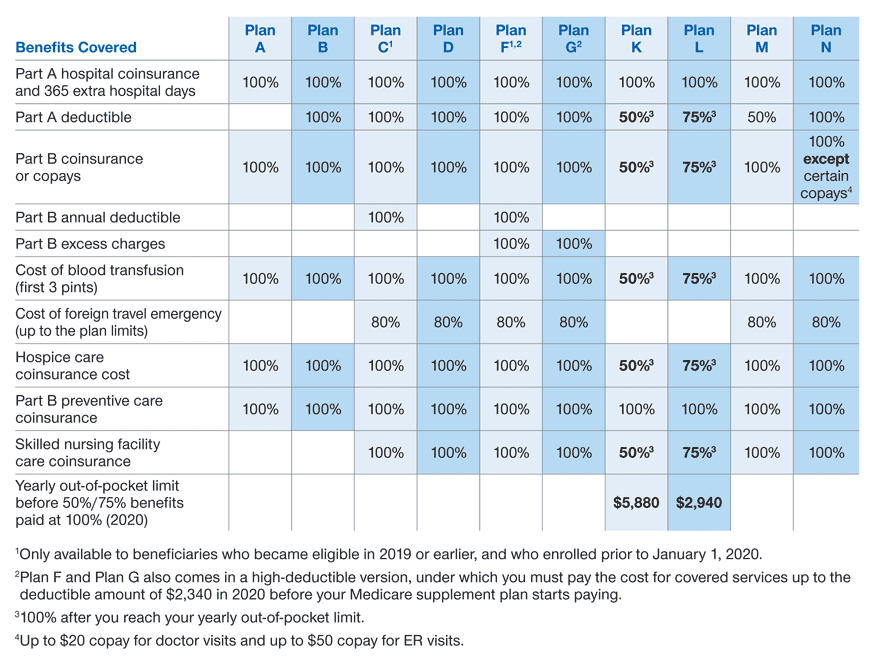

Medicare Supplement plan comparison

| Medicare Supplement plan benefits | Plan D | Plan K | Plan L |

| 1. Part A coinsurance/hospital costs | Yees | Yes | Yes |

| 2. Part B coinsurance/copayment | Yes | 50% | 75% |

| 3. Blood (first 3 pints) | Yes | 50% | 75% |

| 4. Part A hospice care coinsurance | Yes | 50% | 75% |

Full Answer

What is a Medicare supplement plan?

Medicare Supplement plans are standardized by the federal government and are identified as letters. Supplement insurance plans are sold by some private insurance providers in the United States. Not all companies have them, or sell all available plans, so you may have to look for one in your area.

How do Medigap supplement plans work?

Medicare Supplement plans work in addition to your existing Medicare coverage, so the benefits of the Medigap plan kick in once coverage from Part A or Part B ends. Additionally, the federal government regulates which benefits are provided by each plan. The plans themselves provide the same benefits no matter which company sells them.

What is the difference between Medicare and Medicare supplement insurance (Medigap)?

Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

What does Medicare supplement insurance not cover?

Usually, Medicare supplement plans do not cover vision care, dental care, eyeglasses, or private-duty nursing. A range of different plans are available with several different insurance providers.

What letter is a Medicare Supplement plan?

Medicare Supplement Plan F is the most popular policy because of its comprehensive coverage, but as of 2020, Plan F (along with Plan C) is unavailable for new enrollees. The closest substitute for Plan F is Plan G, which pays for everything that Plan F did except the Medicare Part B deductible.

How are Medicare supplements divided?

Supplemental insurance plans are divided into categories with an alphabetic label. Medigap plans in tiers A through K provide the highest cost sharing benefits, while plans K through N plans provide less cost coverage.

What must be included in a Medicare Supplement plan?

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

What is a standard Medicare Supplement plan?

Medicare Supplement insurance plans are standardized, mean that that each plan of the same letter (designated A through N) must offer the same basic benefits, regardless of which insurance company sells it.

