What is Section 1324 (a) of the Affordable Care Act?

Section 1324 (a) of the Patient Protection and Affordable Care Act ( 42 U.S.C. 18044 (a)) is amended by inserting the Medicare Transition plan, before or a multi-State qualified health plan. 1011. Medicare protection against high out-of-pocket expenditures for fee-for-service benefits and elimination of parts A and B deductibles

When is the monthly premium determined under the Medicare for all act?

The Secretary shall, during September of each year (beginning with the first September following the date of enactment of the Medicare for All Act of 2017), determine a monthly premium for all individuals enrolled under this section.

What is the annual out-of-Pocket Threshold under the Medicare for all act?

Subject to subclause (II), for plan years beginning on or after January 1 following the date of enactment of the Medicare for All Act of 2017 and before January 1 of the year that is 4 years following such date of enactment, notwithstanding clauses (i) and (ii), the annual out-of-pocket threshold specified in this subparagraph is equal to $305.

What is the table of contents for the Medicare for all act?

This Act may be cited as the Medicare for All Act of 2017. The table of contents for this Act is as follows: Sec. 1. Short title; table of contents. TITLE I—Establishment of the Universal Medicare Program; universal entitlement; enrollment

Who proposed the Medicare for All?

Representative John ConyersThe Expanded and Improved Medicare for All Act, also known as Medicare for All or United States National Health Care Act, is a bill first introduced in the United States House of Representatives by Representative John Conyers (D-MI) in 2003, with 38 co-sponsors.

What was passed by Congress in 1965 designed to assist in the payment of medical bills for the elderly?

On July 30, 1965, President Lyndon B. Johnson signed the Medicare and Medicaid Act, also known as the Social Security Amendments of 1965, into law. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for people with limited income.

Who co sponsored Medicare for All?

It is co-sponsored by 120 members of Congress in the House; similar legislation was introduced in the Senate last Congress by CPC co-founder Senator Bernie Sanders (I-VT).

What president was responsible for Medicare?

President Lyndon JohnsonOn July 30, 1965, President Lyndon Johnson traveled to the Truman Library in Independence, Missouri, to sign Medicare into law.

Is the government healthcare program for some poor Americans which was enacted in 1965 with the Social Security Act Amendments?

On July 30, 1965, President Lyndon B. Johnson signed into law the Social Security Act Amendments, popularly known as the Medicare bill. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for the poor.

Why was Medicare passed?

The Medicare program was signed into law in 1965 to provide health coverage and increased financial security for older Americans who were not well served in an insurance market characterized by employment-linked group coverage.

How many senators support Medicare for All?

Bernie Sanders (I-Vt.) and fourteen of his colleagues in the Senate on Thursday introduced the Medicare for All Act of 2022 to guarantee health care in the United States as a fundamental human right to all.

What are the pros of Medicare for All?

Pros and Cons of Medicare for All. The most significant benefit to Medicare for All is that the government covers healthcare costs while ensuring doctors provide reasonably affordable quality care. In theory, universal healthcare leads to a healthier society and workforce.

Is Medicare for All universal healthcare?

In the U.S., Medicare and the VA system are both examples of single-payer health coverage, as they're funded by the federal government. But the U.S. does not have universal coverage, nor does it have a single-payer system available to all residents.

What issues AARP oppose?

9 Reasons Not to JoinYou Oppose Socialized Medicine. ... You Oppose Regionalism. ... You Oppose Government “Safety Nets” ... You Don't Believe in Climate Change. ... You Oppose Mail-in Voting. ... You Oppose Forced Viral Testing, Masking, or Social Distancing. ... You Do Not Like Contact Tracing. ... You Do Not Like AARP's Barrage of Political Emails.More items...•

Is Medicare under Social Security?

If you're on SSDI benefits, you won't have to pay a Medicare Part A premium. If you are eligible for Medi-Cal and Medicare, you will automatically be enrolled in Medicare Part D.

