Cigna Medicare Supplement

Medigap

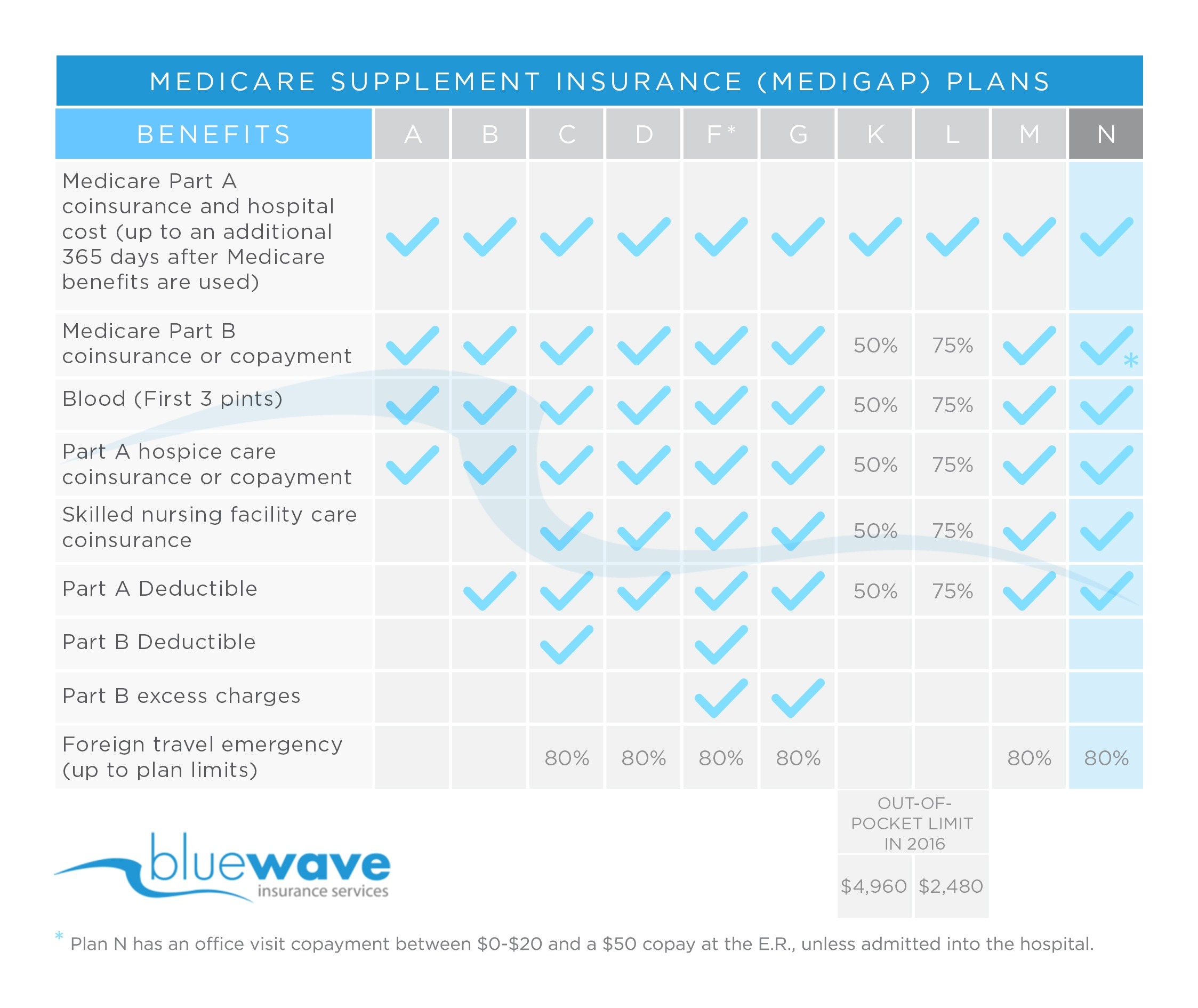

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Why the most popular Medicare Supplement is plan F?

· 1 (855) 208-0542. This plan provides the same level of coverage as regular Plan F, except that coverage will kick in after you meet your calendar year deductible. 2 This is the amount you must pay in out-of-pocket medical expenses before your plan starts sharing costs. The tradeoff for a high deductible plan is a much lower monthly premium.

