Standard and High Kaiser Medicare Advantage Plans provide Medicare Part D prescription medication coverage. Coverage depends on the plan, the medication’s cost-sharing tier on the Kaiser formulary and whether the enrollee uses a network pharmacy or nonaffiliated entity.

Full Answer

How does Medicare work with Kaiser?

· 1. First, you pay your plan's Part D deductible, which means you pay all your drug costs out of pocket until you reach your plan's deductible amount. 2. Next, you pay just a copay or coinsurance, set by your health plan, until your total drug costs reach $4,430 in …

Does Kaiser have a Medicare Advantage plan?

For plans with Part D Coverage: You may be able to get Extra Help to pay for your prescription drug premiums and costs. To see if you qualify for Extra Help, call: …

Does Kaiser accept Original Medicare?

For plans with Part D Coverage: You may be able to get Extra Help to pay for your prescription drug premiums and costs. To see if you qualify for Extra Help, call: …

How much does it cost for Medicare Part D?

This Medicare Part D formulary is a list of drugs covered by Kaiser Permanente’s Senior Advantage plan. Kaiser Permanente Home. Navigation Menu - Opens a Simulated Dialog. ... Selecting these links external site icon will take you away from KP.org. Kaiser Permanente is not responsible for the content or policies of external websites.

Is Kaiser a good choice for Medicare?

Kaiser Permanente is a great option if it's available in your area. It offers consistently high-quality Medicare Advantage plans with low-cost options. So long as you're comfortable in an HMO with comprehensive coverage and don't need standalone supplemental coverage, Kaiser may be the choice for you.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Kaiser Senior Advantage the same as Medicare Advantage?

This is a Medicare Advantage plan, which means that it generally replaces your Medicare coverage. You agree to let Kaiser manage your Medicare benefits. It is an HMO (health maintenance organization) with a closed network of providers.

How much is Kaiser Senior Advantage California?

For Medicare Advantage plans with a premium, the monthly consolidated premium (including Part C and Part D) ranges from $15 to $296. For Dual-Eligible Special Needs Plans, or D-SNPs, monthly premiums range from $28.90 to $33.90 [6].

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Kaiser accept AARP?

Sign up for events near you! AARP in Kaiser is here to help you take on today – and every day. From sharing practical resources like job, health, and financial workshops, to holding fun activities and events, AARP is providing opportunities to connect and help build an even stronger Kaiser. We hope you'll join us!

What is the difference between Kaiser Senior Advantage and Senior Advantage Plus?

As a Kaiser Permanente Senior Advantage member, you enjoy the ease of combining your Medicare coverage with Kaiser Permanente coverage in a single plan. Now, with Advantage Plus, you can get valuable comprehensive dental, hearing, and extra vision benefits added to your plan.

What is Kaiser Permanente Senior Advantage?

Senior Advantage combines your Kaiser Permanente coverage with your Medicare coverage into a single plan at no additional premium. Senior Advantage gives you all the benefits of Medicare, plus more. You may also save money with Senior Advantage because you pay only copayments for services.

How do I cancel my Kaiser Senior Advantage Plus?

There are 2 ways you can ask to be disenrolled:You can make a request in writing to us. Contact Member Services if you need more information on how to do this. or.You can contact Medicare at 1-800-MEDICARE (1-800-633-4227), 24 hours a day, 7 days a week. TTY users should call 1-877-486-2048.

Does Kaiser accept Medicaid?

Kaiser Permanente's participation in Medicaid is core to our mission to provide high-quality, affordable health care services and to improve the health of our members and the communities we serve. This critical program provides health coverage to over 1 in 5 Americans, including 1 out of every 3 children.

Does Kaiser offer prescription drug coverage?

The following Kaiser Permanente plans offer Medicare Advantage Prescription Drug plan coverage to California residents. Medicare Advantage plans are an alternative way to get your Original Medicare. These plans help cover the costs of services provided by hospitals, doctors, lab tests and some preventive screenings.