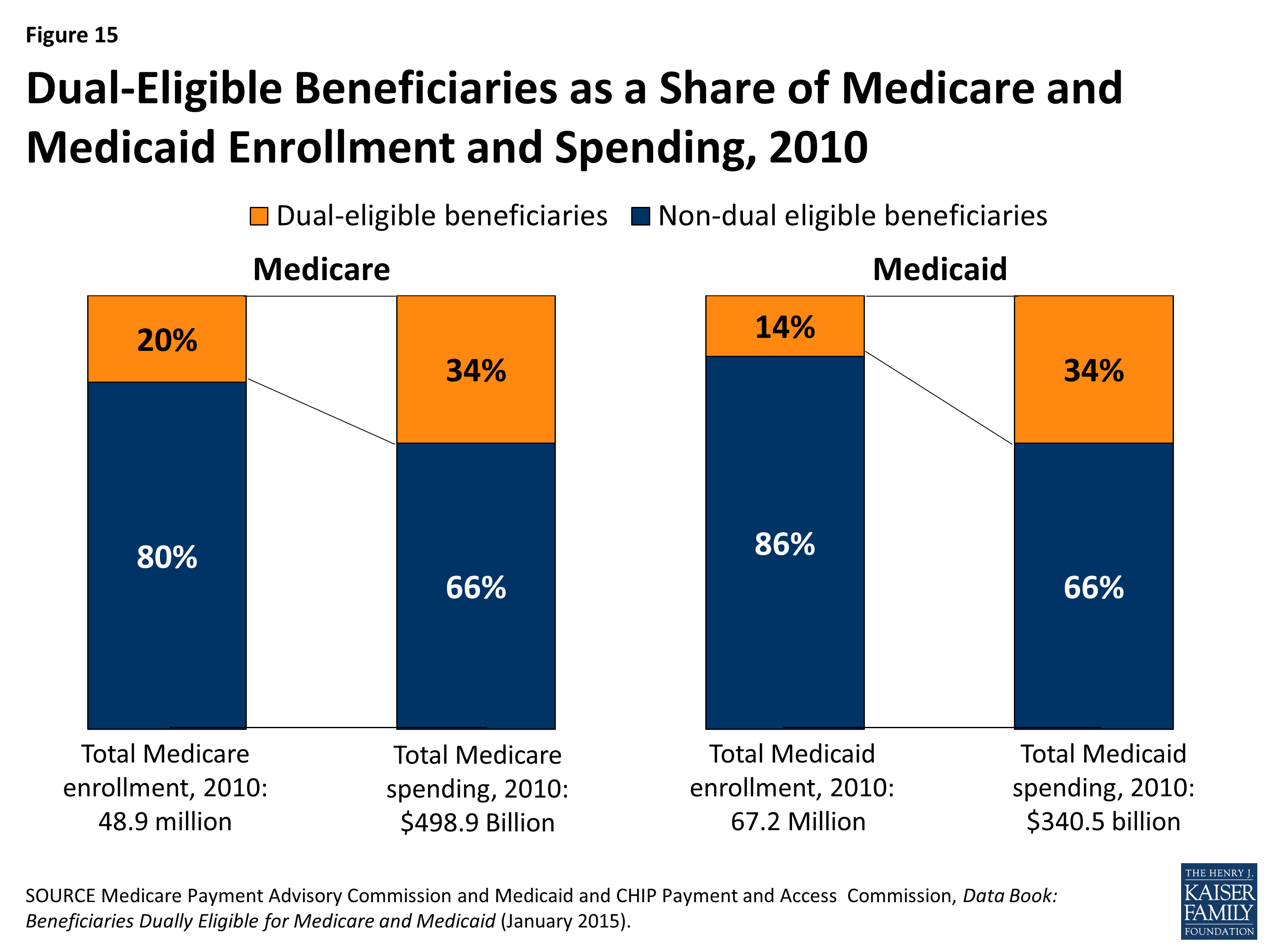

What percentage of the US population is on Medicare and Medicaid?

Of the subtypes of health insurance coverage, employment-based insurance was the most common, covering 54.4 percent of the population for some or all of the calendar year, followed by Medicare (18.4 percent), Medicaid (17.8 percent), direct-purchase coverage (10.5 percent), TRICARE (2.8 percent), and Department of ...

THE MEDICARE-FOR-ALL ACT OF 2017 (S.1804)

Senator Bernie Sanders speaking at a rally for the 50th anniversary of Medicare in 2015.

Executive Summary of the Legislation

This bill establishes a federally administered Medicare-for-all national health insurance program that will be implemented over a four year period.

S. 1804 (115th) was a bill in the United States Congress

A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law.

Where is this information from?

GovTrack automatically collects legislative information from a variety of governmental and non-governmental sources. This page is sourced primarily from Congress.gov, the official portal of the United States Congress. Congress.gov is generally updated one day after events occur, and so legislative activity shown here may be one day behind.

