You are eligible to sign up for a Medicare Advantage plan in Pennsylvania if you have Original Medicare, Part A and Part B; do not have end-stage renal disease (ESRD, or permanent kidney failure) with some exceptions; and you live in the Medicare Advantage plan’s service area.

What is the income limit for Medicaid in PA?

What is the income limit for Medicaid in PA 2021? $130,380 The 2021 maximum is $130,380, and the 2021 minimum is $26,076. What is the income limit for Medicaid in Pennsylvania? Who is eligible for Pennsylvania Medicaid Program?

What are the requirements for Medicaid in PA?

- Payment Limit Demonstrations

- Disproportionate Share Hospitals

- Medicaid Administrative Claiming

- State Budget & Expenditure Reporting for Medicaid and CHIP

- Provider Preventable Conditions

- Actuarial Report on the Financial Outlook for Medicaid

- Section 223 Demonstration Program to Improve Community Mental Health Services

How can I qualify for Medicaid in PA?

Table of Contents

- Pennsylvania Medicaid Definition. Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages.

- Income & Asset Limits for Eligibility. ...

- Qualifying When Over the Limits. ...

- Specific Pennsylvania Medicaid Programs. ...

What are the requirements to receive Medicare?

- Scope of Coverage. Rural health clinics/federally qualified health centers. ...

- Covered Personnel. The IFR requires vaccinations for staff who routinely perform care for patients and clients inside and outside of the facility, such as home health, home infusion therapy, hospice, ...

- Definition of Full Vaccination. ...

- Exemptions. ...

What are 3 ways to qualify for Medicare?

Who is Eligible for Medicare? You are eligible for Medicare if you are a citizen of the United States or have been a legal resident for at least 5 years and: You are age 65 or older and you or your spouse has worked for at least 10 years (or 40 quarters) in Medicare-covered employment.

How does an individual qualify for Medicare?

Medicare is health insurance for people 65 or older. You're first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig's disease).

What is the income limit for Medicare in PA?

This income limit, now $2,523 /month, normally changes on January 1st of each year. This monthly figure represents 300% of the federal SSI benefit amount and is usually revised upwards each year due to inflation. $2,523 is the income threshold amount for 2022.

Who is eligible for Medicare and Medicaid in PA?

Adults age 19-64 with incomes at or below 133% of the Federal Income Poverty Guidelines (FPIG) (Identified for Medical Assistance purposes as MAGI-related) Individuals who are aged (age 65 and older), blind and disabled. (Identified for Medical Assistance purposes as SSI-related) Families with children under age 21.

Can I get Medicare if I never worked?

You can still get Medicare if you never worked, but it will likely be more expensive. Unless you worked and paid Medicare taxes for 10 years — also measured as 40 quarters — you will have to pay a monthly premium for Part A. This may differ depending on your spouse or if you spent some time in the workforce.

Can I get Medicare without Social Security?

Even if you don't qualify for Social Security, you can sign up for Medicare at 65 as long you are a U.S. citizen or lawful permanent resident.

What is considered low income in PA?

2022 POVERTY INCOME GUIDELINES CONTIGUOUS STATES U.S. GRANTEES EFFECTIVE January 12, 2022House Hold/Family Size100%200%1$13,590$27,1802$18,310$36,6203$23,030$46,0604$27,750$55,5004 more rows

What is the monthly income limit for medical assistance in PA 2021?

Specified Low-Income Medicare Beneficiary (SLMB) ProgramNumber of Persons2021 Federal Poverty Level (FPIG)Monthly Income Limit (FPIG + $20 Deductible = Limit)2At least 100 percent but less than 120 percent$1,452 + $20 = $1,472 Less than $1,742 + $20 = $1,7621 more row

What is the asset limit for Medicaid in Pennsylvania?

The MNO-MA asset limits are $2,400 for an individual and $3,200 for a couple. There is no additional asset disregard. More about the medically needy pathway. 2) Asset Spend Down – Seniors who have assets over Medicaid's limit can still become Medicaid eligible by spending down extra assets.

Can you have both Medicare and Medicaid in Pennsylvania?

Partial dual eligibles are people that have Medicare and who receive limited benefits through Medicaid (called Medical Assistance or “MA” in Pennsylvania). Often, the only benefit partial dual eligibles get is MA payment of their monthly Part B premium-known as the Medicare Savings Programs or “buy-in”.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

Who is qualified for Medicaid?

Medicaid beneficiaries generally must be residents of the state in which they are receiving Medicaid. They must be either citizens of the United States or certain qualified non-citizens, such as lawful permanent residents. In addition, some eligibility groups are limited by age, or by pregnancy or parenting status.

How do I get Medicare in PA?

You are eligible to get Medicare in Pennsylvania if you’re a U.S. citizen age 65 or older. You can be eligible for Medicare before 65 if:

How to enroll in Medicare in Pennsylvania?

You can enroll online with the Social Security Administration.[i]You can enroll via phone by calling 1-800-772-1213 (TTY: 1-800-325-0778).You can e...

What does Medicare Cover in PA?

Medicare is a health insurance program that provides hospital and medical coverage for Americans ages 65 and over, and those under 65 with qualifyi...

How much does Medicare cost in PA?

Premiums for Medicare in PA can vary, regardless of whether you choose Parts A and B, Part C or D, or a supplement plan. For most people that enrol...

What is the Best Medicare Supplement Plan in Pennsylvania?

Private insurance companies offer Medigap, a supplemental plan that helps fill cost gaps to Original Medicare. Whether or not a plan is right for y...

What are the Different Plans of Medicare?

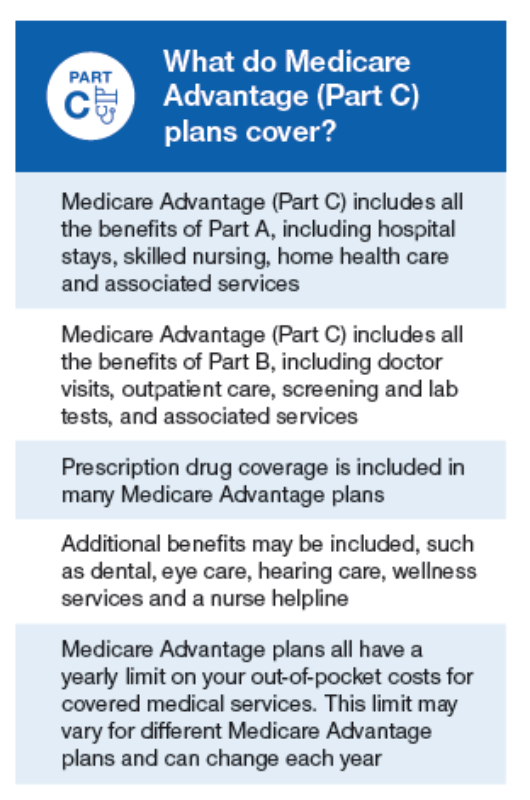

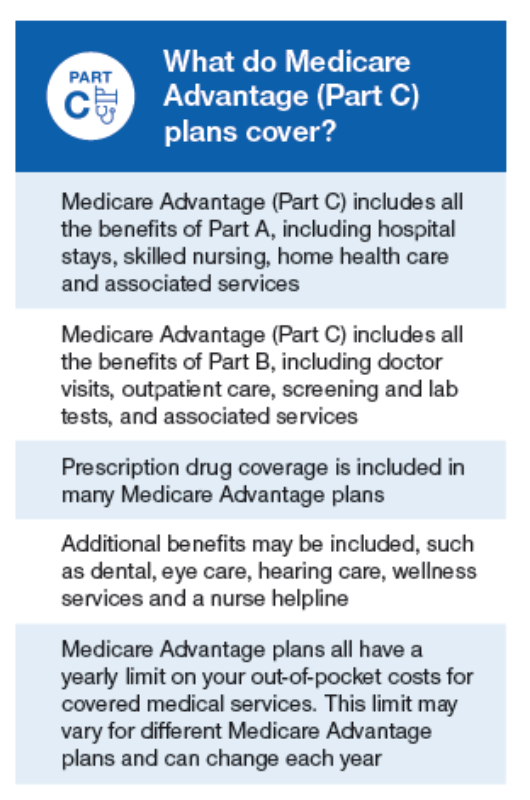

Medicare Advantage plans bundle services, and this is a fundamental difference between Medicare plans in Pennsylvania.

What is the Best Medicare Advantage Plan in Pennsylvania?

While there is a standard Original Medicare plan, Medicare Advantage in Pennsylvania offers multiple plan options to meet your needs and improve yo...

Key Takeaways

Applying for Medicare in Pennsylvania when you approach age 65 is easy, but it’s important that you understand the coverage and costs involved.

How do I get Medicare in PA?

You are eligible to get Medicare in Pennsylvania if you’re a U.S. citizen age 65 or older. You can be eligible for Medicare before 65 if:

What does Medicare Cover in PA?

Medicare is a health insurance program that provides hospital and medical coverage for Americans ages 65 and over, and those under 65 with qualifying disabilities.

How much does Medicare cost in PA?

Premiums for Medicare in PA can vary, regardless of whether you choose Parts A and B, Part C or D, or a supplement plan. For most people that enroll in Medicare in PA, Part A and Part B have standard costs that depend on your income and whether or not you’ve paid enough tax into Medicare and Social Security. Here’s a breakdown:

What is the Best Medicare Supplement Plan in Pennsylvania?

