A Medicare Advantage plan with no premium can be an affordable and cost-effective choice for Medicare beneficiaries. But since plan benefits can vary, it’s not always automatically the best value. For some plans, it may be less expensive overall to pay a higher premium for more coverage.

Full Answer

Why are some Medicare Advantage plans free?

Nov 08, 2021 · A Medicare Advantage plan with no premium* can be an affordable and cost-effective choice for Medicare beneficiaries. But since plan benefits can vary, it’s not always automatically the best value. For some plans, it may be less expensive overall to pay a higher premium for more coverage. SAMPLE PLAN A.

What are the benefits of Medicare Advantage plan?

Oct 31, 2019 · What else do I need to know about $0-premium Medicare Advantage plans? Average Medicare Advantage premiums dropped 33 percent year over year in 2019, according to eHealth research. The popularity of $0-premium plans contributed to the low average premiums. Medicare Part D plans are not available with $0-premiums.

What to consider when comparing Medicare plans?

Jun 15, 2021 · Zero Premium Medicare Plans Many Medicare Advantage plans have a $0 monthly premium. However, zero monthly premium plans may not be totally “free.” You’ll typically still have to pay some other costs like copays, deductibles, and coinsurance, as well as your Part B...

What is the best Medicare plan for You?

Jul 13, 2020 · For people who use their coverage often, a $0 premium plan may not be worth it. But for those who mostly use their coverage for preventative services and the occasional doctor visit, the premium savings could be worth it. Keep in mind that it’s not just about the money: some $0 premium Medicare Advantage plans have fewer benefits too. And if the cost of a service …

Why do some Medicare plans have no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.Oct 6, 2021

How do $0 premium Medicare Advantage plans work?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Which Medicare does not have a premium?

Why do doctors not like Medicare Advantage plans?

Is Medicare completely free?

Who Has the Best Medicare Advantage plan for 2022?

Can I change from Medicare Advantage to regular Medicare?

What is the highest rated Medicare Advantage plan?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Can I get Medicare Part B for free?

Why is my Medicare Part B premium so high?

What Are $0-Premium Medicare Advantage Plans?

No matter whether they have a $0 premium or not, Medicare Advantage plans give you an opportunity to receive your Medicare benefits through a priva...

What Out-Of-Pocket Costs Might $0-Premium Medicare Advantage Plans have?

Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These exp...

What Else Do I Need to Know About $0-Premium Medicare Advantage Plans?

Whether or not it’s a zero-premium Medicare Advantage plan that you sign up for, you still need to continue paying your Medicare Part B premium, in...

What is Medicare Advantage Plan?

Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These expenses may include copayments, coinsurance, and deductibles. A deductible is the amount you have to pay before your Medicare Advantage plan pays its share of covered services.

Does Medicare Advantage have out of pocket costs?

Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These expenses may include copayments, coinsurance, and deductibles.

Does Medicare Advantage cover hospice?

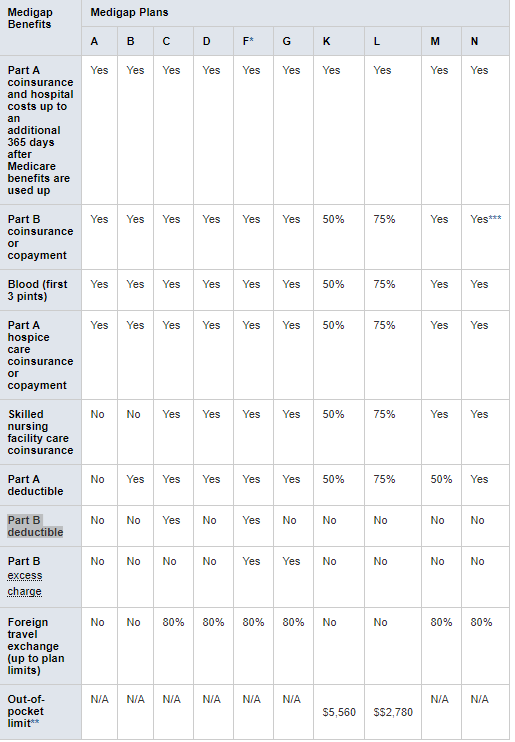

Under the Medicare Advantage (also called Medicare Part C) program, plans must offer the same benefits as Original Medicare, Part A and Part B , but if you need hospice benefits, they’d come directly through Medicare Part A instead of through the plan.

