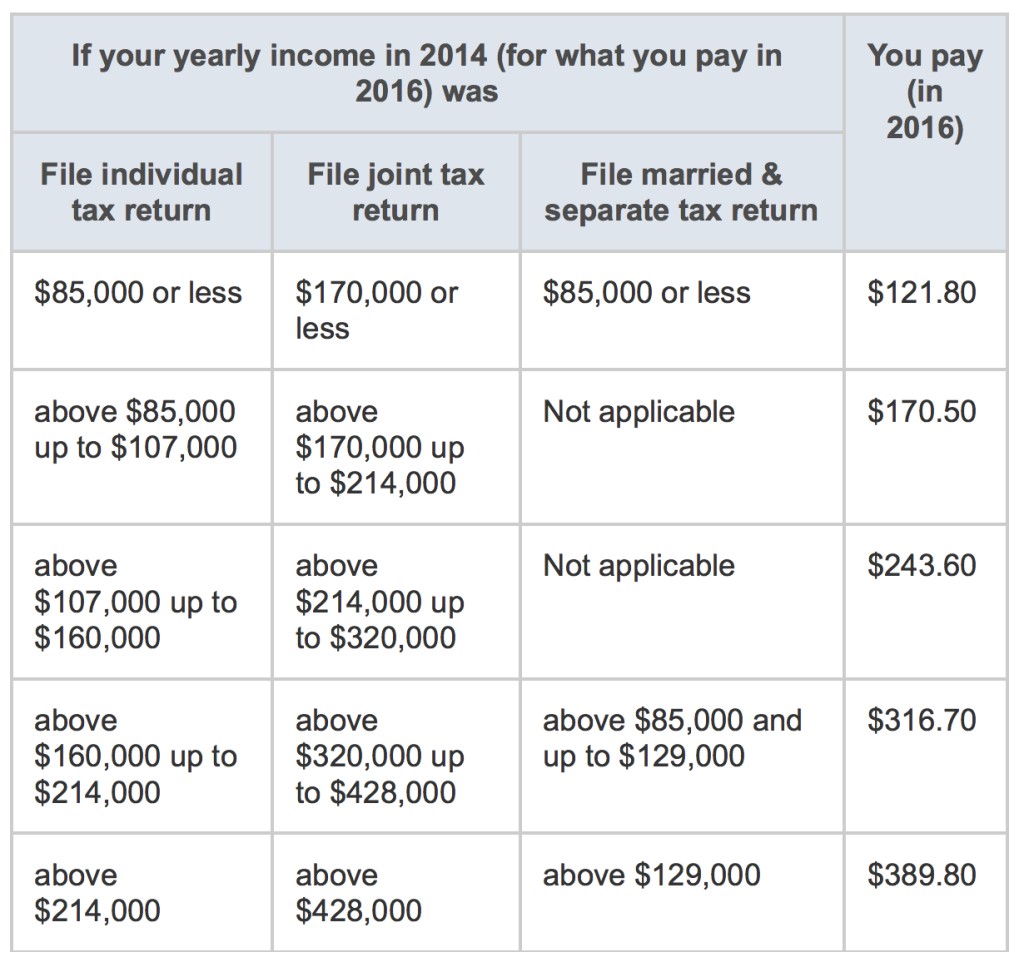

Selling your home only affects Medicare Part B and Part B costs if the sale is taxable income, and the modified adjusted gross income exceeds Medicare limits. Otherwise, there is no effect on the cost of your Medicare. The more you make in gross income, the higher the IRMAA.

Will the sale of my home affect my Medicare benefits?

Happily, it is extremely unlikely that your actual benefits under Medicare Part B (general medical insurance) or Medicare Part D (prescription drug coverage) will be negatively affected. However, the sale of your home could impact the price you pay for those benefits in the form of increased monthly premium fees.

Will selling my home affect my insurance premiums?

Selling your home may impact your Income Related Monthly Adjusted Amount (IRMMA), which could result in increased premium prices. Increased premiums apply to individuals with a modified adjusted gross income (MAGI) of $85,000 or couples with a MAGI of $170,000.

Can the value of your home affect your Medicaid eligibility?

The issue that arises is whether the value of a person’s home is large enough to make them ineligible to qualify for Medicaid, which can cover a person’s stay in a nursing home. Also, is the surcharge in effect for two years until the tax cycle returns you to your lower income?

Can I appeal a Medicare claim for selling a home?

Fortunately, there is an IRMAA process to appeal unusual or “change of life” shifts in income. There are seven such qualifying events listed by Medicare. Unfortunately, most involve a loss of income, and selling a home is not among them.

Do capital gains affect Medicare costs?

Income from your assets whether through IRA withdrawals or by dividends, interest and capital gains from non-IRA assets can make your social security taxable or increase your Medicare premiums.

Does owning a house affect Medicare?

As I mentioned, your home is exempt when you apply and while you're on Medi-Cal. However, your house is no longer exempt after your death or if you're a married couple, after the death of both of you.

Does Medicare consider capital gains as income?

The Medicare surtax applies to the following gross investment income types: Interest. Dividends. Capital gains.

Does selling a house affect Magi?

No, capital gains from the sale of a house that are not included in your income do not factor into your Modified Adjusted Gross Income (MAGI) for purposes of the Affordable Care Act.

Does selling a house affect Social Security benefits?

WHAT HAPPENS AFTER I SELL MY REAL AND/OR PERSONAL PROPERTY? You will have to pay back some or all of the SSI benefits you received while trying to sell the property. You may continue to get SSI benefits. Contact your local Social Security office to find out if your SSI benefits will continue after the sale.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

Do capital gains affect Social Security benefits?

