Full Answer

How is the Medicare levy calculated on my taxes?

Your actual Medicare levy is calculated by us when you lodge your income tax return. In addition to the Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse or dependant children don’t have an appropriate level of private patient hospital cover and your income is above a certain amount.

How long does it take to calculate medicare levies?

– it will take between 2 and 10 minutes to use this calculator. If you have a spouse, use the calculator for your personal circumstances and then use it again for your spouse’s personal circumstances to find out your estimated Medicare levies.

How do I qualify for a reduced Medicare levy rate?

If one of the above applies to you, then you will qualify for a reduced Medicare Levy rate if your family income is equal to or less than $48,092 (or $62,738 if entitled to the seniors and pensioners tax offset) plus $4,416 per dependent child you have. 2. You have a Medicare Entitlement Statement

What is the levy formulae?

The levy formulae operate to ensure that there is no Levy payable if income is not high enough to pay income tax. Pensioners below Age Pension age do not pay the Medicare levy when they have no tax to pay

How is Medicare levy collected?

The Medicare levy is collected from you in the same way as income tax. Generally, the pay as you go amount your employer withholds from your salary or wages includes an amount to cover the Medicare levy. We calculate your actual Medicare levy when you lodge your income tax return. Find out about:

What is Medicare levy?

Medicare levy. The Medicare levy helps fund some of the costs of Australia's public health system known as Medicare. The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances.

Do I have to pay MLS for Medicare?

In addition to the Medicare levy, you may have to pay the Medicare levy surcharge (MLS ) if you, your spouse or dependant children don’t have an appropriate level of private patient hospital cover and your income is above a certain amount.

Can I get a reduction on my Medicare levy?

You need to consider your eligibility for a reduction or an exemption separately. You can use the Medicare levy calculator to work out your Medicare levy.

Introduction

You can use the online Medicare levy calculator to work out how much your Medicare levy will be, including any entitlement you may have to a reduction or exemption. It can calculate the levy for the past 3 tax years.

More information

The calculator gives you an estimate only, as the exact amount can only be calculated when you lodge your income tax return.

When is Medicare levy low income adjusted?

Medicare levy low-income thresholds are typically adjusted for inflation once a year and published in the Federal Budget which is usually in May of the current tax year.

When did Medicare levy increase?

The current rate of 2% medicare levy has been in place since 1 July 2014. An earlier proposal to increase the levy to 2.5% from 1 July 2019 for the 2019-20 and following years was abandoned.

What is the Medicare levy for 2019-20?

Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2019-20 year. The threshold for singles will be increased from $22,398 to $22,801. The family threshold will be increased from $37,794 to $38,474.

Why do pensioners not pay Medicare levy?

Pensioners below Age Pension age do not pay the Medicare levy when they have no tax to pay

Is Medicare levy payable on income?

Once the minimum income threshold is reached, the levy is payable on the entire income unless a reduction or exemption is available.

What is Medicare levied on?

The Medicare Levy Surcharge is different to the Medicare Levy. It is a charge levied on medium and high income earners who do not have private hospital cover. It ranges from 1-1.5% of your annual income. Please click here to read more about the Medicare Levy Surcharge. Popular Articles.

How much Medicare does a part time employee pay?

Using some very simple numbers: A part-time or casual employee who earned $20,000 pays zero Medicare Levy. An employee earning $50,000 in the last tax year pays $1,000. An employee earning $100,000 pays $2,000 in Medicare Levy. These amounts are all in addition to your regular income taxes based on your tax bracket.

What is Medicare entitlement statement?

This is a statement the Department of Human Services issues to people who are not entitled to received Medicare benefits based on their visa type. You can apply for a statement if you fit any one of the following categories:

How much is Medicare tax?

The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year.

What is Medicare tax?

Medicare Levy vs the Medicare Levy Surcharge? The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year. The Medicare Levy Surcharge, on the other hand, ...

What is the Medicare tax rate for 2019?

The Medicare Levy is a flat 2% income tax for any earning above the threshold. The 2019-20 upper threshold is $28,501 per year. For example, if you earned $75,000 your Medicare Levy would be $1,500. You will only have to pay part of the Medicare Levy if your taxable income is between $22,801 and $28,501 ...

