How is Medicare funded by the government?

There is less awareness about how the cost of Medicare benefits is funded by the government. Kaiser Family Foundation (KFF) examined the sources of Medicare funding in 2018. Medicare recipients may be surprised to learn that payroll taxes accounted for only 36%; the federal government’s general fund, 43%; and premiums, a mere 15%.

How is Medicare paid for?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed

Is Medicare a state or federal program?

Medicare is a federal program The US Congress authorized Medicare in 1966 Medicare funds come from federal taxes, consumer payments, and premiums The Centers for Medicare and Medicaid administer Medicare

How much of Medicare revenue comes from payroll taxes?

Medicare recipients may be surprised to learn that payroll taxes accounted for only 36%; the federal government’s general fund, 43%; and premiums, a mere 15%. The remaining revenue came from transfers from states, Social Security benefit taxes and earned interest.

How does Medicare get funded?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Is Medicare paid for by the government?

Is Medicare funded by the state or federal government? Medicare is a federal program, and as a result, the vast majority of Medicare funding comes from the federal government. However, state governments do make a small contribution for enrollees who qualify for both Medicare and Medicaid.

Is Medicare paid for by taxpayers?

Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

How much money does the government contribute to Medicare?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending.

Who paid for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How much of our taxes go to healthcare?

How much does the federal government spend on health care? The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion. The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1).

How does the US pay for healthcare?

Federal taxes fund public insurance programs, such as Medicare, Medicaid, CHIP, and military health insurance programs (Veteran's Health Administration, TRICARE). The Centers for Medicare and Medicaid Services is the largest governmental source of health coverage funding.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

Would Medicare For All Save Billions Or Cost Billions

How much would a Medicare for all plan, like the kind endorsed by the Democratic presidential candidates Bernie Sanders and Elizabeth Warren, change health spending in the United States?

What Does Medicare Part C Cover

A Medicare Part C plan will cover the same medical services as Original Medicare. That means plans will cover doctors, hospital care and many other types of health services. Coverage includes:

Income Related Adjustment Amounts

The cost of your premium can be affected by your income level. The higher your income, the more youll be asked to pay in premiums. The income used to determine your premium payment is based on the income you reported on your IRS tax return from two years prior. See the table below.5

The Medicare Part D Donut Hole Coverage Gap

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

Nhe By Age Group And Gender Selected Years 2002 2004 2006 2008 2010 2012 And 201

Per person personal health care spending for the 65 and older population was $19,098 in 2014, over 5 times higher than spending per child and almost 3 times the spending per working-age person .

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care.

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes.

