The average cost of a Medicare Supplement

Medigap

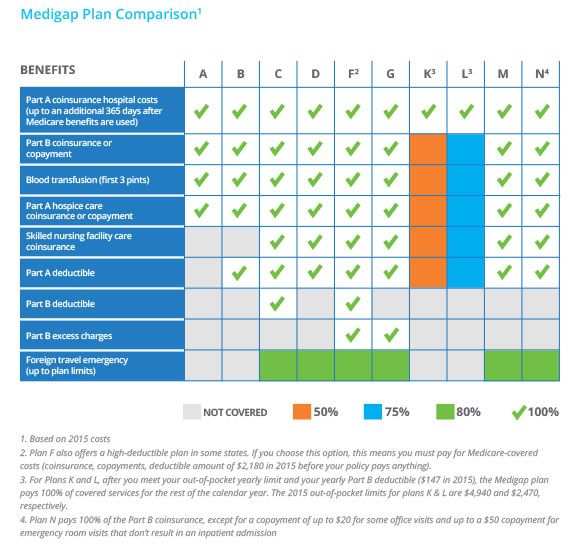

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is the cheapest Medicare supplemental insurance?

Jun 16, 2021 · Determining a true average cost is not easy, but Medicare Supplement Insurance plans can cost anywhere between $50 and $500 per month depending on a number of factors. The chart below shows the range of monthly premiums for some of the most popular Medigap plans for a 65-year-old non-smoking male in several different parts of the country.

What is the average cost of Medicare supplemental insurance?

Feb 03, 2022 · Medicare Supplement Insurance Plan F premiums in 2022 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2022 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

Is Medicare supplemental insurance worth buying?

Summary: The cost of a Medicare Supplement insurance plan will be dependent on factors such as plan rating systems, if you have guaranteed issue rights, and the type of plans of you choose. If you’re enrolled in Medicare, or will soon be eligible for the program, you may be thinking about buying a Medicare Supplement insurance plan to work alongside your Medicare Part A and …

What is the average cost of a Medicare supplement plan?

Sep 26, 2021 · If you’re shopping around for Medigap coverage, you’ll want to know the average cost of Medicare Supplement plans. There’s no simple answer to this question. Medicare Supplement plans can range from $50-$300+ in monthly premiums. These premiums are different for each beneficiary due to being influenced by several factors.

What is the cost of supplemental insurance for Medicare?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

What is the most expensive Medicare supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What are the pros and cons of Medicare supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Does Medicare pay 100 percent of hospital bills?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

How Insurance Companies Set Medicare Supplement Insurance Plan Costs & Premiums

Insurance companies can decide the premium costs for the Medicare Supplement insurance plans they offer. They can use any of three ways to set prem...

When You Apply For A Medicare Supplement Insurance Plan

The time period when you apply for a Medicare Supplement insurance plan can affect your out-of-pocket costs. If you apply during the Medicare Suppl...

The Type of Medicare Supplement Insurance Plan Type You Select

The benefit coverage of the Medicare Supplement insurance plan you choose usually also affects the premium you will pay. For example, you might be...

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

What are the Medicare premiums for 2020?

Based on our analysis, we noted several key takeaways: 1 Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). 2 Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

What is the age factor in Medicare?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age. As you compare Medigap quotes , it may be helpful to consider how your age could ...

What is Medicare Supplement?

Medicare insurance Supplement insurance plans (also known as Medigap plans) are offered by private insurance companies and are designed to help pay out-of-pocket costs for services covered under Medicare Part A and Part B, such as deductibles, copayments, and coinsurance. Medicare supplement insurance coverage for these out-of-pocket expenses ...

How does Medicare Supplement insurance work?

How insurance companies set Medicare Supplement insurance plan costs & premiums 1 Community rating: Generally the premium is priced so that everyone who purchases a Medicare Supplement insurance plan of a particular type pays the same premium each month. Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age. 2 Issue-age rating: The premium you pay is based on your age when you buy the Medicare Supplement insurance plan. Premiums are lower if you purchase the Medicare Supplement insurance plan when you are age 65 than if you wait until you are older. Over time, premiums may increase because of inflation and other factors, but they won’t increase because of your age. 3 Attained-age-rating: The premium you pay is based on your current age. Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Why do Medicare premiums increase?

Premiums may also increase because of inflation and other factors. If you are interested in purchasing a Medicare Supplement insurance plan offered by an insurance company, it is a good idea to ask what rating system they use to set their premiums.

Which states have standardized Medicare Supplement plans?

With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized plans, insurance companies offer standardized Medicare Supplement insurance plans identified by alphabetic letters (such as Medicare Supplement insurance Plan M). However, the premiums (the monthly amount you pay for a Medicare Supplement insurance plan) ...

How long does Medicare Part B last?

This period begins the month you are both 65 years old and enrolled in Medicare Part B, and lasts for six months. If you apply during this period, you’re not required to go through medical underwriting, which can lead to a higher premium cost if you have health conditions at the time you apply.

