The catastrophic phase is the last phase of Medicare Part D Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…Medicare Part D

Is catastrophic health insurance worth it?

High-deductible insurance plans, sometimes known as catastrophic plans, are much lower in cost than other insurance plans, although you'll have to pay a large amount of out-of-pocket money if you need care, so it still makes sense to put money aside each month, even if it's into your own savings account instead of paid as a premium for insurance.

Is catastrophic health insurance still available?

Whether you choose a catastrophic plan or something more, make sure you could afford it if you had to pay up to your maximum out-of-pocket amount. Like other health plans, you can only purchase catastrophic insurance during an open enrollment period, or after a qualifying event.

Should I get catastrophic health insurance?

Those who benefit most from catastrophic health plans are healthy individuals under the age of 30. People under 30 are likely to not need as much health care as older people, so a catastrophic health plan can decrease health care costs. A catastrophic plan can serve as a safety net in case of a serious medical issue.

What is the cost of catastrophic health insurance?

The average cost of a catastrophic health plan is $195 per month, but your cost will depend on your location, age, and insurer. 5 That amount is significantly less than what a bronze plan purchased through the Health Insurance Marketplace would cost. As of 2022, the lowest-tier bronze plan costs $328 per month, on average. 6

What counts towards catastrophic coverage?

Catastrophic coverage: In all Part D plans, you enter catastrophic coverage after you reach $7,050 in out-of-pocket costs for covered drugs. This amount is made up of what you pay for covered drugs and some costs that others pay.

What is Medicare catastrophic coverage?

Catastrophic coverage is a phase of coverage designed to protect you from having to pay very high out-of-pocket costs for prescription drugs. It usually begins after you have spent a pre-determined amount on your health care. For example, Part D prescription drug plans offer catastrophic coverage.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

What is the catastrophic cap for Medicare 2022?

$7,050In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

Does Medicare have a catastrophic limit?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides catastrophic coverage for high out-of-pocket drug costs, but there is no limit on the total amount that beneficiaries have to pay out of pocket each year.

What is catastrophic limit?

Catastrophe limit means the amount of coverage that applies to all losses at all locations during each separate 12-month period of this policy; this is limited to the expiration or anniversary date.

Is the donut hole going away in 2021?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

What is the Doughnut hole for 2021?

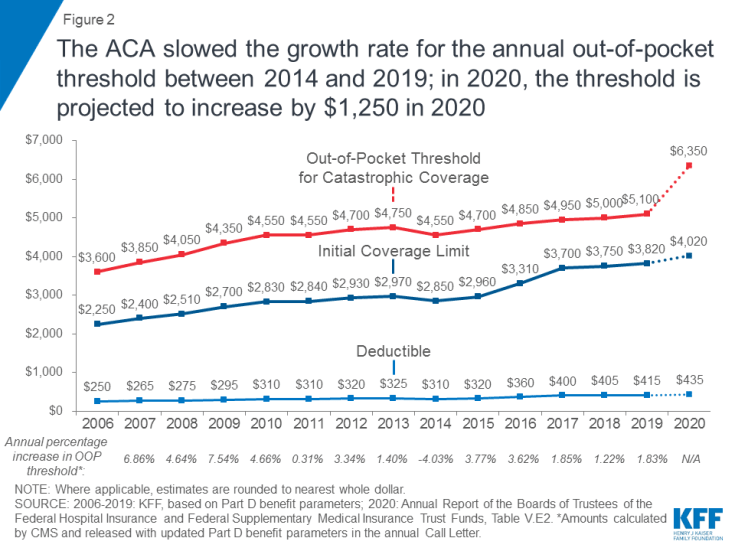

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What are the correct amounts for the 2021 catastrophic coverage level?

Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level ($6,550 in 2021, up from $6,350 in 2020).

What is catastrophic protection out-of-pocket maximum?

For a Self Plus One or a Self and Family enrollment, your out-of-pocket maximum for these types of expenses is $13,000 for Preferred provider services. Only eligible expenses for Preferred provider services count toward these limits.

How do you calculate the donut hole?

An individual and their insurance company have spent $4,020 on medications since the start of their plan. That person is now in the donut hole. The person pays 25% of their medication costs. For example, if they have a medicine that costs $100, they will pay $25.

How much is Medicare Part D 2021?

For 2021, the costs are as follows: Deductibles: Although deductibles vary between Part D plans, Medicare rules ensure that the maximum deductible in 2021 is $445, which is $10 more than it was in 2020.

How many phases are there in Medicare Part D?