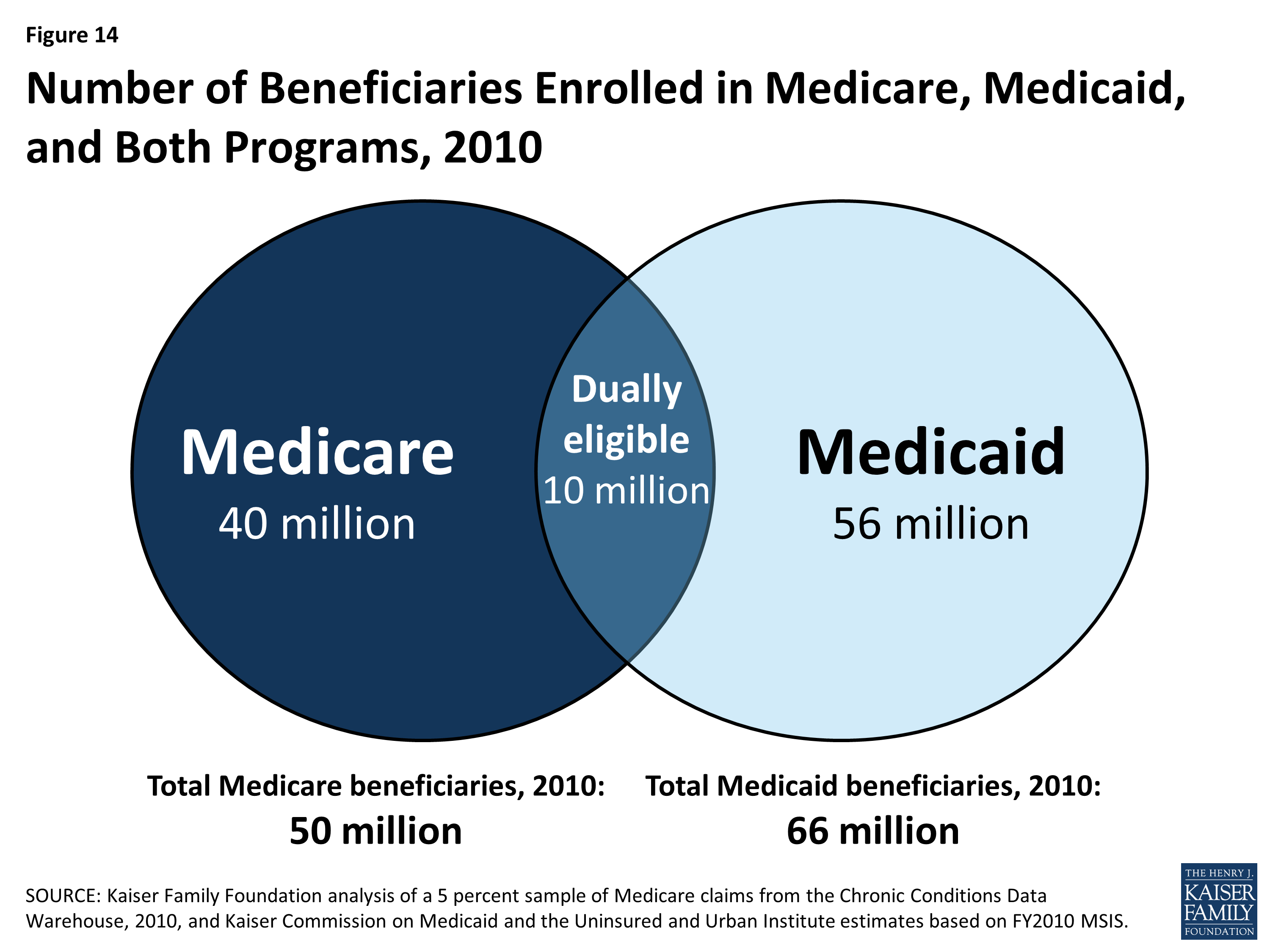

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

What is benchmark amount for Medicare?

Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium. If bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting ...

What are the sources of Social Security?

Another source of funding for the program comes from: 1 Income taxes on Social Security benefits 2 Premiums associated with Part A 3 Interest accrued on trust fund investments

What are the sources of revenue for Advantage Plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the H.I. and the SMI trust funds.

What is supplementary medical insurance?

The supplementary medical insurance trust fund is what’s responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries’ doctors’ visits, routine labs, and preventative care.

Will Medicare stop paying hospital bills?

Of course, this isn’t saying Medicare will halt payments on hospital benefits; more likely, Congress will raise the national debt. Medicare already borrows most of the money it needs to pay for the program. The Medicare program’s spending came to over $600 billion, 15% of the federal budget.

Does Medicare Supplement pay for premiums?

Many times, seniors who are retired may have their premiums paid by their former employers. The federal government doesn’t contribute financially to Medigap premiums.

How many parts does Medicare have?

Medicare has four parts: Part A (Hospital Insurance). Most people do not have to pay for Part A. If you or your spouse worked for at least 10 years in Medicare-covered employment, you should be able to qualify for premium-free Part A insurance.

When can I get Medicare Part A?

Most Federal employees and annuitants are entitled to Medicare Part A at age 65 without cost. When you don't have to pay premiums for Medicare Part A, it makes good sense to obtain coverage. It can reduce your out-of-pocket expenses as well as costs to FEHB, which can help keep FEHB premiums down.

What happens when a FEHB plan is the primary payer?

When the FEHB plan is the primary payer, the FEHB plan will process the claim first. If you enroll in Medicare Part D and we are the secondary payer, we will review claims for your prescription drug costs that are not covered by Medicare Part D and consider them for payment under the FEHB plan.

