Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Why should I buy a Medicare supplement plan?

These benefits are:

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible*

- Part B excess charge

- Foreign travel at 80% up to plan limits

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is the purpose of Medicare supplemental insurance?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

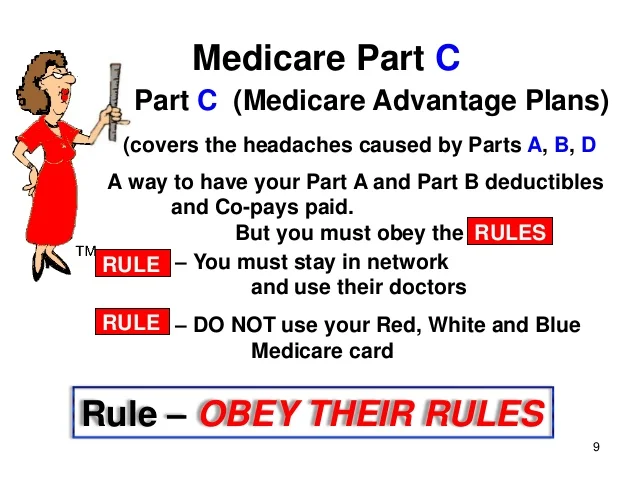

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Does Medicare Supplement cost increase with age?

Medicare Supplement Insurance premiums tend to increase with age.

What percentage does Medicare Supplement cover?

A portion of the cost of most services after you meet your Part B deductible. Medicare pays 80 percent of your costs. You pay the other 20 percent.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How much is Medicare Supplement monthly?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Does Medicare Supplement cover hospital deductibles?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

What is the Purpose of the Medicare Supplement Insurance Plan?

Most people might not know, but Medicare is not free, and it also does not cover all your health care costs. It will pay for some but not all your medical bills. On the other hand, Medigap is developed to help you pay the expense that Medicare does not cover, which includes

How to Enroll for Medigap?

The Medicare Supplement Plan has a one-time enrollment option after you turn 65 and have enrolled for Medicare Part A and B. You will surely want to avail of the one-time enrollment period to take advantage of the ‘guaranteed issue, and there is no hassle to qualify for the coverage.

Bottom Line

Fulmer Insurance Group can help by offering the best insurance plans. Our experts will help you determine the monthly cost and how much you need to pay out of pocket. We can provide you with the Medicare Supplement Plan, compare the plans, and see the best fit.

What is Medicare Supplement Insurance?

Medicare supplement insurance is a type of insurance that is designed to cover the expenses that are not covered by Medicare. It is also referred to as Medigap. Many people who have Medicare are surprised to find out that Part B will only cover about 80 percent of their medical expenses. If you are living on a tight budget, ...

What is the difference between Medicare Advantage and Medigap?

It is also important to note that there is a difference between a Medigap policy and Medicare Advantage plan. A Medicare advantage plan is a type of Medicare plan that you get from a private company instead of the government. Medigap is designed to supplement an existing Medicare insurance plan. You will have to pay a private insurance company ...

How does Medigap work?

How a Medigap Plan Works. Your doctor will send you a bill for the services that have been provided. Medicare will pay their portion. Medigap will pay the remaining balance. The Benefits of Using a Medicare Supplement Plan. You are free to choose your own hospitals and doctors.

How many people does Medigap cover?

You will have a premium that you will have to pay each month. You will have to buy from a company in your state. A Medigap plan will only cover one person.

Is hearing aid covered by Medicare?

Vision care, dental care and hearing aids also aren’t covered. The Cost of Medicare Supplemental Insurance. Because you get Medicare supplemental insurance through a private company, the cost of it can vary. You may have to shop around to find a premium that fits your budget.

Does Medigap cover long term care?

Medigap will cover your hospital expenses, doctor’s bills and medications. However, there are some things that will not be covered. This includes long-term care, such as assisted living, nursing home and home care. Vision care, dental care and hearing aids also aren’t covered. The Cost of Medicare Supplemental Insurance.

Can I get a Medigap plan if I switch back to Medicare?

If you are married, then your spouse will need their own separate plan. Keep in mind that you cannot have a Medigap plan if you have a Medicare advantage plan. However, you can get a Medigap plan if you switch back to original Medicare. Your doctor will send you a bill for the services that have been provided.

What is a medicaid supplement?

A Medicare Supplement Insurance Plan, or Medigap, is private health insurance that Medicare beneficiaries purchase to help them pay for additional expenses not covered by Original Medicare. Currently, there are ten available plans, with benefits ranging from foreign travel emergency care to hospice care. However, starting in January 2020, this will be reduced to eight plans. Your choices are going to change, but one thing will not: the importance of choosing the plan that is most appropriate for your financial and health situation. Although you can decide to switch plans after you first enroll, companies can refuse to issue a policy based on health concerns, or simply hike your rates. So, choose wisely and consult the expertise of an insurance agent or broker.

When will Medicare Part B be eliminated?

The new law comes into effect on January 1, 2020.

Can you deny Medicare coverage at 65?

When looking for a Medicare Supplement Insurance Plan, keep in mind that companies cannot deny you acceptance due to a pre-existing condition when you enroll in a Medigap plan during Medicare open-enrollment at age 65.

Can you switch health insurance plans after enrolling?

Your choices are going to change, but one thing will not: the importance of choosing the plan that is most appropriate for your financial and health situation. Although you can decide to switch plans after you first enroll, companies can refuse to issue a policy based on health concerns, or simply hike your rates.

Can you renew Medigap if you are enrolled?

However, beneficiaries who are currently enrolled can continue to renew their policies because, in general, all Medigap plans are guaranteed renewable as long as enrollees continue to pay their premiums on time. Regardless, these beneficiaries can switch plans.