Private insurance companies offer Medigap, a supplemental plan that helps fill cost gaps to Original Medicare. Whether or not a plan is right for you depends on what you need covered in terms deductibles, copays and coinsurance.

What are the Different Plans of Medicare?

Medicare Advantage plans bundle services, and this is a fundamental difference between Medicare plans in Pennsylvania.

What is the Best Medicare Advantage Plan in Pennsylvania?

While there is a standard Original Medicare plan, Medicare Advantage in Pennsylvania offers multiple plan options to meet your needs and improve your coverage effectiveness. A GoHealth licensed insurance agent specializes in guiding you through the strengths of various plans, helping you make an educated decision.

How many Medicare plans are there in Pennsylvania?

There are 66 insurers that offer Medicare plans in Pennsylvania as of 2020.

How many people are covered by Medicare in Pennsylvania?

Key takeaways. Medicare enrollment in Pennsylvania covers nearly 2.8 million residents. Only one county in Pennsylvania has fewer than 30 Medicare Advantage plans available, and some have more than 70. 45 percent of Pennsylvania beneficiaries have coverage under Medicare Advantage plans (instead of Original Medicare).

How much is Medicare Advantage 2020 in Pennsylvania?

In 2020, there are 31 stand-alone Medicare Part D plans for sale in Pennsylvania, with monthly premiums that range from about $13 to $168. As of mid-2020, there were 1,116,231 beneficiaries of Medicare in Pennsylvania with stand-alone Part D coverage, and another 1,077,018 had Part D coverage integrated with Medicare Advantage plans.

What percentage of Pennsylvania's Medicare beneficiaries are in Medicare Advantage plans?

In Pennsylvania in 2018, 40 percent of Medicare beneficiaries were enrolled in Medicare Advantage plans (at that point, nationwide Medicare Advantage enrollment covered 34 percent of Medicare beneficiaries). But by the middle of 2020, private Medicare coverage enrollment had grown to nearly 45 percent of Pennsylvania’s Medicare population.

How long do you have to wait to get Medicare?

For most Americans, eligibility for Medicare benefits is tied to turning 65. But Medicare eligibility is also triggered when a person has been receiving disability benefits for at least two years (people with ALS or end-stage renal disease do not have to wait two years for their Medicare enrollment to begin).

What is Medicare Advantage?

The first choice is between Medicare Advantage plans, where coverage is through private Medicare Advantage plans, or Original Medicare, where coverage is paid for directly by the federal government.

What percentage of Pennsylvania's population is covered by Medicare?

But by the middle of 2020, private Medicare coverage enrollment had grown to nearly 45 percent of Pennsylvania’s Medicare population. Enrollment in Medicare Advantage plans has been steadily increasing since the early 2000s, and Medicare Advantage enrollment in Pennsylvania is running a little higher than the national average.

How to Apply

There are different ways to apply for MA. Please choose the option that suits you best. If you do not know if you are eligible, you can still apply.

What if I am not eligible?

Contact your CAO and a trained staff member will determine what programs might be available to you. You can explore these links to learn about additional health care programs available in Pennsylvania.

Where can I find information about providers accepting MA patients?

If you are eligible for MA, you may call the Fee-for-Service Recipient Service Center at 1-800-537-8862. They will provide you with a list of enrolled providers for MA patients.

What is Medicaid in Pennsylvania?

Pennsylvania Medicaid Definition. Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. However, this page is focused on Medicaid eligibility, specifically for Pennsylvania residents, aged 65 and over, and specifically for long term care, whether that be at home, ...

How to apply for long term care in Pennsylvania?

To apply for long-term care Medicaid, elderly Pennsylvania residents can do so online at COMPASS or fill out a paper application, “ Medical Assistance (Medicaid) Financial Eligibility Application for Long Term Care, Supports and Services ” and either drop it off or mail it to their local County Assistance Office (CAO).

How long is the Medicaid spend down period in Pennsylvania?

Pennsylvania has a six-month “spend-down” period, so once an individual / couple has paid their excess income down to the Medicaid eligibility limit for the period, they will qualify for the remainder of the period.

What income is counted for Medicaid?

Examples include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, IRA withdrawals, and stock dividends.

When only one spouse of a married couple is applying for nursing home Medicaid or a Medicaid waiver, is the income

When only one spouse of a married couple is applying for nursing home Medicaid or a Medicaid waiver, only the income of the applicant is counted. Said another way, the income of the non-applicant spouse is disregarded.

What are countable assets for Medicaid?

Countable assets include stocks, bonds, investments, savings, and checking accounts. However, for Medicaid eligibility, there are many assets that are considered exempt (non-countable). For instance, Pennsylvania allows an extra $6,000 exemption, which is in addition to the asset limits listed above, for a total asset limit of $8,000. ...

Does the Medically Needy Pathway help with Medicaid?

