, then it is paid to the estate of the policy owner. If the beneficiary dies after, then the death benefit is paid to the estate of the beneficiary. The best way to ensure that someone you choose gets your policy's death benefit is by adding contingent beneficiaries.

Do beneficiaries pay taxes on life insurance policies?

Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the beneficiary does not have to pay taxes on it.

How do I keep life insurance proceeds out of my estate?

Keeping Life Insurance Out of Your EstateInclusion of Insurance for Estate Tax Purposes. ... Irrevocable Life Insurance Trusts. ... Funding an Irrevocable Life Insurance Trust.

When someone dies do their bank accounts get frozen?

If the bank account is solely titled in the name of the person who died, then the bank account will be frozen. The family will be unable to access the account until an executor has been appointed by the probate court.

Does Social Security notify banks of death?

If a payment was issued after the person's death, Social Security will contact the bank to ask for the return of those funds. If the bank didn't already know about the person's death at that point, this request from Social Security will alert them that the account holder is no longer living.

Can you withdraw money from a joint account if one person dies?

Most joint bank accounts include automatic rights of survivorship, which means that after one account signer dies, the remaining signer (or signers) retain ownership of the money in the account. The surviving primary account owner can continue using the account, and the money in it, without any interruptions.

Why don't you like funeral expenses?

If not the expenses, then at the very least, you don’t like it because you’re saying goodbye to someone you’ve loved or cared for greatly in your lifetime. If those don’t even move the needle, then think about this: the decedent’s estate could stand to lose money because ...

What happens if you file a creditor claim?

Unfortunately, if you improperly file a creditor claim, you stand to lose all reimbursement on the funeral and burial expenses. Doing this alone is tough. That’s why you need a probate attorney on your side.

Can a decedent's estate lose money because of funeral expenses?

If those don’t even move the needle, then think about this: the decedent’s estate could stand to lose money because of the funeral and burial expenses. How so? Because you didn’t know that you could be reimbursed. Indeed, reasonable funeral and burial expenses are charged against the probate and trust estate.

Can you be reimbursed for funeral expenses?

Indeed, reasonable funeral and burial expenses are charged against the probate and trust estate. However, you can be reimbursed by filing a creditor claim. A creditor claim is a claim that is required to be filed in writing, and in proper form by someone who is owed money by a person who has passed away.

How long does probate take?

Probate can take anywhere from a few months to several years to fully complete. For most estates of average size, the process will range from six months to two years. If an estate is especially large, if any heirs contest anything, or if beneficiaries cannot be found, things will take longer.

