What does the tax cuts and Jobs Act mean for Medicare?

Editor’s Note: This article was originally published on April 09, 2018. While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals.

What is the impact of Medicare on the economy?

Medicare is one of the largest health insurance programs in the world, accounting for 20% of healthcare expenditures, one-eighth of the Federal Budget, and more than 3% of the Nation’s Gross Domestic Product (GDP). Its impact upon healthcare, the economy, and American life generally has been significant: 1. Financial Benefit to the Elderly

Are Medicare benefits taxable?

Basic Medicare benefits under part A (hospital benefits) are not taxable. Supplementary Medicare benefits under part B (coverage of doctors’ services and other items) are not taxable unless the premiums were previously deducted. That being said, social security benefits used to purchase Medicare Part B remain taxable.

What does the Medicare reforms mean for You?

A federal summary of the changes reveals a long list of reforms intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

Does Filing taxes affect Medicare?

Medicare premium deductions are for your income taxes (federal, state, and local). They do not impact your self-employment taxes, which include taxes to fund the Medicare and Social Security programs. So you'll still pay the same amount in self-employment taxes, regardless of whether you deduct your Medicare premiums.

How did Obamacare affect Medicare?

The ACA made myriad changes to Medicare. Some changes improved the program's benefits. Others reduced Medicare payments to health care providers and private plans and extended the financial viability of the program. Still others provided incentives and created programs to encourage the system to provide better care.

What of taxes go to Medicare?

FICA taxes include money taken out to pay for older Americans' Social Security and Medicare benefits. Both you and your employer pay the Medicare Tax as a part of FICA. Your total FICA taxes equal 15.3 percent of your wages — 2.9 percent for Medicare and 12.4 percent for Social Security.

Why are taxes taken out for Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

Did Obamacare expand Medicare?

Obamacare's expanded Medicare preventive coverage applies to all Medicare beneficiaries, whether they have Original Medicare or a Medicare Advantage plan.

What is the difference between Obamacare and Medicare?

Main Differences Between Medicare and the ACA (Obamacare) In the simplest terms, the main difference between understanding Medicare and Obamacare is that Obamacare refers to private health plans available through the Health Insurance Marketplace while Original Medicare is provided through the federal government.

How is Medicare funded now?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare.

Is Medicare subsidized by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.

Why did my Medicare withholding go up?

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax ( 0.9% ) on earned income. All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax.

What is the Medicare tax limit for 2021?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Who is exempt from paying Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

Which states did not expand Medicaid?

Texas— a state that didn’t expand its Medicaid program—has been the largest beneficiary of this change, gaining a significant increase in its inpatient reimbursement. Hospitals in New York and other states, on the other hand, will see declining reimbursement rates due to their Medicaid expansion and other factors.

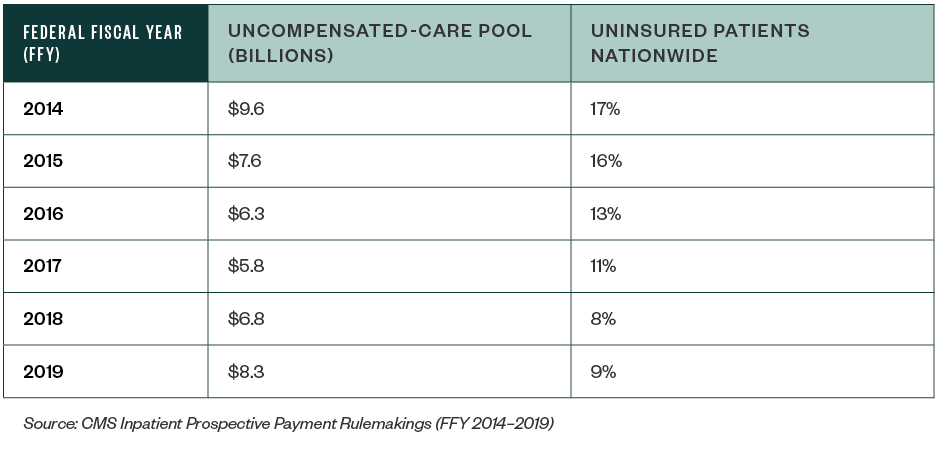

How does the federal government use the number of uninsured patients?

Under the ACA, the federal government uses the number of uninsured patients—which has steadily declined since 2014—to determine the amount that needs to be diverted from the uncompensated-care pool to other programs under the ACA.

When did the individual mandate penalty end?

The recently enacted tax-reform law, commonly known as the Tax Cuts and Jobs Act of 2017 (TCJA), eliminated the individual mandate penalty beginning in 2019—a move which the Congressional Budget Office (CBO) estimates will result in the following changes: