Unless Congress intervenes, the tax bill will trigger an automatic $25 billion cut to Medicare and other programs that benefit people with disabilities through the “pay-as-you-go” or PAYGO rule [ learn more here and here ] It reduces a tax credit for the development of drugs for rare diseases (known as the Orphan Drug credit)

Full Answer

Why do billers send claims directly to Medicare and Medicaid?

Medicare and Medicaid, so cutting Medicaid actually does also affect seniors. That’s sometimes lost in the debate.” Experts are already concerned about funding these programs – and Schneider and Bishop say this new tax law will make matters worse because it is expected to add about $1.5 trillion to the federal deficit.

Why is it so hard to file a claim with Medicare?

Dec 20, 2017 · How the bill will affect healthcare in general. The tax bill repeals the individual mandate penalties under Obamacare, which could lead to as many as 13 million fewer Americans with health insurance. This, in turn, could result in more sick people and higher premiums for those who still have health insurance. Many varying opinions

What percentage of the federal budget goes to Medicaid?

May 22, 2018 · If you’re a joint filer and you make over $170,000 or if you’re a single filer and make over $85,000, you will be hit with Medicare surcharges. That number, by the way, does include tax-free municipal bond income. The new tax law did a couple of things to affect Medicare costs. Number one, it added a new tier on the top.

What do I need to know about billing for Medicaid?

Nov 27, 2017 · Inna Fershteyn Comments Off. on The GOP Tax Plan’s Effect on Medicaid Planning. The Republican Party, also known as the GOP, recently proposed a tax plan which, if enacted, would repeal certain deductions. As of now, nothing is permanent, but, should the plan pass the Senate, medical expense deductions will be eliminated, adversely impacting the …

How does tax affect health care?

Your cost for Marketplace health insurance is based on the income you file on your tax return. Your reported income also determines your eligibility for the tax credits associated with Marketplace health coverage.Oct 16, 2021

Does income tax pay for Medicare?

The Basics of Medicare Tax FICA taxes include money taken out to pay for older Americans' Social Security and Medicare benefits. Both you and your employer pay the Medicare Tax as a part of FICA. Your total FICA taxes equal 15.3 percent of your wages — 2.9 percent for Medicare and 12.4 percent for Social Security.

Is Medicare funded by the federal government?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs Medicare. The program is funded in part by Social Security and Medicare taxes you pay on your income, in part through premiums that people with Medicare pay, and in part by the federal budget.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.Nov 15, 2021

At what income level does Medicare tax increase?

The regulation has been in place since 2013. Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you're self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

Who pays for Medicaid?

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP).

How does the funding of Medicaid differ from the funding for Medicare?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

What are the disadvantages of Medicaid?

Disadvantages of MedicaidLower reimbursements and reduced revenue. Every medical practice needs to make a profit to stay in business, but medical practices that have a large Medicaid patient base tend to be less profitable. ... Administrative overhead. ... Extensive patient base. ... Medicaid can help get new practices established.

What's the difference between Medicaid and Medicare?

Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income. Medicaid is a state and federal program that provides health coverage if you have a very low income.

Will Medicaid pay for my Medicare Part B premium?

Medicaid can provide premium assistance: In many cases, if you have Medicare and Medicaid, you will automatically be enrolled in a Medicare Savings Program (MSP). MSPs pay your Medicare Part B premium, and may offer additional assistance.

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What are the concerns of the ACA?

Our Biggest Concerns with the final bill: 1 Massive tax cuts primarily benefit the wealthiest Americans and corporations; Congress has said it will address the increased federal deficit by next cutting Medicaid, Medicare and other critical services 2 Repealing the ACA’s individual mandate will leave hundreds of thousands with disabilities without insurance, with higher premiums, and could undermine pre-existing condition protections. [ learn more here] 3 Unless Congress intervenes, the tax bill will trigger an automatic $25 billion cut to Medicare and other programs that benefit people with disabilities through the “pay-as-you-go” or PAYGO rule [ learn more here and here ] 4 It reduces a tax credit for the development of drugs for rare diseases (known as the Orphan Drug credit)

What is the final bill?

The final bill keeps the medical expense deduction (eliminated in the House bill) It keeps a tax incentive for businesses to hire people with disabilities (eliminated in the House bill) It keeps the tax credit that helps small businesses to make their businesses more accessible to people with disabilities. (eliminated in the House bill) ...

