Medicare Part D Costs

| Cost | Amount |

| Avg. premium (2) | $30 |

| Max. deductible (3) | $435 |

| Initial coverage limit (4) | $4,020 |

| Out-of-pocket threshold (5) | $6,350 |

Full Answer

How much will I pay in Medicare Part D costs?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

How do I pay for Medicare Part D?

- You’ll want to go to medicare.gov’s Medicare Plan Finder, an online tool that allows you to compare Part D plans available in your ZIP code.

- On the plan finder page, you’ll be asked to enter the prescriptions you take. ...

- You can also find out how many “stars” the federal government has given to the plans available in your area. ...

How much is Medicare Part D premium?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is the penalty for Medicare Part D?

Your Part D penalty would be 33 percent of the national beneficiary premium, one percent for each of the 33 months you waited. This would be calculated as $33.06 x .33 = $10.90. The Part D penalty is rounded to the nearest 10 cents. You’ll pay this penalty in addition to your Part D Premium.

How do I pay Part D premiums?

Medicare Premium Payment OptionsOne-Time Online Payments. ... Automatic Payments. ... Express Scripts Medicare® (PDP) Customers. ... Social Security or Railroad Retirement Board (RRB) Benefits Check Withdrawal. ... Pay by Phone. ... Pay by Check.

Is Medicare Part D deducted from my Social Security check?

Medicare Advantage and Part D premiums aren't automatically deducted from your Social Security benefits, so you'll typically receive a bill and pay the insurer directly. If you'd prefer to have your premiums for these plans deducted from your benefits check, you can contact your insurer to request this change.

Are Part D premiums paid in advance?

If you have Part C, Part D, or Medigap, your insurer will bill you directly for your monthly premiums. These may be due in advance, either monthly or quarterly. If you're already receiving retirement benefits, your premiums will be automatically deducted from your monthly check.

How is Medicare Part D reimbursed?

Medicaid beneficiaries also typically receive covered drugs through pharmacies, which are reimbursed for these drugs by State Medicaid agencies. Most States typically calculate reimbursement based upon the AWP discounted by a specified percentage plus a dispensing fee.

Why is Social Security charging for Part D?

You'll also have to pay this extra amount if you're in a Medicare Advantage Plan that includes drug coverage. If Social Security notifies you about paying a higher amount for your Part D coverage, you're required by law to pay the Part D-Income Related Monthly Adjustment Amount (Part D IRMAA).

How much does Medicare Part D 2020 deduct from Social Security?

