Your Medicare set-aside arrangement funds are required to be kept in a separate account from all your other assets. Your Medicare set-aside arrangement account must earn interest, and the earned interest must also be used to pay medical expenses related to your settlement.

Full Answer

How long does it take to get Medicare set aside?

The process typically begins with a referral to a Medicare set-aside vendor or consultant. Most vendors and consultants can complete the Medicare set-aside allocation within a week or two of receiving a copy of the medical records and prescription history.*

Who pays for a Medicare set aside?

- Injured person’s name

- Injured person’s Medicare Health Insurance Claim Number (HICN) or Social Security Number (SSN)

- Date of incident

- Nature of illness/injury

- Name and address of the WC insurance carrier

- Name and address of the injured person’s legal representatives

- Name of insured

Can I get the money from a Medicare set aside?

Using a Medicare set-aside arrangement, you can set aside the money you’ll need for treatment. The money in your Medicare set-aside arrangement will then be used to pay for the care you need as a result of your injury or illness. Common expenses include:

When to use a Medicare set aside in a settlement?

When someone has been injured due to someone else’s negligence or the injury falls under workers’ compensation and the victim is currently receiving or expected to receive Medicare, it may be necessary to create a trust called a Medicare Set Aside (MSA) to reimburse the government for future medical expenses.

What happens to unused Medicare set aside?

Medicare set aside proceeds are to be used to pay for a beneficiary's future injury-related care otherwise covered by Medicare. Should the beneficiary pass away prior to those proceeds being exhausted, they would pass to the named beneficiary on the MSA account.

What happens if you spend your MSA?

Simple answer: When MSA funds are exhausted, Medicare will begin to pay for all covered items related to your injury, only if you have properly managed your MSA funds and reported your spending to Medicare, and if you are enrolled as a beneficiary on Medicare.

How does a Medicare set aside work?

Settlement funds are 'set aside' in a special account to pay claimants' future medical treatment and service costs. Once the funds are exhausted, Medicare will begin paying for the injured person's qualified medical expenses.

How long is CMS approval good for?

CMS has issued a conditional approval/approved WCMSA amount at least 12 but no more than 48 months prior to filing of an Amended Review request. The case has not yet settled as of the date of the request for re-review.

What happens to money left in a MSA at the end of the year?

Any money left in your account at the end of the year will remain in your account. If you stay with the Medicare MSA Plan the following year, the new deposit will be added to any leftover amount.

Can MSA be used for dental?

You can continue to use the carryover funds in the Limited-use MSA for dental and vision expenses incurred in 2020.

Can I manage my own Medicare set aside?

Medicare beneficiaries may choose to self-administer their CMS-approved WCMSA or have it professionally administered on their behalf.

What is an MSA payment?

An MSA is a financial arrangement that allocates a portion of a settlement, judgment, award, or other payment to pay for future medical services. The law mandates protection of the Medicare trust funds but does not mandate an MSA as the vehicle used for that purpose.

What is MSA seed money?

An initial deposit of “seed money” is used to fund the MSA. The amount of the seed deposit totals the first surgical procedure or replacement and two years of annual payments. The structured settlement then funds the MSA with annual deposits.

Is Medicare set aside taxable?

In most cases, the entire amount paid out in a personal physical injury settlement is non-taxable. So, your MSA funds, as part of that settlement are also not taxed upon receipt. The injured party is responsible for taxes on interest earned on their MSA funds.

What are MSA requirements?

To have an MSA reviewed by CMS, the minimum amount of the total settlement must be more than $25,000 for a Medicare beneficiary, or $250,000 for a claimant with reasonable expectation of Medicare enrollment within 30 months of the settlement date.

How do I stop Medicare set aside?

There is one approach to avoiding MSAs that works — go to court or to the work comp board. The Centers for Medicare and Medicaid Services (CMS) will honor judicial decisions by a court or state work comp boards after a hearing on the merits of a work comp claim.

What is a Medicare set aside trust?

A Medicare set-aside (MSA) trust is a trust created to cover anticipated future medical costs for someone who expects to rely on Medicare. Medicare requires that all workers’ comp and personal injury settlement funds are exhausted before it will begin to cover the costs of treatment for an individual that are related to those injury claims. Insurance payouts are meant to cover future medical treatments, and Medicare wants to ensure that covered parties use all of those funds specifically for injury treatment and not for other purposes.

When is an MSA Required?

Whenever someone else is liable for a person’s injury, whether that is a negligent defendant or a workers’ comp insurance provider, Medicare becomes a secondary payer and requires the parties to set up an MSA. The regulations pertaining to set-asides are labyrinthine and complex.

What is MSA in medical?

MSA’s are typically created as part of a settlement in a personal injury or workers’ comp matter. The trust will house a portion of the personal injury settlement or workers’ comp payout, to be “set aside” for coverage of future medical expenses that would otherwise have been covered by Medicare. Those set-aside funds must be depleted before Medicare will begin to cover the injured party’s qualifying medical expenses.