How much will the tax cuts cost?

These tax cuts will cost nearly $1.5 trillion dollars over the next decade, and Congress has said that they next plan to cut Medicaid, Medicare and other critical programs to address the increased federal deficit.

When did the Senate pass the tax reform bill?

On November 9, Senate Republicans released their tax reform plan, one week after the House released their plan . On November 16th, the House passed their tax bill and on December 2nd, the Senate passed their tax bill . On December 5th, the bill was sent to a conference committee to work out the differences.

Does the Affordable Care Act repeal the Affordable Care Act?

The bill also repeals key provisions of the Affordable Care Act ( ACA), which will cause millions of people to lose insurance and premiums to increase, and has several other provisions will hurt people with disabilities..

When was the Medicaid bill passed?

The Senate and House approved the bill on December 20th , and President Trump signed it into law. Just like the bills passed by the Senate and House, the final bill contains massive tax cuts for wealthy individuals and large corporations that put Medicaid and other programs at risk.

How the bill will affect healthcare in general

The tax bill repeals the individual mandate penalties under Obamacare, which could lead to as many as 13 million fewer Americans with health insurance. This, in turn, could result in more sick people and higher premiums for those who still have health insurance.

Many varying opinions

There are many arguments surrounding the bill and many people predicting what will happen to Medicare. Only time will tell, and it seems likely that smaller structural changes will be made over time to Medicare rather than huge cuts all at once, which would be devastating to many.

What is the GOP tax plan?

Inna Fershteyn Comments Off. on The GOP Tax Plan’s Effect on Medicaid Planning. The Republican Party, also known as the GOP, recently proposed a tax plan which, if enacted, would repeal certain deductions.

Can I deduct medical expenses on my taxes?

According to the IRS, the Internal Revenue Service, taxpayers can currently only deduct medical expenses if the expenses and the income taxes sum to a value which exceeds ten percent of adjusted gross income (AGI). AGI is calculated by subtracting a person’s deductions from their total gross income. Specifically, these deductions can be health insurance premiums, home health care costs and even assisted living fees. Nursing home fees, which are considered deductibles if a doctor certifies that the individual must live in the facility due to health care and cognitive needs, can also be affected because of these deductions.

Is medical expense deduction a downfall?

Furthermore, the removal of the medical expense deductions is not the only downfall. An indirect result may cut from a seemingly unrelated provision in the tax plan – the corporate tax rate cut. The proponents of the tax bill proclaim that this tax change will create higher economic growth, resulting in higher tax revenue. Nevertheless, if the economic growth is insufficient to make up for the direct loss of revenue from the tax cut, the reduction in tax revenues will most likely cause sharp cuts in government spending or a rise in the budget deficit, potentially both.