How much does Medicare tax in Australia?

The Medicare Levy is charged at 2% of your annual income and goes towards funding Australia's public health system, Medicare. You usually need to pay the full 2% if you earn over $28,501, though you might be entitled to a reduction if you earn less or are a senior citizen.

Does Medicare cover everything?

Unfortunately, Medicare doesn't cover everything – but private health insurance can help fill in the gaps. It can cover you for things like ambulance transportation, dental and optical, and often gives you access to treatment quicker than the public system.

What is Medicare levy surcharge?

365. A Medicare levy surcharge may apply if you, your spouse and all your dependants did not maintain an appropriate level of private patient hospital cover for the full income year. Use the number of days listed at A to help you complete the Medicare levy surcharge question on your tax return. See also:

What is the income threshold for MLS?

The base income threshold (under which you are not liable to pay the MLS) is: $90,000 for singles. $180,000 (plus $1,500 for each dependent child after the first one) for families. However, if you had a spouse for the full year, you do not have to pay the MLS if: your family income exceeds the $180,000 ...

How much is a single person liable for MLS?

you may be liable for MLS for the number of days you were single – if your own income for MLS purposes was more than the single surcharge threshold of $90,000. you may be liable for MLS for the number of days you had a spouse or dependent children – if your own income for MLS purposes was more than the family surcharge threshold of $180,000 ...

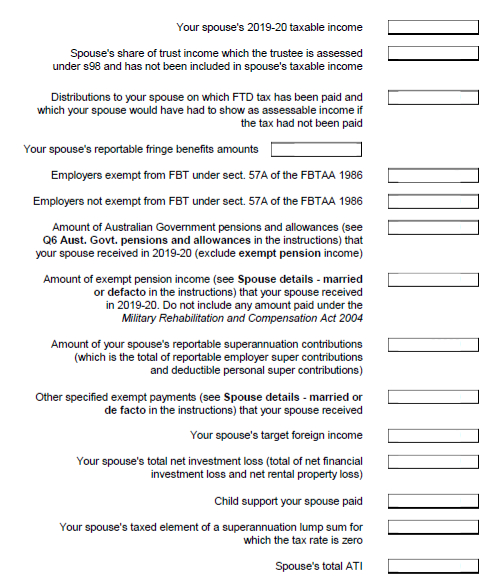

What is MLS income?

Your income for MLS purposes is the sum of the following items for you (and your spouse, if you have one): if you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

What is included in a private health insurance statement?

It will include the number of days that your policy provided the appropriate level of private health hospital cover, as shown below. Number of days this policy provides an appropriate level ...

Can you reduce your income for MLS?

If you meet the following conditions, you can reduce income for ML S purposes by any taxed element of the super lump sum, other than a death benefit, that does not exceed your (or your spouse's) low rate cap: you (or your spouse) received a super lump sum.

Do you have to pay MLS for Medicare?

If you have to pay Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income.

Does Medicare reduce your taxable income?

Medicare levy reduction for low-income earners. The amount of Medicare levy you pay is reduced if your taxable income is below a certain threshold. In some cases, you may not have to pay the levy at all. The thresholds are higher for low-income earners, seniors and pensioners. If your taxable income is above the thresholds, ...

Can I get a Medicare levy reduction if my income is above the threshold?

If your taxable income is above the thresholds, you may still qualify for a reduction based on your family taxable income. You can use the Medicare levy calculator to work out your Medicare levy payable.

Do I have to pay Medicare levy 2020?

In 2020–21, you do not have to pay the Medicare levy if: your taxable income is equal to or less than $23,226 ($36,705 for seniors and pensioners entitled to the seniors and pensioners tax offset). The amount of Medicare levy you pay will be reduced if: your taxable income is between $23,226 and $29,033 ...

Can you get a Medicare levy reduction if you don't qualify?

If you do not qualify for a reduction in the Medicare levy, you may still qualify for a Medicare levy exemption. Your Medicare levy is reduced if your taxable income is below a certain threshold.