Will Medicare Supplement

Medigap

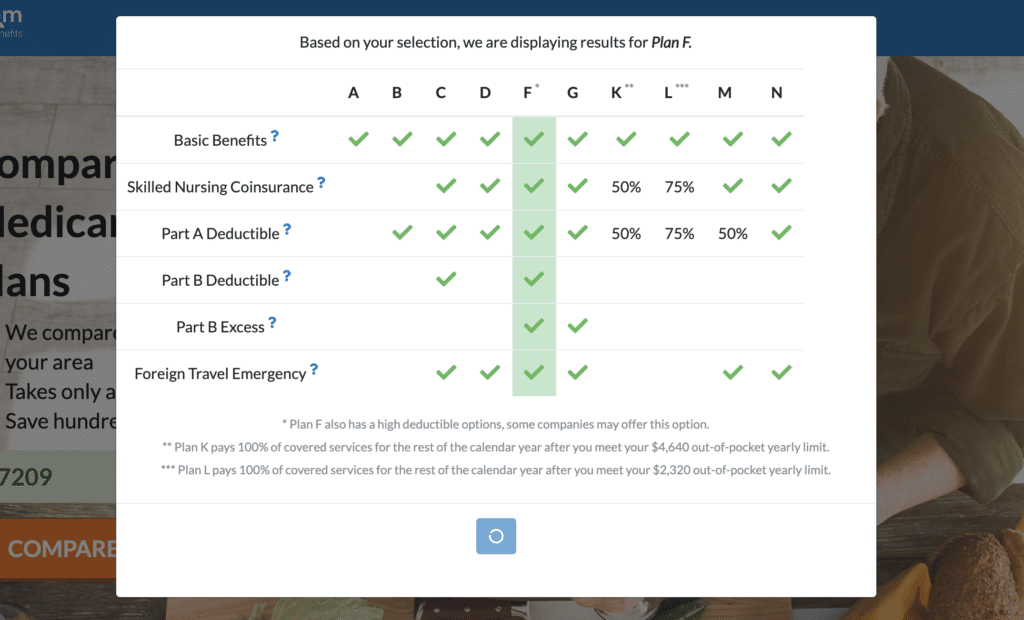

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Are Medicare supplement plan F premiums going up?

52 rows · Feb 15, 2022 · The average premium for high deductible Plan F in 2018 was $57.16 per month, or roughly one-third of the average monthly cost of the traditional Plan F. 2 In 2022, high-deductible Plan F offers an annual deductible of $2,940 , meaning you are responsible for paying the first $2,940 worth of covered expenses before the plan’s coverage begins.

Are Medicare Plan F and Plan C going away?

Out-of-Pocket Maximum. $5,120. $2,560. * Plan F includes a high deductible option where $2000 is required before benefits are paid. Because Medicare supplemental coverage consists of 10 standardized plans (and high deductible Plan F) is easy to compare supplements online and get rates from several companies.

How much is the deductible on a Medicare Plan F?

Here are some changes in Medicare Plan F that would be implemented from 1st January 2020: If you are eligible for Medicare before 1st January 2020, you might be able to sign up for Medicare Supplement F. If you already have signed up for any Plan F, …

Should I get Medicare Plan F when I turn 65?

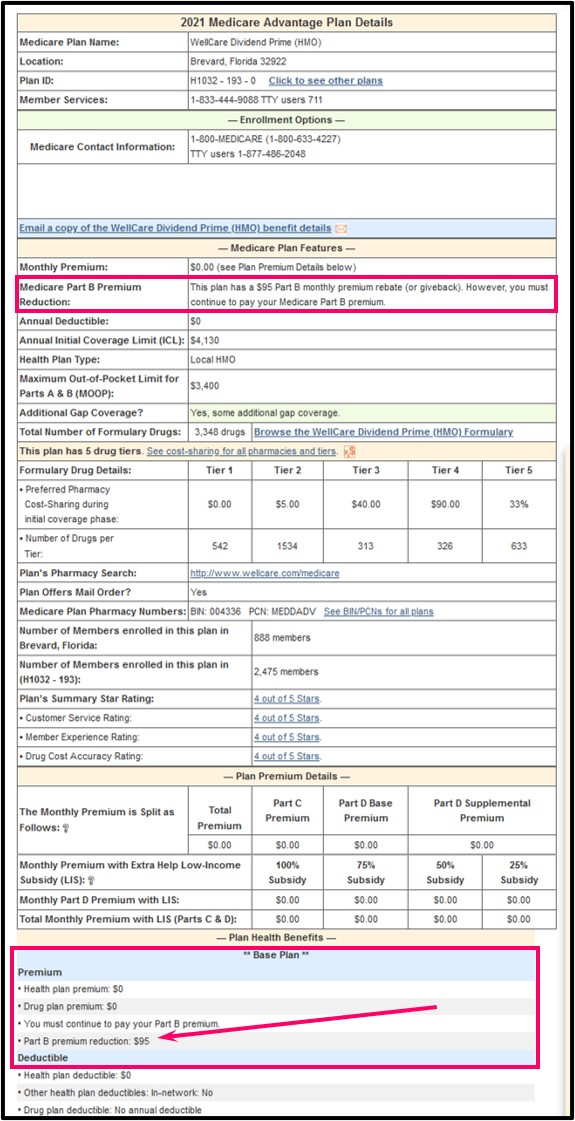

Feb 14, 2022 · In 2022, the standard monthly premium for Part B will be $170.10 per month. In 2021, the Medicare Part B premium was $148.50. That’s an annual premium increase of $21.60. Those who have a higher gross income will have an income-related monthly adjustment amount. If you make more than $91,000 on your individual tax return or have a joint tax ...

