Key Takeaways

- Medicare is the federal government’s health care program for the elderly and disabled.

- If you don’t enroll during your initial enrollment period, long-term late enrollment penalties can apply.

- Medicare Advantage plans (Part C) are a way to receive your Parts A and B benefits, and can limit your out-of-pocket costs and widen your coverage.

How can you tell if someone has Medicare?

Medicare is the federal health insurance program for: People who are 65 or older Certain younger people with disabilities People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

How do I start Medicare?

In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds. Medicare Trust Funds. Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded?

What is Medicare and how do I get It?

Apr 06, 2022 · Medicare is managed by the Centers for Medicare & Medicaid Services (CMS). The Social Security Administration works with CMS by enrolling people in Medicare. Am I eligible? To find out when you are eligible, you need to answer a few questions and learn how to calculate your premium. If you are eligible, learn about the enrollment period. How do I apply?

How to start my Medicare?

Medicare is our country's health insurance program for people age 65 or older. Certain people younger than age 65 can qualify for Medicare too, including those with disabilities and those who have permanent kidney failure. The program helps with the cost of health care, but it does not cover all medical expenses or the cost of most long-term care.

What's the monthly fee for Medicare?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

How does an individual pay for Medicare?

You'll usually pay 20% of the cost for each Medicare-covered service or item after you've paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays.

Does it cost money for Medicare?

Medicare Part A costs will vary person-to-person, but for most people, Medicare Part A is premium-free. It still has a deductible, which you pay per benefit period, and it also requires copays for covered services in the hospital, a skilled nursing facility or for hospice.

How many years do you have to pay for Medicare?

10 yearsYou are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much does Medicare take out of Social Security?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Do I automatically get Medicare when I turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

Is Medicare free for seniors?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free. Each part of Medicare has different costs, which can include coinsurances, deductibles, and monthly premiums.

What is the earliest age you can get Medicare?

age 65Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down.

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.What help is available?Medicare is the federal health insurance program...

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 to the Social Secur...

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.EligibilityPrescript...

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:Log into your MyMedicare.gov account and reque...

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.Original Medica...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is SNF in nursing?

Skilled nursing care and rehabilitation services provided on a daily basis, in a skilled nursing facility (SNF). Examples of SNF care include physical therapy or intravenous injections that can only be given by a registered nurse or doctor. , home health care.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

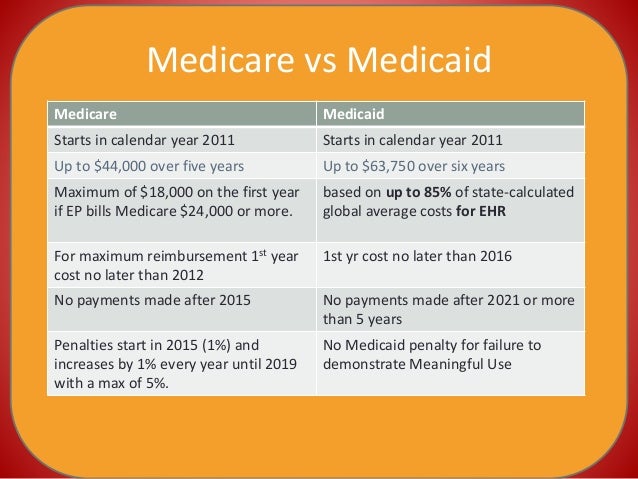

What is Medicare and Medicaid?

Medicare is a national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, ...

How is Medicare funded?

Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare is divided into four Parts: A, B, C and D.

What is CMS in healthcare?

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare").

How much does Medicare cost in 2020?

In 2020, US federal government spending on Medicare was $776.2 billion.

What is a RUC in medical?

The Specialty Society Relative Value Scale Update Committee (or Relative Value Update Committee; RUC), composed of physicians associated with the American Medical Association, advises the government about pay standards for Medicare patient procedures performed by doctors and other professionals under Medicare Part B.

How many people have Medicare?

In 2018, according to the 2019 Medicare Trustees Report, Medicare provided health insurance for over 59.9 million individuals —more than 52 million people aged 65 and older and about 8 million younger people.

When did Medicare Part D start?

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan (PDP) or public Part C health plan with integrated prescription drug coverage (MA-PD). These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies; almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare (Part A and B), Part D coverage is not standardized (though it is highly regulated by the Centers for Medicare and Medicaid Services). Plans choose which drugs they wish to cover (but must cover at least two drugs in 148 different categories and cover all or "substantially all" drugs in the following protected classes of drugs: anti-cancer; anti-psychotic; anti-convulsant, anti-depressants, immuno-suppressant, and HIV and AIDS drugs). The plans can also specify with CMS approval at what level (or tier) they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Overview

Medicare is a government national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, but also for some younger people with disabilitystatus as determined by the SSA, includ…

History

Originally, the name "Medicare" in the United States referred to a program providing medical care for families of people serving in the military as part of the Dependents' Medical Care Act, which was passed in 1956. President Dwight D. Eisenhowerheld the first White House Conference on Aging in January 1961, in which creating a health care program for social security beneficiaries was p…

Administration

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare"). Along with the Departments of Labor and Treasury, the CMS also implements the insurance reform provisions of the Health Insurance Portability an…

Financing

Medicare has several sources of financing.

Part A's inpatient admitted hospital and skilled nursing coverage is largely funded by revenue from a 2.9% payroll taxlevied on employers and workers (each pay 1.45%). Until December 31, 1993, the law provided a maximum amount of compensation on which the Medicare tax could be imposed annually, in the same way that the Social Security payroll tax operates. Beginning on January 1, …

Eligibility

In general, all persons 65 years of age or older who have been legal residents of the United States for at least five years are eligible for Medicare. People with disabilities under 65 may also be eligible if they receive Social Security Disability Insurance (SSDI) benefits. Specific medical conditions may also help people become eligible to enroll in Medicare.

People qualify for Medicare coverage, and Medicare Part A premiums are entirely waived, if the f…

Benefits and parts

Medicare has four parts: loosely speaking Part A is Hospital Insurance. Part B is Medical Services Insurance. Medicare Part D covers many prescription drugs, though some are covered by Part B. In general, the distinction is based on whether or not the drugs are self-administered but even this distinction is not total. Public Part C Medicare health plans, the most popular of which are bran…

Out-of-pocket costs

No part of Medicare pays for all of a beneficiary's covered medical costs and many costs and services are not covered at all. The program contains premiums, deductibles and coinsurance, which the covered individual must pay out-of-pocket. A study published by the Kaiser Family Foundation in 2008 found the Fee-for-Service Medicare benefit package was less generous than either the typical large employer preferred provider organization plan or the Federal Employees He…

Payment for services

Medicare contracts with regional insurance companies to process over one billion fee-for-service claims per year. In 2008, Medicare accounted for 13% ($386 billion) of the federal budget. In 2016 it is projected to account for close to 15% ($683 billion) of the total expenditures. For the decade 2010–2019 Medicare is projected to cost 6.4 trillion dollars.

For institutional care, such as hospital and nursing home care, Medicare uses prospective payme…