How does community rating work?

Community rating: Generally the premium is priced so that everyone who purchases a Medicare Supplement insurance plan of a particular type pays the same premium each month. Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age.

How much does Medicare cost in 2021?

There’s no simple answer to this question. Medicare Supplement plans can range from $50-$300+ in monthly premiums.

What is Plan N?

Plan N is another popular Medigap plan option. Except for Part B excess charges, it covers everything Plan G covers. This is not a downside if you live in a state that doesn’t allow excess charges to begin with. Plan N Average Monthly Cost in Palm Harbor, FL (34684)*.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Plan G the same as Plan F?

A high-deductible version of Plan G is also available. It offers the same benefits as standard Plan G. High-Deductible Plan G requires a higher deductible in exchange for lower monthly premiums, like Plan F’s high-deductible option before it.

Is Plan F deductible?

There’s also a high-deductible version of Plan F. High-Deductible Plan F offers the same benefits as standard Plan F. Premiums for this plan are lower, but there’s a higher deductible the beneficiary must reach before the plan covers all costs.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses you’ll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies. These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is designed to provide coverage that Original Medicare (Parts A and B) does not. Medigap policies are purchased in addition to Original Medicare and have their own monthly premiums you'll need to pay. plans are available to help cover cost gaps in coverage. Offered by private health insurance companies, ...

What is the deductible amount for medical insurance?

Your insurance company will cover the final $800., and deductibles A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself..

What is Medicare Part A?

When you combine Medicare Part A. Medicare Part A, also called "hospital insurance," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare. and Medicare Part B.

What is Part B insurance?

Sometimes called "medical insurance," Part B helps pay for the Medicare-approved services you receive. with a Medigap plan, you pay a monthly premium. A premium is a fee you pay to your insurance company for health plan coverage. This is usually a monthly cost. for Medigap, as well as any Original Medicare premiums.

What is Medigap insurance?

Supplement Insurance (Medigap) is health insurance . Health insurance is a form of insurance that covers a portion of your medical expenses. In exchange, you pay a monthly premium and other costs. sold by private companies to cover costs in these gaps.

What is a K and L plan?

Plans K and L also cover a portion of the Part A and B deductibles. A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

What does it mean to be out of network?

Out-of-network refers to doctors, hospitals and other providers that do not have an agreement to treat your health insurance company's clients. Visiting an out-of-network provider typically means more out-of-pocket costs and less coverage. , you’ll be responsible for all the costs not included in your coverage.

What is senior supplement?

Senior Supplements. Supplemental health insurance for seniors, which is sold by private health insurance companies, is an addition to existing healthcare coverage that’s designed specifically to meet seniors’ needs.

Does Medicare Supplement cover dental?

Like Medicare’s “parts,” each plan offers different benefits and has a different premium amount. These plans cover healthcare expenses that Medicare doesn ’t pay for such as coinsurance and deductibles. But, Medigap plans do not cover dental, vision, or any other supplemental health insurance benefits.

What is Medicare Select?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. policies that may require you to use certain providers. If you buy this type of Medigap policy, your premium may be less.

What is medical underwriting?

medical underwriting. The process that an insurance company uses to decide, based on your medical history, whether to take your application for insurance, whether to add a waiting period for pre-existing conditions (if your state law allows it), and how much to charge you for that insurance.

Why do premiums go up?

They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

What is issue age rated?

Issue-age-rated (also called “entry age-rated”) How it’s priced. The premium is based on the age you are when you buy (when you're "issued") the Medigap policy. What this pricing may mean for you. Premiums are lower for people who buy at a younger age and won’t change as you get older.

Can you compare a Medigap policy?

As you shop for a Medigap policy, be sure to compare the same type of Medigap policy, and consider the type of pricing used .

What is the lowest Medicare premium?

Based on our analysis, Medicare Supplement Insurance Plan F premiums in 2018 were lowest were lowest for beneficiaries at age 64 ( $146.55 per month ) and highest for beneficiaries at age 82 ( $236.53 per month).

Why are Medicare premiums so high?

Medicare Supplement Insurance plan premiums could be more expensive for older beneficiaries for a few reasons, such as: 1 If you wait until after your Medigap Open Enrollment Period to sign up for a Medigap plan, insurance companies can charge you a higher premium based on your health.#N#Your Medigap Open Enrollment Period (OEP) is a 6-month period that starts as soon as you are at least 65 years old and enrolled in Medicare Part B.#N#During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs. 2 There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan.#N#Community-rated#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.#N#Issue-age-rated#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age.#N#Attained-age-rate#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

What is issue age rated?

Issue-age-rated. With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan. You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. Attained-age-rate.

Is Plan F the same as Medicare Supplement?

This means that the 9 basic benefits of Plan F will be the same, no matter where you live or what Medicare Supplement Insurance company you buy it from. Medicare Supplement Insurance is the only plan to provide coverage for each of the following 9 benefit areas.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

What is Plan F?

Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you travel outside of the country.