How do supplemental insurance plans work?

Supplemental health insurance is a plan that covers costs above and beyond what standard health policies will pay. It may provide extra coverage. It may even pay for costs not covered by a traditional health plan, such as coinsurance, copays, and deductibles.

How are Medicare and supplemental policies are billed?

When you have Medicare and other health insurance, such as a Medicare Supplement insurance plan, each type of coverage is called a “payer.” The primary payer will pay what it owes on your health-care bills first and then send the balance to the secondary payer. Coordination of benefit rules decide who pays first.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the difference between a Medicare Advantage plan and a Medicare Supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What are the 10 standardized Medigap plans?

Insurance companies may offer up to 10 different Medigap policies labeled A, B, C, D, F, G, K, L, M and N. Each lettered policy is standardized. This means that all policies labeled with the same letter have the same benefits, no matter which company provides them or their price.

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

What is Medicare Supplement?

A Medicare Supplement (also known as Medigap) plan is a supplemental insurance plan sold by a private company. This kind of insurance helps cover the costs that Original Medicare doesn’t, like deductibles, copayments, or coinsurance.

How long does it take to sign up for Medicare Part B?

Besides picking a plan that suits your needs best, timing is everything when purchasing a Medigap plan. For anyone 65 and over, within a six-month window of signing up for Medicare Part B, federal law guarantees the following protections:

How much is SNF coinsurance?

Although Original Medicare covers treatment from an SNF for up to 20 days, after day 20, you face daily coinsurance fees (currently $176 per day in 2020). 1 Those fees are completely covered if you purchase a plan with the SNF care coinsurance benefit. 6.

How long does Medicare cover hospitalization?

Medicare Part A will cover your first 60 days in a hospital, but only after you meet your not-so-small deductible in your benefit period ($1,408 in 2020). 2 A plan with this benefit covers your Part A deductible completely.

How many pints of blood do you get with Medicare?

Under Original Medicare, you have to pay for every pint of blood you receive until you hit four pints in a calendar year. You’re covered for the first three pints you get in a year with this benefit.

Is Medicare Part A the same as Part D?

Keep in mind, they are not the same. Medicare Part A, Part B, Part C, and Part D are all sections of Medicare. Medicare Supplement Plans A, B, C, D, F, G, K, L, M, and N are Medigap policies that supplement your Original Medicare coverage. The plans supplement coverage for the parts.

When is Medicare due for 2019?

December 12, 2019. If you’re around 65, close to retiring, or already retired, chances are you’re researching Medicare. During your research, perhaps you’ve come to like what Original Medicare, or Medicare Part A and Part B, offers.

How many Medicare Supplement Plans are there?

These plans cover more than just out-of-pocket costs from Medicare and may provide additional benefits for some people. Currently, 10 Medicare supplement plans are available. These are:

What is Medicare Advantage Plan?

People use Medicare Advantage plans as an alternative to Medicare parts A and B. Private companies sell and administer them, just as they do Medicare supplement plans. They provide bundled plans that may cover more than separate Medicare plans, such as dental or vision care.

What is Medicare Part A and B?

Medicare parts A and B, which would serve as the primary payer, administer their coverage first . Afterward, Medigap coverage takes over to fund the out-of-pocket costs of treatment and any other agreed costs, such as treatment received outside the United States on some Medigap plans.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What does "no" mean in Medicare Supplement?

“Yes” under a plan letter means that it covers 100% of the benefit. “No” under a plan letter means that it does not cover that benefit.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. This article explains how Medicare supplement plans work, how to find one, and how to work out which plan is best.

Does Medicare cover all of the costs?

A person can choose to enroll in Medicare parts A and B. However, these may not cover all healthcare costs. People with Medicare will still have to pay different deductibles and coinsurances based on the type of care they receive. Medicare supplement plans can help a person reduce out-of-pocket costs on Medicare parts A and B. ...