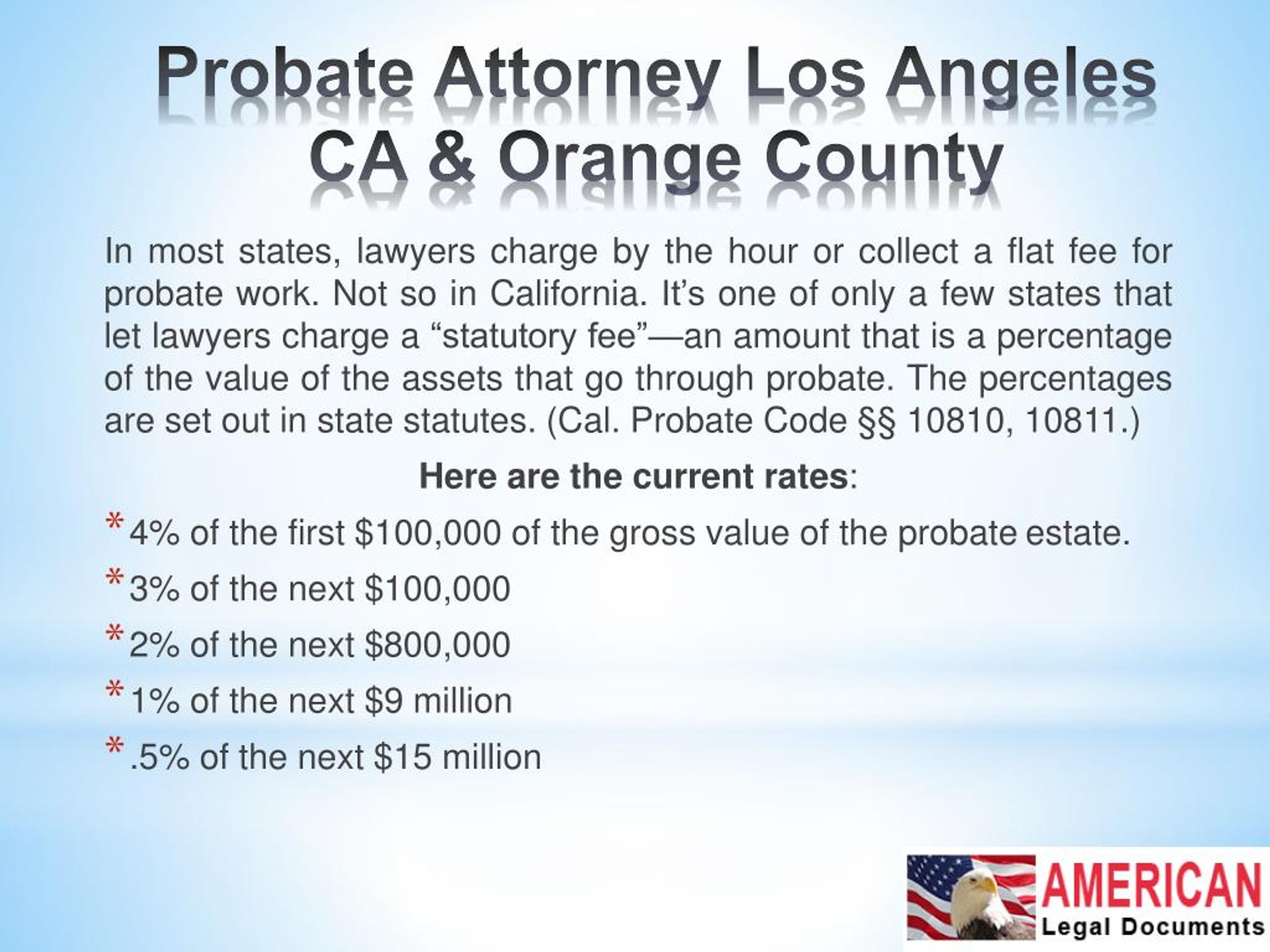

What are the drawbacks of probate?

Perhaps one of the biggest drawbacks to probate is the cost . And the more it costs, the less inheritance your beneficiaries will receive. Total cost can widely vary, depending on a number of factors including: But there are some things you can count on being fairly consistent in the probate process.

What does an executor charge for?

Executors can charge a fee to be reimbursed for most expenses they incur. This can include the cost for any travel needed, to pay for tax prep, to buy any supplies, or for anything else required to settle an estate. Executors can also be reimbursed a fair fee for the job they do as a representative of an estate.

Do you have to pay probate fees out of your estate?

And in some states, you’re actually required to do so by law (although most states do not mandate this). A probate lawyer's fees (and most other costs of probate) are paid out of the estate, so your family will not need to worry about who pays probate fees, and they won’t have to cough up any money out of pocket.

Do all estates need to go through probate?

Depending on how you set it up, your estate may need to go through probate so the courts can begin the process. It’s important to understand that not all estates need to go through probate. And, there are smart, strategic ways you can make probate easier or even eliminate it all together.

Do probate attorneys charge hourly?

At the end of the day, that’s money that could be going to your beneficiaries. Probate lawyer fees can vary - lawyers can charge hourly or a flat rate.

What is the biggest expense after death?

After the death of a loved one, the amount of funeral planning that needs to be done can be overwhelming. Adding to the stress can be the issue of cost. The funeral is one of the first (and typically biggest) expenses after a person dies. A funeral can include everything from the actual burial expenses and the burial plot to a headstone and casket.

Why can't an estate pay bills?

There are several reasons why the estate can not pay this bill immediately. First, there are laws governing how money in an estate is distributed. In cases where there ends up not being enough money left in an estate, debts must be paid in a certain order, which is set by law. Funeral expenses are among the first things estate funds can be used ...

What is an executor adviser?

The Executor Adviser is an advice column created by Executor.org for Legacy. Executor.org's experts aim to help readers with questions about executorship and provide comprehensive, free online resources to guide executors through this complex process.

Can you use money in an estate to pay for funeral expenses?

Fortunately, the answer is YES, but with a caveat. While you can use money in the estate to pay for funeral cost s, you can’t do it immediately; you will need to treat funeral cost s like any other expense of the estate. Therefore, you’ll need to ask the funeral home to bill the estate for the associated cost s instead of offering ...

Can you use money to pay for a funeral?