What is Medicare Advantage?

Medicare Advantage is the term used to describe the various health plan choices available to Medicare beneficiaries. If you are eligible for Medicare, you may choose to enroll in and get your Medicare benefits from a Medicare managed care plan. These are health care choices (like HMOs) in some areas of the country.

How to contact SSA about FEHB?

For more information about this extra help, visit SSA online at www.ssa.gov (external link), or call them at 1-800-772-1213 (TTY 1-800-325-0778) . The FEHB health plan brochures explain how they coordinate benefits with Medicare, depending on the type of Medicare managed care plan you have.

How to apply for medicare before 65?

It's easy. Just call the Social Security Administration toll-fee number 1-800-772-1213 to set up an appointment to apply. If you do not apply for one or more Parts of Medicare, you can still be covered under the FEHB Program.

What is the original Medicare plan?

It is the way everyone used to get Medicare benefits and is the way most people get their Medicare Part A and Part B benefits now. You may go to any doctor, specialist, or hospital that accepts Medicare. The Original Medicare Plan pays its share and you pay your share.

Where does Medicare Advantage money come from?

The money that the government pays to Medicare Advantage providers for capitation comes from two U.S. Treasury funds.

What is Medicare Advantage Reimbursement?

Understanding Medicare Advantage Reimbursement. The amount the insurance company receives from the government for you as a beneficiary is dependent upon your individual circumstances. As a beneficiary of a Medicare Advantage plan, if your monthly health care costs are less than what your insurance carrier receives as your capitation amount, ...

What is the second fund in Medicare?

The second fund is the Supplementary Medical Insurance Trust which pays for what is covered in Part B, Part D, and more. As a beneficiary enrolled in a Medicare Advantage plan, you will also be responsible for some of the costs of your healthcare.

How old do you have to be to get Medicare Advantage?

How Does Medicare Advantage Reimbursement Work? In the United States, you are eligible to enroll in a Medicare Advantage plan if you are either 65 years of age or older, are under 65 with certain disabilities.

Does Medicare Advantage cover dental?

Medicare Advantage plans must provide the same coverage as Parts A and B, but many offer additional benefits, such as vision and dental care, hearing exams, wellness programs, and Part D, prescription drug coverage.

Is Medicare Part C required?

Having a Medicare Part C plan is not a requirement for Medicare coverage, it is strictly an option many beneficiaries choose. If you decide to enroll in a Medicare Advantage plan, you are still enrolled in Medicare and have the same rights and protection that all Medicare beneficiaries have.

What is the federal government's role in Medicaid?

The federal government watches the quality of care that states use when providing Medicaid assistance. In effect, each state program is a combination of federal funds, federal quality standards, and state resources.

What is Medicare for older people?

Medicare is the national health services program for older Americans. It has several parts designed to make a comprehensive healthcare system. It provides medical care, prescription drugs, and hospital care. The federal government has a strong legal responsibility when carrying out Medicare. It must keep a rule of medical necessity.

What does Medicare Supplement require?

States require a combination of comprehensive plans along with any limited option plans. The insurance companies can use medical underwriting to determine process, discriminate against applicants and reject applications.

What is Medicare Advantage?

The private insurance plans in Medicare Advantage offer a wide variety of choices for consumers. There is another level of choice, and that is the managed care organizations. The balancing of resources, prices, and consumer costs require trade-offs. High premiums go along with low deductibles and out-of-pocket costs.

What is the massive undertaking to insure a national and diverse population?

The massive undertaking to insure a national and diverse population requires technical expertise and consistency. The Centers for Medicare and Medicaid use several networks of private contractors to process claims and maintain records.

What is a PPO plan?

They feature prevention and wellness programs in addition to a network for medical services. They did not use outside resources. PPO is the preferred provider organization. This form of the plan does not restrict users to network resources; it pays a lower rate of cost sharing for outside resources.

What is managed care?

A managed care approach that helps one user may work against another. The use of networks means that there is a price preference for them and this limits choice or makes choices more costly. The below-itemized managed care types affect consumer choice in Medicare Advantage plans.