- Both Medicare and Medicaid are government-sponsored health insurance plans.

- Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults.

- Funding for Medicare is done through payroll taxes and premiums paid by recipients.

Will Medicare pay for medical bills if I have Medicaid?

Medicare pays first, and Medicaid pays second. Medicaid never pays first for services covered by Medicare. It only pays after Medicare, employer group health plans, and/or Medicare Supplement (Medigap) Insurance have paid.

Does Medicaid cover more than Medicare for seniors?

Since Medicaid can help seniors to pay for the costs they are still left to cover when they have Medicare, qualifying for Medicaid is important for people who are older and who have limited incomes.

Does Medicaid pay Medicare premiums?

Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them). Qualifications

What insurance plans does Medicaid offer?

Medicaid. Insurance program that provides free or low-cost health coverage to some low-income people, families and children, pregnant women, the elderly, and people with disabilities. Many states have expanded their Medicaid programs to cover all people below certain income levels. Whether you qualify for Medicaid coverage depends partly on whether your state has expanded its program.

How is Medicare paid?

premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment). If you don't get benefits from Social Security (or the Railroad Retirement Board), you'll get a premium bill from Medicare. Get a sample of the Medicare bill.

How is Medicare paid for by the government?

A: Medicare is funded with a combination of payroll taxes, general revenues allocated by Congress, and premiums that people pay while they're enrolled in Medicare. Medicare Part A is funded primarily by payroll taxes (FICA), which end up in the Hospital Insurance Trust Fund.

Do patients pay for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

How is Medicare funded Australia?

The Australian government pays for Medicare through the Medicare levy. Working Australians pay the Medicare levy as part of their income tax. High income earners who don't have an appropriate level of private hospital insurance also pay a Medicare levy surcharge.

Who pays for Medicaid?

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP).

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

How is Australian health care paid for?

Health care in Australia is primarily funded through the public Medicare program and delivered by highly regulated public and private health care providers. Individuals may purchase health insurance to cover services offered in the private sector and further fund health care.

Who pays the Medicare levy and how much do they pay?

Medicare levy The levy is about 2% of your taxable income. You pay the levy on top of the tax you pay on your taxable income. Your Medicare levy may reduce if your taxable income is below a certain amount. In some cases, you may not have to pay this levy at all.

Who funds healthcare in Australia?

The Australian GovernmentThe Australian Government usually funds most of the spending for medical services and subsidised medicines. It also funds most of the $5.5 billion spent on health research in Australia in 2016–17. State and territory governments fund most of the spending for community health services.

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

Can you spend down on medicaid?

Medicaid spenddown. Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid . The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

What is Medicare and Medicaid?

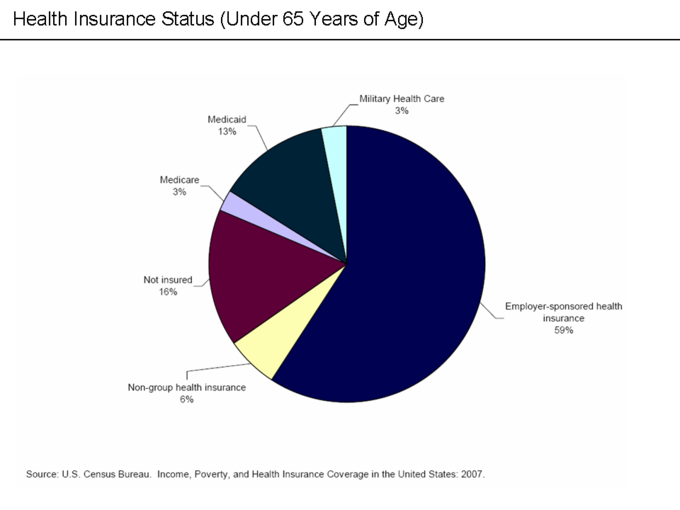

Differentiating Medicare and Medicaid. Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program ...

How to apply for medicaid?

How to Apply. To apply for Medicare, contact your local Social Security Administration (SSA) office. To apply for Medicaid, contact your state’s Medicaid agency. Learn about the long-term care Medicaid application process. Prior to applying, one may wish to take a non-binding Medicaid eligibility test.

How much does Medicare Part B cost?

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

How old do you have to be to qualify for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old. For persons who are disabled or have been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis), there is no age requirement. Eligibility for Medicare is not income based. Therefore, there are no income and asset limits.

Does Medicare cover out-of-pocket expenses?

