How did tax reform affect Medicare tax treatment?

While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals. The takeaway here is that there were no changes to the tax treatment of Medicare benefits or rules due to tax reform.

How would a payroll tax cut affect social security and Medicare?

Full details on how the Trump administration could implement a payroll tax cut are still not known. Particularly, it’s unclear how that cut would affect levies for Social Security or Medicare or both. Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare.

What does the tax cuts and Jobs Act mean for Medicare?

Editor’s Note: This article was originally published on April 09, 2018. While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals.

How much will Medicare cuts affect you?

According to the Congressional Budget Office (CBO), this 4% cut amounts to $36 billion for Medicare providers, which could have a substantial impact on the delivery of care to our patient community. These Medicare cuts could increase by an additional potential 4% if Congress fails to waive PAYGO on any additional spending packages passed this year.

What is the Medicare tax limit for 2021?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Are taxes taken out of Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Does everyone pay the same rate for Medicare tax?

Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

What affects Medicare tax?

An individual will owe Additional Medicare Tax on wages, compensation and self-employment income (and that of the individual's spouse if married filing jointly) that exceed the applicable threshold for the individual's filing status.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

Who pays additional Medicare tax 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

What income is subject to the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

What is the additional Medicare tax for 2022?

0.9%2022 updates 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

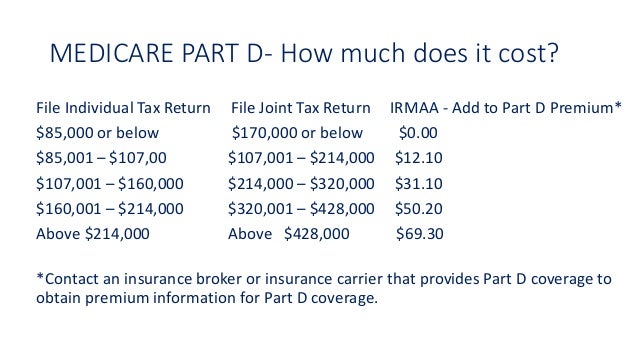

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How much will Medicare be reduced?

It’s estimated that would create an annual reduction of $25 billion in Medicare spending, starting next year.

What percentage of medical expenses are deducted in the tax cut?

This provision allows families to deduct extraordinary medical expenses that eat up more than 10 percent of their income. The original House bill proposed eliminating this deduction.

Why is the ACA mandate necessary?

Experts have told Healthline that the mandate is necessary because it forces healthier consumers into the insurance pool overseen by ACA marketplaces.

What are the provisions that will have the biggest impact on the healthcare industry?

Without a doubt, the provisions that will have the biggest impact on the healthcare industry are the repeal of the individual mandate and the potential cuts in Medicare spending. The individual mandate is a key component of the Affordable Care Act (ACA). It requires everyone to have health insurance.

What is the deduction for 2017?

During those tax years, the deduction will kick in at 7.5 percent of a household’s annual income. After that, it returns to the 10 percent threshold.

What is the cap on interest payments for healthcare?

A story in Modern Healthcare also notes that the tax bill will cap at 30 percent the ability of for-profit healthcare corporations to deduct interest payments. That kicks in next year and will be further restricted beginning in 2022.

Why is the American Hospital Association opposing the tax waiver?

The bill keeps the tax waiver for reduced tuition for graduate students. Medical schools had pushed to preserve this break because it helps make graduate medical studies more affordable.

When will Medicare run out of money?

The Medicare Part A trust fund is projected to run out of money in 2026. Meanwhile, the latest estimate projects Social Security’s trust funds will be insolvent in 2035.

Why is payroll tax cut important?

A payroll tax cut is one idea President Donald Trump is considering in response to the negative effects of coronavirus on the U.S. economy. Experts say such a move would not necessarily be a magic bullet. One reason why: It could impair funding to Medicare and Social Security, which rely on payroll taxes for funding and are already facing looming ...

How much is Social Security taxed?

Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare. Self-employed individuals, meanwhile, make the full contributions on their own, 12.4% for Social Security and 2.9% for Medicare.

When was the last time there was a payroll tax cut?

That could be accomplished as it was the last time there was a payroll tax cut, in 2011, when money was moved from the general fund to the trust funds. However, halting payroll taxes for up to a year, which has been mentioned as a potential strategy, would be very expensive.

Is payroll tax regressive?

The other problem is that payroll taxes are regressive, so it’s a bigger chunk for people with low or moderate incomes than high income workers. And big earners are unlikely to spend that extra cash. “We know when high -income people get a tax cut, they don’t spend as much as low-income people do,” Gleckman said.

Will people who lose their jobs get a payroll tax cut?

Those who lose their jobs because of the negative impacts of the coronavirus will not benefit from a payroll tax cut. “They’re the ones who are going to have the biggest drops in income, and yet they’re not going to get anything from a payroll tax holiday,” Greszler said.

Can payroll tax cuts stimulate consumer spending?