What Are The Basics Of Medicare Supplement Insurance?

Medicare Supplement insurance is provided by private insurance companies. It is specifically designed to work with Original Medicare. Medicare Supplement pays for some or all of the gaps in Original Medicare. These gaps are costs that you are expected to pay out of pocket, among which include:

How Much Does Medicare Supplement Insurance Cost?

When you are asking yourself if Medicare Supplement insurance is worth it, you have to know how the premiums are set to in order to answer that question. The price of Medicare Supplement coverage is based on how many gaps your policy covers. There are ten standardized Medicare Supplement plans: A, B, C, D, F, G, K, L, M, and N.

Are Medicare Supplement Plans Worth the Cost?

The answer to this question is different for everyone. To help answer it for yourself, it would be wise to compare Medicare Supplement plans to the other two options available to you:

Are Medicare Supplement Plans Worth the Cost for You?

So, what is the final answer? Are Medicare Supplement plans worth the cost? They are not for everyone. Certainly, if you are on a tight budget, Medicare Advantage plans might be a better option.

When will seniors be automatically enrolled in Medicare?

Fact 4: Some seniors are enrolled in Part A automatically. Some seniors will be enrolled in Medicare Part A automatically around their 65th birthday. If you are not automatically enrolled, you can enroll in Medicare Parts A and B during certain enrollment periods.

How many people are covered by Medicare?

Fact 2: Medicare covers more than 61 million people. Medicare had over 61 million enrollees in the United States in November 2019, according to statistics from the Centers for Medicare & Medicaid Services (CMS). 1.

What is Medicare Part D?

Medicare Part D is optional prescription drug coverage that is also provided by private insurance companies. Both Part C and Part D are regulated by the federal government. You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

What is Medicare and Medicaid?

Medicare is administered by the Centers for Medicare & Medicaid Services and is an entitlement program similar to Social Security. This means that most U.S. citizens earn Medicare health insurance eligibility by paying taxes for a set period of time.

When is Medicare open enrollment?

The Medicare Open Enrollment Period for Medicare Advantage plans and Medicare Part D prescription drug plans runs from October 15 to December 7. During this time, you can make several changes such as joining a Medicare Advantage plan or a Medicare prescription drug plan.

Is Medicare for seniors?

Fact 1: Medicare is for seniors and the disabled. Medicare is a federally-funded health insurance program for people age 65 or older and some younger people who have qualifying disabilities or who have end-stage renal disease (ESRD).

Do you have to pay Medicare premiums?

If you or your spouse paid Medicare taxes for 10 or more years while working, you are eligible for premium-free Medicare Part A coverage. If you are under 65, you may also qualify for premium-free Part A coverage. All Medicare beneficiaries may still be responsible ...

What is the first significant pro for Medicare Supplement?

The first significant “pro” is that all insurance companies that offer a Medicare Supplement policy have several plans to choose from, giving you choices of coverage and cost. All plan names are letters like Plan A, Plan B, Plan F, Plan N, etc.

What is Medicare Supplement Policy?

So, many individuals who turn 65 purchase a Medicare supplement policy (also known as a Medigap policy) to pay for those out-of-pocket health care costs that Medicare doesn’t pay.

How much does an insurance premium cost at 65?

The average monthly premium for someone age 65 ranges from about $127 to over $200 depending on the insurance company. Premiums vary from company to company. The second “con” is that your premium will most likely go up a few percentage points every year.

How long past your 65th birthday can you get supplement insurance?

The third ‘con” is that you must qualify medically for a supplement policy if you are more than 6 months past your 65 th birthday and do not have current qualifying coverage.

What age do you have to be to qualify for Medicare?

Most people qualify for Medicare when they turn 65. It covers most but not all of your health care costs. Original Medicare has two parts, Part A and Part B.

Do you have to worry about copays and deductibles with Medicare?

You will no longer have to worry about copays and deductibles of any Medicare approved costs. Another significant “pro” is that with a Medicare supplement policy, you may see any doctor or specialist that accepts Medicare. You are not subject to an HMO network and “gatekeeper” rules. For most people who compare Medicare supplement plans, ...

Do you have to pay deductible for outpatient surgery?

You will pay a deductible out-of-pocket when you enter the hospital, and you will pay about 20% out-of-pocket for doctors charges, all outpatient costs like doctor visits, lab work, tests, ambulance service, and outpatient surgeries. Generally, you will not have to pay a monthly premium for Part A, and you will pay a monthly premium ...

What Is Medicare Advantage?

Medicare Advantage (also known as Part C) plans are provided by private insurers and essentially replace Original Medicare as your primary insurance. They cover all Medicare-covered benefits and may also provide additional benefits like some dental, hearing, vision and fitness coverage.

What Are the Benefits of Medicare Advantage?

Medicare Advantage plans provide all the same benefits provided by Original Medicare, plus coverage for items and services not covered by Original Medicare, including some vision, some dental, hearing and wellness programs like gym memberships.

How Much Does Medicare Advantage Cost?

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: “If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 [or higher, depending on your income].”

What Is Medicare Supplement?

Medicare Supplement plans (commonly known as Medigap plans) are sold by private insurance companies to help fill the gaps of Original Medicare coverage.

What Are the Benefits of a Medicare Supplement Plan?

A Medicare Supplement plan makes your out-of-pocket costs more predictable and easier to budget.

How Much Does a Medicare Supplement Plan Cost?

The estimated average monthly premium (the amount you pay monthly) for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Sources

NORC at the University of Chicago. Innovative Approaches to Addressing Social Determinants of Health for Medicare Advantage Beneficiaries. Better Medical Alliance. Accessed 9/6/21.