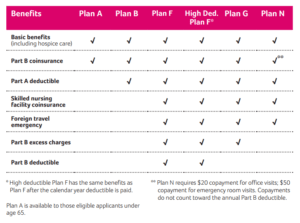

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

When can you change your Medicare supplement plan?

You’ve been enrolled in a Medicare Supplement insurance plan for fewer than six months. Your insurance company may agree to sell you a new policy with the same basic benefits, but you may have to wait up to six months before the new plan covers any pre-existing health conditions.

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

How much does Medicare supplement plan cost?

Medicare Supplement Insurance Plan F premiums in 2021-2022 are lowest for beneficiaries at age 65 ($184.93 per month) and highest for beneficiaries at age 85 ($299.29 per month). Medigap Plan G premiums in 2021-2022 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

What is the difference between supplemental F and G?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you'll need to pay your Part B deductible ($233 for 2022), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

What does plan F cover that plan G does not?

The only benefit Plan F offers that Plan G doesn't is coverage for the Medicare Part B deductible. Even though Plan G doesn't cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.

Should I switch from Medicare F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

Does plan G replace plan F?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs. Part B copays/coinsurance (not deductibles)

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Which plan is best F or G?

Which Is Better: Medicare Plan F vs. Plan G?If coverage for the Part B deductible is important to you, you may want to stick with Medicare Plan F. ... Although Plan G does not cover the Part B deductible ($203 in 2021),2 the premium savings could offset the cost of the yearly deductible.

How much cheaper is plan G than plan F?

Insurance companies are currently pricing Medigap Plan G $30 to $60 less each month than Medigap F. Most times you can save $500 or more a year in lower premiums on Plan G.

Is plan F still available in 2022?

However, as of January 1, 2020, Plan F was phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. The only real difference between Plan F and Plan G is that Plan F covers the deductible for Part B, which is $170.10 in 2022.

Will plan F be available in 2021?

Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What percent of private insurance companies sell Plan F?

85 percent of private insurance companies sell Plan F, and 66 percent sell Plan G policies. While new Plan F policies are no longer sold to new Medicare beneficiaries, existing policies still provide ongoing coverage in many states. Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, ...

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Can I sell my Medicare Part B policy?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C ...

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

What is Medicare Plan F and G?

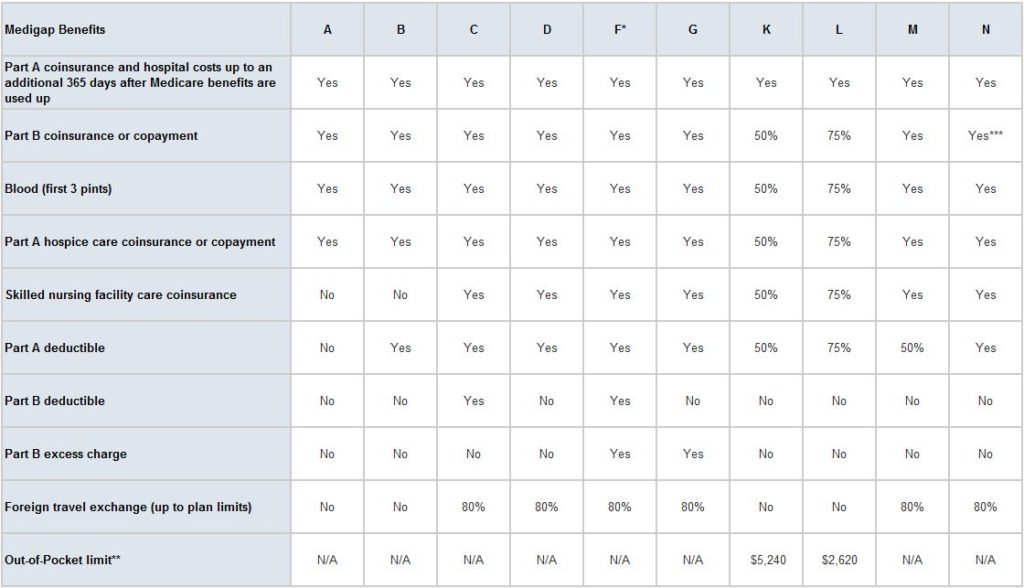

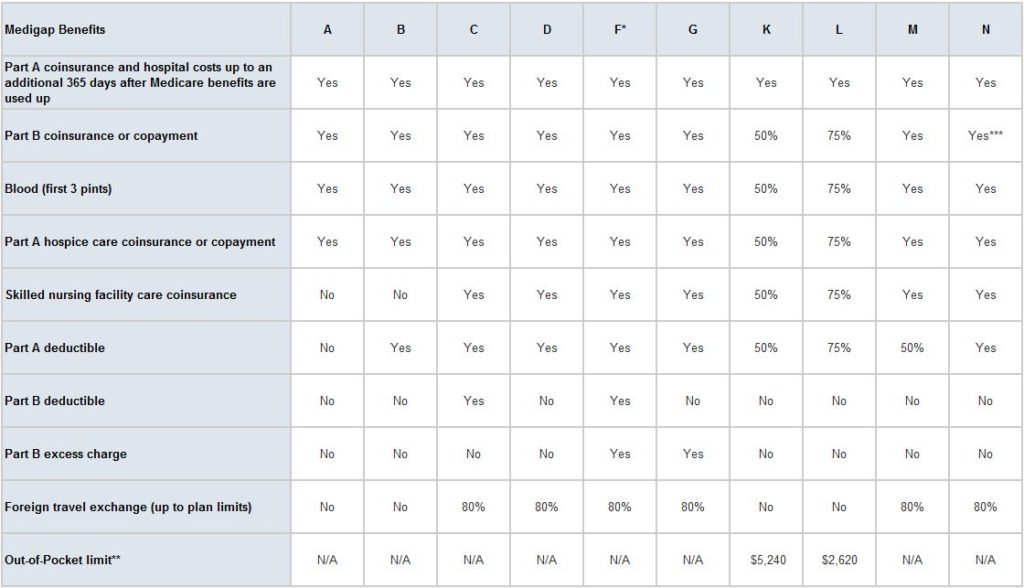

Medicare Plan F and Plan G are two of the 10 different types of standardized Medicare supplemental health insurance plans available in most states. You pay a premium for both types of plans, but both plans help pay for out-of-pocket expenses that Original Medicare doesn’t cover. The following chart provides a side-by-side look at all 10 ...