What is Medicare Advantage?

Medicare Advantage plans are an alternative way to get your Original Medicare. These plans help cover the costs of services provided by hospitals, doctors, lab tests and some preventive screenings. These plans' prescription drug component helps cover medications.

How to contact Medicare for extra help?

To see if you qualify for Extra Help, call: 1-800 -MEDICARE (1-800-633-4227).

How long does Medicare Supplement last?

government or the federal Medicare program. For Medicare Supplement Insurance Only: Open enrollment lasts 6 months and begins the first day of the month in which you are 65 or older and enrolled in Medicare Part B.

Does Kaiser offer Medicare Advantage?

If you live in a state that offers Kaiser Permanente Medicare Advantage plans, you can get full coverage that includes Original Medicare Parts A and B, prescription drug coverage (Part D), and additional optional benefits like hearing, vision, and dental care.

Can I enroll in Kaiser Permanente if I live in Hawaii?

Medicare recipients can enroll in a Kaiser Permanente program if they are a resident of Hawaii, Washington, Oregon, California, Colorado, Maryland, Virginia, Georgia, or the District of Columbia.

What is Medicare Advantage?

In general, private insurance companies across the United States offer Medicare Advantage (Part C) plans to those who are eligible for Medicare. What plan is available in your location depends on what insurance companies are approved by Medicare to sell Part C plans.

Is Kaiser Permanente a nonprofit?

Today, Kaiser has one of the country’s largest nonprofit health care plans and provides coverage for over 12 million people enrolled in the program.

Is Kaiser a non profit?

Today, Kaiser has one of the country’s largest nonprofit health care plans and provides coverage for over 12 million people enrolled in the program. Medicare recipients can enroll in a Kaiser Permanente program if they are a resident of Hawaii, Washington, Oregon, California, Colorado, Maryland, Virginia, Georgia, or the District of Columbia.

What percentage of medical expenses does Medicare cover?

While Original Medicare insurance covers 80 percent of medical and hospital expenses, beneficiaries are responsible for the remaining 20 percent, as well as copayments, coinsurance, and deductibles.

What is Medicare Part D?

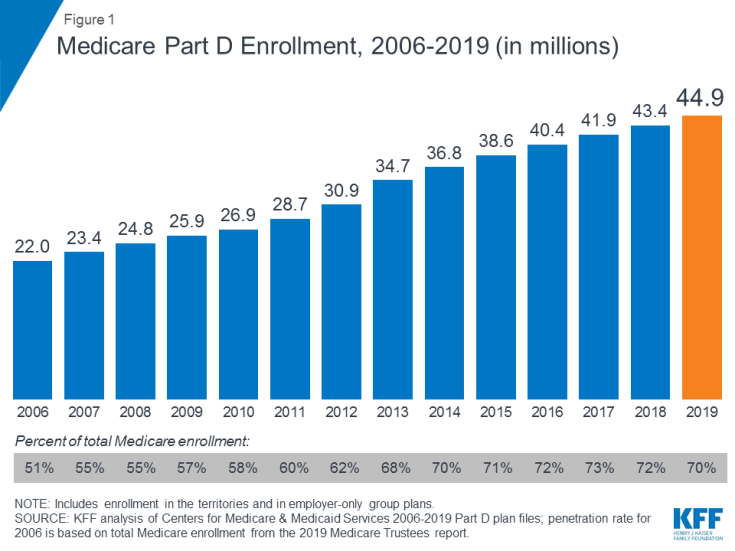

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare, provided through private plans approved by the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan (PDP) to supplement traditional Medicare or a Medicare Advantage prescription drug plan (MA-PD), mainly HMOs and PPOs, that cover all Medicare benefits including drugs. In 2020, 46 million of the more than 60 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services (CMS), the Congressional Budget Office (CBO), and other sources.

