Summary: If you have a Medicare Supplement insurance plan, you pay your premium separately from your monthly Medicare premiums, like Medicare Part B. You pay your Medicare Supplement Insurance (Medigap) premium as directed by the insurance company that sold you the plan. Medicare Supplement insurance plans are sold by private insurance companies and may help you pay for out-of-pocket costs for services covered under Original Medicare (Part A and Part B).

Do I really need a Medicare supplement?

Summary: If you have a Medicare Supplement insurance plan, you pay your premium separately from your monthly Medicare premiums, like Medicare Part B. You pay your Medicare Supplement Insurance (Medigap) premium as directed by the insurance company that sold you the plan. Medicare Supplement insurance plans are sold by private insurance companies and may help …

What are the top 5 Medicare supplement plans?

riginal Medicare pays for many, but not all, health care services and supplies. Medicare Supplement Insurance (Medigap) policies, sold by private companies, can help pay for some of the costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles.

Which Medicare supplement plan should I buy?

Once you pay the plan’s limit, the plan pays 100% for covered health services for the rest of the year. Medicare Supplement Insurance (Medigap): Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year. You must keep paying your Part B premium to keep your supplement insurance.

What is the average cost of Medicare supplement insurance?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer. What it means to pay primary/secondary The insurance that pays first (primary payer) pays up to the limits of its coverage.

How does Medicare Supplement get paid?

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

How are Medicare and supplemental policies are billed?

When you have Medicare and other health insurance, such as a Medicare Supplement insurance plan, each type of coverage is called a “payer.” The primary payer will pay what it owes on your health-care bills first and then send the balance to the secondary payer.

Can Medicare Supplement premiums be paid from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How are Medigap premiums paid?

Medicare B premiums are deducted from your Social Security check, but Medigap premiums are paid directly to the private insurance carrier that provides the plan.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

Is Part D premium automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

How much does Medicare take out of my Social Security check?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the difference between an Advantage plan and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Who sells Medicare Supplement insurance?

Medicare Supplement insurance plans are sold by private insurance companies and may help you pay for out-of-pocket costs for services covered under Original Medicare (Part A and Part B).

Why does Medicare premium go up?

This is called attained-age-rated. With all three ways, premiums may go up because of inflation and other factors. A third factor influencing your Medicare Supplement insurance plan cost is whether or not you were subjected to medical underwriting.

What is community rated Medicare?

The first way doesn’t take age into account when setting the price of the plan. This is called community rated or “no-age-rated.”. The second way bases the premium on the age you are when you buy the Medicare Supplement insurance plan. This is called issue-age rated or “entry age-rated.”.

What is the difference between Plan F and Plan G?

The only difference between Plan F and Plan G is that Plan G doesn’t cover the Medicare Part B deductible.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. or a. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.

What are the benefits of Medicare Supplement?

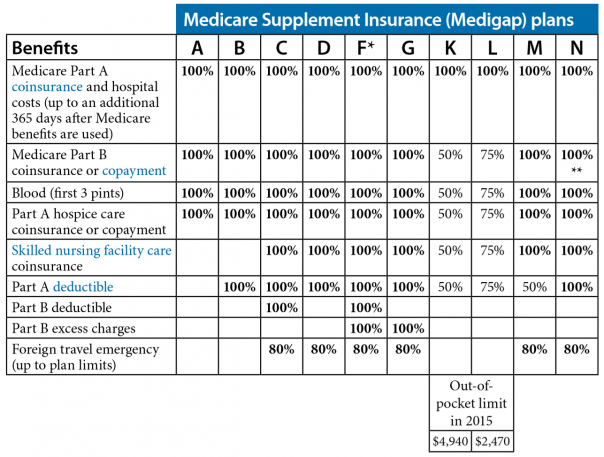

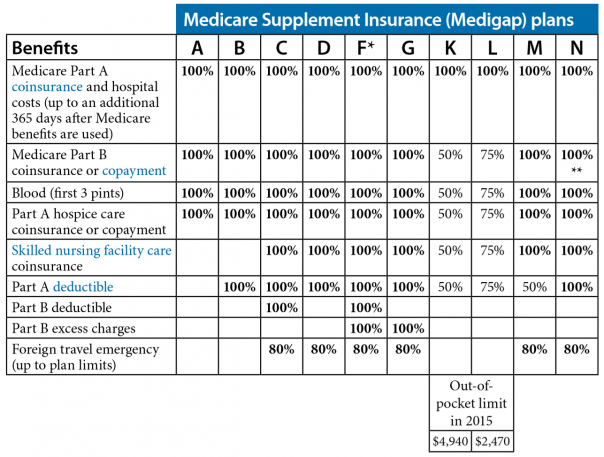

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

What is medicaid?

Medicaid is a joint federal and state program that: 1 Helps with medical costs for some people with limited income and resources 2 Offers benefits not normally covered by Medicare, like nursing home care and personal care services

What is extra help?

And, you'll automatically qualify for. Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying for your.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

Does medicaid pay first?

Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second. Medicaid never pays first for services covered by Medicare. It only pays after Medicare, employer group health plans, and/or Medicare Supplement (Medigap) Insurance have paid.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."