Is plan F a viable Medicare supplement option?

Cigna Medicare Supplement Plan F. Cigna Medicare Supplement Plan F is offered as a Medigap insurance plan. Medicare Part A and Part B cover hospital costs, most aspects of health care, and doctor’s offices visits, but they have deductibles and only cover 80% of outpatient health care, and therefore these basic Medicare benefits may not be the best choice for seniors looking to avoid …

Is Medicare Plan G better than Plan F?

Medicare Supplement Insurance Policies Help Pay What Medicare Doesn’t Plans that help pay some of your out-of-pocket costs. Get a Free Online Quote Find out what your monthly …

Is Medigap plan F the best supplement?

Cigna Medicare Supplement Plan F can cover you for all kinds of vital and less vital medical fees, and that may work out for you as your situation implies. However, it is just as important to …

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Is Plan F being discontinued in 2020?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

What is Plan F Medicare supplement?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What is Medicare Plan F being replaced with?

Popular Plan F Replacements Include Medicare Supplement Plan G and Plan N. There are no explicit replacements for Plan F – you'll have to choose from a number of existing Medicare Supplement plans. Fortunately, most Medicare Supplement plans are very similar.

Can I switch from plan F to plan G?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch.

Does plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

What are the benefits of Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Does Plan F have a deductible?

As with other health insurance policies, premiums for Plan F are tax-deductible. However, people who became eligible for Medicare after January 2020 will be unable to purchase a Plan F policy.

What is the difference between Medicare Supplement Plan F and G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Is plan F going away in 2021?

Summary: Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

Is there a Medicare supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is the difference between F plan and G plan?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

When is high deductible plan F available?

High Deductible Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020) or you qualified for Medicare due to a disability before January 1, 2020.

Which states have Medicare Supplement Plans?

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

When does the Medicare deductible end?

3 A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of the hospital and have not received skilled care in any other facility for 60 days in a row.

How long do you have to be in a hospital to be eligible for Medicare?

Must have been in a hospital for at least 3 days and have entered a Medicare-approved facility within 30 days after discharge from the hospital. Services. Medicare Pays. HD Plan F Pays. (after you pay $2,370 deductible 5) You Pay. (in addition to $2,370 deductible 5) First 20 days. All approved amounts.

What is the phone number for Medicare?

Learn more*. Or call: 1 (855) 208-0542. Mon-Fri, 8:30 am-8:30 pm, ET. This plan provides the same level of coverage as regular Plan F, except that coverage will kick in after you meet your calendar year deductible. 2 This is the amount you must pay in out-of-pocket medical expenses before your plan starts sharing costs.

Does Cigna offer a discount?

Cigna offers competitive rates and, in some states, a 7% household premium discount 7 may be available for qualified applicants.

How much does Cigna Medicare Supplement cost?

However, Cigna Medicare Supplement Plan F rates generally tend to be a monthly premium of around $135.00 to $250.00. Enrollees should expect their Cigna Medigap Plan F rates to gradually increase over time, but a household discount might be available if Plan F, Plan A or any other plan is purchased by more than one person in the household. Potential beneficiaries of these plans should compare several available plans before purchasing one.

What is Medicare Supplement Plan?

A Medicare Supplement plan is a health insurance option that is interchangeably referred to as a Medigap policy. These Medicare Supplement plans/Medigap plans are not the same thing as Medicare Advantage plans, which replace original Medicare; they are plans that supplement original Medicare by providing additional benefits beyond the basic Medicare benefits. It is necessary to be enrolled in Part A and B Medicare before purchasing a Medicare Supplement insurance plan. Individuals should carefully compare and review various plans and the plan options before deciding on the Medigap policy that is best for them, and consulting an insurance agent who can compare the various options, provide advice about their benefits and how they compare to Medicare benefits, and can identify the best rated Medicare Supplement insurance plan F, is always a good idea.

How long does it take for Medicare to pay Part A deductible?

After 90 days of hospitalization, it pays all of the Part A deductibles up to an additional 425 days

Does Medicare cover dental insurance?

Medicare supplement plans do not cover prescription drug costs, eyeglasses, or dental work, which are not covered by Medicare parts A and B; however, beneficiaries who desire coverage of these options can obtain plans that provide benefits for them that can be added to a Cigna Medigap Plan F, such as a plan purchased from Cigna or a Medicare Part D prescription drug plan. Signing up for drug coverage or other additional coverage can help you save big throughout the year.