Persons who are enrolled in both Medicaid and Medicare may receive greater healthcare coverage and have lower out-of-pocket costs. For Medicare covered expenses, such as medical and hospitalization, Medicare is always the first payer (primary payer). If Medicare does not cover the full cost, Medicaid (the secondary payer) will cover the remaining cost, given they are Medicaid covered expenses. Medicaid does cover some expenses that Medicare does not, such as personal care assistance in the home and community and long-term skilled nursing home care (Medicare limits nursing home care to 100 days). The one exception, as mentioned above, is that some Medicare Advantage plans cover the cost of some long term care services and supports. Medicaid, via Medicare Savings Programs, also helps to cover the costs of Medicare premiums, deductibles, and co-payments.

Does Medicaid cover nursing home care?

Medicaid also pays for nursing home care, and often limited personal care assistance in one’s home. While some states offer long-term care and supports in the home and community thorough their state Medicaid program, many states offer these supports via 1915 (c) Medicaid waivers.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

Does Medicaid cover cost sharing?

If you are enrolled in QMB, you do not pay Medicare cost-sharing, which includes deductibles, coinsurances, and copays.

Does Medicare cover medicaid?

If you qualify for a Medicaid program, it may help pay for costs and services that Medicare does not cover.

Is medicaid the primary or secondary insurance?

Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors’ visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

Does Medicaid offer care coordination?

Medicaid can offer care coordination: Some states require certain Medicaid beneficiaries to enroll in Medicaid private health plans, also known as Medicaid Managed Care (MMC) plans. These plans may offer optional enrollment into a Medicare Advantage Plan designed to better coordinate Medicare and Medicaid benefits.

What is Medicare insurance?

Medicare. Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients. Patients pay part of costs through deductibles for hospital and other costs.

Do you pay for medical expenses on medicaid?

Patients usually pay no part of costs for covered medical expenses. A small co-payment is sometimes required. Medicaid is a federal-state program. It varies from state to state. It is run by state and local governments within federal guidelines.

Is Medicare a federal program?

Small monthly premiums are required for non-hospital coverage. Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Do you pay out of pocket for home health care?

You will pay nothing out of pocket for covered home health care services. However, you may require durable medical equipment2 as part of your care. This includes, but is not limited to, such items as: Under Original Medicare, you will pay 20 percent of the full cost for any durable medical equipment you need.

Does Medicare cover speech pathology?

Speech-language pathology services. Medical social services. Certain injectable osteoporosis medications. Original Medicare does not cover personal care, auxiliary care, or any home care services needed 24 hours per day. If you have Medicare Part C (Medicare Advantage) or a supplemental plan, check directly with your plan provider for information.

Is Medicaid more black or white?

Medicaid is a bit less black and white than Medicare because it is administered by the states. Therefore, the state you live in determines which home care services are covered and what eligibility requirements you must meet.

Can I get home care insurance if I already have long term care?

Note that you must go through the underwriting process to be eligible, so you may not qualify to obtain this insurance if you already have certain health conditions. However, if you already have long-term care insurance, it may cover some or all of your home care needs. Contact your insurer for more information.

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

Who pays for Part B?

On the other hand, in a Part B claim, who pays depends on who has accepted the assignment of the claim. If the provider accepts the assignment of the claim, Medicare pays the provider 80% of the cost of the procedure, and the remaining 20% of the cost is passed on to the patient.

What is 3.06 Medicare?

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

Is it harder to bill for medicaid or Medicare?

Billing for Medicaid. Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program ...

Can you bill Medicare for a patient with Part C?

Because Part C is actually a private insurance plan paid for, in part, by the federal government, billers are not allowed to bill Medicare for services delivered to a patient who has Part C coverage. Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D.

Does Medicare Pay for Assisted Living?

In most cases, Medicare will not pay for the cost of long-term care, including assisted living and nursing homes. Medicare will, however, cover your stay in a long-term-care facility for up to 100 days following a severe injury or major surgery. This is so you can receive skilled nursing care as part of physician-prescribed rehab.

Does Medicaid Pay for Assisted Living?

Medicaid provides health-care coverage for eligible low-income adults, children, pregnant women, seniors, and people with disabilities in the United States. Jointly funded by federal and state governments, Medicaid benefits vary by state.

Medicaid Benefits for Assisted Living

Currently, 46 states and Washington, D.C. offer some Medicaid coverage for assisted living expenses. The states that do not are Alabama, Kentucky, Louisiana, and Pennsylvania.

Qualifying for Medicaid Assisted Living Benefits

Long-term-care Medicaid is a joint federal and state program that helps low-income older adults and individuals with disabilities get the care they need. Income and asset limits for membership vary depending on factors such as the kind of care required, medical diagnosis, location, and marital status.

Paying for Room and Board in Assisted Living

Assisted living costs are undoubtedly high. In the United States, the average cost of a monthlong stay in assisted living is $4,300 — or $51,600 per year. Prices vary based on the care needed, geographic location, and community amenities, but they are quite expensive regardless.