How to contact Careguard about special needs trust?

Still have questions about special needs trusts? Call our experts at 877.275.7415 or email us at [email protected].

Why do we need a special needs trust?

When the medical portion of a personal injury case settles, sometimes it is necessary for a Special Needs Trust (SNT) to be established in order to protect an individual’s financial and medical benefits, including Medicaid, Medi-Cal, housing benefits, and Supplemental Security Income (SSI).

What is SNT trust?

The Special Needs Alliance, a national nonprofit of attorneys who serve people with disabilities and their families, defines an SNT as: "a trust that will preserve the beneficiary’s eligibility for needs-based government benefits because the beneficiary does not own or control the assets being held on his or her behalf.

How long does it take for Medicare to start?

The plaintiff is likely to begin Medicare coverage within 30 months and the settlement is greater than $250,000. If the plaintiff will need an SNT, the MSA should be incorporated within the trust document. Creation of an SNT and/or MSA should be handled at settlement time.

Does Medicare pay for MSA?

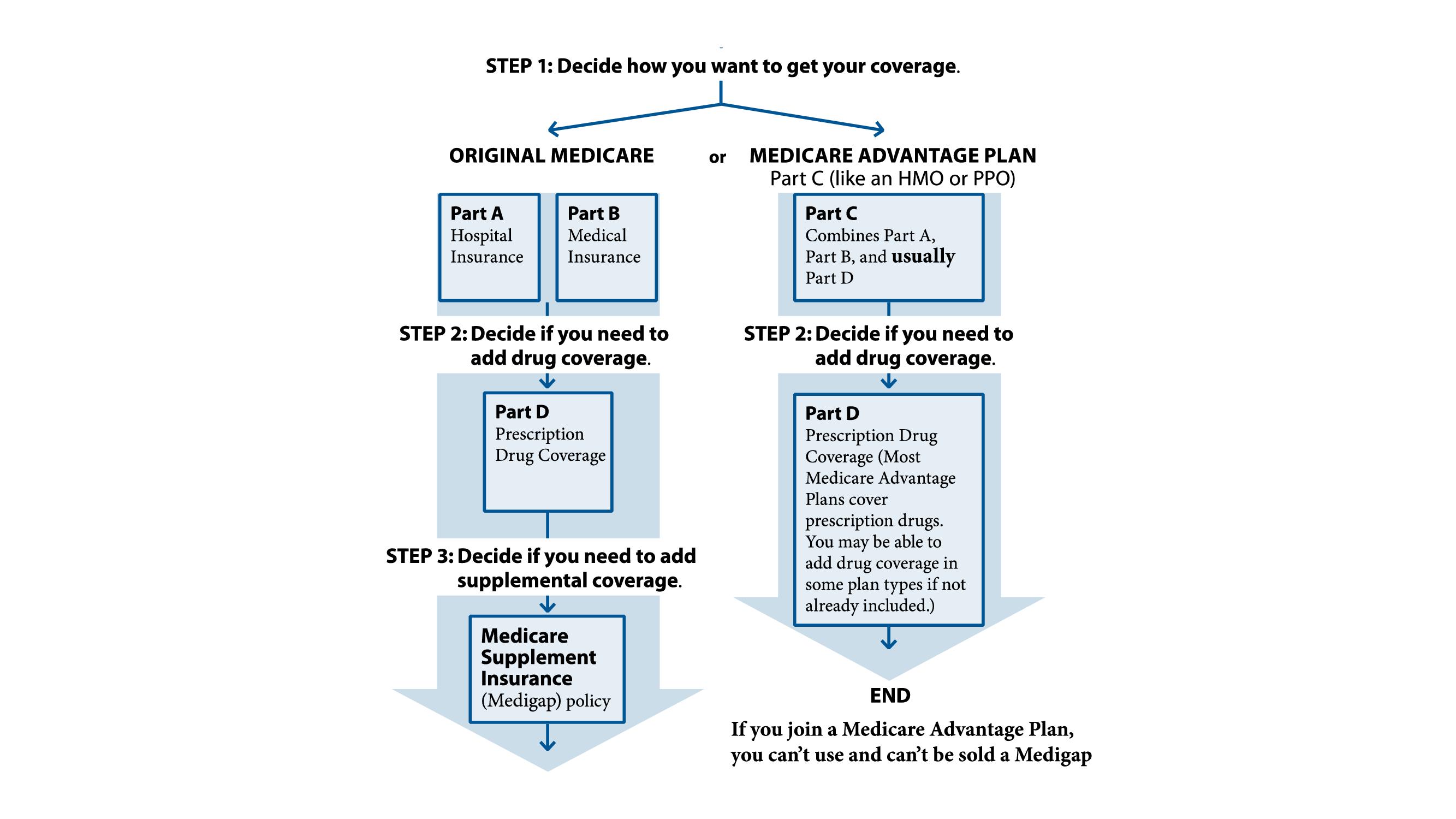

In certain cases, Medicare requires that a portion of settlement funds be allocated to a Medicare set aside (MSA) to cover related future expenses that Medicare would otherwise pay for. The guidelines for worker’s compensation cases are clear and are often used for other personal injury settlements, as well. Creating an MSA should be considered if:

Does Careguard report to Medicare?