Does Medicare cover blood transfusions?

In addition to the benefits listed above, beneficiaries are also fully covered for blood transfusions; the federal Medicare program only provides benefits for blood transfusions during hospitalization after the first three pints of blood per year. This plan also covers Medicare Part B excess charges.

Does Medicare Supplement Plan G pay for doctor visits?

Unlike most Medicare Supplemental plans (like Plans A and N or Cigna Medicare Supplement Plan G), it also helps pay for the yearly Medicare Part B deductible, which goes towards paying for regular doctor’s office visits and associated medical services and medical expenses. Enrollees must continue to pay their Medicare Part B premium.

Does Cigna pay for Medicare Supplement Plan F?

Cigna’s Medicare Supplement Plan F benefits help pay for Medicare deductibles, co-payments , and co-insurance all throughout the calendar year so that you can reduce your out-of-pocket expenses. Your Cigna plan through Cigna Health and Life Insurance can help you save on emergency room visits, hospital stays, doctor’s office visits and more.

How long do you have to be on Cigna to get a discount?

To qualify for the online discount, you must be a new Medicare Supplement policy holder with Cigna**, without an active policy in the last 90 days. You must submit your Medicare Supplement Insurance application online at Cigna.com to qualify for the discount.

What states have Medicare Supplement Plans?

The following Medicare Supplement Plans are available to persons eligible for Medicare due to disability: Plan A in Arkansas, Connecticut, Indiana, Maryland, Oklahoma, Texas, and Virginia; Plans A & F in North Carolina; and Plan C & D in New Jersey for individuals aged 50-64.

How much does the 80% travel insurance cover?

Plans that include this benefit cover 80% of medically necessary emergency care received outside of the U.S., which began during the first 60 days of each trip, after you pay a $250 deductible per calendar year, not to exceed the lifetime maximum of $50,000.

When does Medicare kick in?

Coverage kicks in after you pay the calendar year deductible. *. * Plans only available if you first become eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you have qualified for Medicare due to disability before January 1, 2020.

Is Medicare Part B a good fit?

A good fit if you’re looking for the most coverage , after you pay the Medicare Part B annual deductible.

Does Cigna offer no cost programs?

You’ll also enjoy no-cost programs and savings as part of becoming a Cigna customer. 5

Does Cigna have a PPO?

Cigna-HealthSpring is contracted with Medicare for PDP plans, HMO and PPO plans in select states, and with select State Medicaid programs. Enrollment in Cigna-HealthSpring depends on contract renewal.

The Full Coverage of Plan F

Although these Medicare Supplements are systematized by the Original Medicare, all the different insurance providers have the liberty to estimate their own rates, but they must strictly adhere to standardized coverage levels. This entails that anywhere you look; Plan F will always be Plan F in terms of coverage regardless of the provider.

Purchasing Plan F

To be eligible for Plan F, you need to have the basic Medicare Plan known as the Original Medicare. This covers you for majority of the Medicare Part A and Part B expenses. The supplemental plans like Plan F fill in the uncovered portions in Medicare’s services in varying degrees.

Compare to Save Money

Cigna Medicare Supplement Plan F can cover you for all kinds of vital and less vital medical fees, and that may work out for you as your situation implies. However, it is just as important to look at other plans and be open minded. Some other plans can still offer great coverage without being as expensive as Plan F.

What is Cigna health insurance?

Cigna is a well-known health and life insurance company. Cigna offers health insurance and other products. It includes divisions like the American Retirement Life Insurance Company, Loyal American Life Insurance Company, Cigna Health and more.

Why are Cigna rates stable?

Rates are typically stable because risk is spread out among many beneficiaries. This is because Plan F’s benefits make it the best and most popular choice for many people. Choosing a company like Cigna is another way to make sure that your rates remain stable.

Which Medicare Supplement Plan is the most expensive?

If you do a comparison of rates against other plans that don’t offer as many benefits, you’ll see that Medicare Supplement insurance Plan F is generally the most expensive of your plan options. When you compare the benefits, though, you’ll probably find that the higher price is worth it.

Does Cigna have a Medicare Supplement Plan F?