No. Income that comes from something other than work, such as pensions, annuities, investment income, interest, IRA and 401(k) distributions, and capital gains is not counted toward the earnings limit and will not affect your benefit.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What income is subject to Medicare tax?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2022, this base is $147,000. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

Does selling a house count as income?

Home sales profits are considered capital gains, taxed at federal rates of 0%, 15% or 20% in 2021, depending on income. The IRS offers a write-off for homeowners, allowing single filers to exclude up to $250,000 of profit and married couples filing together can subtract up to $500,000.

Is money made from selling a house taxable?

If you owned and lived in the home for a total of two of the five years before the sale, then up to $250,000 of profit is tax-free (or up to $500,000 if you are married and file a joint return). If your profit exceeds the $250,000 or $500,000 limit, the excess is typically reported as a capital gain on Schedule D.

Do capital gains count towards Magi?

Yes, capital gains can increase your AGI. Taxable capital gains are included in your adjusted gross income (AGI) and modified adjusted gross income (MAGI).

Selling your home could lead to higher Medicare premiums if your taxable income sees a boost

Although your Medicare benefits shouldn't change when you sell your home, your monthly premiums may. It depends on whether the sale of your home affects your taxable income.

What Is the High-Earner Threshold?

Medicare considers you a high earner if your modified adjusted gross income (MAGI) exceeds $91,000 per year if you file your taxes as a single, or $182,000 for married couples filing jointly.

How Does Selling Your Home Affect Medicare Premiums?

The capital gains tax may apply when you make a profit on an investment, which includes the sale of real estate. Luckily, the IRS does allow you to exclude a portion of your capital gains on real estate.

When Can't You Take Advantage of Capital Gains Exclusions?

It wouldn't be the U.S. tax code if there weren't limits to the real estate exclusion. If any of the following apply, you will have to pay tax on the whole gain, meaning it will count toward your MAGI:

Appealing the Income-Related Monthly Adjustment Amount

Although Medicare premiums are determined by the Centers for Medicare & Medicaid Services (CMS), the " Initial IRMAA Determination Notice " comes from the Social Security Administration. This notice describes how SSA determined you owe IRMAA and provides information on filing an appeal.

How Long Does IRMAA Apply?

The good news is that an IRMAA determination doesn't mean you owe the high-earner surcharge forever. If your adjusted gross income dropped below the IRMAA threshold, you'll pay the standard Medicare premiums next year.

If I Sell My House, Will I Lose My Medicare Benefits?

Selling your home will not cause you to lose your Medicare benefits. However, if you have a Medicare plan and move to a new address, you may need to change your plan.

What are the changes in life for Medicare?

Medicare publishes a list of qualifying change of life events, which include things like spousal death, divorce, work reduction or stoppage, etc. All of these events involve a loss of income, though, whereas the sale of your home likely involves an income increase.

Does selling your home affect Medicare?

Selling your home may not affect premiums. In some cases, selling your home may not affect your Medicare premiums at all. This is because tax laws often allow a large exclusion on the sale of your final home.

Does Medicare charge higher rates for Part B and Part D?

Medicare generally charges higher rates for Part B and Part D coverage if you have a high income. The question is whether or not the sale of your home will change what is known as your Income Related Monthly Adjusted Amount, or IRMAA for brevity’s sake. The federal government examines your federal tax returns to see if your income changes ...

Does Medicare affect your home?

Fortunately, it is extremely unlikely that your benefits under Medicare Part B (general medical insurance) or Medicare Part D (prescription drug coverage) will be negatively affected. However, the sale of your home could impact the price you pay for those benefits in the form of increased monthly premium fees.

Can you appeal a Medicare premium increase?

Premiums may not be affected if you qualify for an exclusion on the sale of a ‘final home.’. It is possible to appeal a premium increase through the Social Security Administration. You may have heard horror stories about fellow Medicare recipients losing their coverage after selling their home.

How long is Medicare special enrollment period?

In some cases where this happens, Medicare will provide plan members a three-month special enrollment period to find other plans. Details on qualifying events have not been released but Medicare is the only entity that can call for such a special enrollment period; individuals can’t request one.

Does Ralph's last home roll over to a new home?

This is a bit surprising, in that tax laws permit a hefty tax exclusion when someone sells their “last” home and does not roll over the proceeds into a new home. But let’s assume Ralph has done his homework here and, for whatever reason, has or will report a big rise in his taxable income tied to the sale of his home.

Does Medicare cover cataract surgery?

Phil Moeller: Medicare and your Medicare supplement plan (also known as Medigap insurance) will cover the costs of medically necessary cataract surgery and the costs of new prescription glasses afterwards.

Does IRMAA jack up Medicare?

Of course, IRMAA should only jack up his Medicare premiums for a single year. But still, unfair is unfair.”. Ralph apparently is concerned that the sale of his home will produce a big surge in his taxable income.

How much is long term capital gain taxed?

As a result, your realized gain will be taxed in full as long-term capital gain if held more than one year, or as a short-term capital gain if held one year or less, she said. “Long-term capital gains do currently benefit from preferential federal tax rates and can be 0%, 15% or 20% depending on your income,” Fusillo said.

Is a primary residence exempt from capital gains tax?

First, primary residences are afforded special tax treatment when sold, specifically, the exclusion of a statutory amount of realized capital gain based on your filing status, said Cynthia Fusillo, a certified public accountant with Peapack Private Wealth Management in New Providence.