Is Medicare Part D voluntary?

Enrollment in Medicare Part D plans is voluntary, with the exception of beneficiaries who are eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own.

How many people with Medicare have no drug coverage?

Another 12% of people with Medicare are estimated to lack creditable drug coverage.

How many people will be covered by Medicare in 2020?

In 2020, 46 million of the more than 60 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services (CMS), the Congressional Budget Office (CBO), ...

How much is the 2021 PDP premium?

But actual premiums paid by Part D enrollees vary considerably. For 2021, PDP monthly premiums range from a low of $5.70 for a PDP in Hawaii to a high of $205.30 for a PDP in South Carolina (unweighted by plan enrollment). Even within a state, PDP premiums can vary; for example, in Florida, monthly premiums range from $7.30 to $172. In addition to the monthly premium, Part D enrollees with higher incomes ($87,000/individual; $174,000/couple) pay an income-related premium surcharge, ranging from $12.32 to $77.14 per month in 2021 (depending on income).

What is the Part D coverage phase?

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage. Between 2020 and 2021, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, ...

Does Medicare help with out of pocket costs?

The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But with drug costs on the rise, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D enrollees are likely to face higher out-of-pocket costs for their medications.

Does Medicare cover dialysis?

Medicare covers dialysis treatment for people who have permanent kidney failure. You can get more information and sign up for Medicare by calling the Social Security office at 1-800-772-1213 or by applying online at www.socialsecurity.gov/medicareonly. Penalty for late enrollment.

Do you have to pay Medicare premiums if you are 65?

Part A. A monthly payment, or premium, is not required for people (including spouses) who are 65 or older and paid Medicare taxes while they were working. You don't pay a premium if you are 65 or older and you get retirement benefits from Social Security or the Railroad Retirement Board.

What is Medicare for people over 65?

Medicare is health insurance that the United States government provides for people ages 65 and older. It also covers some people younger than 65 who have disabilities and people who have long-term (chronic) kidney failure who need dialysis or a transplant. Medicare helps pay for most hospital services and doctor visits.

Does Medicare cover long term care?

But Medicare doesn't cover everything. It doesn't pay for: Long-term care. This is different from short-term care to recover from an illness or injury.

Does Medicare cover home health?

It also helps pay for physical therapy, occupational therapy, and some other home health services. But Medicare doesn't cover everything. It doesn't pay for: Long-term care. This is different from short-term care to recover from an illness or injury. Dental and vision care. Dentures.

Does Medicare Advantage cover prescriptions?

This part covers prescription drug benefits. With original Medicare, you need to join a drug plan (run by a private company) and pay a monthly premium. With Medicare Advantage, drug coverage may be part of your plan. If not, you can choose to join and pay for a separate drug plan along with Medicare Advantage.

Is a mammogram free with Medicare?

Most preventive services—such as flu shots, mammograms, colorectal screenings—are free if the provider accepts Medicare. Part C. These plans have different costs depending on the plan you choose. You may have monthly premiums, as well as deductibles and co-pays.

For our Medicare health plan members

If you're already a member of a Kaiser Permanente Medicare health plan, you can see and download much of your plan information online.

For our members turning 65

If you have individual or group health coverage through Kaiser Permanente and are eligible for Medicare coverage for the first time, we can take you through your options. Visit our website for members turning 65 and over and learn how to make a smooth transition to our Medicare health plan.

Join a Kaiser Permanente Medicare health plan

Go to our Medicare health plan website and explore what's available in your area. Learn all about when you are eligible, when you can enroll, and which plans offer the right cost and coverage for you or a loved one.

Need to know the basics?

Learn about Medicare parts A, B, C, and D. Get an overview of eligibility, enrollment dates, and your rights as a member. Check out the seminars available through our Medicare health plan website and see if there's one scheduled in your town.

Important information

You must reside in the Kaiser Permanente Medicare health plan service area in which you enroll.