Here are three key effects that a repeal of the ACA would have:

- Higher spending on Medicare Part A and Part B, leading to higher premiums, deductibles and copayments for beneficiaries.

- Loss of key benefits. Under a complete repeal, beneficiaries would lose some new Medicare benefits, like screenings for...

- Medicare would become insolvent more quickly. The ACA established...

What happens to Medicare if the Affordable Care Act is repealed?

What are the key Medicare provisions in the ACA and how would repeal affect Medicare spending and beneficiaries? Payments to Health Care Providers. The ACA reduced updates in Medicare payment levels to hospitals, skilled nursing... Payments to Medicare Advantage Plans. Prior to …

How many people would lose their health insurance if Obamacare is repealed?

Oct 29, 2020 · Many effects of overturning the ACA on Medicare are not clear, yet some are straightforward. Overturning the ACA would unquestionably further erode the Medicare Trust Fund, jeopardizing the financing of beneficiaries’ hospital benefits. If parts of the law were overturned that increased federal spending for Medicare through higher payments to providers, …

What would happen to Medicare Part B premiums if the payment reductions repealed?

Here are three key effects that a repeal of the ACA would have: Higher spending on Medicare Part A and Part B, leading to higher premiums, deductibles and copayments for beneficiaries. Loss of key benefits. Under a complete repeal, beneficiaries would lose …

Would repealing the Affordable Health Care Act cost jobs?

Abstract. ISSUE: The Affordable Care Act enhanced Medicaid's role as a health care purchaser by expanding eligibility and broadening the range of tools and strategies available to states. All states have embraced delivery and payment reform as basic elements of their programs. GOAL: To examine the effects of reducing the size and scope of ...

How will repealing Obamacare affect Medicare?

What are the implications of repealing the Affordable Care Act for Medicare spending and beneficiaries?

What are the implications of repealing the Affordable Care Act?

Did the ACA expand Medicare?

What is a new benefit that the ACA added for Medicare beneficiaries?

How does the Affordable Care Act affect the elderly?

What effect will the repeal of the Patient Protection and Affordable Care Act have on health insurance markets?

Is Medicare Advantage the same as ObamaCare?

Can I have both Medicare and Obamacare?

What would happen if the ACA was repealed?

Overturning the ACA in its entirety would likely repeal these provisions, with implications for Medicare and its beneficiaries. Repealing the payroll tax increases would reduce revenues to the Medicare Hospital Insurance Trust Fund, which covers the costs of beneficiaries’ hospital visits and is currently projected to become insolvent in 2024. Repealing these provisions also would make preventive care more expensive.

What did the ACA do to Medicare?

The ACA reduced Medicare payments to many health care providers, such as hospitals, skilled nursing facilities, hospice, and home health providers. Because the law provided new sources of coverage for the uninsured, it also reduced Medicare Disproportionate Share Hospital payments that compensate hospitals for providing care to low-income and uninsured patients. The law also reformed payments to Medicare Advantage plans, required a minimum portion of plans’ premiums be spent on medical benefits (rather than administrative costs and profits), and added bonus payments for higher-quality plans.

What did the ACA do to hospitals?

In a shift toward value-based payments, the ACA imposed penalties on hospitals with higher rates of readmissions and avoidable infections and shifted payments from lower -performing to higher-performing hospitals. It also launched accountable care organizations (ACOs). Would these be allowed to continue? Would the Center for Medicare and Medicaid Innovation (CMMI) be shuttered, and likewise the Medicare–Medicaid Coordination Office? Doing so also would prevent implementation of some programs proposed by the Trump administration, such as using international reference pricing for drugs covered under Medicare.

How would overturning the Affordable Care Act affect Medicare?

Overturning the ACA would unquestionably further erode the Medicare Trust Fund, jeopardizing the financing of beneficiaries’ hospital benefits. If parts of the law were overturned that increased federal spending for Medicare through higher payments to providers, then all Medicare premiums, deductibles, and cost-sharing would increase. Medicare payments to health care providers also would be less predictable while policymakers sorted through the various questions, adding instability to a turbulent time. While the effects of overturning the Affordable Care Act on younger adults has received significant attention, the potential effects on Medicare should not be overlooked.

