What happens if you don't qualify for Medicare?

If you do not qualify on your own or your spouse's work record. You cannot enroll in a Medicare Advantage plan (such as an HMO or PPO) or buy a Medigap supplemental insurance policy unless you’re enrolled in both A and B. Most people receive statements from Social Security saying whether they're yet eligible on their work records.

Do I qualify for Medicare?

You qualify for full Medicare benefits if: You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and; You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

Should the age of eligibility for Medicare be lowered?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and older who weren’t on Medicare and had heard about proposals to lower the age of eligibility, 64% favored lowering the age.

Do you have to pay for Medicare Part A?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

What are the 3 requirements for a member to be eligible for a Medicare?

You're 65 or older.You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and.You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.More items...•

How difficult is it to apply for Medicare?

A: Applying for Medicare online is easy and requires information that you'll likely have on hand. Your initial enrollment window for Medicare spans seven months, beginning three months before the month of your 65th birthday and ending three months after that month.

How long does it take Medicare to be approved?

between 30-60 daysMedicare applications generally take between 30-60 days to obtain approval.

What is the downside of Medicare?

There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling. Whether you choose original Medicare or Medicare Advantage, it's important to review healthcare needs and Medicare options before choosing your coverage.

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How long before you turn 65 do you apply for Medicare?

3 monthsYour first chance to sign up (Initial Enrollment Period) It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Does Medicare start on the first day of the month you turn 65?

You will have a Medicare initial enrollment period. If you sign up for Medicare Part A and Part B during the first three months of your initial enrollment period, your coverage will start on the first day of the month you turn 65.

Can you claim hospital bills on Medicare?

Medicare does not cover private patient hospital costs, ambulance services, and other out of hospital services such as dental, physiotherapy, glasses and contact lenses, hearings aids. Many of these items can be covered on private health insurance.

What are two major problems with respect to the future of Medicare?

Financing care for future generations is perhaps the greatest challenge facing Medicare, due to sustained increases in health care costs, the aging of the U.S. population, and the declining ratio of workers to beneficiaries.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What would happen if Medicare ended?

Payroll taxes would fall 10 percent, wages would go up 11 percent and output per capita would jump 14.5 percent. Capital per capita would soar nearly 38 percent as consumers accumulated more assets, an almost ninefold increase compared to eliminating Medicare alone.

Medicare basics

Start here. Learn the parts of Medicare, how it works, and what it costs.

Sign up

First, you’ll sign up for Parts A and B. Find out when and how to sign up, and when coverage starts.

What happens if you don't enroll in Medicare Part B?

People who fail to enroll in Medicare Part B when they first should will face lifetime penalties, a coverage gap and disruptions in care. The penalty is hefty: an extra 10 percent for each full year you could have had Part B but didn’t apply and were not covered beyond 65 by health insurance from a current employer.

Does Medicare cover everything?

Medicare doesn’t cover everything. Decide whether traditional (also called original) Medicare and a supplement Medigap plan or a Medicare Advantage plan, which combines Medigap and prescription coverage, is best for you. Learn more about Medicare Advantage plans and search for a Medigap plan here.

How old do you have to be to get Medicare?

citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by: Paying premiums for Part A, the hospital insurance.

How long do you have to live to qualify for Medicare?

You qualify for full Medicare benefits if: You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

How much will Medicare premiums be in 2021?

If you have 30 to 39 credits, you pay less — $259 a month in 2021. If you continue working until you gain 40 credits, you will no longer pay these premiums. Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive); or. You receive a disability pension from the Railroad Retirement Board and meet certain conditions; or.

How long is the Medicare Part B enrollment period?

If you meet these criteria, you’ll receive an 8-month long special enrollment period (SEP) during which you can enroll in Part B without penalty. The Medicare Part B SEP begins the sooner of when: ...

What is Medicare Part B?

Medicare Part B covers most of the services people expect in a health plan – such as outpatient physician visits , mental health services, lab tests, and physical therapy. It’s important to sign up at the correct time for this part of Medicare – because simple enrollment mistakes can result in gaps in coverage and lifelong premium penalties.

Can Medicare beneficiaries buy individual market policies?

In fact, Medicare beneficiaries are not allowed to purchase individual market policies other than Medigap plans. Many Americans are enrolled in the individual market when they qualify for Medicare – and can keep their individual market plan after becoming Medicare eligible.

Do you have to pay for Medicare if you have an individual market plan?

But once you’re eligible for Medicare, an individual market plan may pay little or nothing toward your care. This is why it’s important to enroll in Medicare (and a Medigap or Medicare Advantage plan) when you’re first eligible for the benefit.

Do large companies have to enroll in Medicare?

Employees of large companies (i.e., usually one with more than 20 employees) do not have to enroll in Medicare. However, if they choose to sign up for Part A and B, Medicare will act as secondary coverage and pay for care after the GHP pays.

Can you get a cobra if you don't have Medicare?