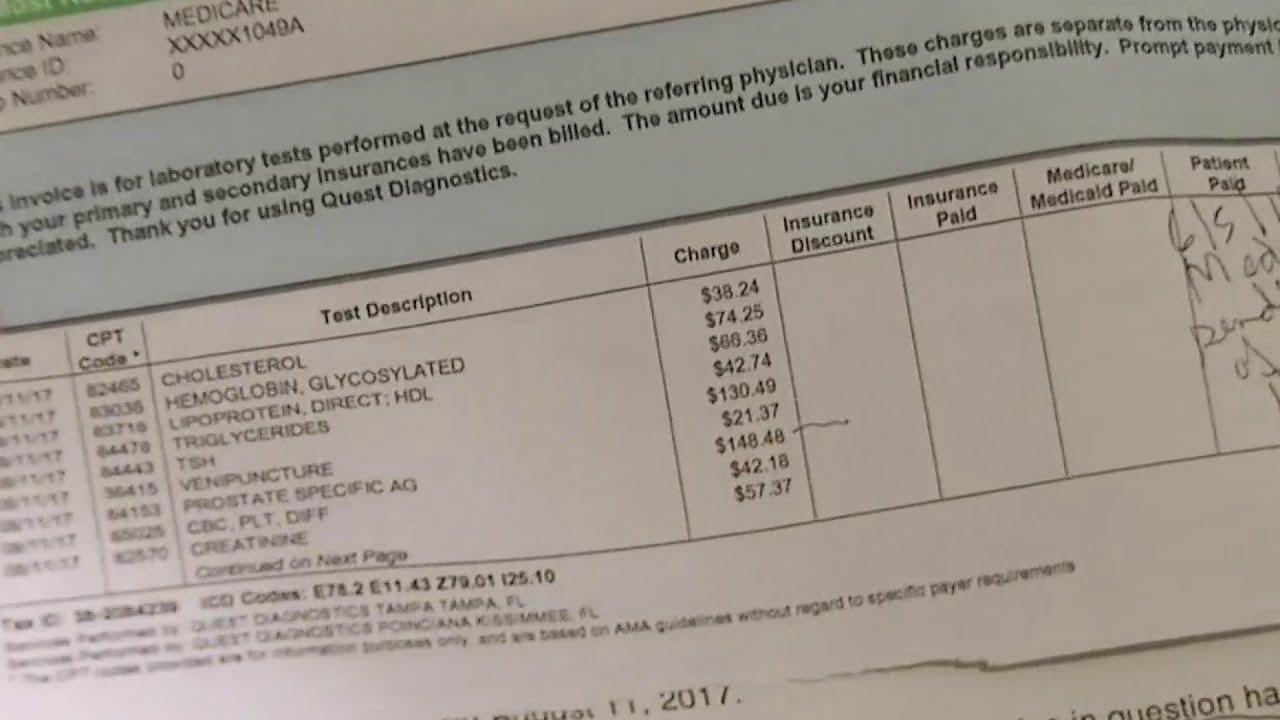

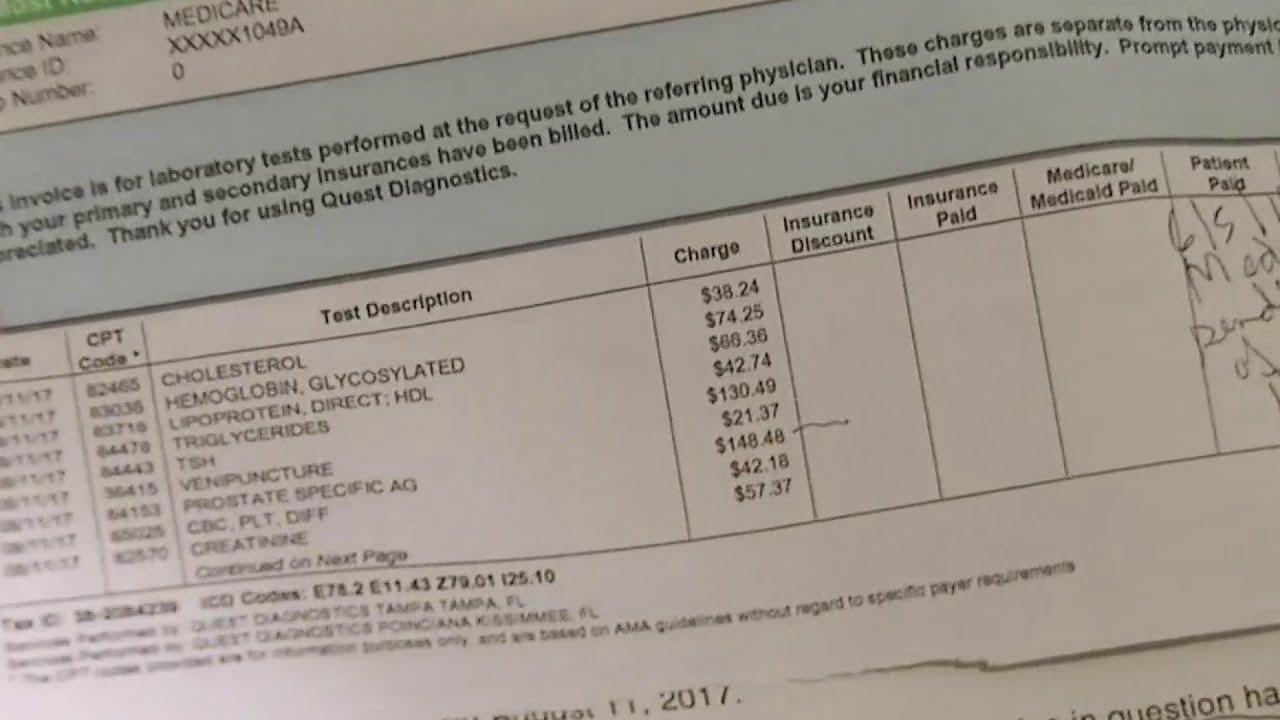

What is 3.06 Medicare?