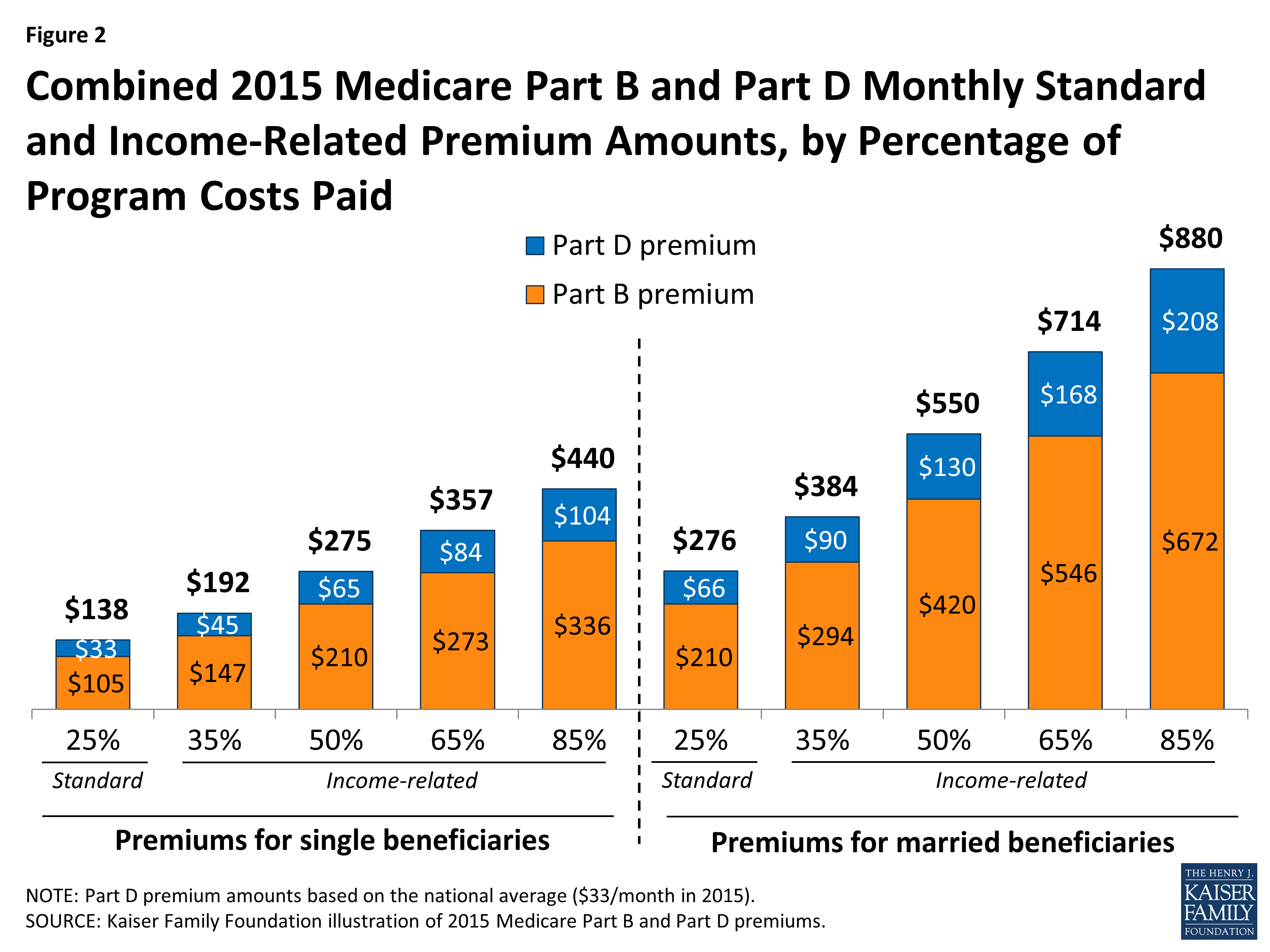

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2020 is $32.74, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Are Medicare premiums paid monthly or quarterly?

BILL TYPE Some people with Medicare are billed either monthly or quarterly. If you are billed for Part A or IRMAA Part D, you will be billed monthly. If this box says: • FIRST BILL, it means your last payment was received timely or this is your initial bill. SECOND BILL, it means a payment is late by at least 60 days.

Are Medicare premiums paid in advance or arrears?

in advanceSocial Security benefits are paid in arrears, while Medicare premiums are paid in advance, so it's important to recognize the timing of these events. 1. The individual is collecting Social Security benefits for the months of November and December of the year prior to the COLA increase to Medicare.

Are Medicare Part D premiums tax deductible?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

How does pharmacy reimbursement work?

Pharmacy reimbursement under Part D is based on negotiated prices, which is usually based on the AWP minus a percentage discount, plus a dispensing fee (more on dispensing fees later). Private third-party payers currently base their reimbursement formula on AWP.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Medicare recipients have a number of out-of-pocket costs, including premiums, deductibles, and co-insurance or co-payments

How Medicare premiums are paid depends on which part you're paying and whether you collect benefits from either Social Security or the Railroad Retirement Board (RRB). This post describes your various options for paying your Medicare premiums.

How Do You Pay Your Premiums for Original Medicare?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). If you collect Social Security or RRB benefits, your Part B premium is automatically deducted from your monthly payment.

How to Pay with Medicare Easy Pay

If the Centers for Medicare & Medicaid Services (CMS) sends you a bill for one or more premiums, you can enroll in Medicare Easy Pay. To sign up, complete the Authorization Agreement for Pre-authorized Payments (form SF-5510).

How to Pay Online with a Credit or Debit Card

You may use your MyMedicare.gov account to pay your Medicare bill with a credit or debit card. The payment shows on your statement as being made to CMS Medicare. When you complete the payment, you'll receive a confirmation number. Keep a copy of it for your records.

How to Pay Your Medicare Premium with Online Bill Pay

Online bill pay lets you pay directly from your checking or savings account. To set it up, you need your 11-digit Medicare ID number (found on your new Medicare card).

