Wisconsin Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

How do I find out if Medicare is available in Wisconsin?

, on the Medicare website, provides information on plans available in your area. You can also call Wisconsin's Medigap Hotline at 1-800-242-1060. People with Medicare can enroll in plans that cover some prescription drug costs.

Is Medicare supplement plan F still available for new Medicare beneficiaries?

However, Medicare Supplement Plan F is no longer available for new Medicare beneficiaries. As a result, Plan G is quickly becoming the next most popular Medigap plan. Let's explore the differences between Plan F vs. Plan G.

What if I already had Medicare Plan C or plan F?

If you already had Plan C or Plan F before 2020, you will be able to keep your plan. If you became eligible for Medicare before 2020, you may still be able to buy either Plan C or Plan F if either is available where you live.

Which states have the most Medicare beneficiaries under 65?

In Alabama, Arkansas, Kentucky, and Mississippi, 22 percent of Medicare beneficiaries are under 65, while just 9 percent of Hawaii’s Medicare beneficiaries are eligible due to disability. Medicare beneficiaries can chose among several options to access Medicare coverage.

Why are Medigap plans different in Wisconsin?

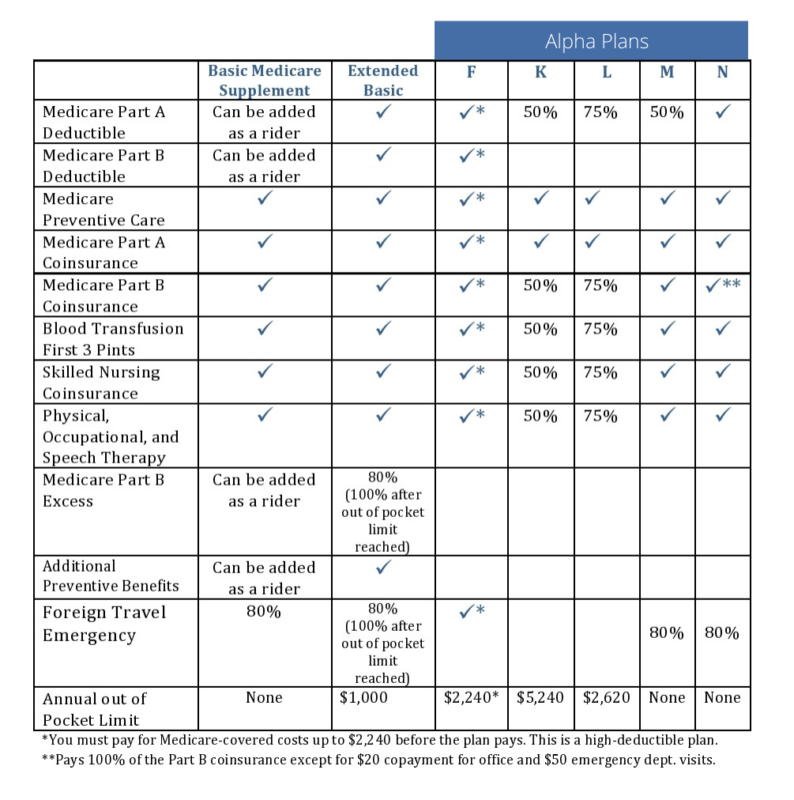

Wisconsin Medicare Supplement plans are much different from the standard letter plans available through most of the nation. The program in this state includes a Basic Plan with the option of riders. State laws require Medigap insurance carriers to cover specific benefits in addition to the primary coverage.

What is Medicare Type F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What is the advantage of Medicare Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

What is Medicare called in Wisconsin?

Medicare Plan Finder , on the Medicare website, provides information on plans available in your area. You can also call Wisconsin's Medigap Hotline at 1-800-242-1060.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Who is eligible for plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Is Medicare Part G better than Part F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

Does Medicare Plan F have a deductible?

As with other health insurance policies, premiums for Plan F are tax-deductible. However, people who became eligible for Medicare after January 2020 will be unable to purchase a Plan F policy.

What is the best Medicare plan in Wisconsin?

Medicare Advantage Plans in WisconsinInsurance companyMedicare ratingJ.D. Power rankingAetna4 starsFifth out of 10Humana4 starsThird out of 10UnitedHealthcare3.5 starsFourth out of 10

Is Medicare free in Wisconsin?

Wisconsin Medicare beneficiaries and their caregivers can get free and unbiased help with Medicare through the State Health Insurance Assistance Program (SHIP).

Does Wisconsin have Medicare?

Medicare in Wisconsin starts with Original Medicare (Part A and Part B). You can add on to that coverage, or you can decide to get your Part A & Part B benefits through a Medicare Advantage plan. Learn more about your Medicare plan options in Wisconsin.

Medigap: Supplemental Insurance If You Have Medicare

Known as Medigap, supplemental insurance policies cover expenses not paid for by Medicare. It is important to shop around for a Medigap policy. Und...

