A Medicare Savings Program from the state may help subsidize your Medicare and Medicare Advantage premiums. If you meet certain conditions, a Medicare Savings Program may also pay hospital and medical insurance deductibles, copayments

Copayment

A copayment or copay is a fixed amount for a covered service, paid by a patient to the provider of service before receiving the service. It may be defined in an insurance policy and paid by an insured person each time a medical service is accessed. It is technically a form of coinsurance, but is defined differently in health insurance where a coinsurance is a percentage payment after the deductible up to a ce…

Is Medicare funded by state or government?

That means Medicare is primarily funded by taxpayers through general federal tax revenue, payroll tax revenue from the Medicare tax, and premiums paid by its beneficiaries. How Medicare is funded Funding for Medicare comes from the Medicare Trust Funds, which are two separate trust fund accounts held by the U.S. Treasury:

Are Medicare Advantage plans subsidized?

The government paying a portion or all of your Medicare Advantage premiums, coinsurance, copayments, and deductibles is generally considered by most people to be a Medicare subsidy, even if the payment is for a Medicare Advantage plan instead of for Original Medicare. What is Medicare Advantage?

Is Medicare covered by Medicare?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Is Medicare considered welfare?

No, Medicare is not considered welfare. When most people are talking about welfare, they are talking about food stamps, Medicaid, unemployment benefits, housing assistance, child care assistance, etc. Medicare recipients have paid Social Security taxes for at least 10 years in order to receive health care coverage through Medicare.

How is Medicare Part A funded?

Part A, which covers inpatient hospital stays, skilled nursing facility (SNF) stays, some home health visits, and hospice care, is financed primarily through a 2.9% tax on earnings paid by employers and employees (1.45% each).

Does everyone get Medicare Part A for free?

coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A. The health care items or services covered under a health insurance plan.

What is the revenue source for Medicare Part A?

Medicare Part A derives most of its funding from a payroll tax of 2.9% on earnings, with employers and employees each paying 1.45%. High-income earners pay a slightly higher percentage, and the self-employed pay the full 2.9% tax with their quarterly filings.

Is Medicare subsidized by the federal government?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury.

Who is not eligible for Medicare Part A?

Why might a person not be eligible for Medicare Part A? A person must be 65 or older to qualify for Medicare Part A. Unless they meet other requirements, such as a qualifying disability, they cannot get Medicare Part A benefits before this age. Some people may be 65 but ineligible for premium-free Medicare Part A.

Do you pay for Medicare out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

How much of the federal budget goes to Medicare?

12 percentMedicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How is Medicare funded by paid taxes quizlet?

How is Medicare funded? Partially funded by federal government through tax dollars. -The rest is funded by premiums, deductibles and coninsurance payments.

How much funding does Medicare get?

Medicare is funded through a mix of general revenue and the Medicare levy. The Medicare levy is currently set at 1.5% of taxable income with an additional surcharge of 1% for high-income earners without private health insurance cover. Medicare funds access to health care in two main ways.

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

What is Covered Under Medicare A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bi...

What is Not Covered Under Medicare Part A?

Even in the case of an inpatient stay that Medicare Part A covers, Part A won’t cover:

Does Medicare Part A Cover Doctor Visits?

Part A covers qualifying hospital visits; Part B, rather than Part A, covers doctors’ services at the hospital, much like Part B covers non-emergen...

Does Medicare Part A Cover 100 Percent?

For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay th...

What Does Medicare Part A Cost?

Most people don’t have to pay a monthly premium for Part A. If you or your spouse have worked 40 quarters (10 years) while paying Medicare taxes, y...

How to Enroll in Medicare Part A?

If you believe you would benefit from Part A coverage and qualify for it, the final step is the Part A enrollment process. If you are near the Medi...

Do you need Medicare Part A for hospital coverage?

If you, like most people, don’t have to pay a monthly premium for Part A, there is no downside to enrolling when you become eligible at age 65. You...

Do you need more than Part A for hospital coverage?

While Part A covers a significant portion of a typical hospital bill and usually provides coverage for U.S. citizens age 65 and older without a mon...

What is unique about Medicare Advantage when it comes to hospital coverage?

Medicare Advantage plans protect you with an annual out-of-pocket maximum — a dollar amount specific to your plan that defines the most money you w...

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

What happens if you wait to enroll in Part A?

Keep in mind that if you wait to enroll in Part A after you’re first eligible, you may owe a late-enrollment penalty in the form of a higher premium. Your Part A premium could go up 10%, and you’ll have to pay this higher premium for twice the number of years that you could have enrolled in Part A but went without it.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What is Medicare Part A?

Medicare Part A#N#Medicare Part A, also called "hospital insurance ," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare.#N#provides coverage to U.S. citizens age 65 and older for inpatient stays in hospitals and similar medical facilities.

Why is Medicare Part A called Medicare Part A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bills.

How much does Medicare cover inpatients?

Does Medicare Part A Cover 100 Percent? For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay the deductible for that benefit period.

How long does it take to pay coinsurance for Medicare?

After 60 days , you must pay coinsurance that Part A doesn’t cover. For hospital expenses covered by Part B, you have to pay 20 percent coinsurance after meeting your annual deductible. Part A and B are collectively known as Original Medicare and work hand-in-hand to help cover hospital stays.