Mailing Your Premium Payment to Medicare

If you have not arranged for electronic payment or Medicare Easy Pay, your Medicare bill comes with a payment coupon. To mail your payment to Medicare, complete this coupon and send it along with your payment method. Your choices are:

How to Pay Your Medicare Premium Through the Railroad Retirement Board

None of the above applies if you receive your Medicare bill from the Railroad Retirement Board. Instead, you must mail your premium payment to: RRB, Medicare Premium Payments; PO Box 979024; St Louis, MO 63197-9000.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

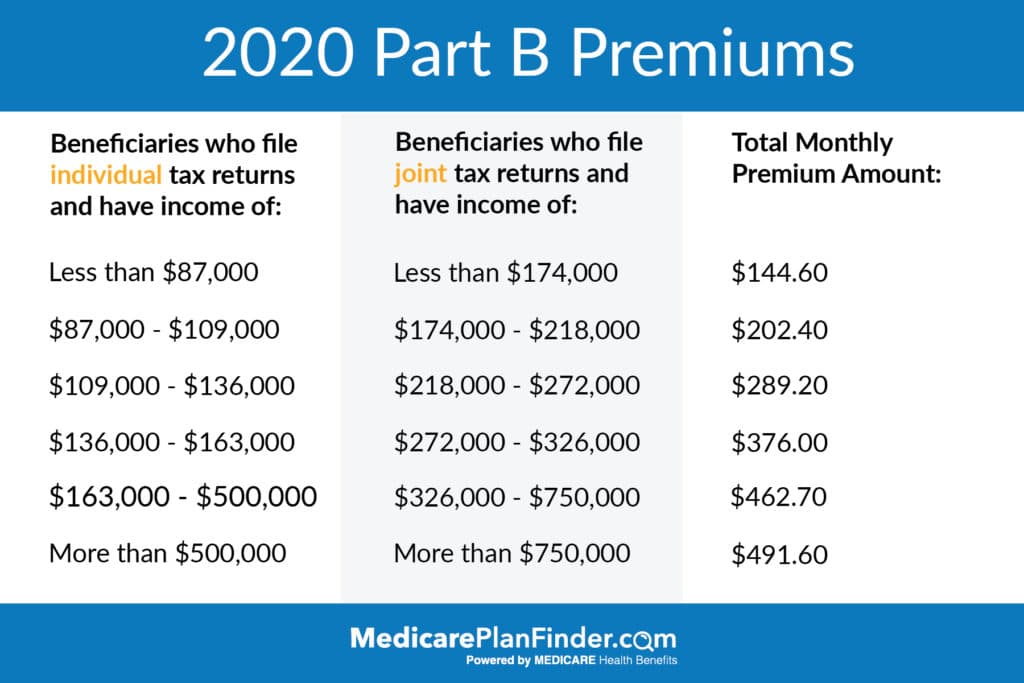

Are Medicare Part D Premiums Based on Income?

Medicare Part D is available to all individuals enrolled in Medicare. While there are no eligibility requirements to enroll in a Medicare Part D plan, Medicare Part D premiums may be higher for some individuals. If you are an individual or married couple with a higher income, enrollment in a Part D plan may look a little different for you.

Part D Costs with Higher Incomes

Medicare beneficiaries who have higher incomes may have to pay an additional amount for Medicare Part D premiums (see chart below). This additional amount is called the Income-Related Monthly Adjustment Amount (IRMAA) and applies to all prescription drug coverage through Medicare including Medicare Advantage plans.

How Much Will I Have to Pay?

Depending on the income bracket you fall under, either through individual income or joint income, the Part D IRMAA is determined based on the following income brackets:

How is the Additional Amount Collected?

If Social Security determines your income qualifies for Part D IRMAA, you will have to pay an additional amount each month on top of your monthly Part D premium. The additional amount is paid directly to Medicare and is separate from your Part D plan premium.

What Happens if my Income Changes?

If your income changes and the change is significant enough that it moves your income into a different bracket, you should notify Social Security right away. Since IRMAA is based on income you may not be required to pay the extra amount if your earnings fall below a certain threshold. Common reasons for a change in income include:

Do I Have to Pay the Extra Amount?

Yes. You must pay the additional amount including your monthly Part D premium to keep your prescription drug coverage. If you do not pay the additional amount, you may lose your coverage.

Can I Appeal the Decision?