Who is entitled to health care benefits under the Health Care Act?

Every individual who is a resident of the United States is entitled to benefits for health care services under this Act. The Secretary shall promulgate a rule that provides criteria for determining residency for eligibility purposes under this Act.

What is the Social Security Act?

Except as otherwise provided in this section, the Secretary shall establish, by regulation, fee schedules that establish payment amounts for benefits under this Act in a manner that is consistent with processes for determining payments for items and services under title XVIII of the Social Security Act ( 42 U.S.C. 1395 et seq.), including the application of the provisions of, and amendments made by, section 612.

What is Medicare Transition Plan?

To carry out the purpose of this section, for plan years beginning with the first plan year that begins after the date of enactment of this Act and ending with the effective date described in section 106, the Secretary, acting through the Administrator of the Centers for Medicare & Medicaid (referred to in this section as the Administrator ), shall establish, and provide for the offering through the Exchanges, of a public health plan (in this Act referred to as the Medicare Transition plan) that provides affordable, high-quality health benefits coverage throughout the United States.

What is the purpose of the National Health Insurance Program?

There is hereby established a national health insurance program to provide comprehensive protection against the costs of health care and health-related services, in accordance with the standards specified in, or established under, this Act.

Who appoints the Beneficiary Ombudsman?

The Secretary shall appoint a Beneficiary Ombudsman who shall have expertise and experience in the fields of health care and education of, and assistance to, individuals entitled to benefits under this Act.

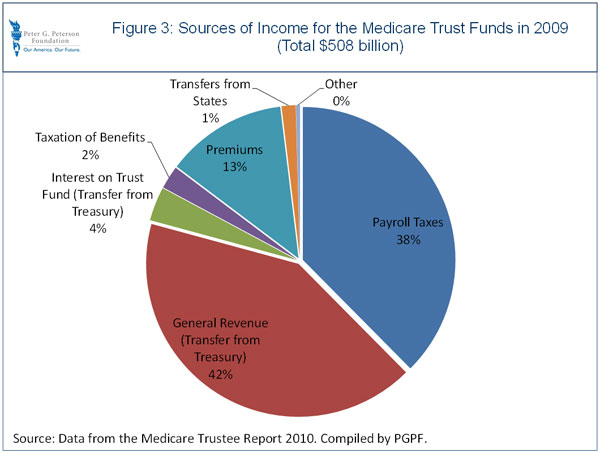

What percentage of Medicare is paid after 200,000?

After $200,000 of wages, Medicare contributions tick up from 1.45 percent to 2.35 percent and continue at that level for the rest of the wages. The employee-side payroll taxes currently look like this: Unlike the employer-side taxes, there is no contribution to unemployment insurance.

What research institute ran the numbers on Medicare for All?

The Political Economy Research Institute ( PERI) also ran the numbers on Medicare for All and found the savings realized by switching to such a system to be significantly greater than what Mercatus reported.

How much will we spend on healthcare in 2022?

According to the Mercatus Center, Americans are set to spend $59.7 trillion on health care between 2022 and 2031 under our status quo healthcare system. Because of its enormous efficiencies, switching to a Medicare for All system would cut that figure down to $57.6 trillion even while covering 30 million more Americans, eliminating cost-sharing, ...

When we transition to Medicare for All, should we convert all of the payroll taxes to flat taxes?

When we transition to Medicare for All, we should convert all of the payroll taxes to flat taxes. This will ensure that the middle class winds up, as promised, with better health care at a lower price, and provide a cushion for low-earners on Medicaid so that they do not see a cut back in disposable income.

Is Medicare for All better than Medicaid?

Lastly, Medicare for All as proposed does actually give them better insurance than Medicaid. But nonetheless, if you want to address that distributive issue, then the easiest way to do it is by cutting down the high payroll taxes low-earners pay.

Can you borrow money from the government to bridge the gap between Medicare and the employer side?

In order to bridge the gap from year one of the program until the employer-side Medicare tax reaches its necessary level, you can just have the government borrow money . Using a one-off increase in the national debt to facilitate a transition into Medicare for All is as good a use of Treasury bonds as any other.

Is Medicare for All distributive?

One of the main distributive criticisms people make against Medicare for All is that many low-earners already receive free government health insurance in the form of Medicaid and so moving them onto Medicare while also making them pay higher taxes will leave them worse off overall.