Medicare Part D plans have four coverage phases for prescription drugs. These are as follows: Deductible: Individuals with a Part D plan pay a deductible before their plan covers the cost. During the deductible phase, people with a Part D plan pay the full cost of their prescription.

What is the OOP limit for Part D 2021?

The catastrophic phase of Part D coverage happens when a person reaches their maximum OOP expenses. For 2021, the OOP limit is $6,550 out of pocket. A person will then be out of the coverage gap for Medicare prescription drug coverage and will automatically get catastrophic coverage.

How much is the OOP expense for 2021?

OOP expenses: In 2021, the allowed OOP expense is $6,550, which is a $200 increase from 2020.

How much will I pay for prescriptions in 2021?

In 2021, that maximum expense is $6,550. In the catastrophic coverage phase, individuals pay significantly less for their prescription medications. In 2021, according to the KFF, people will pay whichever is higher of 5% of the retail costs of the medication or $9.20 for a brand-name drug and $3.70 for a generic drug.

What is Part D coverage?

Initial coverage: After an individual meets their deductible, their Part D plan covers some of the cost of their prescription medications. During the initial coverage phase, a person’s plan pays some of the costs, and the individual pays a coinsurance. The amount of time a person stays in the initial phase depends on their drug costs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is catastrophic coverage?

Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level ( $6,550 in 2021, up from $6,350 in 2020). At this point, you are out of the prescription drug “donut hole” and your prescription drug coverage begins paying for most of your drug expenses.

Do out of pocket costs drop to zero?

So although out-of-pocket costs drop to a much lower level once you hit the catastrophic threshold, they don’t drop to zero. And if you’re taking an expensive medication, even 5 percent of the cost can continue to add up to a significant amount of spending each month.

Is there an out of pocket cap for Medicare Part D?

But unlike most other types of health coverage, there is no out-of-pocket cap for Part D coverage (this is also the case with Original Medicare, which is why most enrollees have some form of supplemental coverage ).

What is the cost of Medicare Part D for 2021?

You can buy Medicare Part D coverage through a standalone plan if you have original Medicare or a Medicare Advantage plan that doesn’t offer prescription drug coverage.

What to know about drug pricing

Part D plans are not required to cover all drugs that the federal government says are eligible to be included in Part D plans. Instead, they can create their own “formularies,” or lists of drugs they are willing to cover. The government sets some ground rules, including mandating that insurers include drugs to cover all kinds of diseases.

Is there an out-of-pocket maximum for Part D?

No. Medicare Part D has never capped out-of-pocket costs. Even when you reach catastrophic coverage, your 5% coinsurance lasts the rest of the year.

What can you do to manage your Part D costs?

Check available pharmacies. Sometimes just changing pharmacies to a “preferred” one in your insurer’s network can lower a drug’s price. Use GoodRX to compare prices and look for coupons that could save you money on your medications. Sometimes checking competitors or switching to a mail-order pharmacy can make a big difference.

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

The bottom line

Medicare Part D looks simple, but it isn’t. Take the time to understand whether you have selected the best plan for you based on the drugs you take and how they’re covered in your plan formulary.

How much does catastrophic coverage cost?

Once in Catastrophic Coverage, the cost drops to $1,300. (Costs can vary depending on location and drug plan.) Although 5% may sound reasonable — and it often can be — for very expensive drugs that didn’t exist when Medicare Part D was introduced in 2006, it can quickly become unaffordable for many people.

What is a formulary in Medicare?

Each drug plan includes a formulary, or in plain English, a list of drugs that are covered under the policy. As you choose between and among Medicare Part D plans or Medicare Advantage plans, it’s important to make sure that the medicines you need will be covered. Otherwise, you pay full price for your medicine.

Can you buy a separate Medicare Part D policy?

Specialty drugs, such as non-injectable cancer treatments or medicines used to treat autoimmune diseases and Hepatitis C, are particularly expensive. People with Medicare who opt for Original Medicare (Part A and Part B, with a Medicare Supplement) can purchase a separate Part D policy to cover prescription drugs.

Is there a lifetime limit on 5% co-insurance?

There is no lifetime limit on this 5% co-insurance. Even after you spend $6,350 each year on drugs, you’ll have to pay something for the rest of the calendar year, no matter how expensive the drugs you need may be. One example: Before hitting Catastrophic Coverage, one could pay over $6,500 for Idhifa, a drug to treat leukemia. ...

Does Medicare cover pharmaceuticals?

Medicare Part D, the federal program that covers pharmaceutical drugs for Medicare recipients, has gone a long way to help patients pay for the rising costs of medicines. But there are some gaps in coverage that consumers, specifically those coping with serious illnesses, need to understand. Some Medicare patients may find themselves overwhelmed ...