Furthermore, COBRA carriers may recoup what they paid toward your medical bills when they discover you were eligible for Medicare but not enrolled in it. This is because COBRA plans cover only the portion of your health care claims Medicare wouldn’t be responsible for paying – even if you don’t have Medicare.

Do I need to enroll in Medicare if I'm still employed?

You’re still employed … and ‘pass’ on Part B. If you’re happy with the coverage your employer offers, you may think you don’t need to enroll in Medicare. But individuals who work for a small employer (i.e., generally one with fewer than 20 employees*) should enroll in Part B because that will be their “primary” insurance coverage. ...

Key Takeaways

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and older who weren’t on Medicare and had heard about proposals to lower the age of eligibility, 64% favored lowering the age.

Full Retirement Age by Year - What to Know

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

What happens if you decline Medicare?

Declining. Late enrollment penalties. Takeaway. If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later. Medicare is a public health insurance program designed for individuals age 65 and over ...

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Is Healthline Media a licensed insurance company?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S . jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on May 14, 2020.

Is Medicare Part D mandatory?

Medicare Part D is not a mandatory program, but there are still penalties for signing up late. If you don’t sign up for Medicare Part D during your initial enrollment period, you will pay a penalty amount of 1 percent of the national base beneficiary premium multiplied by the number of months that you went without Part D coverage.

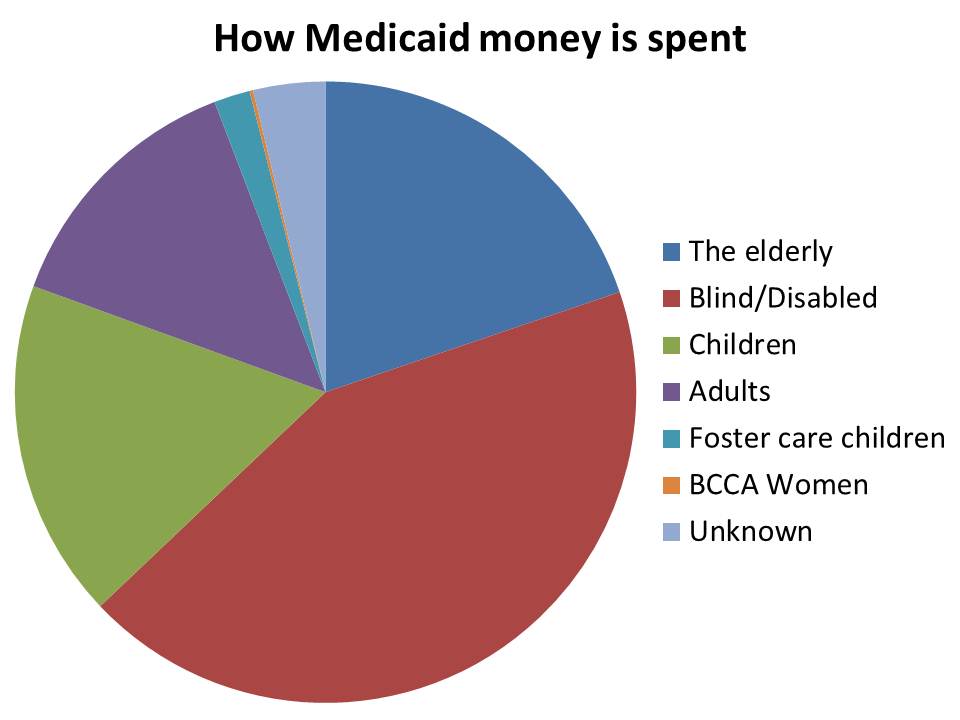

What happens if a senior is denied Medicaid?

If a senior in a nursing home is denied benefits, often the nursing home has a difficult time collecting the outstanding balance for care.

How much does Medicaid cost for nursing homes?

With long term care nursing costs typically exceeding $11,000 per month, Medicaid benefits are necessary for over half of the nursing home population in our country. Yet, applying for Medicaid is long, tedious, and for those who are not prepared, sometimes not entirely predictable.

What documents do you need to apply for medicaid?

In addition to strict requirements for submission of financial statements, Medicaid applicants must submit a variety of documents such as citizenship papers, marriage licenses, birth records, deeds, affidavits, etc. to support their applications.

When did Medicaid have to submit financial information?

Since the enactment of the Deficit Reduction Act of 2005, Medicaid applicants have had to submit all financial data pertaining to the five year period leading up to the filing of the application. Even statements from accounts that were closed during this period must be submitted.

Can I get long term care insurance if I have a US citizenship?

Citizenship also must be proven. Those who qualify can receive medical coverage, even coverage for long term care expenses, which are not covered for any extended time period by health insurance policies, Medicare, or policies purchased under the Affordable Care Act.

Does Medicaid require proof of eligibility?

Throughout the Medicaid application process, the burden of proof of eligibility status remains with the applicant. Unless the applicant can adequately show eligibility for benefits, the Medicaid office will deny benefits. The applications themselves must be signed under oath by the applicant or his representative.