While payroll tax cuts can stimulate consumer spending, there are reasons to believe that won’t necessarily work in this situation.

What are the various parts of Medicare?

Medicare Part A helps cover: inpatient care in hospitals; skilled nursing facility care; hospice care; and home health care.

What is Medicare?

Medicare is a form government provided health insurance for individuals 65 or older, or certain disabled individuals under the age 65. Medicare is funded by a payroll tax, premiums and surtaxes from beneficiaries, and general revenue. It provides health insurance for Americans aged 65 and older who have worked and paid into the system through the payroll tax. It also provides health insurance to younger people with some disability status as determined by the Social Security Administration.

What is the TCJA repeal?

While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals. The takeaway here is that there were no changes to ...

What does Medicare Part B cover?

Medicare Part B helps cover: services from doctors and other health care providers; outpatient care; home health care; durable medical equipment; and some preventive services. Part B is optional and may be deferred if the beneficiary or their spouse is still working and has health coverage through their employer.

Did Medicare change tax form?

The takeaway here is that there were no changes to the tax treatment of Medicare benefits or rules due to tax reform. While there are no changes to Medicare rules because of tax form, understanding how Medicare works can be helpful in understanding your overall financial picture.

Is Medicare Part B taxable?

That being said, social security benefits used to purchase Medicare Part B remain taxable. Part B premiums normally are not paid directly by the taxpayer but are withheld from his or her social security benefits.

Does Medicare have a claim number?

Until now, the Medicare claim number displayed on the enrollee’s Medicare card was his or her Social Security Number. That is about to change. To help prevent identity theft, the Centers for Medicare and Medicaid Services (CMS) will soon begin mailing new Medicare cards with new identifying numbers.

How much did CMS reduce conversion factor?

The new rules from CMS reduce the Medicare conversion factor, the basic starting point for unit cost calculations for medical care, by nearly 11% , bringing it to its lowest point in 25 years. What's worse is that private insurance often bases how much it pays surgeons on Medicare's rates, meaning these cuts will be compounded throughout the health care system.

Why does Congress need to enact legislation to waive Medicare's budget neutrality requirements?

Congress needs to enact legislation to waive Medicare's budget neutrality requirements so that these cuts are not necessary . Our medical system needs all the help that it can get right now.

When did cancer deaths drop in 2020?

23, 2018 file photo, a doctor, center, directs a special camera to look at a patient's tumor at a hospital in Philadelphia. According to research released on Wednesday, May 13, 2020, cancer deaths have dropped more in states that expanded Medicaid coverage under the Affordable Care Act ...

Is telehealth a replacement for surgical care?

But telehealth is no replacement for surgical care, and the health care system simply cannot absorb cuts of this magnitude right now.

Medicare PAYGO Cuts

The American Rescue Plan Act of 2021, signed into law by President Biden in March, increased spending without offsets to other federal programs. Under statutory Pay-As-You-Go (PAYGO) rules, any increases to the federal deficit automatically triggers an additional series of acrossthe-board deductions to federal programs.

Medicare Sequester Delay Extension

At the onset of the COVID-19 pandemic, Congress delayed the automatic 2% Medicare sequestration cuts as providers were struggling to keep their doors open to their communities. Various delays were enacted during this public health emergency, with the last pause setting to expire on January 1, 2022.

Changes to the Medicare Conversion Factor

Last year, due to a temporary patch approved by Congress, the Centers for Medicare & Medicaid Services (CMS) increased all providers’ payments by 3.75% to offset a change in the Medicare conversion factor that CMS implemented as part of a change to Evaluation and Management (E/M) codes designed to increase support for primary care services.

What cuts will Medicare make in 2021?

That's because the Centers for Medicare & Medicaid Services (CMS) recently proposed cuts to certain Medicare services, including breast cancer screening, radiation oncology and physical therapy , along with other medical specialties. The agency is proposing shifting billions from specialist doctors — radiologists, surgeons and the like — to primary care physicians in order to address the shortage of primary care physicians in the country. Per the HHS, "A five percent annual reduction to the valuations of all non-primary care services and procedures, as determined by the Secretary, under the Physician Fee Schedule will pay for the cost of these payments." But in the process, this move would complicate the lives of patients who need to see specialists, including specialists like myself in radiology.

Is Medicare a long delay?

Millions will wake up to a Medicare system that operates with long delays for previously routine services; conditions that are normally treatable with early detection will thrive undetected. Read More. This is unconscionable, and it's worse because there's an easy fix.

Can Congress suspend Medicare cuts?

This is unconscionable, and it's worse because there's an easy fix. Congress can direct the CMS to suspend these cuts by waiving the requirement that changes to Medicare must be budget-neutral. That would allow CMS a one-time reprieve from balancing its budget, and it would give the medical profession an opportunity to recover and rebuild. Alternatively, if Congress wants to allow the budget neutrality rules to remain in place, then it should authorize emergency funds to cover the gap.