How many people will lose Medicare coverage?

But if the Supreme Court takes a broad approach, as the Trump administration has urged it to do, and strikes the law in its entirety — including the many Medicare-related provisions — not only will 20 million people lose health coverage, but virtually every patient, health care provider, and health plan in the United States could be affected.

Will the ACA repeal Medicare?

Overturning the ACA in its entirety would likely repeal these provisions, with implications for Medicare and its beneficiaries. Repealing the payroll tax increases would reduce revenues to the Medicare Hospital Insurance Trust Fund, which covers the costs of beneficiaries’ hospital visits and is currently projected to become insolvent in 2024.

Three Ways An Obamacare Repeal Would Affect Medicare

The new President and Congress are working to repeal the 2010 Affordable Care Act (ACA) — more commonly known as Obamacare. The healthcare law included many provisions that affect Medicare and the 57 million retired and disabled Americans who rely on Medicare for their health coverage.

Emergency Senior Stimulus

The Senior Citizens League will collect both online and print petitions and bring a collective voice to members of Congress urging them to issue a $1,400.00 stimulus check to Social Security recipients. Sign the Emergency Senior Stimulus Petition today!

How many people would lose their health insurance if the Affordable Care Act was repealed?

A cross the country, 29.8 million people would lose their health insurance if the Affordable Care Act were repealed—more than doubling the number of people without health insurance. And 1.2 million jobs would be lost —not just in health care but across the board.

How would losing health insurance affect the economy?

By helping pick up the tab for individual insurance and expanding coverage on Medicaid, the ACA has helped millions of Americans afford their care. If this support were withdrawn, people would have less money to spend on other basic necessities like food and rent. Fewer dollars spent at grocery stores and other businesses means 1.2 million jobs would be lost.

How did the ACA help the states?

The ACA encouraged states to view Medicaid as a vehicle for health care transformation in other ways. “Health homes,” for example, represent an explicit effort on the part of Congress to give states additional improvement tools for their most vulnerable patients. 6 Additionally, many of the ACA’s delivery and payment reforms—initially targeted chiefly at Medicare—were incorporated into Medicaid through regulations that gave states additional flexibility. These reforms include: promoting payment reform; 7 promoting use of integrated delivery and accountable care models 8 that already have begun to show measurable savings; 9 establishing a “state innovation model” initiative within the Center for Medicare and Medicaid Innovation; 10 and establishing a Medicaid Innovation Accelerator program, which aims to ensure that innovations in care are more rapidly disseminated to all states, with technical support available. 11 The ACA also acted to promote Medicaid managed care plans to better care for high-need, high-cost beneficiaries and to improve health care quality, efficiency, and health outcomes for people eligible for both Medicare and Medicaid. 12,13

What impact did the American Health Care Act have on the health care system?

The American Health Care Act, reported by the House Energy and Commerce and Ways and Means committees in March 2017, would eliminate the ACA’s enhanced funding to support the expansion population, among other changes.

How many people are on medicaid in 2016?

According to government statistics, as of October 2016, Medicaid enrollment surpassed 74 million. More than 17 million people—an increase of 30 percent—gained eligibility since October 2013, just before full implementation of the ACA. Although 19 states have not yet chosen to adopt the ACA’s adult Medicaid eligibility expansion, ...

How does fixed limit Medicaid funding help?

At least in theory, fixed limits on per person Medicaid funding could help foster innovation by encouraging strategies that substitute less costly but equally appropriate care, reduce excessive use of services of questionable value, or lower the price paid for care.

What is the goal of delivery and payment reform?

Goal: To examine the effects of reducing the size and scope of Medicaid under legislation to repeal the ACA. Findings and Conclusions: Were the ACA’s Medicaid expansion to be eliminated and were federal Medicaid funding to experience major reductions ...

What are the implications of the House bill?