CareGuard completes all of the reporting to Medicare and reports annually back to the trust so the trust’s regulations and thresholds are accommodated. Ametros has another service called Amethyst that allows the trust company to keep the medical settlement funds in the trust’s bank account.

Should SNT be handled at settlement time?

Creation of an SNT and/or MSA should be handled at settlement time. These are complex instruments, and there are strict regulations concerning the necessary sequence of events when creating and funding them with a settlement. In fact, failing to protect a client’s benefits can leave a personal injury attorney open to liability. ...

Who Administers the Medicare Set Aside Account?

MSA account administration may be performed by the injured person (self-administered) or by a professional administrator. The party who administers the MSA (individual or administrator) must keep accurate records of all disbursements from the account for CMS reporting.

Who must report Medicare set aside expenses?

Rules and Regulations. Medicare Set Aside account holders are required to report their expenditures on annual basis to the Centers for Medicare and Medicaid Services (CMS). They must hold on to all receipts in order to validate the expenses.

What are the Qualifications for an MSA?

CMS guidelines state that it will review new claims proposals for the following:

What Happens When the MSA Funds are Gone?

Once all Medicare Set Aside account funds have been exhausted, a final audit is performed on expenditures. If the funds were used appropriately, then the injured person should receive Medicare benefits for medical expenses related to the claim.

How Does the Injured Person Access MSA Funds?

For any expense, the account holder must keep detailed records and receipts.

What happens if you don't manage your MSA?

If account holders do not manage their MSA account properly, pay more than the approved amount for a service or treatment , or pay for non-allowable expenses from the account, they can face some serious repercussions, such as paying back the overages/improperly spent funds and jeopardizing future Medicare benefits.

What is MSA settlement money?

MSA settlement money is only for approved medical services and other costs directly related to the specific injury. MSA accounts must be interest-bearing and the interest must stay in the account to be used for medical expenses. Recipients should keep ALL records and receipts for every expense paid for from the account.

What is a Medicare set aside trust?

A Medicare Set-Aside Trust is a trust or trust-like arrangement that is set up to hold settlement proceeds for future medical expenses. A specialized company evaluates your future medical needs, recommends an amount that should be set aside for future medical care, and the government approves the amount. The funds are then either placed in the Medicare Set-Aside account in one lump-sum or the account is funded with a “structured settlement annuity” that will refill the account over time. In either case, the administrator of the Medicare Set-Aside trust may use the funds only to pay for medical care related to your personal injury, leaving Medicare or your private insurance free to provide coverage for medical expenses that are not related to your injury.

How long does it take to get Medicare if you settle a claim?

Currently, the government is interested in setting up a Medicare Set-Aside Trust if you are a Medicare recipient settling a personal injury claim for more than $25,000 or if you settle for more than $250,000 and can be expected to receive Medicare within 30 months of settlement (this happens a lot if you receive SSDI, which has a 24-month waiting period before you can receive Medicare benefits)..

Can you use Medicare for a personal injury settlement?

If you are already a Medicare recipient at the time of the settlement, you may have to use some of the settlement funds to reimburse the federal government for injury-related “conditional” medical expenses that Medicare paid for prior to your settlement. This is because Medicare is a “secondary” payer that is only supposed to pay for medical services that are not provided by another party. In the case of your personal injury settlement, the person who injured you includes funds in your settlement to pay for your past medical expenses. Therefore, he is the “primary” payer, and some of those settlement funds must be applied towards any bills that Medicare has already paid on your behalf.

Does Medicare require set aside trusts?

But several years ago the government has instituted a set of reporting requirements for anyone who is responsible for compensating a personal injury victim, and many practitioners believe that the government will soon require Medicare Set-Asides for all personal injury cases (right now, you are responsible for protecting Medicare’s interest in your future medical care in case of a settlement, but there are few hard-and-fast rules defining this requirement, especially for small claims).

What is the recommended method to protect Medicare's interests?

The recommended method to protect Medicare’s interests is a WCMSA. The amount of the WCMSA is determined on a case-by-case basis. To assist you in determining if a WCMSA is reasonable, please review Section 15.1 (Criteria) in the WCMSA Reference Guide.

How to submit a WCMSA?

If you decide to submit a WCMSA for review, it can be submitted electronically through the WCMSA Portal (WCMSAP) or by paper/CD through the mail. The portal submission is the recommended approach for submitting a WCMSA as it is significantly more efficient than sending this information via the mail. For more information about this application, please see the WCMSAP page.

Is WCMSA a CMS submission?

While there are no statutory or regulatory provisions requiring that a WCMSA proposal be submitted to CMS for review, submission of a WCM SA proposal is a recommended process. More information on this process can be found on the WCMSA Submissions page.