What is a deductible in Medicare?

A deductible is the amount you have to pay before your Medicare Advantage plan pays its share of covered services. Not every plan might have a deductible amount, and they may vary among plans. A copayment is generally a set dollar amount you may have to pay for a covered service (for example, $15). A coinsurance amount is a percentage ...

What is copayment in Medicare?

A copayment is generally a set dollar amount you may have to pay for a covered service (for example, $15). A coinsurance amount is a percentage of the total cost that you may have to pay for a covered service (for example, 20%). Insurance companies offering Medicare Advantage plans have some flexibility in setting their rates.

What is coinsurance amount?

A coinsurance amount is a percentage of the total cost that you may have to pay for a covered service (for example, 20%). Insurance companies offering Medicare Advantage plans have some flexibility in setting their rates. Plan premiums, deductibles, coinsurance amounts, and copayments may vary among plans. Another cost-related item ...

What is a copayment?

A copayment is generally a set dollar amount you may have to pay for a covered service (for example, $15). A coinsurance amount is a percentage of the total cost that you may have to pay for a covered service (for example, 20%).

Is zero premium Medicare good?

Zero premium Medicare Advantage plans can be a great option for people who are looking to either bundle or supplement their existing Medicare coverage. Research your plan options thoroughly before choosing one to make sure it covers everything you need at a cost that makes sense for your budget.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) is a healthcare plan that’s offered by private insurance companies. But can you really get anything for free? Let’s take a closer look at zero premium Medicare Advantage plans and whether this might be a good option for your healthcare needs. Share on Pinterest.

How to enroll in Medicare?

If you are helping your loved one enroll in Medicare, remember to: 1 gather important documents, such as a social security card and any other insurance plan documents 2 compare plans online through Medicare.gov’s plan finder tool or through your preferred insurance company’s website

Does Medicare Advantage cover dental?

Depending on the plan you choose, a Medicare Advantage plan may also cover extra services like hearing, vision, dental, and other wellness programs that traditional Medicare does not . To keep costs low, the federal government contracts with private insurance companies to provide your plan.

How much does a health plan cover?

Once that amount is met, the health plan will cover 100 percent of the cost for the healthcare services for the rest of the year.

What is coinsurance in insurance?

Coinsurance. Coinsurance is the amount that you are responsible for paying for a covered service, even after you’ve paid your deductible. For example, if your coinsurance is 20 percent, you will pay the first 20 percent of the amount due, and your health plan will cover the rest. Deductible.

What is deductible insurance?

A deductible is the amount that you are responsible for paying before your insurance plan begins to pay its share. Deductibles are often higher with plans that have lower premiums, meaning you’ll pay less each month in premiums but more out of pocket for individual healthcare services.

What are the downsides of a $0 premium plan?

The downsides of a $0 premiums plan. The downsides of a $0 premium plan usually come in the form of costs you'll pay down the line. Often, plans with lower premiums have higher deductibles, copayments, and other costs. You may also have fewer benefits than a higher-priced plan.

Do Medicare premiums come out of Social Security?

If you’re receiving Social Security benefits, these premiums automatically come out of your monthly checks. If you have Original Medicare, your premiums go directly to the Medicare program. However, if you enroll in Medicare Advantage, a portion of these funds are paid to your plan provider to pay for your care.

What are the benefits of Medicare Advantage?

Medicare Advantage plans must cover everything Part A (hospital insurance) and Part B (medical insurance) cover, but most also include some extra benefits. These are the most common perks: 1 Prescription drug coverage 2 Dental work 3 Vision care and eyeglasses 4 Hearing aids 5 A fitness plan

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must cover everything Part A (hospital insurance) and Part B (medical insurance) cover, but most also include some extra benefits. These are the most common perks: Other benefits could include transportation to and from doctor appointments and allowances to purchase over-the-counter items like compression socks ...