Medicare Advantage: Medicare Managed Care Plans

In some parts of Wisconsin, people covered by Medicare can receive their benefits through a managed care plan. 1. Medicare Advantage Plans in Wisco...

Medicare and Prescription Drug Coverage

People with Medicare can enroll in plans that cover some prescription drug costs. Medicare provides the following resources to help you choose a Pa...

How many Medicare beneficiaries are there in Wisconsin?

The other 661,785 Medicare beneficiaries in Wisconsin had coverage under Original Medicare as of mid-2020. The popularity of Medicare Advantage enrollment varies from one state to another. In Minnesota, nearly half of the state’s Medicare population is enrolled in Advantage plans, whereas only 1 percent of Alaska Medicare beneficiaries have ...

What is Medicare Advantage in Wisconsin?

Medicare Advantage in Wisconsin. Medicare Advantage includes all of the coverage provided by Medicare Parts A and B, and the plans often include additional benefits , usually including integrated Medicare Part D prescription drug coverage and often including coverage for things like dental and vision care.

How many insurance companies offer Medigap plans in Wisconsin?

At least 32 insurers offer Medigap plans in Wisconsin; the state does its own Medigap plan standardization, so Medigap plans in Wisconsin are different from Medigap plans sold in most states.

How much is Medicare in Wisconsin in 2020?

There are 30 stand-alone Medicare Part D prescription drug plans available in Wisconsin in 2020, with monthly premiums ranging from about $13 to $124. About 38% of Wisconsin Medicare beneficiaries have stand-alone Part D prescription drug plans. Per-enrollee spending for Original Medicare in Wisconsin is 13% lower than the national average.

What is the first choice for Medicare?

The first choice is between Medicare Advantage plans, where coverage is through private Medicare Advantage plans or Original Medicare, where coverage is paid for directly by the federal government. There are pros and cons to either option, and the right solution is different for each person.

Can disabled people get Medicare Advantage?

Disabled Medicare beneficiaries have the option to enroll in a Medicare Advantage plan instead of Original Medicare, as long as they don’t have kidney failure (as of 2021, Medicare beneficiaries who have kidney failure will be able to enroll in Medicare Advantage plans).

Does Wisconsin have Medicare for disabled people?

Medigap insurers in Wisconsin are required to offer coverage to disabled enrollees under age 65, with the same six-month open enrollment period that begins when the person is enrolled in Medicare Part B. But premiums for people under the age of 65 are considerably higher than premiums for people who are 65 and over.

When will Part B be available for Medicare?

Part B copayment or coinsurance. *Note: Coverage of the Part B deductible will no longer be available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to get this benefit.

How many days per lifetime does Medicare cover mental health?

175 days per lifetime in addition to Medicare's benefit of inpatient mental health coverage. Health care services and supplies a doctor decides you may get in your home under a plan of care established by your doctor. Medicare only covers home health care on a limited basis as ordered by your doctor.

What is covered benefits?

The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. 175 days per lifetime in addition to Medicare's benefit of inpatient mental health coverage.

Who Qualifies for Medicare in Wisconsin?

Medicare covers most Wisconsin residents who are 65 or older, and it also covers disabled Wisconsin residents. In general, Medicare enrollment in Wisconsin works the same way as it does in the rest of the country. If you qualify for Original Medicare, also known as Part A and Part B, it will help cover 80% of your health care costs.

Wisconsin Medicare Enrollments

For more information on how you can save money on your out-of-pocket costs with a Part C, Part D, or Medigap plan, please click the plans below to learn more. Licensed agents can also answer any of your questions and help you find a plan that fits your needs, lifestyle, and budget by clicking here.

Wisconsin Medicare Advantage Plans (Part C)

More than 44% of Wisconsin Medicare beneficiaries select Medicare Advantage plans.

Wisconsin Medicare Supplement (Medigap) Insurance Plans

Wisconsin insurers have waivers from the government, which allows them to conduct their own Medigap standardization.

Wisconsin Medicare Prescription Drug Coverage (Part D)

Original Medicare doesn’t cover outpatient prescription drugs. However, Medicare beneficiaries can get prescription coverage via a Medicare Advantage plan, an employer-sponsored plan (offered by a current or former employer), or a stand-alone Part D plan. Medigap plans don’t cover prescription drugs unless they’re covered under Part B.

Local Medicare Health Plan Resources in Wisconsin

The Wisconsin State Health Insurance Assistance Program provides free, unbiased information and enrollment assistance to Medicare beneficiaries, their family members, and seniors who are nearing retirement.

What is Medicare Part B in Wisconsin?

Medicare Part B coinsurance for medical care. The first three pints of blood per year for blood transfusions. Medicare Part A hospice coinsurance or copayment. The specific Medicare Supplement plans available in Wisconsin are: Basic Plan: The basic Medicare Supplement plan in Wisconsin covers all of the above benefits, ...

What is the basic Medicare Supplement Plan in Wisconsin?