Remember, the money you use to pay for the funeral is money that the estate’s beneficiaries will not inherit. And, as mentioned, if a funeral home requires the person signing the contract to guarantee payment of all expenses, that person is personally responsible for that debt. Planning the funeral of a loved one can be a very stressful process.

Can you pay funeral expenses immediately?

Finally, there are practical reasons why you can’t pay the funeral expenses immediately.

When a family member pays for a funeral, are they the first person to be reimbursed?

Therefore, when a family member pays for the funeral, they are the first person to be reimbursed for their expenses. We highly recommend that you keep all records of invoices and payments so you can support your claim for reimbursement.

What is the priority in funeral expenses?

There may be some variation from state to state, but the general priority in payments is: Funeral expenses (including reimbursements) Estate administrative expenses (including reimbursements) Court fees. Public notices. Legal expenses.

How to make a claim for reimbursement from estate assets?

In order to make a claim, you will need to submit a creditor claim to the estate and the probate court, specifying what the claim is for and including supporting documentation such as invoices and receipts.

What happens after death of a loved one?

After the death of a loved one, family members often have to handle many immediate expenses, specifically the costs associated with a funeral, before the estate is officially opened and the probate court grants access to estate assets.

Do funeral expenses have to be paid by the government?

The answer is: absolutely, yes ! In fact, funeral expenses are the #1 priority in any estate and will supersede any other creditor, including taxes due to the government.

Does Medicare Cover Funeral Expenses?

The punch line is that your Medicare coverage will not be of help when it comes to paying for funeral arrangements. Let’s take a look at the various parts one-by-one — Original Medicare, Medigap, and Medicare Advantage plans.

Does Medicaid Cover Funeral Expenses?

Like Medicare, Medicaid is also a government-administered health insurance program.

Does The VA Cover Burial Costs?

The Department of Veterans Affairs is a U.S. Government agency that handles programs benefiting veterans and their family members.

Frequently Asked Questions

Original Medicare (Medicare Parts A & B) covers only inpatient and outpatient medical services. There is no Medicare “death benefit” payout.

Conclusion & Key Takeaways

Does Medicare cover funeral costs? Are there other government programs that help family members cope with the exorbitant cost of traditional funerals?

What does the executor use to pay off creditors?

The executor will use his cash and liquidate assets, if necessary, to pay off all bills and creditors. The equation includes assets the decedent owned in his sole name and that comprise his probate estate.

How much is a decedent's estate considered solvent?

A decedent's estate is considered solvent if the value of all the decedent's assets adds up to $500,000 and his debts, including mortgages and car loans, equal $350,000. The personal representative can pay his bills in full, although she might have to sell the car and the real estate to cover those loans.

Can heirs inherit debt?

In most cases, the answer is no. Exceptions can exist, such as if you're the surviving spouse and you live in a community property state, or if you cosigned on a particular debt, but for the most part, heirs don't "inherit" debt. 1 .

Do creditors divide assets equally?

6. Creditors typically do not divide up the available cash and assets equally when an estate is worth $500,000 but the decedent left $600,000 in debt.

Does cosigning debt go away with death?

The situation also changes with debts that weren't taken in the decedent's sole name. If you cosigned with him on a credit card or an auto loan, this debt does not go away with his death even if his estate is insolvent. Nor is his estate responsible for paying it if indeed is solvent. 2 .

Can nursing home bills be paid by adult children?

Several jurisdictions allow these institutions to pursue adult children for some portion of their parents' unpaid medical bills if the estate can't cover them. 8

Do beneficiaries get paid when an estate is insolvent?

Unfortunately, the decedent's beneficiaries or heirs-at-law typically receive nothing when an estate is insolvent, but neither are they responsible for paying off the balance of the decedent's unpaid debts. The companies that weren't paid in full usually have to write off their debts.

How much does a funeral cost with Social Security?

And Social Security’s death benefit is a mere $255. According to the National Funeral Directors Association, the national median cost of a funeral with viewing and burial in 2019 was $7,640. 1. Relying on retirement assets left to your estate to pay the bill is 1 option.

How much is Social Security death benefit?

Planning for our deaths, however, isn’t quite as much fun. The simple fact is that Medicare coverage ends, well, when your life does. And Social Security’s death benefit is a mere $255.

Why add a final expense policy to your retirement plan?

First, having this type of coverage can keep your spouse from having to tap into your retirement savings to pay for final expenses.

What is a final expense policy?

A final expense policy is a type of life insurance that's designed to eliminate any financial loose ends when you pass away. These policies feature a guaranteed death benefit that's payable to your beneficiary.