Unfortunately, the Medically Needy Pathway does not assist one in spending down extra assets for Medicaid qualification. Said another way, if one meets the income requirements for Medicaid eligibility, but not the asset requirement, the above program cannot assist one in reducing their extra assets.

What is the income limit for Medicare in Pennsylvania?

Qualified Medicare Beneficiary (QMB): The income limit is $1,063 ...

What is the minimum income for HCBS in Pennsylvania?

The monthly income limits to be eligible for HCBS in Pennsylvania are $2,349 (single) and $4,698 (married and both spouses are applying). Spousal impoverishment rules in Pennsylvania allow spouses who don’t have Medicaid to keep a Minimum Monthly Maintenance Needs Allowance that is between $2,155 and $3,216 per month.

How much does Medicare pay for nursing home care?

Income limits: The income limit is $2,349 a month if single and $4,698 a month if married (and both spouses are applying ). This income limit doesn’t mean nursing home enrollees can keep all of their income up to this level.

How much equity can a nursing home have?

These levels are set based on a federal minimum of $595,000 and maximum of $893,000.

How much can a spouse keep on Medicaid?

If only one spouse has Medicaid, the other spouse can keep up to $128,640. Certain assets are never counted, including many household effects, family heirlooms, certain prepaid burial arrangements, and one car. Nursing home enrollees also can’t have more than $595,000 in home equity. Back to top.

When did Medicare and Medicaid start paying for estate recovery?

Congress exempted Medicare premiums and cost sharing from Medicaid estate recovery starting with benefits paid starting on January 1, 2010. Here are answers to frequently asked questions about estate recovery in Pennsylvania.

What is the Medicaid spend down limit in Pennsylvania?

Income eligibility: The income limit is $425 a month if single and $442 a month if married (as of 2018). Asset limits: The asset limit is $2,400 if single and $3,200 if married.

What is the SSN for medical assistance?

Identity — Identity can be verified by a driver's license, state identification card or another piece of identification. Social Security Number (SSN) — A SSN must be provided for each person applying for Medical Assistance. County Assistance Office staff will help you apply for an SSN for anyone who does not have one.

How is medical assistance determined?

Medical Assistance eligibility is determined using income and household size in comparison to income limits. Age and disability are also factors in determining which income limits apply. (Income limits for the various eligibility groups are listed below.) Examples of income counted in determining eligibility include:

What are some examples of income counted in determining eligibility?

Examples of income counted in determining eligibility include: Wages (certain deductions are allowed) Interest. Dividends. Social Security. Veterans' Benefits (except for MAGI MA) Pensions. Spouse's income if living with him/her. Examples of income not counted when determining eligibility include:

When will Medicare become the main health insurance?

July 08, 2020. Most Americans understand that when they turn 65, Medicare will become their main health insurance plan. However, many Americans are less familiar with another health care program, Medicaid, and what it means if they are eligible for both Medicare and Medicaid. If you are dual eligible, Medicaid may pay for your Medicare ...

What is dual eligible for medicaid?

Qualifications for Medicaid vary by state, but, generally, people who qualify for full dual eligible coverage are recipients of Supplemental Security Income (SSI). The SSI program provides cash assistance to people who are aged, blind, or disabled to help them meet basic food and housing needs.

What is Medicare Advantage?

Medicare Advantage plans are private insurance health plans that provide all Part A and Part B services. Many also offer prescription drug coverage and other supplemental benefits. Similar to how Medicaid works with Original Medicare, Medicaid wraps around the services provided by the Medicare Advantage plan andserves as a payer of last resort.

What is dual eligible?

The term “full dual eligible” refers to individuals who are enrolled in Medicare and receive full Medicaid benefits. Individuals who receive assistance from Medicaid to pay for Medicare premiums or cost sharing* are known as “partial dual eligible.”.

What is Medicaid managed care?

Medicaid managed care is similar to Medicare Advantage, in that states contract with private insurance health plans to manage and deliver the care. In some states, the Medicaid managed care plan is responsible for coordinating the Medicare and Medicaid services and payments.

What is a PACE plan?

Similar to D-SNPs, PACE plans provide medical and social services to frail and elderly individuals (most of whom are dual eligible). PACE operates through a “health home”-type model, where an interdisciplinary team of health care physicians and other providers work together to provide coordinated care to the patient. PACE plans also focus on helping enrollees receive care in their homes or in the community, with the goal of avoiding placement in nursing homes or other long-term care institutions.

Does Medicare cover Part A and Part B?

Some Medicare beneficiaries may choose to receive their services through the Original Medicare Program. In this case, they receive the Part A and Part B services directly through a plan administered by the federal government, which pays providers on a fee-for-service (FFS) basis. In this case, Medicaid would “wrap around” Medicare coverage by paying for services not covered by Medicare or by covering premium and cost-sharing payments, depending on whether the beneficiary is a full or partial dual eligible.