Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How does Medicaid work with Medicare?

Here are a few examples of how Medicaid can work with Medicare. Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors’ visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

How is Medicare paid for?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed

Who pays first – Medicare or Medicaid?

In some situations, Medicare will serve as your primary payer, which means Medicare pays first. Your other insurance coverage will then serve as your secondary payer. You are “dual-eligible” (entitled to both Medicare and Medicaid ).

Does Medicaid pay for Medicare cost-sharing?

Medicaid can provide cost-sharing assistance: Depending on your income, you may qualify for the Qualified Medicare Beneficiary (QMB) MSP. If you are enrolled in QMB, you do not pay Medicare cost-sharing, which includes deductibles, coinsurances, and copays.

Who pays payroll taxes?

How many people did Medicare cover in 2017?

What is the CMS?

What is Medicare Part B?

What is covered by Part A?

Does Medicare cover home health?

See more

About this website

Where does Medicare money come from?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Who administers funds for Medicare?

The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, and the Children's Health Insurance Program (CHIP).

Is Medicare federally funded?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.

Does everyone pay for Medicare?

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly).

Who pays for Medicaid?

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP).

Who controls Medicare premiums?

The State of California participates in a buy-in agreement with the Centers for Medicare and Medicaid Services (CMS), whereby Medi-Cal automatically pays Medicare Part B premiums for all Medi-Cal beneficiaries who have Medicare Part B entitlement as reported by Social Security Administration (SSA).

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Who controls Medicare?

the Centers for Medicare & Medicaid ServicesMedicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

What is the difference between Medicare and Medicaid?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

How much does the average person pay into Medicare?

By dividing the total Medicare tax that came from wage income by the number of workers, we find that the average American worker's contribution to the Medicare Hospital Insurance (HI) program was about $1,537.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

What part of Medicare is free?

Part APart A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

How Is Medicare Funded in 2022? - Policygenius

How is Medicare Part A funded? Medicare Part A (hospital insurance) is paid through the HI Trust Fund. The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’s investments.

Who Pays For Medicare?

By clicking the button above, you provide your signature expressly consenting to receive communications via live telephone, an automatic dialing system, pre-recorded message, or text message from United Medicare Advisors or its subsidiaries, affiliates, or Companies at the telephone number provided including your wireless number (if provided) as well as via email regarding your health ...

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

Can you spend down on medicaid?

Medicaid spenddown. Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid . The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

Who pays for Part B?

On the other hand, in a Part B claim, who pays depends on who has accepted the assignment of the claim. If the provider accepts the assignment of the claim, Medicare pays the provider 80% of the cost of the procedure, and the remaining 20% of the cost is passed on to the patient.

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

What is 3.06 Medicare?

