How are irmaa income limits calculated?

Part B IRMAA is calculated by multiplying the average expenditure (which is the standard premium multiplied by 4) by the subsidy percentage assigned to a particular income bracket. The subsidy amounts can be found in table 2. The resulting answer is the total amount you will pay (standard premium plus IRMAA).

Does irmaa adjust annually?

This amount is recalculated annually. The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

Is irmaa calculated annually?

IRMAA is an extra charge added to your premium ... so if 2022 is your first year enrolling in Medicare, they will use data from your 2020 tax return.” Anspach gave this example: Let's ...

How is Irma income calculated?

- Marriage

- Divorce

- Death of a spouse

- Work stoppage

- Work reduction

- Loss of income-providing property due to a disaster or other event beyond your control

- Loss of a pension

- Employer settlement payment

What does CMS do with IRMAA?

How much does IRMAA pay for Part B?

Who calculates Medicare Part B premiums?

About this website

How do I calculate my Irmaa?

How Is IRMAA Calculated? The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it.

What are the Irmaa brackets for 2021 Part D?

D. IRMAA tables of Part D Prescription Drug coverage premium year for three previous premium yearsIRMAA Table2021More than $165,000 but less than $500,000$70.70 + Plan premiumMore than or equal to $500,000$77.10 +Plan premiumMarried filing jointlyMore than $176,000 but less than or equal to $222,000$12.30 + Plan premium12 more rows•Dec 6, 2021

How is Irmaa calculated 2020?

How is my income used in my IRMAA determination? IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

Is Irmaa adjusted automatically?

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B? Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

How do you calculate modified adjusted gross income for Irmaa?

That means your 2021 premiums and IRMAA determinations are calculated based on MAGI from your 2019 federal tax return. MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

Does Irmaa affect Part D?

Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

How is Irmaa calculated 2021?

Remember, IRMAA is based on your income from two years ago. So, your 2021 Modified Adjusted Gross Income (MAGI) will determine your IRMAA adjustments for 2023.

How are Medicare Irmaa brackets calculated?

As if it's not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

What time of year is Irmaa calculated?

The Social Security Administration (SSA) determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year when you pay the IRMAA. For example, Social Security would use tax returns from 2021 to determine your IRMAA in 2023.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

2022 IRMAA: Slight increase in Medicare Part D IRMAA payments for most ...

Since 2020, the Income-Related Monthly Adjustment Amount (IRMAA) income brackets are inflation adjusted. Consequently, people with an annual income under $170,000 who are at the low end of their 2021 IRMAA income bracket could see a decrease (-26% to -100%) in their IRMAA payments as they are moved to a lower 2022 IRMAA income bracket (see comparison chart below).

2022 Medicare IRMAA Brackets - Crowe & Associates

2022 Medicare IRMAA Brackets. Each year CMS releases the Medicare Part B premium amounts.. The standard Medicare Part B premium in 2022 is $170.10. This amount is $148.50 in 2021.

2020 Medicare IRMAA: Part B and Part D Premium Brackets

For updated information about 2021 Medicare IRMAA costs for Part B and Part D, read our updated What Is IRMAA? 2021 guide. The 2020 Medicare IRMAA (Income-Related Monthly Adjusted Amount) was the additional surcharge some higher income earners pay on top of their Medicare Part B and Part D premiums.. This IRMAA surcharge is in addition to the standard Part B premium and any premium associated ...

What does CMS do with IRMAA?

CMS also calculates IRMAA amounts for prescription drug coverage based on the Medicare base beneficiary premium. Once the IRMAA calculations are done, CMS notifies the Social Security Administration (SSA) so we can make IRMAA determinations.

How much does IRMAA pay for Part B?

Part B beneficiaries usually pay about 25% of the true cost for Part B. The true cost of Part B that IRMAA beneficiaries pay is 35% for level 1, 50% for level 2, 65% for level 3, 80% for level 4, and 85% for level 5.

Who calculates Medicare Part B premiums?

The Centers for Medicare & Medicaid Services (CMS) calculates the Medicare Part B monthly premium amounts and the income-related monthly adjustment amount (IRMAA). CMS publishes the amounts, which can be found in the current Federal Register each year.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

How much is the IRMAA premium for 2021?

In 2021, the standard monthly premium for Part B is $148.50. Depending on your yearly income, you may have an additional IRMAA surcharge. This amount is calculated using your income tax information from 2 years ago. So, for 2021, your tax information from 2019 will be assessed.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

How many people will be covered by Medicare in 2027?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027. Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

Who does IRMAA apply to?

IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

In other words..

Social Security and Medicare are partner programs. To receive Social Security benefits, you are required by law to enroll in Medicare. Medicare has a monthly premium that must be paid by the consumer to stay in the program. To pay this premium, the Medicare program generally takes a portion of the retiree’s Social Security check.

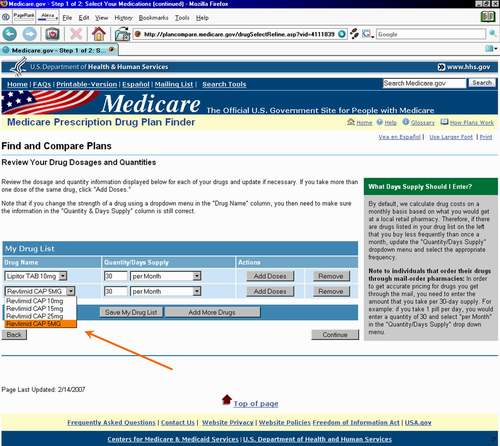

Steps of using software

Fill in some basic information such as name, tax filling status, and income sources. This step can be completed in under 10 minutes. Once you’ve completed this step your part is done. No new skill to learn here.

How often is IRMAA calculated?

Unlike late enrollment penalties, which can last as long as you have Medicare coverage, the IRMAA is calculated every year. You may have to pay the adjustment one year, but not the next if your income falls below the threshold.

What is IRMAA in Medicare?

What is IRMAA? The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What is Part B IRMAA?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month. If you are not currently receiving retirement benefits each month, ...

What does CMS do with IRMAA?

CMS also calculates IRMAA amounts for prescription drug coverage based on the Medicare base beneficiary premium. Once the IRMAA calculations are done, CMS notifies the Social Security Administration (SSA) so we can make IRMAA determinations.

How much does IRMAA pay for Part B?

Part B beneficiaries usually pay about 25% of the true cost for Part B. The true cost of Part B that IRMAA beneficiaries pay is 35% for level 1, 50% for level 2, 65% for level 3, 80% for level 4, and 85% for level 5.

Who calculates Medicare Part B premiums?

The Centers for Medicare & Medicaid Services (CMS) calculates the Medicare Part B monthly premium amounts and the income-related monthly adjustment amount (IRMAA). CMS publishes the amounts, which can be found in the current Federal Register each year.