Why switch to Medicare Plan G?

Switching to a Medicare Plan G might be a good idea because you’ll pay lower premiums, and you might also never pay the $203 Medicare Part B deductible.

How much does Medicare cover if you have a plan F?

If you have Medicare Plan F and you haven’t yet met your Medicare Part B deductible, it would cover the $203 deductible plus the 20% of the Medicare-approved coinsurance amount. If you have Medicare Plan G, you’ll need to pay the $203 Medicare Part B deductible first. Then your Medicare Supplement plan would cover the 20% coinsurance.

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Medicare change to Plan F?

Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Is everyone eligible for Medicare Plan F and Plan G?

Medicare Plan F and Plan G can help you save money on your Medicare costs. However, as of January 1, 2020, not everyone is eligible for both plans, and you need to understand the new requirements.

What is the difference between a plan F and a plan G?

The main difference is that Plan F covers the Medicare Part Bdeductible while Plan G doesn’t. Both plans also have a high-deductible option. In 2021, this deductible is set at $2,370, which must be paid before either policy begins paying for benefits. Another big difference between Plan F and Plan G is who can enroll.

How many different Medigap plans are there?

Medigap is made up of 10 different plans, each designated with a letter: A, B, C, D, F, G, K, L, M, and N. Each plan includes a specific set of basic benefits, no matter what company sells the plan.

What is a Medigap plan?

Medigap is supplemental insurance that helps cover costs that aren’t covered by original Medicare. Medigap Plan F and Plan G are two of the 10 different Medigap plans that you can choose from.

How long does it take to get Medicare Part B?

This is a 6-month period that begins the month you turn age 65 and you’ve enrolled in Medicare Part B. Some people are eligible for Medicare before age 65. However, federal law doesn’t require companies to sell Medigap policies to people under age 65.

Do you have to pay for Medigap?

You’ll have to pay a monthly premium for your Medigap plan. This is in addition to the monthly premium that you pay for Medicare Part B if you have Plan G. Your monthly premium amount can depend on your specific policy, plan provider, and location. Compare Medigap policy prices in your area before deciding on one.

Does Medigap cover Part B?

Similar to Plan F, Medigap Plan G covers a wide variety of costs; however, it does not cover your Medicare Part B deductible. You have a monthly premium with Plan G, and what you pay can vary depending on the policy you choose. You can compare Plan G policies in your area using Medicare’s search tool.

Can you enroll in Medicare Part B in 2020?

The enrollment rules for Plan F changed in 2020. As of January 1, 2020, Medigap plans are no longer allowed to cover the Medicare Part B premium. If you were enrolled in Medigap Plan F before 2020, you are able to keep your plan and benefits will be honored. However, those new to Medicare are not eligible to enroll in Plan F.

Why do insurance companies recommend Plan F over Plan G?

There are a couple reasons why an agent or insurance company might recommend Plan F over Plan G . Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between ...

When will Medicare stop selling Plan F?

This includes Medigap Plan F. Insurance companies will no longer be able to sell Plan F to anyone who becomes eligible for Medicare on or after January 1, 2020.

What is the best Medicare supplement plan?

Plan F is the most comprehensive Medicare supplement plan. But as it’s been explained, Plan F is not necessarily the best value for your premium dollar. As always, our goal is to show you how to save significant amounts of money by choosing the best plan for your premium dollar.

Why do people get Plan F?

Most people get Plan F because their friend has Plan F. Or, perhaps their agent or insurance carrier didn’t explain the other plans available. Some agents will quickly tell you that everyone gets Plan F because it “pays for everything”. This is true. But you also need to make sure Plan F’s premium suits your budget.

Is Part B deductible a Plan G?

Looking at the chart below, you can see the Part B deductible is not a Plan G benefit. Medicare Supplement Benefits.

Does Part B deductible go into premium?

It costs money for the insurance company to manage, handle, and pay the Part B deductible payment for you. This is factored into your premium dollar. So, you actually end up paying for this “convenience” with Plan F. Plan F can also be more susceptible to rate increases.

Is Plan G the same as Plan F?

After the deductible is met , Plan G benefits are exactly the same as Plan F . Plan F benefits include coverage for all copays, deductibles and coinsurance. This type of coverage has made Plan F extremely popular among seniors on Medicare.

Which is better, Plan G or Plan F?

Plan F – The plan pays the deductible. Plan G – You pay the deductible. That’s it! Conventional wisdom would suggest that because Plan F is the more comprehensive plan that it would be “better”, but “better” is certainly relative. Let’s take a closer look.

How much would Plan G save?

Plan G would save him $30 a month or $360 a year! Once John accounts for the deductible, he has true savings of $177 a year (or about $15 a month). By enrolling in G, John gets the “best bang for his buck” and doesn’t sacrifice on coverage.

Is Plan F discontinued?

There is no reason not to, and that’s the attitude of most Plan F policyholders. One more reason to buy Plan G: For the reasons cited above, Plan F will be discontinued as of January 1, 2020 as part of the Medicare Access and CHIP Reauthorization.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.