Cuts of the type contained in the House bill carry major implications for payment and delivery reform. First and foremost, the CBO projects that elimination of enhanced funding for the ACA expansion population would lead states to roll back their expansions or forgo expansion in the first place, ultimately reducing the number of people covered by 17 percent by 2026—14 million fewer people annually. Without coverage there can be no delivery and payment reform.

How would Medicaid be transformed?

House of Representatives that would transform Medicaid, not only by eliminating enhanced federal funding for eligibility expansion but also by reducing the amount of funding states receive to run their traditional programs.

What is the ACA for Medicaid?

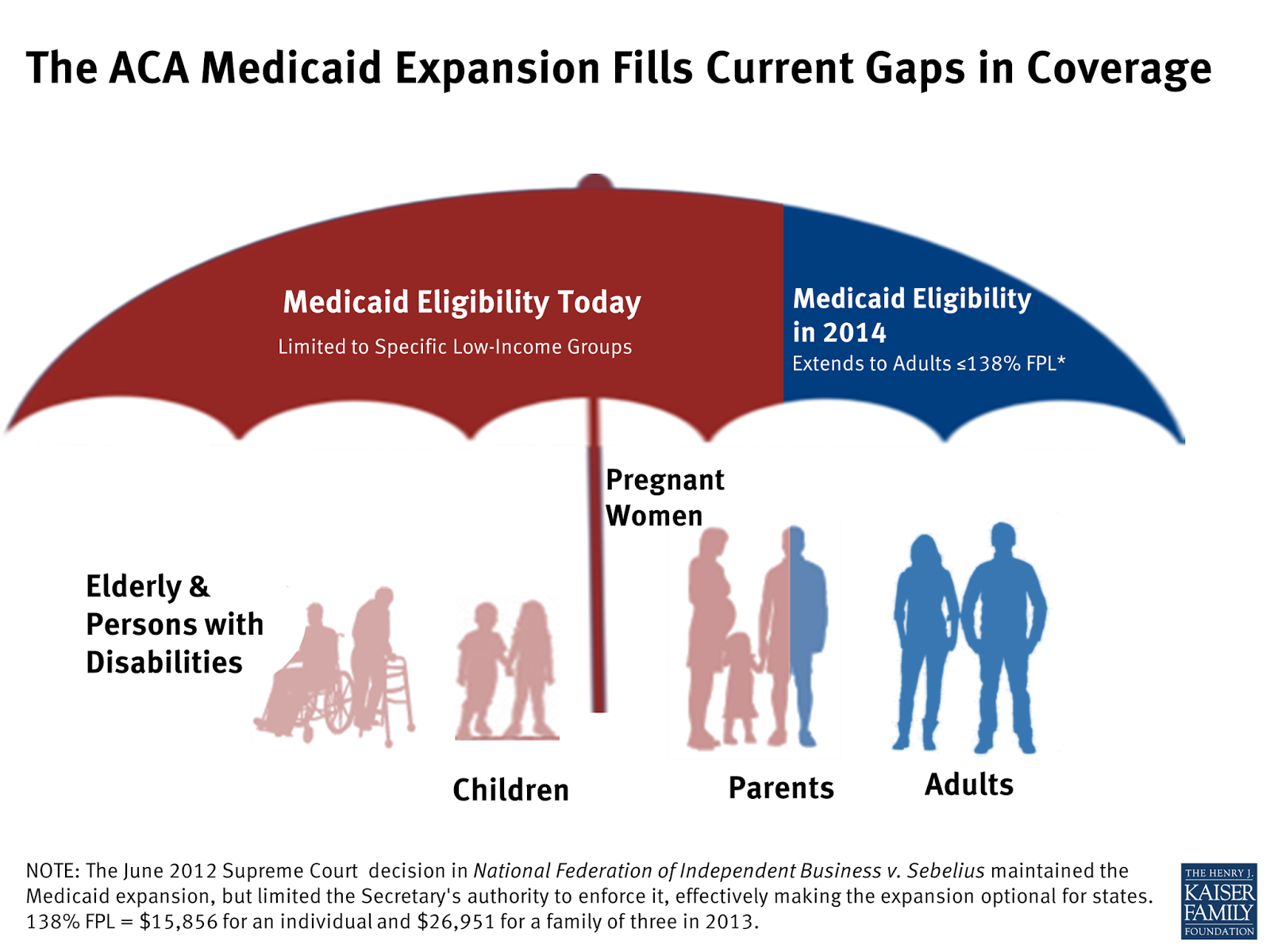

The ACA allows states to expand Medicaid eligibility to individuals with incomes at or below 138 percent of the federal poverty level. It permitted qualified non-elderly childless adults and other traditionally ineligible low-income people to enroll in Medicaid in all states.

