Main Differences Between Medicare and Medicare Advantage

- The Medicare facility includes all the payments to be done in the hospital and the medicine purchased bill, whereas...

- The drug coverage in the Medicare plan is absent, whereas comparatively, on the other hand, the drug coverage in the...

- The additional benefits offered in the Medicare plan are nothing while...

How much cheaper is Medicare Advantage compared to Medicare?

You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). Medicare drug coverage (Part D) is included in most plans. In most types of Medicare Advantage Plans, you can't join a separate Medicare drug plan. In most cases, you don’t have to get a service or supply approved ahead of time for Original Medicare to cover it.

When to choose Original Medicare vs. Medicare Advantage?

Jul 26, 2021 · Medicare was created over 50 years ago to assist Americans with the oftentimes exorbitant medical expenses they face as they age. But, in the intervening decades, as life expectancies have risen and medical practices have improved, so too have the range of patient needs—and medical expenses—that everyday Americans encounter.

Does Medicare Advantage cost less than traditional Medicare?

Sep 16, 2018 · Another significant difference between Original Medicare vs. Medicare Advantage is that with Medicare Advantage, once you reach a specific limit on out-of-pocket expenses, you pay nothing for your covered health care costs. This limit varies from plan to plan and can change each year, so it’s important to check the plan details before you enroll.

Is Medigap better than Medicare Advantage?

Dec 01, 2021 · In most cases, Medicare coverage is nationwide, while Medicare Advantage plans require you to stay in your local area for medical services. …

What is the difference between basic Medicare and Medicare Advantage?

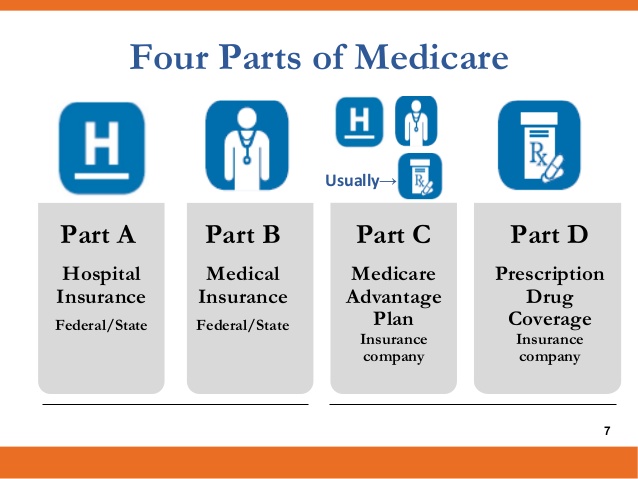

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Can I change from Medicare Advantage to regular Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Does Medicare Advantage have a deductible?

Medicare Advantage plans out of pocket costs: deductibles Some Medicare Advantage plans have $0 medical deductibles, $0 prescription drug deductibles, and $0 premiums.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare have a maximum out-of-pocket?

There is no limit on out-of-pocket costs in original Medicare (Part A and Part B). Medicare supplement insurance, or Medigap plans, can help reduce the burden of out-of-pocket costs for original Medicare. Medicare Advantage plans have out-of-pocket limits that vary based on the company selling the plan.

Original Medicare vs. Medicare Advantage: What’S The Difference?

In order to understand the differences between the two programs, it’s important to understand how each one works.Original Medicare, Part A and Part...

Are There Different Types of Medicare Advantage Plans?

Many people like the flexibility that Medicare Advantage plans provide. Unlike Original Medicare, which is the same for everyone, there are several...

How Can I Find Which Medicare Advantage Plans Are Available in My area?

I’m available to help you understand your options. If you prefer, you can request information via email or schedule a phone call at your convenienc...

What is Medicare Advantage?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap. Instead of having multiple insurance plans to cover medical costs, a Medicare Advantage plan offers all your coverage in one place.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

Does Medicare Advantage save money?

For some people, Medicare Advantage plans can help save money on long-term medical costs, while others prefer to pay for only what they need with Medicare add-ons. Below you’ll find an estimated cost comparison for some of the fees associated with Medicare Advantage in 2021: Cost. Medicare. Advantage amount.

Does Medicare cover dental and vision?

Medical services. If you’re someone who rarely visits the doctor, Medicare and Medicare add-ons may cover most of your needs. However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Is travel a way of life?

For some people, travel is a way of life. This is especially true for people who retire and choose to travel or who live someplace warmer during the colder months.

Is Medicare a government or private insurance?

Original Medicare is a government-run option and not sold by private insurance companies. Medicare Advantage is managed and sold by private insurance companies. These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in ...

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is Medicare Advantage Plan?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

What happens if you don't get a referral?

If you don't get a referral first, the plan may not pay for the services. to see a specialist. If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care. These rules can change each year.

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

What is EGWP in Medicare?

Group Medicare Advantage, or Employer Group Waiver Plans (EGWP), is one of the most challenging markets within Medicare, igniting interest and questions from health plan executives as this market grows. In 2018, there were 4.1 million retirees in EGWPs out of nearly 20 million Medicare Advantage beneficiaries making this a highly valuable business ...

Why is discipline important in EGWP?

Discipline is essential to manage EGWP accounts effectively. Because of the complexities of operating successful EGWPs, there are high-level considerations to keep in mind when determining the value of managing group vs. individual Medicare Advantage plans. For example, the following are fundamental operational differences to consider:

What is the 800 series?

The “800 series” represents most EGWPs. The second basic category is Direct Contract EGWPs (“E contracts”). Employers or unions that directly contract with CMS to become Prescription Drug Plan (PDP) sponsors or Medicare Advantage Organizations (MAO) for their members offer this type of plan. The employer is self-insured and assumes most of the risk.

Is an employer self-insured?

The employer is self-insured and assumes most of the risk. Advantages: Employers can provide group medical, drug, and supplemental coverage to their retiree population at a reduced cost and / or increased benefits because of the prospective payment and management opportunities found in high performing MA plans.