What is the maximum out of pocket amount for Medicare?

The maximum out-of-pocket amount (MOOP) may also be higher for $0 premium plans. By law, all Medicare Advantage MOOPs must be $6,700 or lower in 2020. 2 Many plans offer low limits to help you keep your costs down, but you might not see low MOOPs among $0 premium plans.

Do Medicare Advantage plans cover a smaller portion of your expenses?

And the benefits you do receive could cover a smaller portion of your expenses.

What is coinsurance and copay?

Copays and coinsurance are other cost-sharing mechanisms. For each service you receive, you might pay a copay (such as $25 for a doctor visit) or coinsurance (such as 20% of a medication). The insurer pays the remaining balance.

Is Medicare Part C the same as Medicare Part A?

Last Updated : 09/16/2018 2 min read. Medicare Part C ( Medicare Advantage) plans are required to offer at least the same amount of coverage as Original Medicare, Part A and Part B (except for hospice care, which remains covered by Medicare Part A). Medicare Advantage plans are sold by private insurers that have contracted with the Medicare program.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) plans are required to offer at least the same amount of coverage as Original Medicare, Part A and Part B (except for hospice care, which remains covered by Medicare Part A). Medicare Advantage plans are sold by private insurers that have contracted with the Medicare program.

Does Medicare pay monthly premiums?

So, Medicare (run by the government) pays a monthly premium to the insurance carrier on your behalf, and that amount can range depending on the county.

How to choose a Medicare Advantage plan?

