- Medicare A: U.S. citizens are automatically eligible for this coverage when they turn 65. There is no premium for this plan and it covers most of the cost of hospitalization.

- Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor's services, and prescribed drugs.

- Medicare C: Medicare C plans are offered through private insurance companies that are approved by the Medicare program. Some Medicare C plans provide vision and dental care.

- Medicare D: Like Medicare C, this plan is offered through approved private insurance companies. It provides coverage for prescriptive drugs.

What is a Medicare beneficiary?

A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan.

How do I check Medicare eligibility for a beneficiary?

To check Medicare eligibility, you must have the following beneficiary information: The following provides information about the systems available to CGS home health and hospice providers to check a beneficiary's eligibility. myCGS – A CGS web portal that provides eligibility information based on the HIPAA 270/271 transaction.

Who is eligible for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

What happens if a Medicare beneficiary has other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What are the 3 requirements for a member to be eligible for a Medicare?

You're 65 or older.You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and.You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.More items...•

Does Medicare cover family members?

Medicare is individual insurance, not family insurance, and coverage usually does not include spouses and children. Unlike other types of insurance, Medicare is not offered to your family or dependents once you enroll. To get Medicare, each person must qualify on their own.

Do Medicare beneficiaries pay monthly premiums?

If you don't get premium-free Part A, you pay up to $499 each month. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty. Most people pay the standard Part B monthly premium amount ($170.10 in 2022).

Who are Medicare Part B beneficiaries?

Since 1972, individuals receiving Social Security retirement benefits, individuals receiving Social Security disability benefits for 24 months, and individuals otherwise entitled to Medicare Part A, are automatically enrolled in Part B unless they decline coverage.

Is my spouse eligible for Medicare when I turn 65?

Your spouse is eligible for Medicare when he or she turns 65. Your eligibility for Medicare has no impact on the date that your spouse is eligible for Medicare. Continue reading for more answers to your questions about Medicare, individual health insurance, and coverage options for your spouse after you enroll.

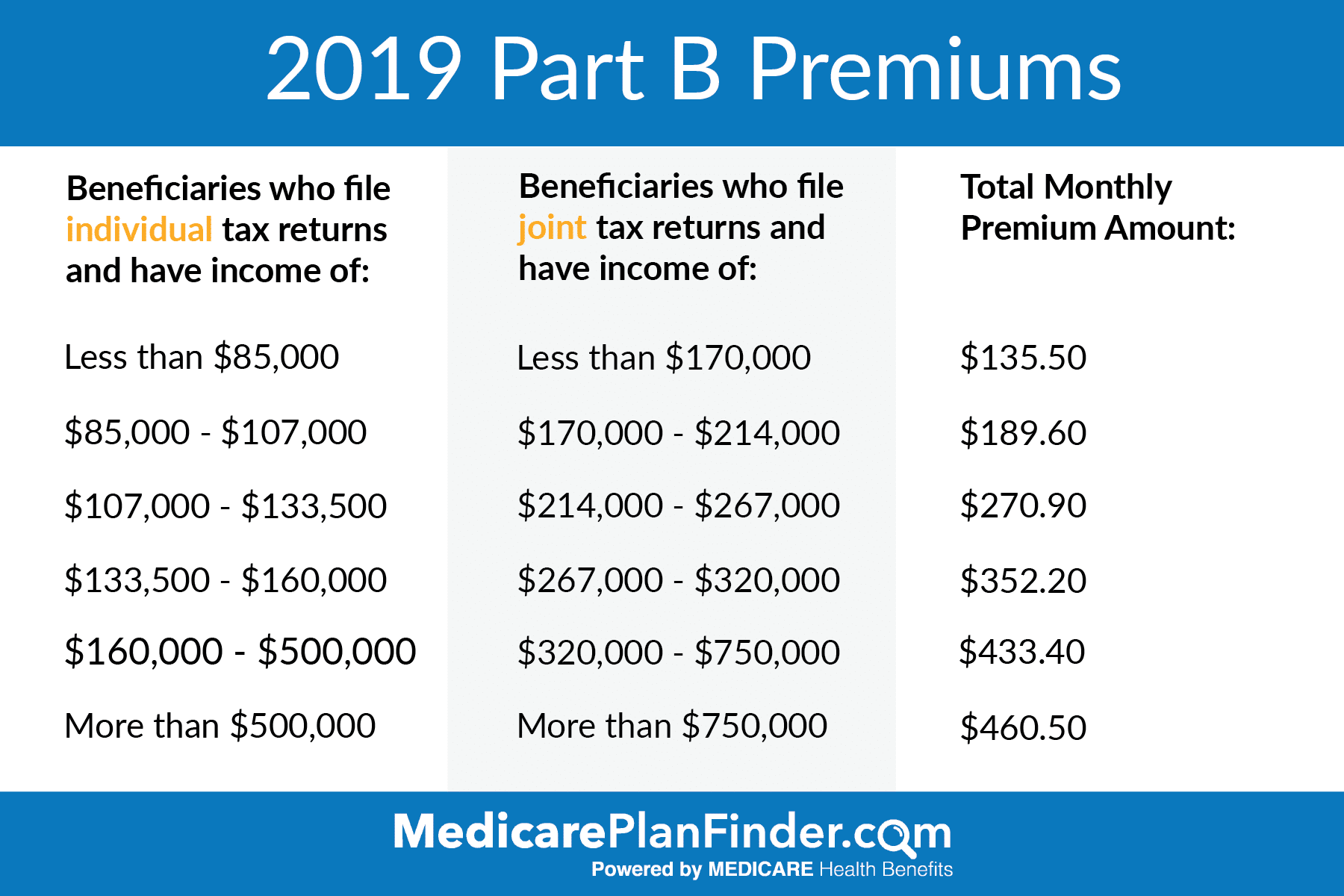

Why is my Medicare premium higher than my husbands?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you'll pay higher premiums.

What does Medicare beneficiary pay?

Beneficiaries enrolled in Part B are generally required to pay a monthly premium ($104.90 in 2015). Beneficiaries with annual incomes greater than $85,000 for a single person or $170,000 for a married couple in 2015 pay a higher, income-related monthly Part B premium, ranging from $146.90 to $335.70.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How many Medicare Part B beneficiaries are there?

Monthly premiums: The national base beneficiary premium for 2019 was $32.74....Number of People Receiving Medicare (2019): *Total Medicare beneficiaries • Aged • Disabled61.2 million • 52.6 million • 8.7 millionPart A (Hospital Insurance, HI) beneficiaries • Aged • Disabled60.9 million • 52.2 million • 8.7 million3 more rows•Aug 24, 2020

What is a Medicare beneficiary identifier?

The Medicare Beneficiary Identifier (MBI) is the new identification number that has replaced SSN-based health insurance claim numbers (HICNs) on all Medicare transactions, such as billing, claim submissions and appeals.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What happens when Medicare beneficiaries have other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What is Medicare for seniors?

Medicare is a health insurance program designed to assist the nation's elderly to meet hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

How long does it take for Medicare to pay a claim?

When a Medicare beneficiary is involved in a no-fault, liability, or workers’ compensation case, his/her doctor or other provider may bill Medicare if the insurance company responsible for paying primary does not pay the claim promptly (usually within 120 days).

Does Medicare pay a conditional payment?

In these cases, Medicare may make a conditional payment to pay the bill. These payments are "conditional" because if the beneficiary receives an insurance or workers’ compensation settlement, judgment, award, or other payment, Medicare is entitled to be repaid for the items and services it paid.

What is Medicare beneficiary?

A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan. Although Medicare beneficiaries are typically seniors, those who are younger than 65 years of age can still qualify for Medicare benefits if they meet certain qualifications, such as being a recipient ...

What are the benefits of Medicare?

There are four kinds of Medicare coverage that a Medicare beneficiary can avail themselves of: 1 Medicare A: U.S. citizens are automatically eligible for this coverage when they turn 65. There is no premium for this plan and it covers most of the cost of hospitalization. 2 Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor's services, and prescribed drugs. 3 Medicare C: Medicare C plans are offered through private insurance companies that are approved by the Medicare program. Some Medicare C plans provide vision and dental care. 4 Medicare D: Like Medicare C, this plan is offered through approved private insurance companies. It provides coverage for prescriptive drugs.

Does Medicare B cover outpatient care?

There is no premium for this plan and it covers most of the cost of hospitalization. Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor's services, and prescribed drugs.

How to contact Medicare.org?

Call us at (888) 815-3313 — TTY 711 to speak with a licensed sales agent.

What are the eligibility requirements for QMB?

Although the rules may vary from state to state, in general, you must meet the following requirements in order to be eligible for the QMB program: You must be entitled to Medicare Part A. Your income must be at or below the national poverty level (income limits generally change annually).

Does QMB cover Medicare?

It means that your state covers these Medicare costs for you, and you have to pay only for anything that Medicare normally does not cover. QMB does not supplement your Medicare coverage but instead ensures that you will not be precluded from coverage because you cannot afford to pay the costs associated with Medicare.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

What age do you have to be to get a Social Security card?

Understanding the Rules for People Age 65 or Older. To be eligible for premium-free Part A on the basis of age: A person must be age 65 or older; and. Be eligible for monthly Social Security or Railroad Retirement Board (RRB) cash benefits.