Your zip code matters for Medicare because plan options change depending on your location. Also, Medicare Advantage plan networks are dependent on the private insurance company providing care to each client. Zip code is important in terms of Medicare program eligibility.

Does your zip code matter for Medicare Advantage plans?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans …

Does your zip code affect your life expectancy?

Jan 07, 2022 · Why Does My Zip Code Matter for Medicare? Your zip code matters for Medicare because plan options change depending on your location. Also, Medicare Advantage plan networks are dependent on the private insurance company providing care to each client. Zip code is important in terms of Medicare program eligibility.

How to get Medicare Part B reimbursement advantage?

Nov 30, 2021 · I t might come as a surprise to you, but the Medicare benefits you receive can vary depending on the state in which you live. The pricing, rules …

Why do we have ZIP codes in USA?

Does my ZIP code affect my Medicare coverage? Zip code does affect which plan options are available to you. For example, Medigap and Medicare Advantage plans will vary in pricing as well as features depending on your location. Additionally, you must live in the plans service area to be eligible for enrollment. Medicare Advantage plans are impacted most by zip code changes. …

Do Social Security benefits vary by zip code?

Social security benefits are not impacted by geographic location but other federal benefits are. We took a look at these programs and how benefits vary. Social security benefits are calculated the same nationally.Dec 9, 2021

Why do Medicare benefits vary by state?

Because prices, benefits and population vary from state to state, Medicare Advantage may be more popular alternatives to Original Medicare in some states compared to others.

How do I get $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What makes you eligible for Medicare?

To qualify to receive Medicare services, you must be aged 65 or older, and you must have been getting disability income from Social Security or the Railroad Retirement Board (RRB) for 24 months.

How can the service vary?

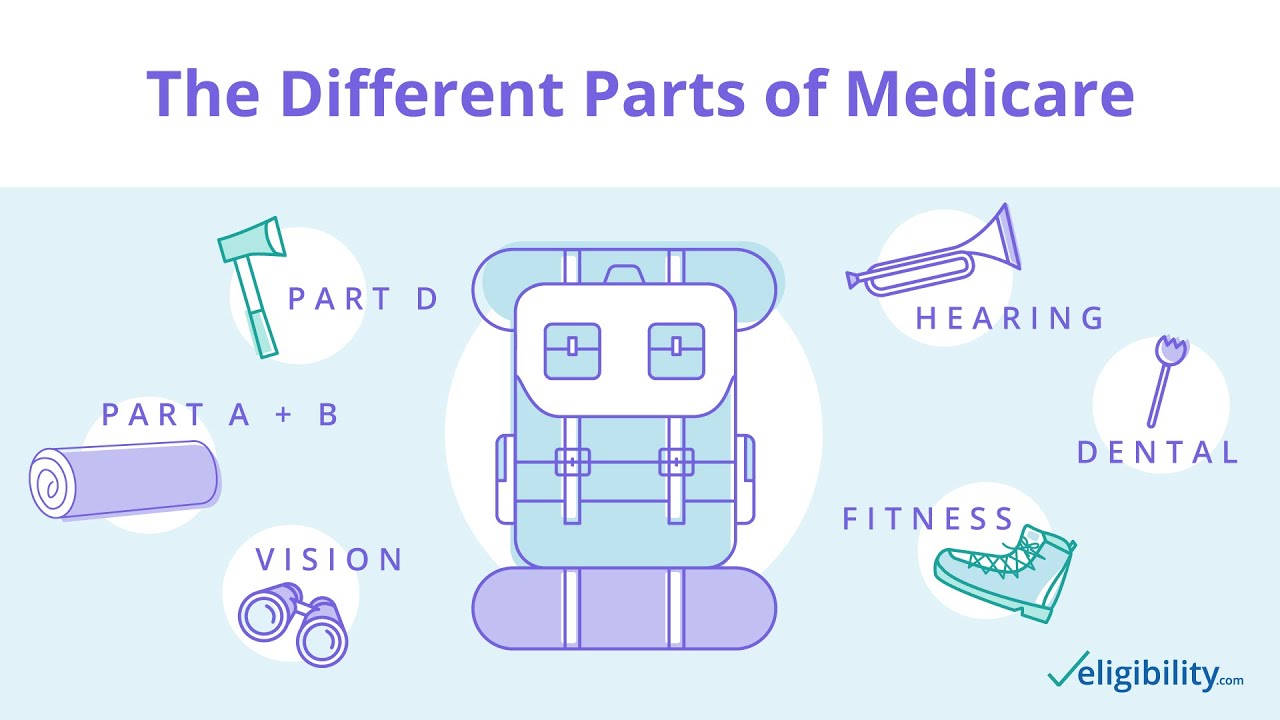

Medicare can be broken down into two different plans: Medigap and Medicare Advantage.

What makes you eligible for Medicare?

To qualify to obtain Medicare companies, you should be aged 65 or older, and you have to have been getting incapacity revenue from Social Security or the Railroad Retirement Board (RRB) for twenty-four months.

How can the service fluctuate?

Medicare may be damaged down into two totally different plans: Medigap and Medicare Benefit.

Contributing Factors

There are a plethora of factors that contribute to the health and welfare of people. Social factors like whether a person has a stable place to live, the types of food they have access to, and whether they have access to health care services are generally the top tier issues among healthcare practitioners.

For Your Consideration

It is important for nurses and other medical professionals to consider social determinants of health during the diagnostic process. Taking a little time during the assessment process could mean the difference between life and death for a patient who is facing social challenges like homelessness, unemployment, or a lack of health insurance.

The Count

Another issue that has a huge impact on the type of healthcare a community has is directly connected to whether there is a hospital or a medical provider in the area. Most people in America are not aware that there have been over 100 rural hospital closures since 2010.

Selling your home could lead to higher Medicare premiums if your taxable income sees a boost

Although your Medicare benefits shouldn't change when you sell your home, your monthly premiums may. It depends on whether the sale of your home affects your taxable income.

What Is the High-Earner Threshold?

Medicare considers you a high earner if your modified adjusted gross income (MAGI) exceeds $91,000 per year if you file your taxes as a single, or $182,000 for married couples filing jointly.

How Does Selling Your Home Affect Medicare Premiums?

The capital gains tax may apply when you make a profit on an investment, which includes the sale of real estate. Luckily, the IRS does allow you to exclude a portion of your capital gains on real estate.

When Can't You Take Advantage of Capital Gains Exclusions?

It wouldn't be the U.S. tax code if there weren't limits to the real estate exclusion. If any of the following apply, you will have to pay tax on the whole gain, meaning it will count toward your MAGI:

Appealing the Income-Related Monthly Adjustment Amount

Although Medicare premiums are determined by the Centers for Medicare & Medicaid Services (CMS), the " Initial IRMAA Determination Notice " comes from the Social Security Administration. This notice describes how SSA determined you owe IRMAA and provides information on filing an appeal.

How Long Does IRMAA Apply?

The good news is that an IRMAA determination doesn't mean you owe the high-earner surcharge forever. If your adjusted gross income dropped below the IRMAA threshold, you'll pay the standard Medicare premiums next year.

If I Sell My House, Will I Lose My Medicare Benefits?

Selling your home will not cause you to lose your Medicare benefits. However, if you have a Medicare plan and move to a new address, you may need to change your plan.