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

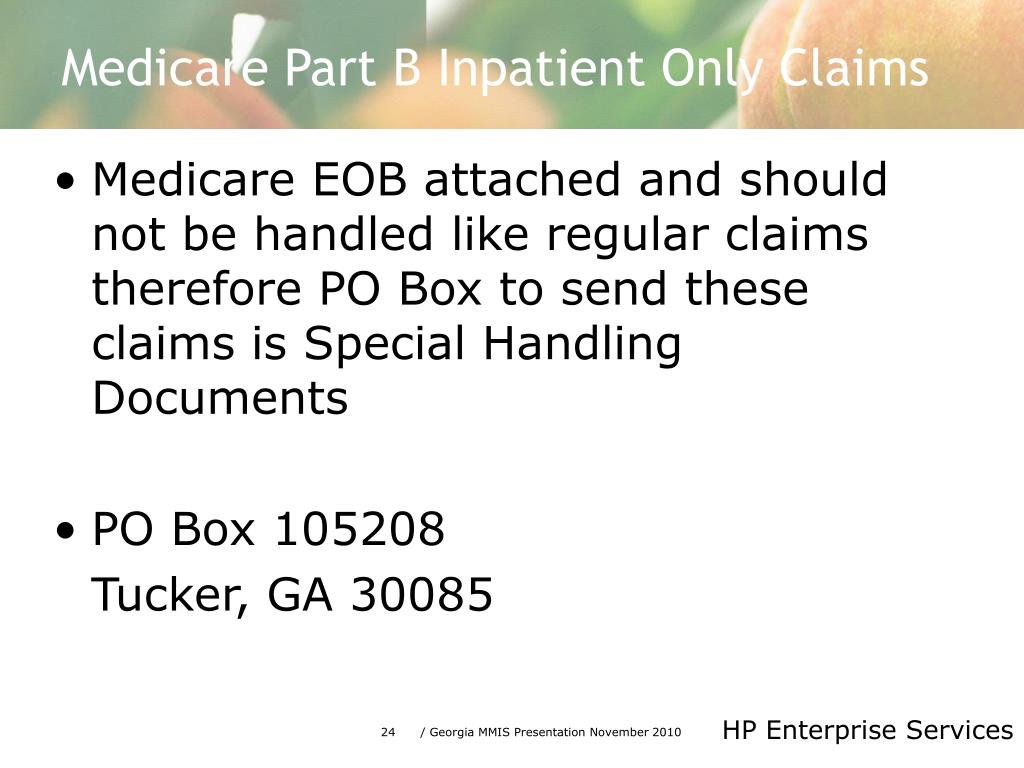

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

Is it harder to bill for medicaid or Medicare?

Billing for Medicaid. Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program ...

Can you bill Medicare for a patient with Part C?

Because Part C is actually a private insurance plan paid for, in part, by the federal government, billers are not allowed to bill Medicare for services delivered to a patient who has Part C coverage. Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D.

Which pays first, Medicare or ESRD?

The group health plan pays first for qualified services, and Medicare is the secondary payer. You have ESRD and COBRA insurance and have been eligible for Medicare for 30 months or fewer. COBRA pays first in this situation.

What is Medicare Advantage?

A Medicare Advantage plan replaces your Original Medicare coverage. In addition to those basic benefits, Medicare Advantage plans can also offer some additional coverage for things like prescription drugs, dental, vision, hearing aids, SilverSneakers programs and more.

How long do you have to be on Cobra to get Medicare?

You have ESRD and COBRA insurance and have been eligible for Medicare for at least 30 months. COBRA is the secondary payer in this situation, and Medicare pays first for qualified services. You are 65 or over – or you are under 65 and have a disability other than ESRD – and are covered by either COBRA insurance or a retiree group health plan.

What is a group health plan?

The group health plan is your secondary payer after Medicare pays first for your health care costs. You have End-Stage Renal Disease (ESRD), are covered by a group health plan and have been entitled to Medicare for at least 30 months. The group health plan pays second, after Medicare. You have ESRD and COBRA insurance and have been eligible ...

Is Medicare a secondary payer?

Medicare serves as the secondary payer in the following situations: You are 65 or older and are covered by a group health plan because you or your spouse is still working and the employer has 20 or more employees. The group health plan is the primary payer, and Medicare pays second.

Does tricare work with Medicare?

You may use both types of insurance for your health care , but they will operate separately from each other. TRICARE does work with Medicare. Active-duty military personnel who are enrolled in Medicare may use TRICARE as a primary payer, and then Medicare pays second as a secondary payer. For inactive members of the military who are enrolled in ...

Is Medicare Part A or Part B?

While you must remain enrolled in Medicare Part A and Part B (and pay the associated premiums), your Medicare Advantage plan serves as your Medicare coverage. Medicare Part D, which provides coverage for prescription drugs, is another type of private Medicare insurance.

Does Medicaid cover cost sharing?

If you are enrolled in QMB, you do not pay Medicare cost-sharing, which includes deductibles, coinsurances, and copays.

Does Medicare cover medicaid?

If you qualify for a Medicaid program, it may help pay for costs and services that Medicare does not cover.

Is medicaid the primary or secondary insurance?

Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors’ visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

Does Medicaid offer care coordination?

Medicaid can offer care coordination: Some states require certain Medicaid beneficiaries to enroll in Medicaid private health plans, also known as Medicaid Managed Care (MMC) plans. These plans may offer optional enrollment into a Medicare Advantage Plan designed to better coordinate Medicare and Medicaid benefits.

How much was Medicare reimbursement in 2015?

At the end of last year, it was reported by the American Hospital Association (AHA) that Medicaid and Medicare reimbursement in 2015 was less than the actual hospital costs for treating beneficiaries by $57.8 billion. That is billion with a “B”.

How much money do community hospitals provide?

Community hospitals provided more than $35.7 billion in uncompensated care to patients. The Centers for Medicare and Medicaid Services (CMS) does assist U.S. hospitals with additional funding. The Disproportionate Share Hospital payments help providers that treat large proportions of uninsured and Medicaid individuals.