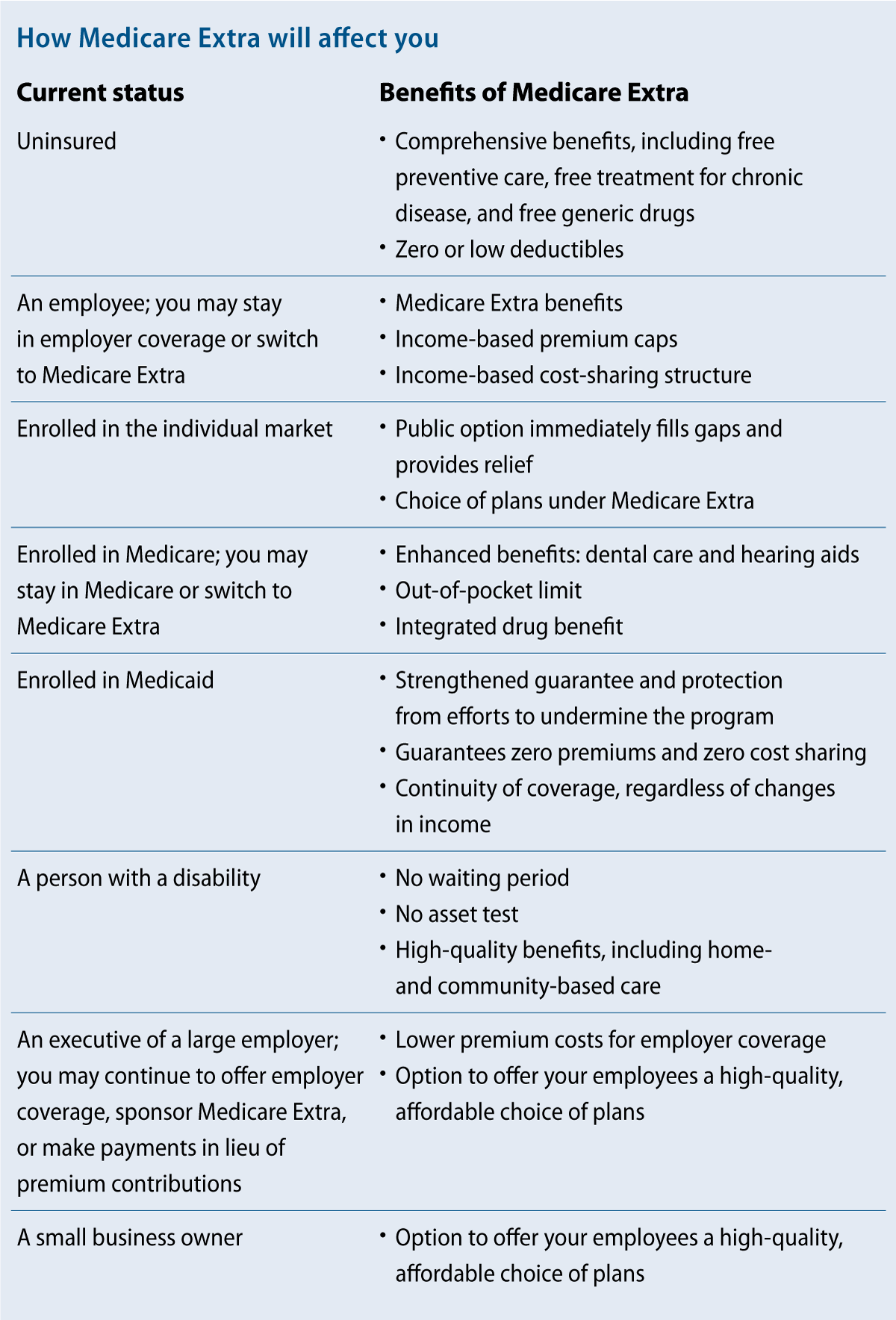

A no-premium Medicare Advantage plan might be a good idea for you if: 1 You’re healthy and are willing to take on the risk of a high deductible in exchange for low or no monthly premium. 2 You rarely go to the doctor and have enough money saved up to cover any very unexpected emergencies. 3 You’re dual eligible, meaning you’re eligible for both Medicare and Medicaid. 4 You don’t travel much and live in one state for the entire year.

What are the different types of Medicare Advantage plans?

Medical Savings Accounts – Another Type of Medicare Advantage 1 Health Maintenance Organization (HMO) plans: In most HMOs, you can only go to doctors in your network (except in an urgent or emergency situation). 2 Preferred Provider Organization (PPO) plans: In a PPO, you pay less if you use doctors in your network. You usually pay more if you go outside of your network. 3 Private Fee-for-Service (PFFS) plans: PFFS plans are similar to Original Medicare in that you can generally go to any doctor as long as they accept the plan’s payment terms. The plan determines how much it will pay and how much you must pay when you get care. 4 Special Needs Plans (SNPs): SNPs provide specialized health care for specific groups of people, like those who have both Medicare and Medicaid, live in a nursing home, or have certain chronic medical conditions. 5 HMO Point-of-Service (HMO/POS) plans: HMO plans may allow you to get some services out-of-network for a higher copayment or coinsurance. 6 Medical Savings Account (MSA) plans: These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan.

What is Medicare Advantage?

In case you’re new to Medicare, Medicare Advantage is an alternative option for health coverage. Medicare Advantage, or MA, is offered by private insurance companies, and it’s approved by Medicare. MA plans cover everything traditional Medicare covers as well as emergency and urgent care. These plans often include extra perks, like dental coverage, ...

Can you have both Medicare and Medicaid?

You rarely go to the doctor and have enough money saved up to cover any very unexpected emergencies. You’re dual eligible, meaning you’re eligible for both Medicare and Medicaid.

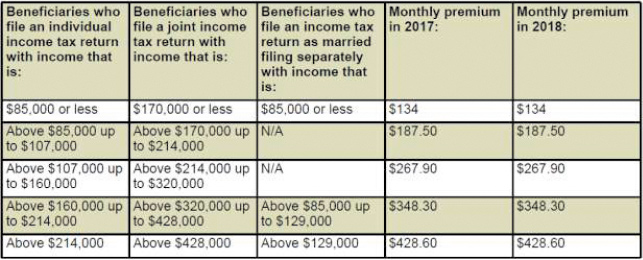

How much does Medicare Part B cost?