Cigna Medicare Supplement Plan F is designed to work with your Medicare benefits to help you save on health care and medical expenses . If you are going to be signing up for your Medicare benefits soon and want additional health care coverage, it’s best to compare Medicare Supplement plan options.

Is Plan G cheaper than Plan F?

If this rule applies to you and if you’ve been thinking about signing up for Medigap Plan F, this might be disappointing news. However, Plan G is a good alternative to consider. Monthly premiums are cheaper than Medigap Plan F rates. However, it offers the same benefits as Plan F, other than the fact that the benefits don’t include payment of the Medicare Part B deductible.

Is Cigna Medigap Plan F good?

Although you might be interested in Cigna Medigap Plan F, you should compare the benefits of other options before signing up for your benefits. Cigna Medigap Plan F is a great choice, but you should check out Medigap Plan G as well.

What is Medicare Supplement Insurance?

A Medicare Supplement Insurance plan, also called a Medigap plan, is a separate policy that supplements your coverage from Original Medicare Part A and Part B. Medicare Supplement insurance helps protect you against high out-of-pocket costs by helping pay for eligible health care expenses that Medicare does not pay for.

What is coinsurance in Medicare?

For example, a Physician’s Visit. Coinsurance is the percent of the Medicare approved amount that you have to pay after you pay the deductible for Part A and/or Part B.

Does Cigna offer Medicare?

Cigna offers a variety of Medicare Supplement insurance plans for you to choose from.

Does Medicare cover hospital services after deductible?

Medicare Part A deductible. Close ×. Within each benefit period, for your first 60 days of hospital services, Medicare will cover all services after the Part A deductible cost has been reached. (You are responsible for the deductible cost unless you have a Medicare Supplement insurance plan that covers it.)

Is Medicare Supplement Plan F the same as Cigna?

When comparing Medicare Supplement Insurance plans, it’s important to note that the government decides what benefits each plan offers, so coverage remains the same across all companies. For example, the basic benefits you’ll receive if you purchase Medicare Supplement Plan F from Cigna are the exact same basic benefits you’ll receive ...

When will Cigna Medicare Supplement Plan G be available?

Cigna Medicare Supplement Plan G offers the highest benefit level of all Medicare Supplement plans that are currently available for people new to Medicare after January 1, 2020.

What is Cigna health insurance?

Based in Bloomfield, Connecticut, Cigna is one of the country’s major health services and insurance providers. Through Cigna, you can purchase the following types of health care and life insurance plans: 1 Medical 2 Dental 3 Disability 4 Life 5 Accident 6 Plus many other related products and services.

How long is the free look period for Medigap?

Another advantage of signing with Cigna is they give you a 30-day “Free Look Period” when you enroll. This gives you the option to cancel your Medigap policy, for any reason, at any time during the first 30 days.

What is Part B coinsurance?

Part B coinsurance After Medicare pays 80% of the approved cost of a medical service or supply, your Medigap plan pays the remaining 20% for you.

How much does Medicare Supplement Plan N pay for emergency room visits?

Whereas Medicare Supplement Plan N only pays $50.00 for emergency room visits that do not end up as hospital inpatient admissions.

Does Cigna have a high deductible?

Even though Plan F and high deductible Plan F have more coverage, they are not available for all people. That is why Cigna Medicare Supplement insurance Plan G is outselling most other supplemental insurance plans. Plan G and Plan G with a high deductible are insurance plans that provide the same broad coverage as Plan F, apart from the Medicare Part B annual deductible.

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement insurance Plan G does not cover the Part B deductible. You are responsible for the $203.00 (in 2021) deductible of Medicare Part B.

Servicios médicos de Medicare (Parte B) – Qué paga el Plan F (por año calendario)

Incluye gastos dentro o fuera del hospital y tratamiento ambulatorio en el hospital, como los servicios de un médico, servicios y suministros médicos y de cirugía para pacientes internados y ambulatorios, terapia física y del habla, pruebas de diagnóstico y equipo médico duradero.

Tarifas del Plan Suplementario F de Medicare

Si bien los beneficios del Plan Suplementario F de Medicare son los mismos independientemente de cuál es tu compañía de seguros (como exige el gobierno), en algunos estados la prima que pagas puede variar de acuerdo con algunos factores como la edad, el lugar, el género y la salud general.