Will Plan F premiums rise after 2020?

What is the average cost for Medicare Plan F?

Is Medicare Plan F expensive?

Why is Plan F being discontinued?

Does Plan F have a deductible?

Does Medicare Plan F cover deductible?

Why is Plan F more expensive than Plan G?

Is Plan F still available in 2022?

Can I get Plan F in 2022?

Will plan F be grandfathered?

Is Medicare Plan F being discontinued in 2020?

What is the most popular Medigap plan for 2021?

Does Medicare cover gym membership?

Walt, Medicare supplement Plan F does not offer any benefit for gym membership. Plan F is a Medigap policy and is designed to cover your share of Medicare covered expenses such as hospital deductible and the 20% coinsurance for outpatient services.

Does Medicare cover eye glasses?

Unless the company is offering you some extra benefit beyond the standardized plan F benefit schedule you are probably not going to be happy. Medicare supplement plan F fills in the gaps of original Medicare. Medicare does not cover eye glasses so a supplement will generally not be of benefit. Christy.

Premium pricing methods

Pricing methods define if and how your Medigap monthly premiums will increase as you age. Medigap insurance companies price policies based on one of the following structures:

Popularity

The popularity of the three pricing methods differ across the country.

Inflation and health care costs

Two additional factors that affect premiums are increases in inflation and health care costs. As the overall cost of health care rises, the insurance to cover the costs must also increase.

What is Plan F for Medicare?

Plan F also covers expenses related to Medicare Part A including coinsurance during hospitalization, hospice care, and a skilled nursing facility. It also covers the first three pints of a blood transfusion and Medicare takes care of the rest.

What is Medicare Supplement Plan F?

Medicare supplement Plan F represents a great value for the people facing higher co-payments and deductibles due to regular medical attention. It is offered through several insurance companies. It should be noted that some plans might be available at a lower cost while some may require a higher premium.

Is Medigap Plan F going to be discontinued?

Apparently, Medigap Plan F would be discontinued in the coming year. It might not be sold after 2020. These modifications will be a part of the MACRA (Medicare Access and CHIP Reauthorization Act) of 2015, which states the plans that pay for the Medicare Part B deductible would no longer be sold to the newly eligible.

What is the Medicare Part B deductible?

The Medicare Part B deductible that refers to the deductible amount involved in the MACRA legislation, changes every year. In 2019, it was $185. This is the amount you need to pay before Part B pays for the services that are covered. However, once MACRA legislation is implemented in 2020, the coverage for this deductible by Medicare plan F would no ...

What is Medicare Supplement Insurance Plan F?

Medicare Supplement Insurance Plan F is standardized by the federal government. This means that the 9 basic benefits of Plan F will be the same, no matter where you live or what Medicare Supplement Insurance company you buy it from.

Why are Medicare premiums so high?

Medicare Supplement Insurance plan premiums could be more expensive for older beneficiaries for a few reasons, such as: 1 If you wait until after your Medigap Open Enrollment Period to sign up for a Medigap plan, insurance companies can charge you a higher premium based on your health.#N#Your Medigap Open Enrollment Period (OEP) is a 6-month period that starts as soon as you are at least 65 years old and enrolled in Medicare Part B.#N#During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs. 2 There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan.#N#Community-rated#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.#N#Issue-age-rated#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age.#N#Attained-age-rate#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

What is issue age rated?

Issue-age-rated. With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan. You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. Attained-age-rate.

Is Medicare Supplement Plan F still available?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

Does Medicare Supplement Plan F have a high deductible?

Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan. Medicare Supplement Plan F also has a high-deductible version.

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

Which states have standardized Medicare Supplement Plans?

Please note that Massachusetts, Minnesota, and Wisconsin have their own standardized Medicare Supplement plans. Medicare Supplement Plan F isn’t available in those states. Here’s an overview of what Medicare ...

Do Medigap premiums increase with age?

Most Medicare Supplements sold today are on an attained age pricing structure. This means that each year, you’ll have an age-related rate increase on your birthday.

What can you do when Medigap rates go up?

You can’t avoid rate increases. It’s just part of having a Medicare Supplement. However, you do have some ammunition in your back pocket – you can go price shopping!

Switching Medigap plans requires medical underwriting

The only issue we sometimes run into is if you’re not healthy enough to pass underwriting. You do have to be accepted if you want to switch from one Medicare Supplement to another.

Get a Free Policy Review

There is no harm in confirming that your best is the best plan for you. Let us help you by doing a free policy review. If your plan is the right plan for you, we can high-five and know that you’re all set! If there’s a better option, we might be able to save you some of your hard-earned money.