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

Is it harder to make a claim for medicaid or Medicare?

Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program to learn what forms ...

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

What are the benefits of the Cares Act?

The CARES Act expands Medicare's ability to cover treatment and services for those affected by COVID-19 including: 1 Providing more flexibility for Medicare to cover telehealth services 2 Authorizing Medicare certification for home health services by physician assistants, nurse practitioners, and certified nurse specialists 5

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

Is Medicare a government program?

Both Medicare and Medicaid are government-sponsored health insurance plans. Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults.

Is Medicaid administered by the state?

Medicaid, on the other hand, is administered at the state level. Although all states participate in the program, they aren't required to do so. The Affordable Care Act (ACA) increased the cost to taxpayers—particularly those in the top tax brackets—by extending medical coverage to more Americans. 1 2 .

Is Medicare a major segment of the health insurance market?

Medicare and Medicaid constitute a major segment of the health insurance market for tens of millions of Americans. Although Medicare and Medicaid funding is projected to fall short at some point, the CARES Act aims to address costs related to the coronavirus outbreak.

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

What is the plan for Medicare for all?

As the debate over the future direction of our health care system heats up leading into the 2020 Presidential election, several Democratic proposals to create a single, federal, universal health insurance program known as Medicare-for-all have garnered significant attention. These proposals would replace most current public and private health insurance with a new federal program that would guarantee health coverage for all or nearly all U.S. residents. However, many details about how a new public program would be implemented and financed are not yet known. While much attention has focused on the implications of ending private insurance and Medicare, the debate has largely ignored the effects on the low-income and vulnerable populations covered by Medicaid and the broader implications for states of eliminating the Medicaid program. Key changes related to Medicaid under current proposals include:

How many people are covered by medicaid?

Medicaid covers 75 million low-income adults, children, pregnant women, seniors, and people with disabilities. The Affordable Care Act (ACA) expanded Medicaid eligibility to serve as the basis of its larger set of coverage and affordability reforms.

Is Medicaid the primary payer for long term care?

One of the most fundamental changes under Medicare-for-all would be uniform coverage of community-based long-term care services for all Americans. Medicaid is the primary payer for these services today, with substantial state variation in eligibility and coverage.

What is Medicaid access?

Medicaid provides access to a broad range of providers, including many with unique expertise in treating vulnerable and low-income populations. States set provider payment rates within broad federal guidelines, and as a result, there is significant variation across states in how provider rates are determined and in payment levels. Despite lower payment rates in Medicaid and gaps in access to some types of specialists, national data show that access to services for children and adults is comparable to private insurance and exceeds access for the uninsured. Medicaid programs contract with a broad range of providers, including many safety net clinics, hospitals, and other providers that have experience in meeting the needs of Medicaid’s vulnerable enrollees. Managed care has become the dominant Medicaid delivery system, though states have substantial flexibility in designing their delivery and payment systems.

Does Medicare cover nursing homes?

Medicare-for-all proposals vary as to whether they would include institution al long-term care, such as nursing homes, or instead continue the current Medicaid coverage of these services, locking in state spending, variation in benefits across states, and limited access to populations beyond Medicaid.

What are the benefits of Medicare for All?

The Medicare-for-all benefit package also would include mental health and substance use treatment services.

Will Medicare be universal?

As the debate over the future direction of our health care system heats up leading into the 2020 Presidential election, several Democratic proposals to create a single, federal, universal health insurance program known as Medicare-for-all have garnered significant attention. These proposals would replace most current public and private health insurance with a new federal program that would guarantee health coverage for all or nearly all U.S. residents, though many details about how a new public program would be implemented and financed are not yet known. While much attention has focused on the implications of ending private insurance and Medicare, the debate has largely ignored the effects on the low-income and vulnerable populations covered by Medicaid and the broader implications for states of eliminating the Medicaid program.

How much fraud is there in Medicare?

However, others, including U.S. Attorney General Eric Holder, suggest that there is an estimated $60 to $90 billion in fraud in Medicare and a similar amount for Medicaid. Big money! Ironically, ObamaCare cutting $500 billion, as I have pointed out elsewhere, was an accounting sham.

When did the Medicare fraud strike force start?

Federal officials set up the Medicare Fraud Strike Force in 2007, which visited at random nearly 1,600 businesses in Miami, ground zero for Medicare fraud, that had billed Medicare for durable medical equipment.