Yes, if Social Security determines your income is high enough for IRMAA and you feel the decision was made in error due to a mistake on your tax return or a mistake from SSA you can file an appeal. To file an appeal visit socialsecurity.gov, or call Social Security at 1-800-772-1213.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

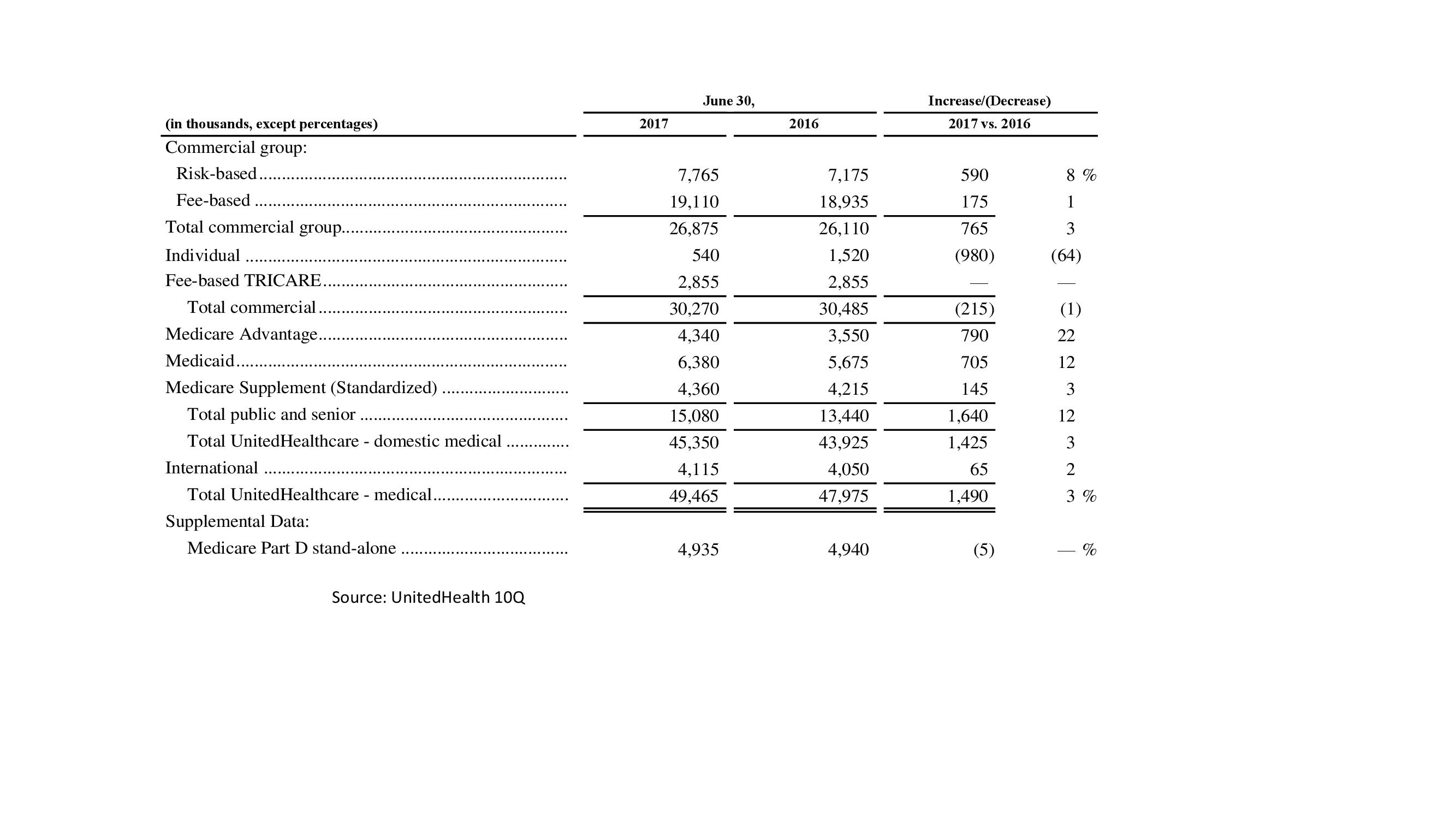

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much is the deductible for Part D in 2021?

Part D. Deductibles vary according to plan. However, Part D deductibles are not allowed to exceed $455 in 2021, and many Part D plans do not have a deductible at all. The average Part D deductible in 2021 is $342.97. 1.

How much coinsurance is required for hospice?

A 5 percent coinsurance payment is also required for inpatient respite care. For durable medical equipment used for home health care, a 20 percent coinsurance payment is required.

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

How much is a copayment for a mental health facility?

For an extended stay in a hospital or mental health facility, a copayment of $371 per day is required for days 61-90 of your stay, and $742 per “lifetime reserve day” thereafter.

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.