How long does Medicare Part A and Part B last?

Your IEP begins three months before the month you turn 65. The IEP is open for a total of seven months and allows you to enroll in Medicare Part A and Part B.

Do you have to pay Medicare premiums at 65?

If you, like most people, don’t have to pay a monthly premium for Part A, there is no downside to enrolling when you become eligible at age 65. You don’t have to pay a premium if you have paid Medicare taxes for at least 10 years.

Is short term care covered by Medicare?

Short-term care in a skilled nursing facility or nursing home may also be covered by Medicare Part A if it’s a doctor-approved treatment for a medical condition stemming from an inpatient hospital stay.

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.

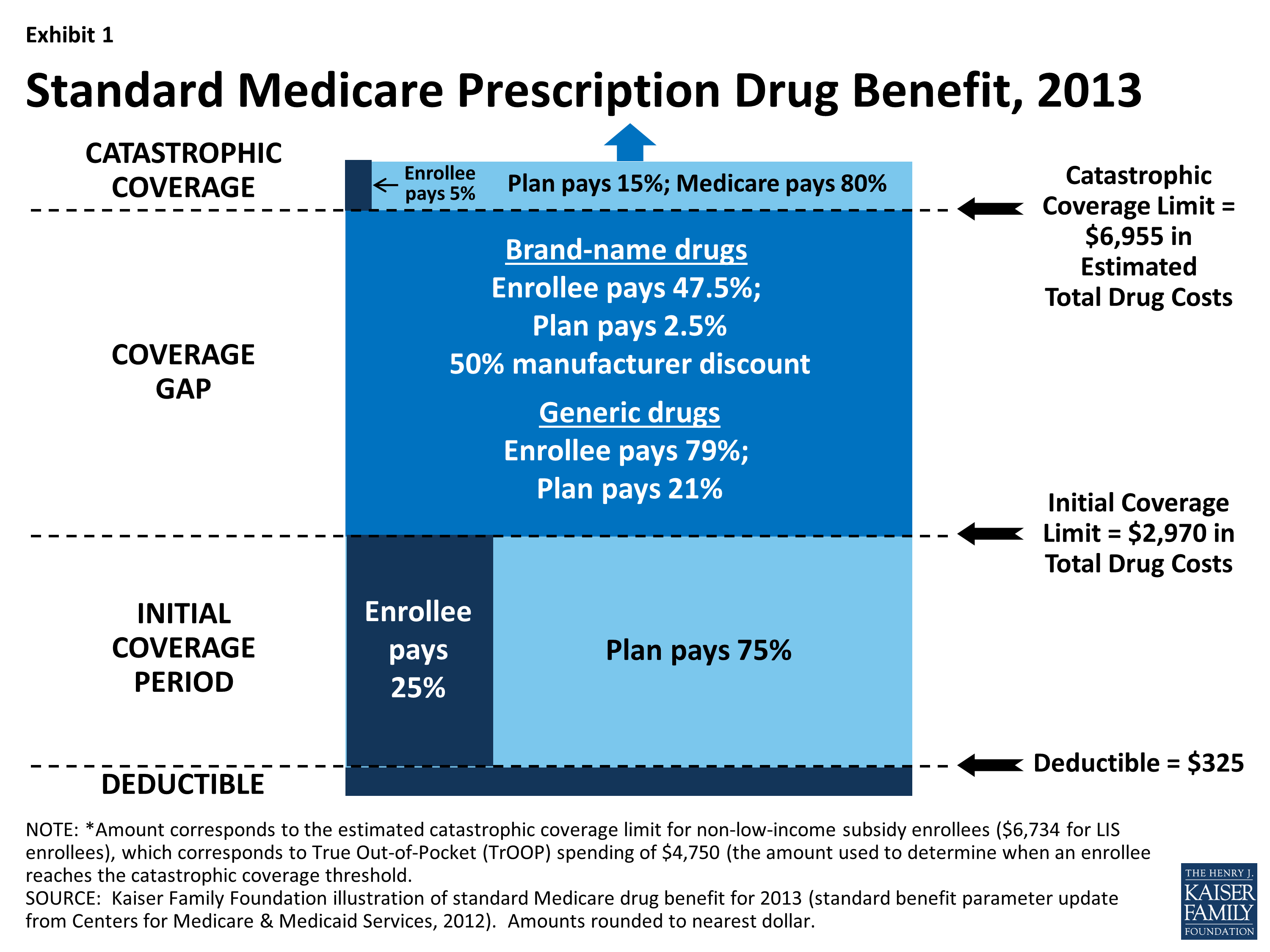

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

What is the Affordable Care Act?

The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How long will the Medicare Trust fund be extended?

The Affordable Care Act Ensures the Protection of Medicare for Future Years. Under the Affordable Care Act, the Medicare Trust fund will be extended to at least the year 2029. This is a 12-year extension that is primarily the result of a reduction in waste, fraud, and abuse, as well as Medicare costs.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

When does Medicare Part B start?

Also, you are only permitted to enroll in Medicare Part B (and Part A in some cases) during the Medicare general enrollment period that runs from January 1 to March 31 each year. However, coverage will not begin until July of that year. This could create a gap in your insurance coverage.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.