Basic Plan: The basic Medicare Supplement plan in Wisconsin covers all of the above benefits, as well as Part A coinsurance for skilled nursing facilities. You’ll also get coverage for 40 additional home health visits and 175 additional days of inpatient mental health care.

What is the advantage of Medigap in Wisconsin?

One of the advantages of Wisconsin’s Medigap policy options is that you can customize coverage to fit your needs. Start with the basic Medicare Supplement plan and add options that will most benefit you. For example, you can add more home health care coverage if you have health issues that require in-home treatment.

What is Medicare Advantage?

Medicare Advantage, or Medicare Part C, usually includes benefits like vision and prescription drug coverage. It works like an HMO or PPO, meaning you’re restricted to in-network providers. 5. Medicaid: Medicaid is the government-run health insurance program for low-income Americans.

Does Medicare Part A cover 100% of medical bills?

Medicare Part A and Part B won’t cover 100% of your medical bills, and there isn’t a cap on out-of-pocket costs. You need a way to bridge these gaps in your coverage. That’s where Medicare Supplement can help. Medicare Supplement plans, or Medigap policies, fill some or all of the gaps in Original Medicare. You pay a premium each month ...

Does Medicare cover all medical expenses in Wisconsin?

Medicare Part A and B, or Original Medicare , may not cover all of your medical costs. See how Medicare Supplement plans in Wisconsin could fill the gaps in your Medicare coverage.

Can you enroll in a Medicare Advantage plan in Wisconsin?

Medicare Supplement plans help pay out-of-pocket costs not covered by Medicare Part A and B. In most cases, you can’t enroll in a Medicare Advantage plan and have a Medigap policy. Medigap policies in Wisconsin have different standardization than other states.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What percent of private insurance companies sell Plan F?

85 percent of private insurance companies sell Plan F, and 66 percent sell Plan G policies. While new Plan F policies are no longer sold to new Medicare beneficiaries, existing policies still provide ongoing coverage in many states. Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, ...

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Can I sell my Medicare Part B policy?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C ...

What is the Medicare number for Wisconsin?

For help navigating the Medicare in Wisconsin and to get the details you need to know, give us a call 920-545-4884, we are a local Independent Medicare Supplement agency and we know Medicare in Wisconsin. Please keep reading for more information on Wisconsin Medicare Supplemental Insurance.

What are the most common Medicare Supplement Plans in Wisconsin?

The three most common Medicare Supplement Plans are Plan F , Plan G and Plan N. The benefits of these plans are easily obtained with the base and a combination of the riders in Wisconsin.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G | Wisconsin. A Plan G would give you 100% coverage of Medicare approved charges after you pay the Part B deductible of $185.00 (in 2019). A Plan G would give you 100% coverage of Medicare approved charges after you pay the Part B deductible of $185.00 (in 2019).

How long does it take to enroll in Medicare Supplement in Wisconsin?

Medicare Supplement Wisconsin Enrollment. Your Medicare Supplement open enrollment period will be the six months of you turning 65 and starting Medicare Part B. You can than enroll in any Medicare Supplement Plan in Wisconsin with no underwriting and it is guarantee issue. You cannot be turned down.

How much does a Wisconsin Plan F cost?

In most states the Plan F will cost you about $300.00 more per year than a Plan G. (that means you are paying the insurance company $300.00 to pay a $183.00 deductible for you, ya nuts, I know). The Wisconsin Plan F the price is actually about the same if you pay it or if the insurance company pays it.

Does Medicare pay out of your Medicare Supplement?

If you have got Original Medicare and you purchase a Medicare Supplement insurance policy, Medicare will pay out its portion of the Medicare-approved amount for covered health care expenses, and then your Medicare Supplement insurance pays its share of the covered health care expenses....

Is Medicare the same as Medigap in Wisconsin?

Medicare in Wisconsin is the same as the rest of the nation, it is the supplemental insurance that does not follow the same standardization. The benefits can be matched it is just a different way of getting there. Medicare Supplement Plans or Supplemental Insurance, also known as Medigap, is always sold by private insurance companies.

When will Medicare plan F be available?

Because of a recent federal law, Plan F and Plan C are no longer available for Medicare beneficiaries who became eligible on or after January 1, 2020. If you already had Plan C or Plan F before 2020, you will be able to keep your plan.

What is the benefit of choosing Plan F?

One potential benefit of choosing Plan F is that it covers many out-of-pocket Medicare costs. The chart below shows how Plan F compares with of other types of Medigap plans. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

How much is the 2021 F deductible?

In 2021, high-deductible Plan F offers an annual deductible of $2,370, meaning you are responsible for paying the first $2,370 worth of covered expenses before the plan’s coverage begins.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Does Medicare Supplement Insurance have a higher monthly premium?

Benefits. Because Plan F provides more benefits than any other type of Medigap plan, Plan F may have higher monthly premiums than other types of Medigap plans in some areas.