Does Medicare cover medical expenses?

The ACA survey results showed that Medicaid and Medicare payments do not cover the amounts hospitals pay for personnel, technology, and other goods and services required to provide care to Medicare and Medicaid beneficiaries. This is critical in areas where the population is largely covered by Medicare and Medicaid.

Can hospitals participate in Medicare?

Despite low Medicaid and Medicare reimbursement rates and high uncompensated care costs, the AHA report pointed out that few hospitals can elect not to participate in federal healthcare programs. “Hospital participation in Medicare and Medicaid is voluntary,” noted the AHA.

How much is the average out of pocket medical bill?

All Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. The average out-of-pocket limit typically ranges from $3,000 to $4,000.

How much does Medicare pay for lab visits?

Medicare Part B – Medical/doctor visits. Most people pay $135.30 each month. Some who are at a higher-income level pay more. The deductible is $185 per year. After your deductible is met, you typically pay 20 percent of the cost of the services. You can expect to pay: $0 for Medicare-approved laboratory services.

What percentage of Medicare coverage is a generic drug?

During the coverage gap, you’ll pay 25 percent for most brand-name drugs, and 63 percent for generic drugs. If you have a Medicare plan that includes coverage in the gap, you may get an additional discount after your coverage is applied to the price of the drug. Click here for up-to-date information on the coverage gap.

What percentage of Medicare premium is late enrollment?

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

What is the maximum out of pocket limit for Medicare?

The average out-of-pocket limit typically ranges from $3,000 to $4,000. In 2019, the maximum out-of-pocket limit is $6,700. With most plans, once you reach this limit, you’ll pay nothing for covered services. Any monthly premium you pay for Medicare Advantage coverage does not count towards your plan’s out-of-pocket maximum.

What is the coverage gap for Medicare?

After you reach a predetermined amount in copayments, you’ve reached the coverage gap, also called “the donut hole .”. According to the Medicare website for 2019, once you and your plan have spent $3,820 on covered drugs, you’re in the coverage gap. This amount may change from year to year.

How much does Part A cost?

For most people, Part A will be provided to you at no charge. If you need to buy Part A, you’ll pay up to $437 each month. A deductible amount of $1,364 must be paid for by the insurance policy holder (you) for each benefit period. Copayments are based on the number of days of hospitalization.

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

What happens if Medicare pays $80?

If the state's payment were $90, the state would pay the difference between Medicare's payment and the state’s payment, or $10.

Can advocates work with states to increase the state's cost sharing payment to the full Medicare rate?

Advocates can work with their states to increase the state’s cost-sharing payment to the full Medicare rate. Perhaps it is time for Congress to revisit the question of whether limited cost-sharing payments adversely impact beneficiaries.

Does Medicaid cover dual eligibles?

State Medicaid agencies have legal obligations to pay Medicare cost -sharing for most " dual eligibles" – Medicare beneficiaries who are also eligible for some level of Medicaid assistance . Further, most dual eligibles are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [1] .

Is dual eligible Medicare?

But the particulars are complex in traditional Medicare and become even more complex when a dual eligible is enrolled in a Medicare Advantage (MA) plan. [2] It may be helpful to think of dual eligibles in two categories: those who are Qualified Medicare Beneficiaries (QMBs) (with or without full Medicaid coverage) and those who receive full ...

Does Medicaid require cost sharing?

In addition to this obligation, the Medicaid statute authorizes – but does not require – states to pay providers Medicare cost-sharing for at least some non-QMB dual eligibles. [5] . It appears from the language of the statute that such payment could include cost-sharing for services not covered in the state Medicaid program.

Can you pay premiums for MA plans?

States can, but are not required to, pay premiums for MA plans' basic and supplemental benefits. The "Balance Billing" Q & A referenced above answers the question, "May a provider bill a QMB for either the balance of the Medicare rate or the provider's customary charges for Part A or B services?".

Does Medicare pay for a claim?

In the traditional Medicare program, a provider files a claim with Medicare, then Medicare, after it has paid its portion, sends the claim to Medicaid for payment of the beneficiary’s cost-sharing. However, if a beneficiary is in an MA plan, the provider does not bill Medicare; the provider bills the plan or receives a capitated payment from ...

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.