As of 2018, that premium is $134 per month, and it generally comes right out of your social security check.

What is an HMO plan?

HMO Point-of-Service (HMO/POS) plans: HMO plans may allow you to get some services out-of-network for a higher copayment or coinsurance. Medical Savings Account (MSA) plans: These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible).

Is Medicare Advantage 0 premium?

Just because you may have found a $0 premium Medicare Advantage plan in your area, that doesn’t automatically mean it’s the best plan for you. $0 premium Medicare Advantage plans may have other expenses, such as copayments, coinsurance, and deductibles. Also, different plans may include different extra benefits.

Is Medicare Advantage a low cost plan?

Get Started. Yes, it’s true – some Medicare Advantage plans can have premiums as low as $0. You might wonder how they can offer plans so cheaply. Here’s some information that might help explain.

Does Medicare pay for Part A?

Medicare pays insurance companies a fixed amount of money to provide your Medicare Part A and Part B coverage. $0 premium Medicare Advantage plans have to follow Medicare rules, but have some flexibility in setting their premiums and cost sharing amounts. The same is true for all Medicare Advantage plans. Learn more about what you need ...

What is copayment in Medicare?

Copayments and coinsurance are cost-sharing amounts you may have to pay towards covered medical services. For example, a Medicare Advantage plan might cover 80% of a certain doctor visit, and you might have to pay the remaining 20% coinsurance.

What is a Medicare deductible?

A deductible is an amount of money you may have to pay for medical services before your plan begins to cover them. Generally deductibles apply on an annual basis. For example, if your plan’s deductible is $700 ...

Does Medicare Advantage pay out of pocket?

Unlike Original Medicare, Medicare Advantage has an out-of-pocket limit on your annual spending. That means that once you’ve spent a certain amount of your own money on medical services within a calendar year, the plan may pay all your approved medical costs for the rest of that year.

What is coinsurance and copayment?

Also, different plans may include different extra benefits. Copayments and coinsurance are cost-sharing amounts you may have to pay towards covered medical services. For example, a Medicare Advantage plan might cover 80% of a certain doctor visit, and you might have to pay the remaining 20% coinsurance. A deductible is an amount of money you may ...

What makes Medicare Advantage Plans attractive?

One feature that makes Medicare Advantage Plans attractive is choice. As long as plans include all Medicare Part A and Part B benefits, sponsors have the freedom to set premiums, determine cost-sharing amounts (deductibles, coinsurance and copayments) and include any extra benefits not covered by original Medicare .

What is the benefit of Medicare Advantage Plan?

One benefit of enrolling in a Medicare Advantage Plan is avoiding the out-of-pocket costs associated with original Medicare. Rather than paying a lump sum deductible for inpatient care, Advantage Plans often require a much smaller per day payment for a limited number of days, beyond which no further payment is required.

How The Plans Work

All health insurance companies that offer “Medicare Advantage plans” must accept Medicare-eligible enrollees. In this regard, the plans are advantageous because they cannot deny anyone coverage. Additionally, MA Plan customers can simply switch back to “Original Medicare” during an annual enrollment period.

Costs and Premiums

The premiums paid and costs associated with MA plans can also be more expensive than they first appear. Copays, for example, can cost as much as $300 for an ambulance or $175 per day for a hospital stay. Lab service fees can cost up to $100. Out-of-pocket costs can quickly add up if you become sick (or an existing condition worsens).

Why Medicare Advantage Plans Are Bad

Other problematic issue with MA plans is the fact that care can actually end up costing more than it would under original Medicare. This is particularly true if you suffer from a very serious medical condition. Additionally, some private health insurance companies are not very financially stable. They may suddenly cease coverage without warning.

The Bottom Line

Medicare Advantage plans are not always as wonderful as they are made out to be. While the $0 premium may be enticing, the reality is that the out-of-pocket expenses and restrictions end up making them expensive over time. These plans are best for those who are relatively healthy.