The Medicare Hospital Insurance Tax Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax.

Full Answer

What's the difference between Medicare tax and Social Security tax?

Unlike the Social Security tax—the other component of the "Federal Insurance Contributions Act" or FICA—all your wages and business earnings are subject to at least the 2.9% Medicare tax.

Do we pay Medicare tax on earnings?

We also pay a Medicare tax taken out of our earnings. The Medicare tax, also referred to as a hospital insurance tax, is a mandatory federal employment tax that's paid both by employers and employees. The proceeds fund much of the Medicare insurance program that seniors and other eligible people use for health care coverage.

What is the Medicare hospital insurance tax?

The Medicare Hospital Insurance Tax. Unlike the Social Security tax—the other component of the "Federal Insurance Contributions Act" or FICA—all your wages and business earnings are subject to at least the 2.9% Medicare tax.

Does the employer match the additional Medicare tax?

However, the Additional Medicare Tax is not matched by the employer.) The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021.

Does health insurance reduce Medicare tax?

Above-the-line deduction for people who are self-employed If you're self-employed, the self-employed health insurance deduction — putting your Medicare premiums on Schedule 1 of your 1040 — is the most direct way to reduce your tax burden.

What kind of tax pays for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Is Medicare the same as federal tax?

The Medicare tax is one of the federal taxes withheld from your paycheck if you're an employee or that you are responsible for paying yourself if you are self-employed.

What is Medicare and how is it taxed?

The Basics of Medicare Tax FICA taxes include money taken out to pay for older Americans' Social Security and Medicare benefits. Both you and your employer pay the Medicare Tax as a part of FICA. Your total FICA taxes equal 15.3 percent of your wages — 2.9 percent for Medicare and 12.4 percent for Social Security.

Can I opt out of paying Medicare tax?

As such, there is no legal way to stop paying Social Security taxes without applying and receiving approval or becoming a member of a group that is already exempt.

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

How much of our taxes go to healthcare?

How much does the federal government spend on health care? The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion. The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1).

Do I get Medicare tax back?

No, you can not get the Social Security and Medicare taxes refunded.

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

Why do I have to pay an additional Medicare tax?

Additional Medicare Tax applies when your earned Medicare wages surpass a certain threshold based on your tax filing status. Your employer is respo...

When did Medicare become a payroll deduction?

Medicare became a payroll deduction in 1966, a year after the Medicare tax was added to the Federal Insurance Contribution Act (FICA).

Are health insurance premiums exempt from the Medicare tax?

If health insurance premiums are qualified, they’re exempt from both Social Security and Medicare taxes, according to Gaito.

Can you opt out of the Medicare tax?

Nearly all workers in the United States are required to pay Medicare tax. Ann Martin with Credit Donkey Crypto says there are a handful of exceptio...

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can I deduct self employment tax?

You're allowed to deduct half your self-employment tax as an adjustment to income on your Form 1040 tax return. 6 . Unlike many other deductions, this one reduces your adjusted gross income (AGI), which is a good thing. Many tax breaks depend on your AGI falling below certain limits.

What is the Medicare tax?

We pay many taxes in life: income tax, payroll tax, property tax, sales tax, you name it. We also pay a Medicare tax taken out of our earnings.

Who pays the Medicare tax?

Nearly everyone who works and reports income earned to the government has to pay Medicare taxes.

2021 Medicare tax rates

The current tax rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Social Security and Medicare

It's easy to get confused by the Social Security tax on your paycheck, which is different from the Medicare tax. Together, they comprise FICA payroll taxes. Both are referred to as "earned benefits" because you've contributed to these benefits throughout your working years.

Frequently Asked Questions

Additional Medicare Tax applies when your earned Medicare wages surpass a certain threshold based on your tax filing status. Your employer is responsible for withholding a 0.9% Additional Medicare Tax on your wages paid in excess of $200,000 in a calendar year, regardless of filing status.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

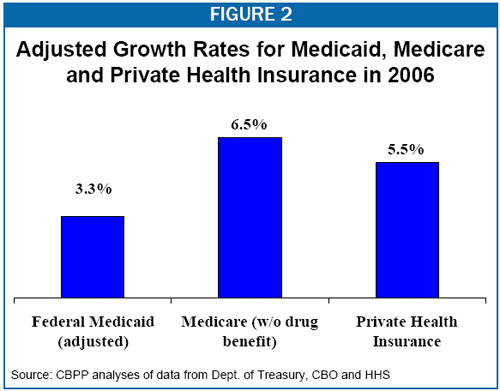

How much higher is Medicare compared to private insurance?

However, according to a 2020 KFF study, private insurance payment rates were 1.6-2.5 times higher than Medicare rates for inpatient hospital services. 5.

What is the difference between Medicare and private insurance?

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents. Not only does Medicare provide many coverage combinations to choose from, ...

What is Medicare Supplement?

Medicare Supplement plans are designed to cover the out-of-pocket costs left over from Original Medicare. For example, these plans can cover coinsurance amounts, copays, or deductibles. Original Medicare + Medicare Supplement + Prescription Drug.

What happens if you delay Medicare for four years?

For example, if you delayed enrolling in Medicare for four years, you’ll have to pay a higher premium for eight years. Medicare Part B. The Part B penalty is a lifelong consequence to delaying your Medicare coverage. This late-enrollment penalty can increase your premiums by 10% for each year you delayed coverage. 10.

How much is Medicare Part A deductible?

The Medicare Part A deductible is $1,484. The Medicare Part B deductible is $203. 4. On average, an employer insurance plan will have an annual deductible of $1,400. 6. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

How much is the deductible for bronze health insurance?

It is best to use your plan information to make comparisons. On average, a bronze-level health insurance plan will have an annual medical deductible of $1,730. 7. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

Which is better: Medicare or Original?

Medicare is the front-runner when it comes to networks. If you don’t want to stick to a limited number of doctors or hospitals, Original Medicare is likely your best option. With Original Medicare , you can go to any provider who accepts the national program.

How much is Medicare payroll tax?

Medicare Payroll Tax. The Medicare payroll tax is 1.45% and is based on each employee's earnings without limit. The Medicare tax is withheld from each employee's earnings and is also matched by the employer. This makes the total Medicare tax equal to 2.9% on every dollar of earnings.

What is the FICA rate?

FICA Payroll Tax. The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021. Each employee's earnings in excess ...

What is the Social Security payroll tax rate for 2021?

In the calendar year 2021, the Social Security payroll tax rate of 6.2% is applied to each employee's earnings up to the maximum of $142,800. The 6.2% that is withheld from the employee is also matched by the employer. As a result, the total Social Security tax in 2021 for an employee is equal to 12.4% of each employee's annual earnings up ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

Can you deduct retirement from paycheck?

In many cases, you can elect to have a portion deducted from your paycheck for this purpose. Many employers offer certain types of retirement plans, depending on the length of time an employee has been with an organization (known as vesting) and the type of organization (company, nonprofit, or government agency).

Do self employed people pay Medicare?

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes. 6 .

Is there a limit on Medicare tax?

4 . Unlike the Social Security tax, there is no income limit on the Medicare tax.