What is the ACA?

The ACA ushered in a new platform for testing innovative, value-based payment and delivery system models to improve care and reduce costs. That platform is now instrumental in the implementation of the Quality Payment Program for physicians under Medicare, which was created under the Medicare Access and CHIP Reauthorization Act (MACRA).

What is the mandate for health insurance?

This is known as the individual mandate . Exemptions apply for some groups.

What would happen if the ACA was left in place?

Leaving the ACA’s market reforms in place would limit insurers’ ability to use strategies that were common before the ACA was enacted. For example, insurers would not be able to vary premiums to reflect an individual’s health care costs or offer health insurance plans that exclude coverage of preexisting conditions, plans that do not cover certain types of benefits (such as maternity care), or plans with very high deductibles or very low actuarial value (plans paying a very low share of costs for covered services).

How long after the repeal of the Medicaid expansion did the subsidies take effect?

The bill’s effects on insurance coverage and premiums would be greater once the repeal of the Medicaid expansion and the subsidies for insurance purchased through the marketplaces took effect, roughly two years after enactment. Effects on Insurance Coverage.

How will H.R. 3762 affect health insurance?

By CBO and JCT’s estimates, enacting H.R. 3762 would increase the number of people without health insurance coverage by about 27 million in the year following the elimination of the Medicaid expansion and marketplace subsidies and by 32 million in 2026, relative to the number of uninsured people expected under current law. (The number of people without health insurance would be smaller if, in addition to the changes in H.R. 3762, the insurance market reforms mentioned above were also repealed. In that case, the increase in the number of uninsured people would be about 21 million in the year following the elimination of the Medicaid expansion and marketplace subsidies; that figure would rise to about 23 million in 2026.)

What would happen if we eliminated the penalty for not having health insurance?

But eliminating the penalty for not having health insurance would reduce enrollment and raise premiums in the nongroup market. Eliminating subsidies for insurance purchased through the marketplaces would have the same effects because it would result in a large price increase for many people.

How would H.R. 3762 affect premiums?

3762’s changes into their premium pricing in the first new plan year after enactment. The majority of that increase would stem from repealing the penalties associated with the individual mandate. Doing so would both reduce the number of people purchasing health insurance and change the mix of people with insurance—tending to cause smaller reductions in coverage among older and less healthy people with high health care costs and larger reductions among younger and healthier people with low health care costs. Thus, average health care costs among the people retaining coverage would be higher, and insurers would have to raise premiums in the nongroup market to cover those higher costs. Lower participation by insurers in the nongroup market would place further upward pressure on premiums because the market would be less competitive.

What was the impact of H.R. 3762?

3762, the Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015, which would repeal portions of the Affordable Care Act (ACA) eliminating, in two steps, the law’s mandate penalties and subsidies but leaving the ACA’s insurance market reforms in place. At that time, CBO and JCT offered a partial assessment of how H.R. 3762 would affect health insurance coverage, but they had not estimated the changes in coverage or premiums that would result from leaving the market reforms in place while repealing the mandate penalties and subsidies. This document—prepared at the request of the Senate Minority Leader, the Ranking Member of the Senate Committee on Finance, and the Ranking Member of the Senate Committee on Health, Education, Labor, and Pensions provides such an estimate.

How many people will not have medicaid in 2026?

The estimated increase of 32 million people without coverage in 2026 is the net result of roughly 23 million fewer with coverage in the nongroup market and 19 million fewer with coverage under Medicaid, partially offset by an increase of about 11 million people covered by employment-based insurance.